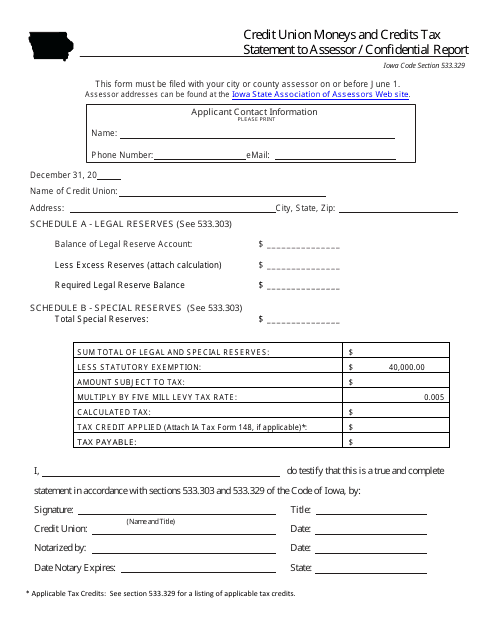

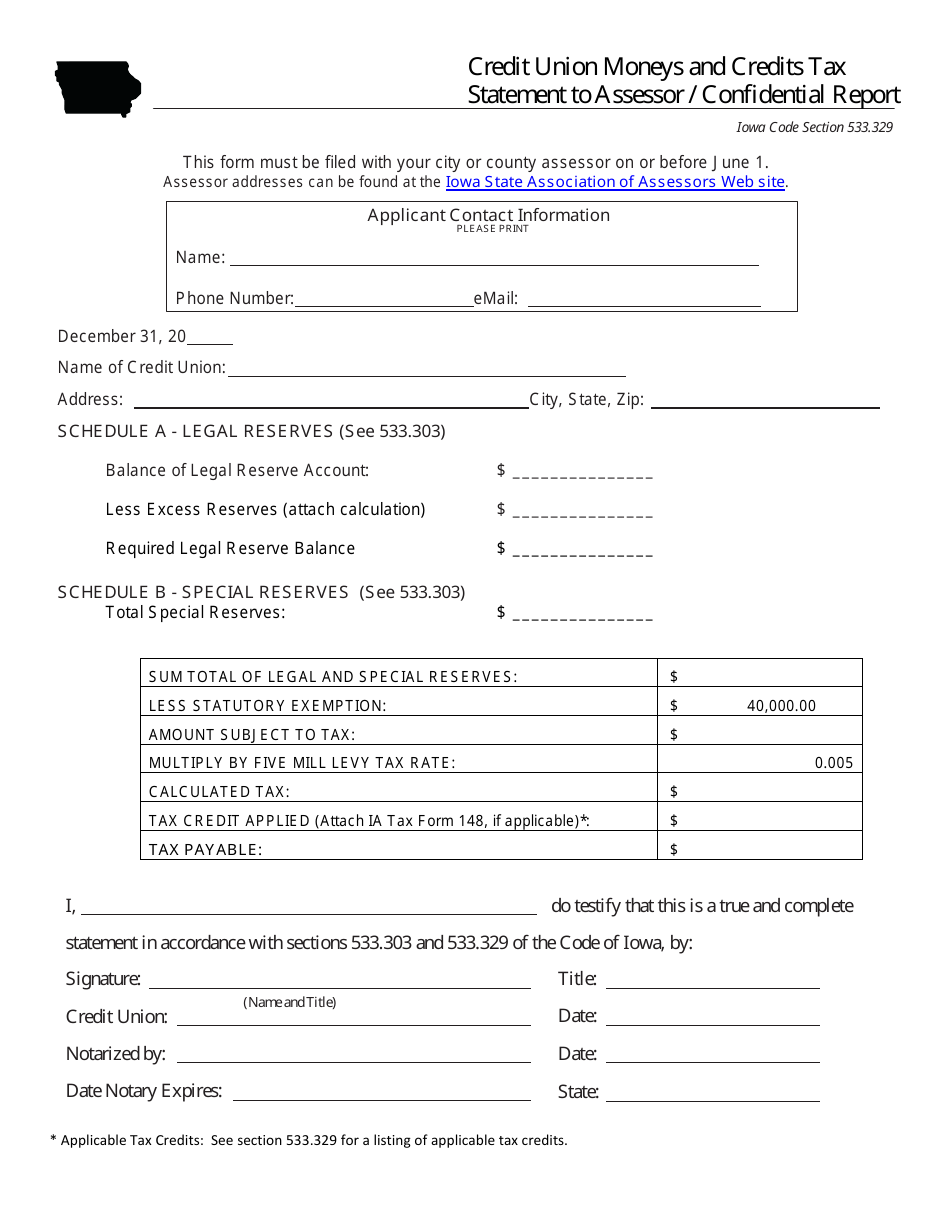

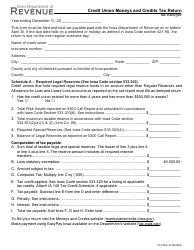

Credit Union Moneys and Credits Tax Statement to Assessor / Confidential Report Form - Iowa

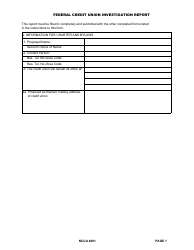

Credit Union Moneys and Credits Confidential Report Form is a legal document that was released by the Iowa Department of Revenue - a government authority operating within Iowa.

FAQ

Q: What is the Credit Union Moneys and Credits Tax Statement to Assessor?

A: It is a form used by credit unions in Iowa to report their moneys and credits for tax purposes.

Q: What is the purpose of the Credit Union Moneys and Credits Tax Statement?

A: The purpose is to calculate and report the taxable value of a credit union's moneys and credits.

Q: Who needs to fill out the Credit Union Moneys and Credits Tax Statement?

A: Credit unions in Iowa are required to fill out this form.

Q: What information is included in the Credit Union Moneys and Credits Tax Statement?

A: The form includes details about the credit union's assets, loans, and investments.

Q: Is the Credit Union Moneys and Credits Tax Statement confidential?

A: Yes, it is a confidential report that is submitted to the assessor.

Form Details:

- The latest edition currently provided by the Iowa Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.