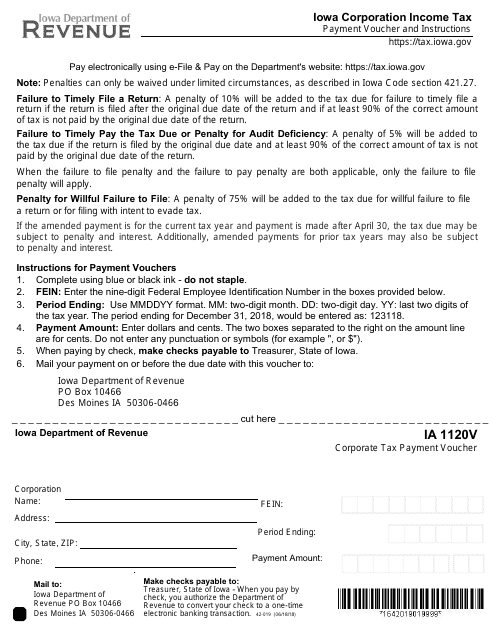

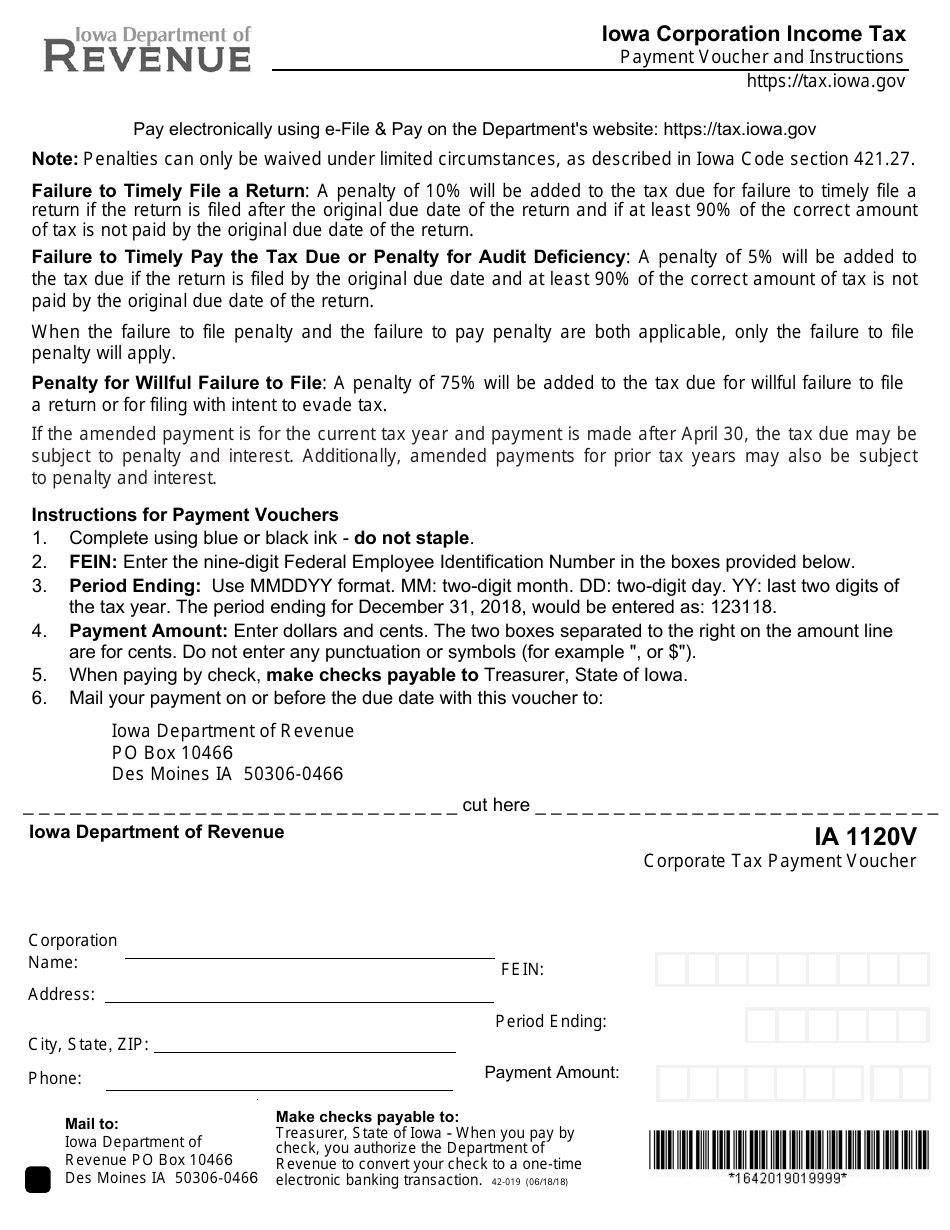

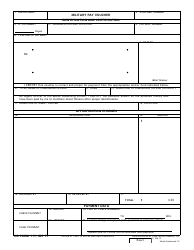

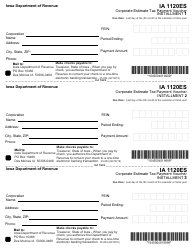

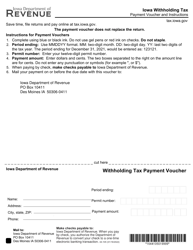

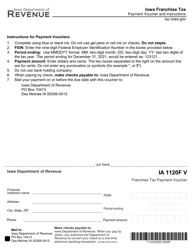

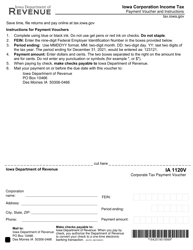

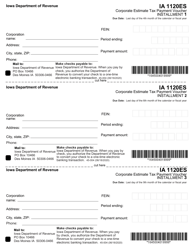

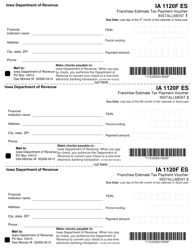

Form IA1120V Corporate Tax Payment Voucher - Iowa

What Is Form IA1120V?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA1120V?

A: Form IA1120V is the Corporate Tax Payment Voucher specific to Iowa.

Q: Who should use Form IA1120V?

A: Corporations in Iowa should use Form IA1120V to make tax payments.

Q: What is the purpose of Form IA1120V?

A: Form IA1120V is used to make payments for corporate taxes owed to the state of Iowa.

Q: When is Form IA1120V due?

A: Form IA1120V is due on the 30th day of the 4th month following the close of the tax year for corporations.

Q: What information should I include on Form IA1120V?

A: You should include your corporation's name, address, tax identification number, the tax year, and the amount of tax being paid.

Q: Are there any penalties for late payment of corporate taxes?

A: Yes, there are penalties for late payment of corporate taxes in Iowa. The specific penalties depend on the amount and duration of the overdue payment.

Form Details:

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1120V by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.