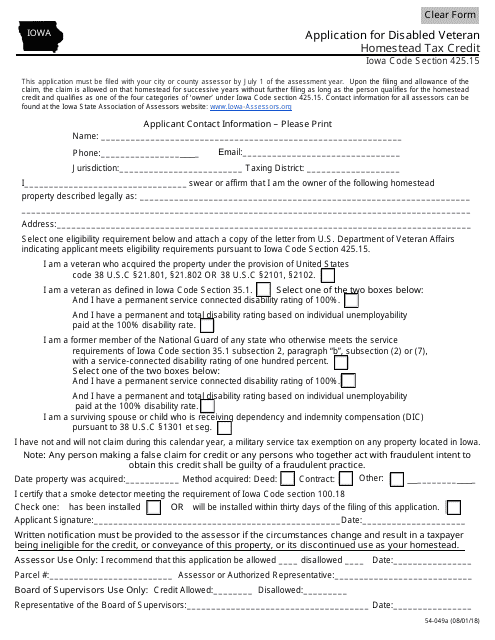

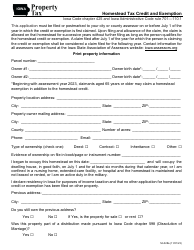

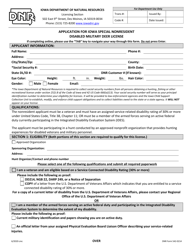

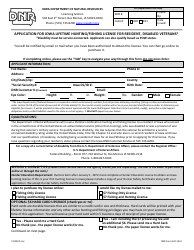

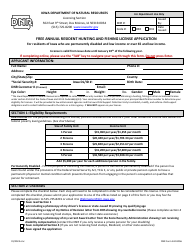

Form 54-049A Application for Disabled Veteran Homestead Tax Credit - Iowa

What Is Form 54-049A?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

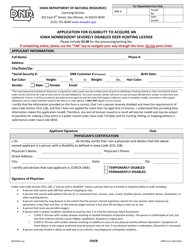

Q: What is Form 54-049A?

A: Form 54-049A is the Application for Disabled VeteranHomestead Tax Credit in Iowa.

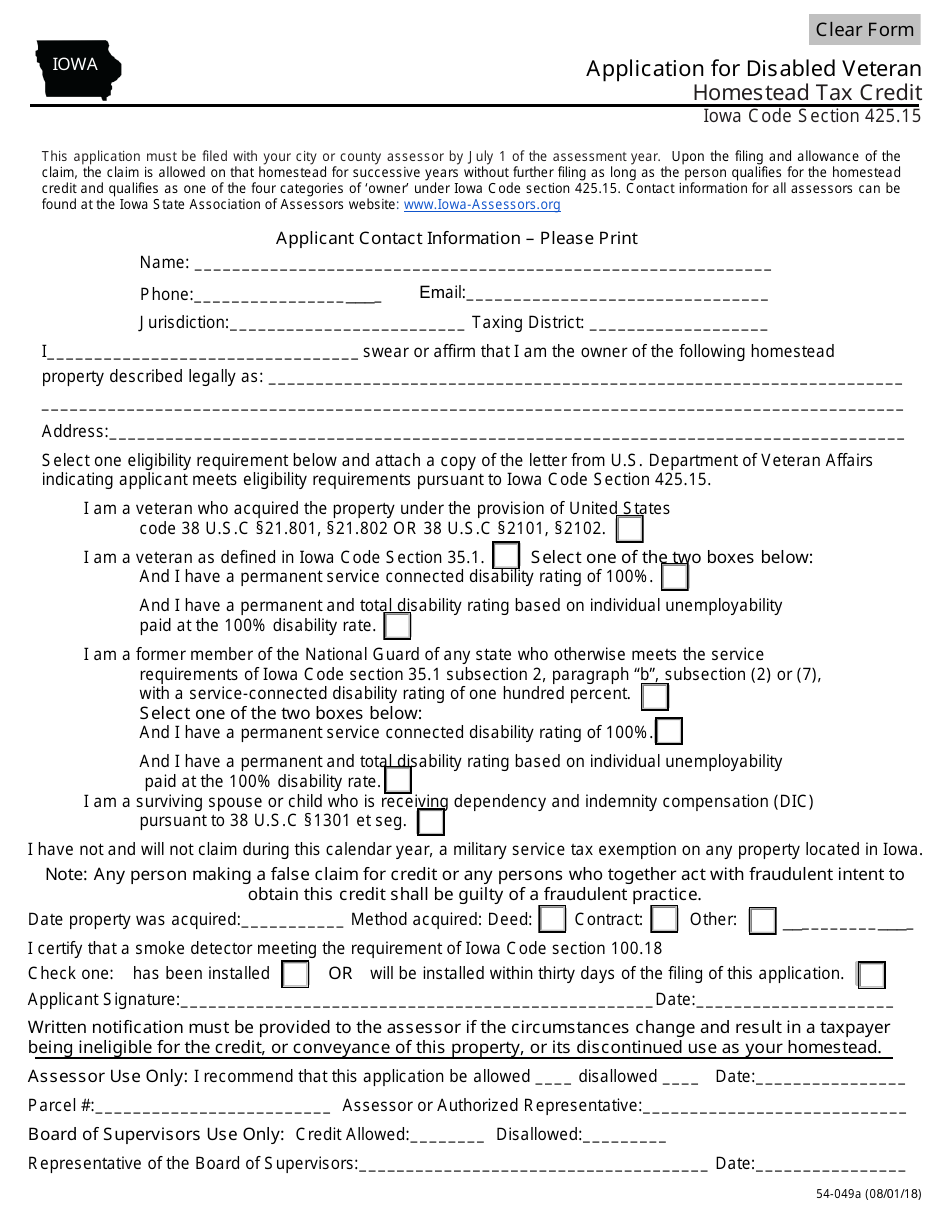

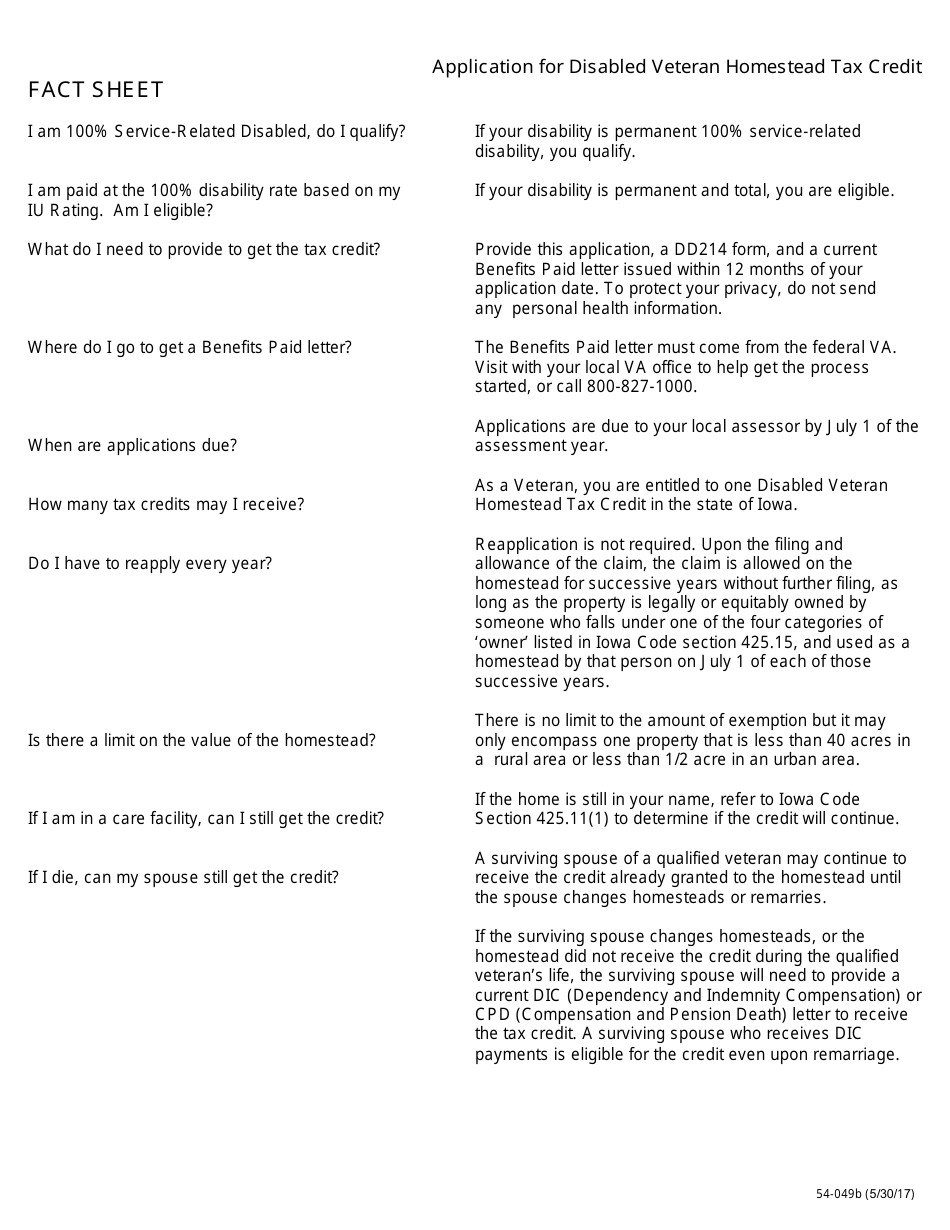

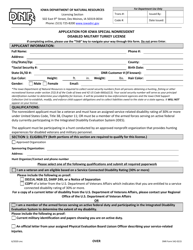

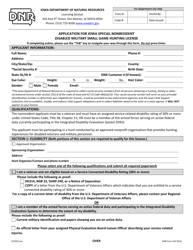

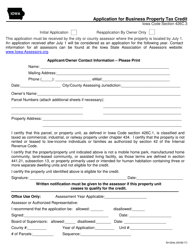

Q: Who is eligible for the Disabled Veteran Homestead Tax Credit in Iowa?

A: Eligible individuals include disabled veterans who own or are buying a home in Iowa, and meet certain criteria.

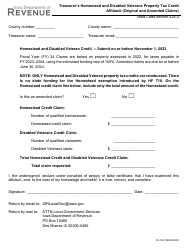

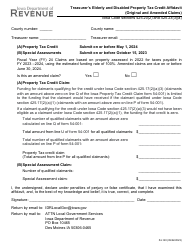

Q: What is the purpose of the Disabled Veteran Homestead Tax Credit?

A: The purpose of this credit is to provide property tax relief to disabled veterans in Iowa.

Q: What information is required to complete Form 54-049A?

A: You will need to provide personal information, proof of disability, and property ownership details.

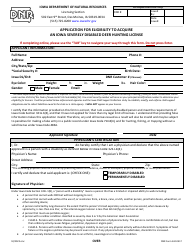

Q: What is the deadline for submitting Form 54-049A?

A: The deadline for submitting Form 54-049A is July 1st of the assessment year.

Q: Are there any fees associated with the application?

A: There are no fees associated with the Form 54-049A application.

Q: How long does it take to process the application?

A: Processing times may vary, but it generally takes several weeks to process the application.

Q: How much tax credit can I receive with this program?

A: The amount of tax credit you can receive depends on your disability rating and the value of your property.

Q: Can I apply for the Disabled Veteran Homestead Tax Credit if I am a surviving spouse or child of a disabled veteran?

A: Yes, surviving spouses and children may be eligible to apply for the tax credit under certain conditions.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-049A by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.