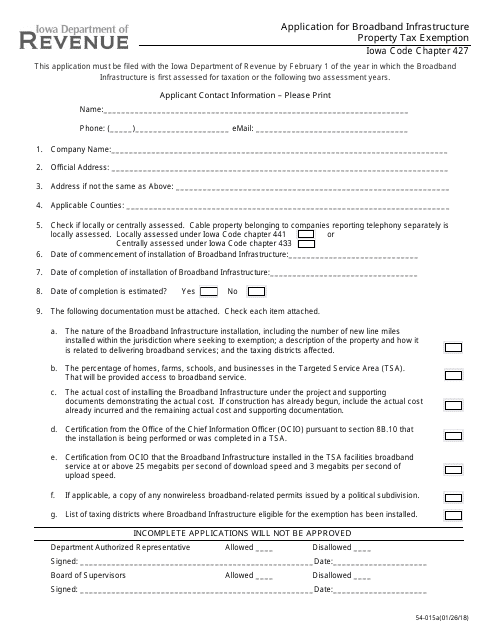

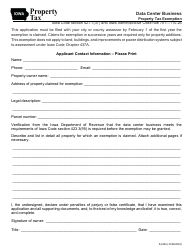

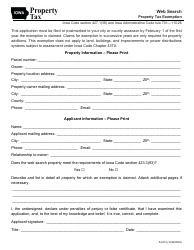

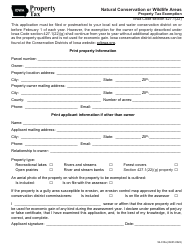

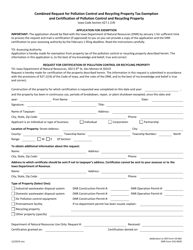

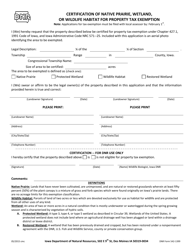

Form 54-015A Application for Broadband Infrastructure Property Tax Exemption - Iowa

What Is Form 54-015A?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

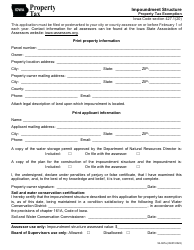

Q: What is Form 54-015A?

A: Form 54-015A is an application for Broadband Infrastructure Property Tax Exemption in Iowa.

Q: Who can use Form 54-015A?

A: Anyone who is seeking a property tax exemption for broadband infrastructure in Iowa can use Form 54-015A.

Q: What is a Broadband Infrastructure Property Tax Exemption?

A: A Broadband Infrastructure Property Tax Exemption is a tax benefit provided to individuals or organizations who invest in broadband infrastructure projects.

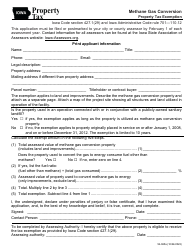

Q: Is there a fee for filing Form 54-015A?

A: There is no fee for filing Form 54-015A.

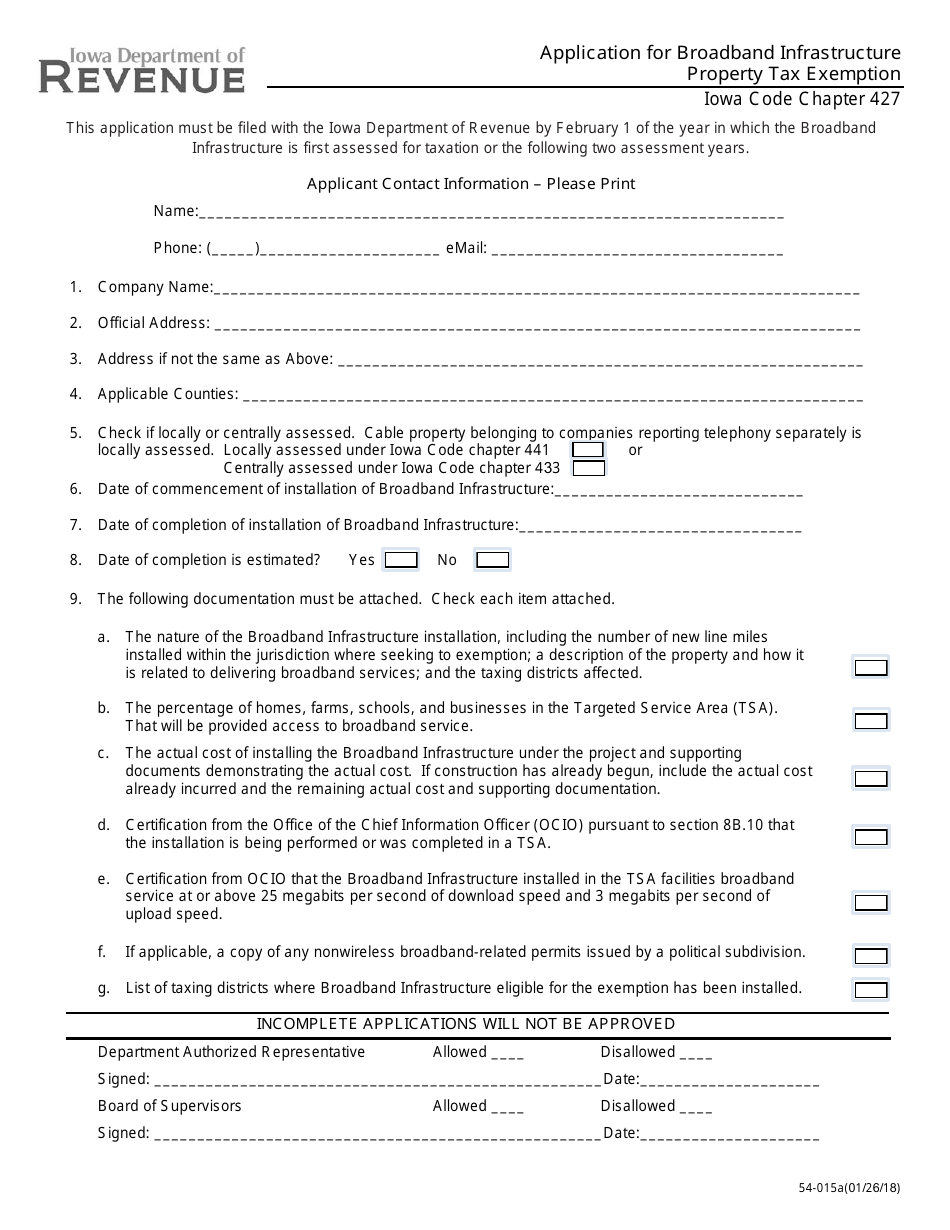

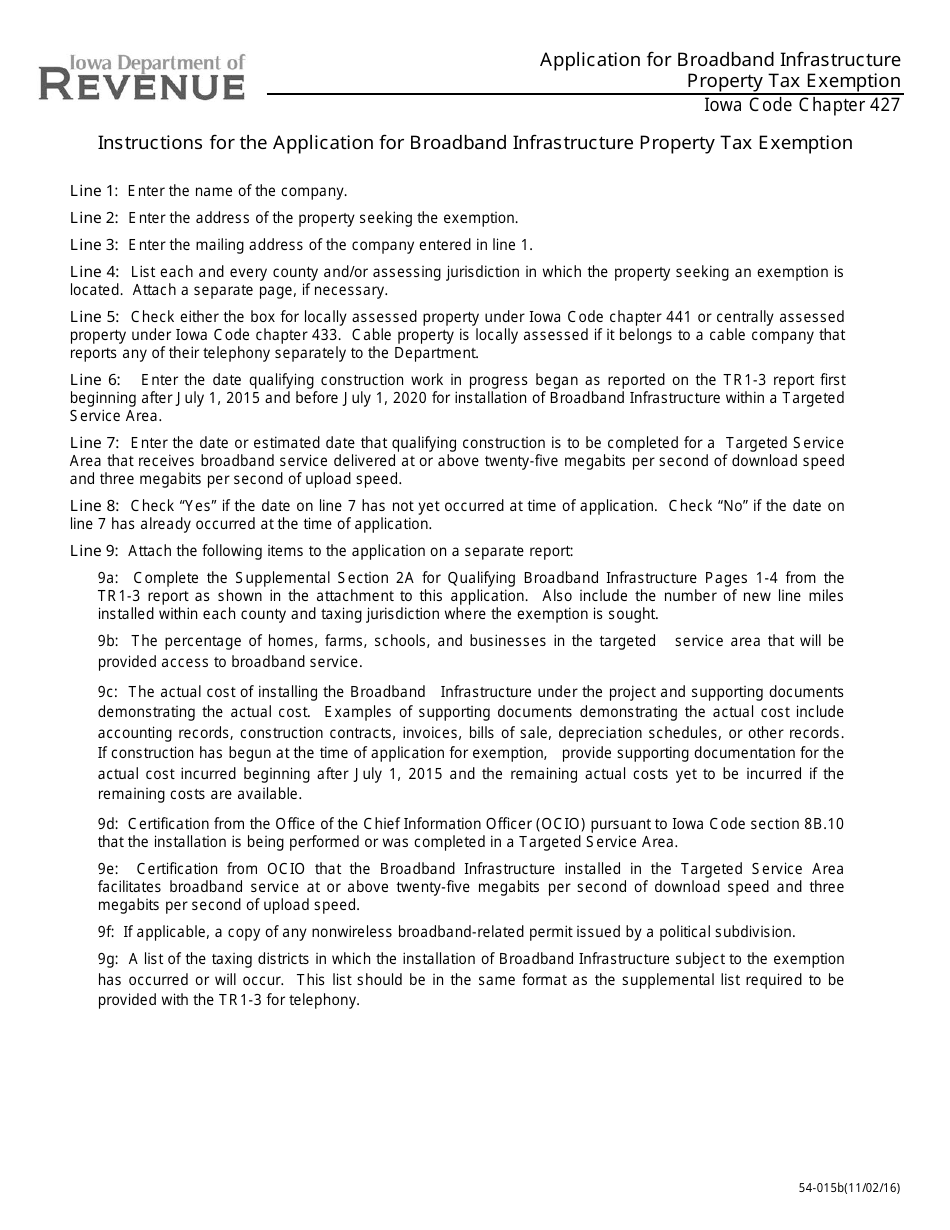

Q: What information is required on Form 54-015A?

A: Form 54-015A requires information about the applicant, details of the broadband infrastructure project, and supporting documentation.

Q: What is the deadline for filing Form 54-015A?

A: Form 54-015A must be filed annually by January 1st.

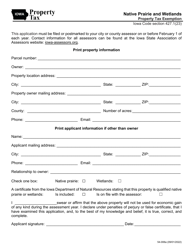

Q: Who should I contact for more information about Form 54-015A?

A: For more information about Form 54-015A, you can contact the Iowa Department of Revenue.

Form Details:

- Released on January 26, 2018;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-015A by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.