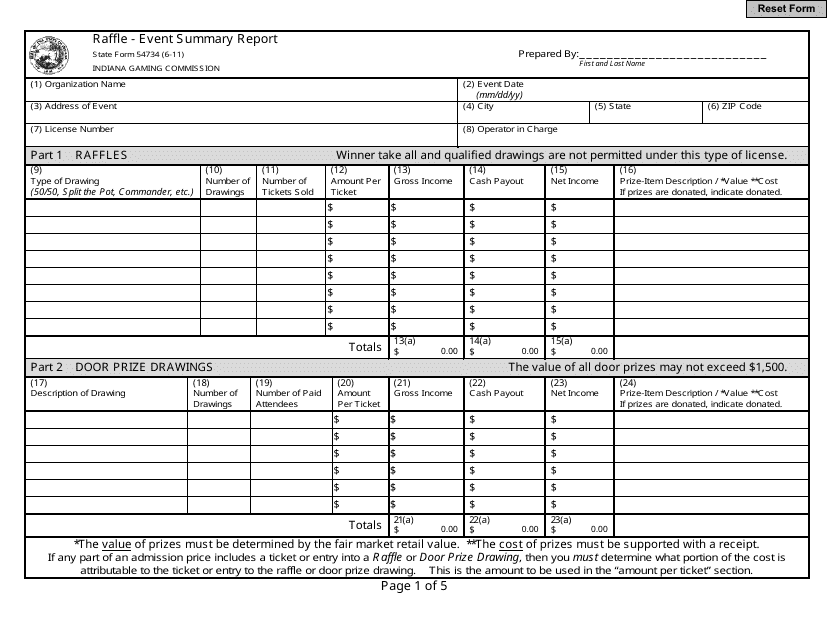

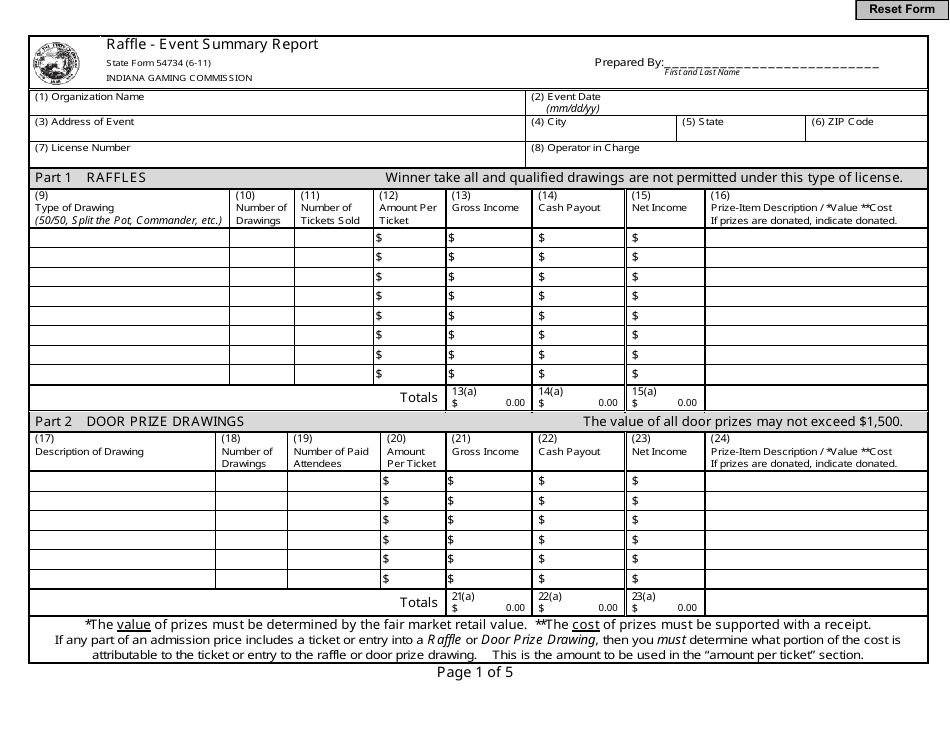

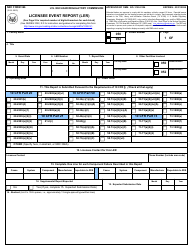

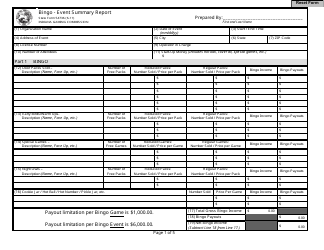

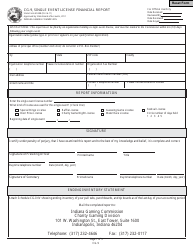

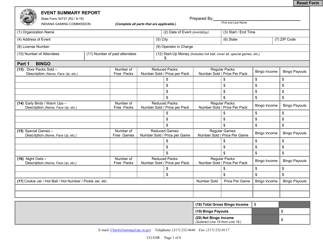

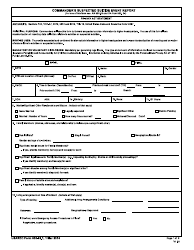

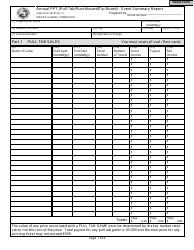

State Form 54734 Raffle - Event Summary Report - Indiana

What Is State Form 54734?

This is a legal form that was released by the Indiana Gaming Commission - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 54734?

A: State Form 54734 is a raffle event summary report form.

Q: What is the purpose of State Form 54734?

A: The purpose of State Form 54734 is to report the summary of a raffle event in Indiana.

Q: Who needs to fill out State Form 54734?

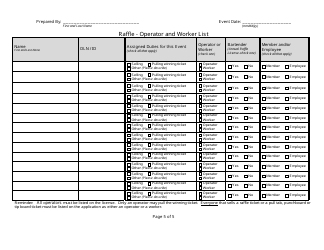

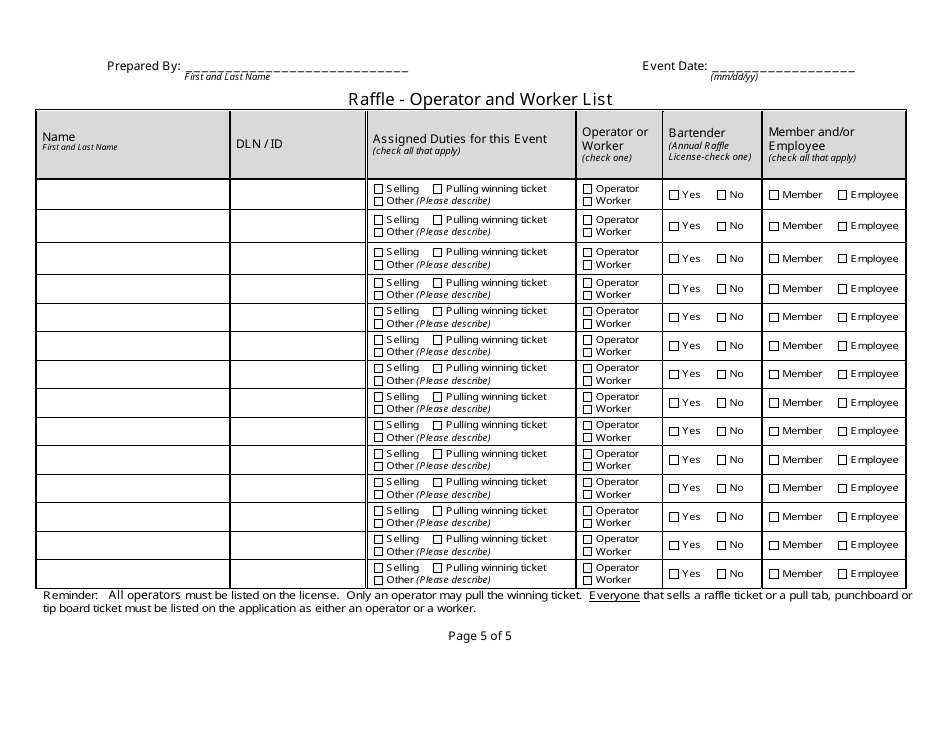

A: Event organizers or licensees conducting raffles in Indiana need to fill out State Form 54734.

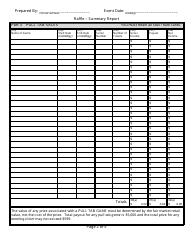

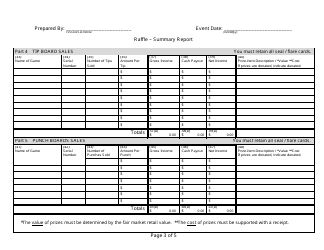

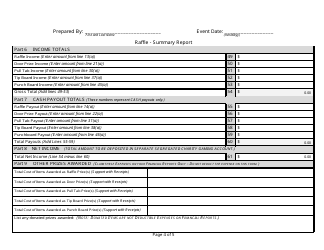

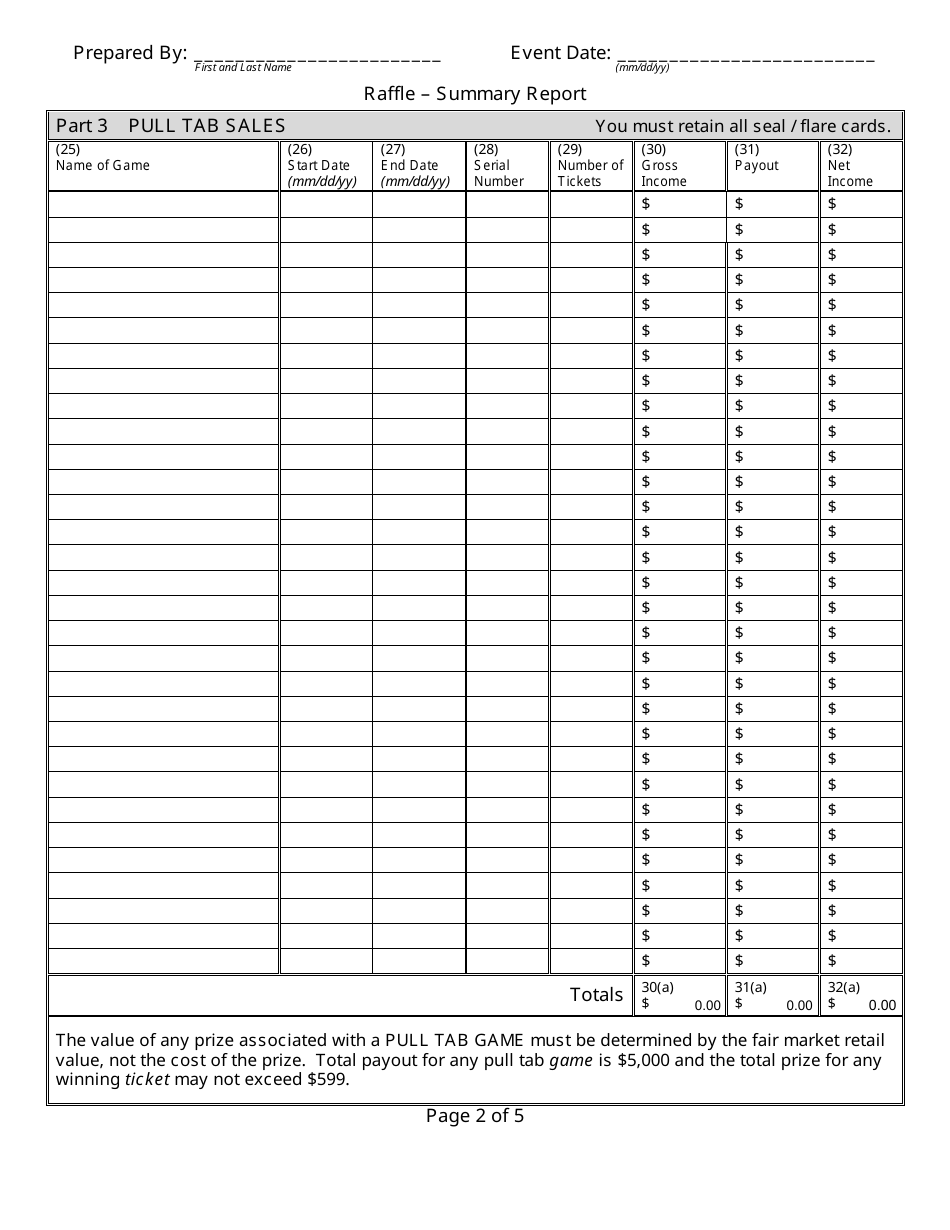

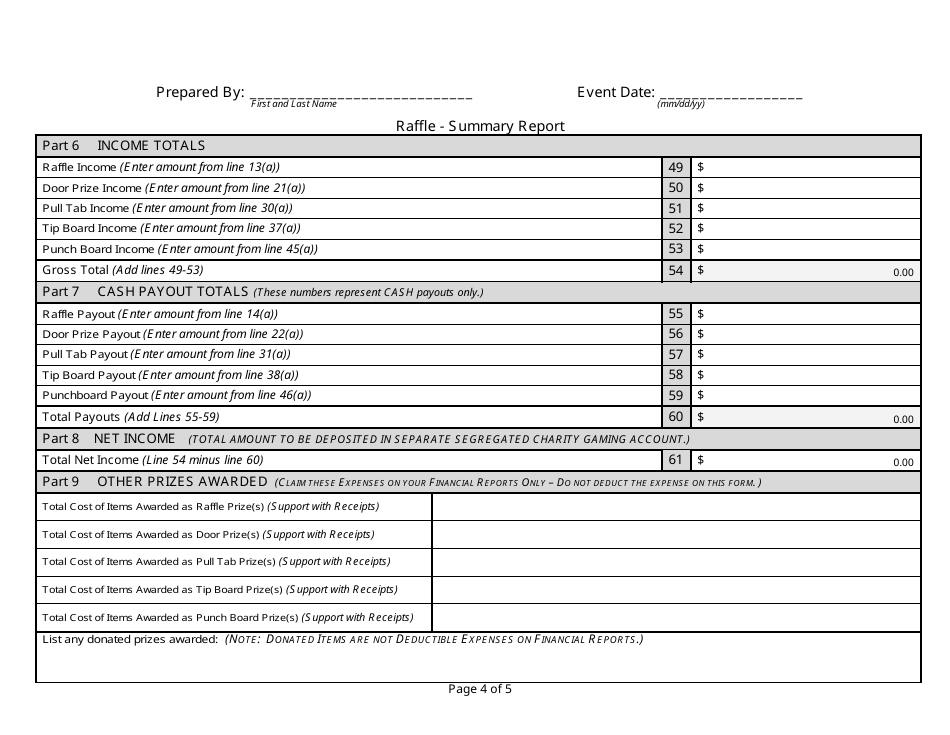

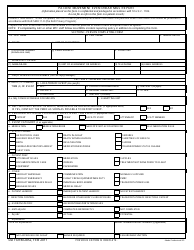

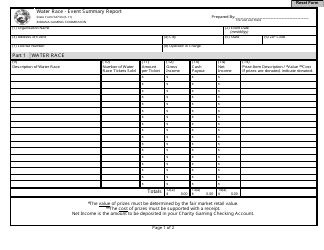

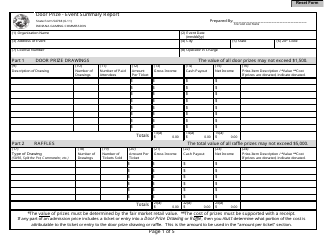

Q: What information is required on State Form 54734?

A: State Form 54734 requires information such as event details, ticket sales, expenses, and net proceeds from the raffle.

Q: When should State Form 54734 be submitted?

A: State Form 54734 must be submitted within 30 days following the end of the raffle event.

Q: Are there any fees associated with submitting State Form 54734?

A: No, there are no fees associated with submitting State Form 54734.

Q: What happens if I do not submit State Form 54734?

A: Failure to submit State Form 54734 may result in penalties or consequences as per Indiana state regulations.

Q: What should I do if I have questions or need assistance with State Form 54734?

A: If you have questions or need assistance with State Form 54734, you can contact the Indiana Department of Revenue or local government offices for guidance.

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the Indiana Gaming Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54734 by clicking the link below or browse more documents and templates provided by the Indiana Gaming Commission.