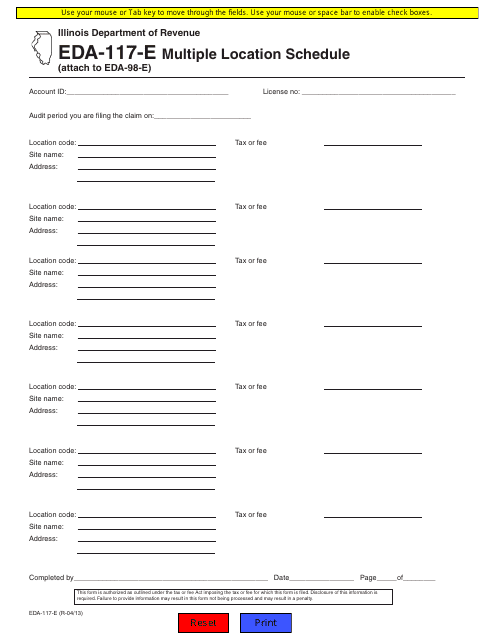

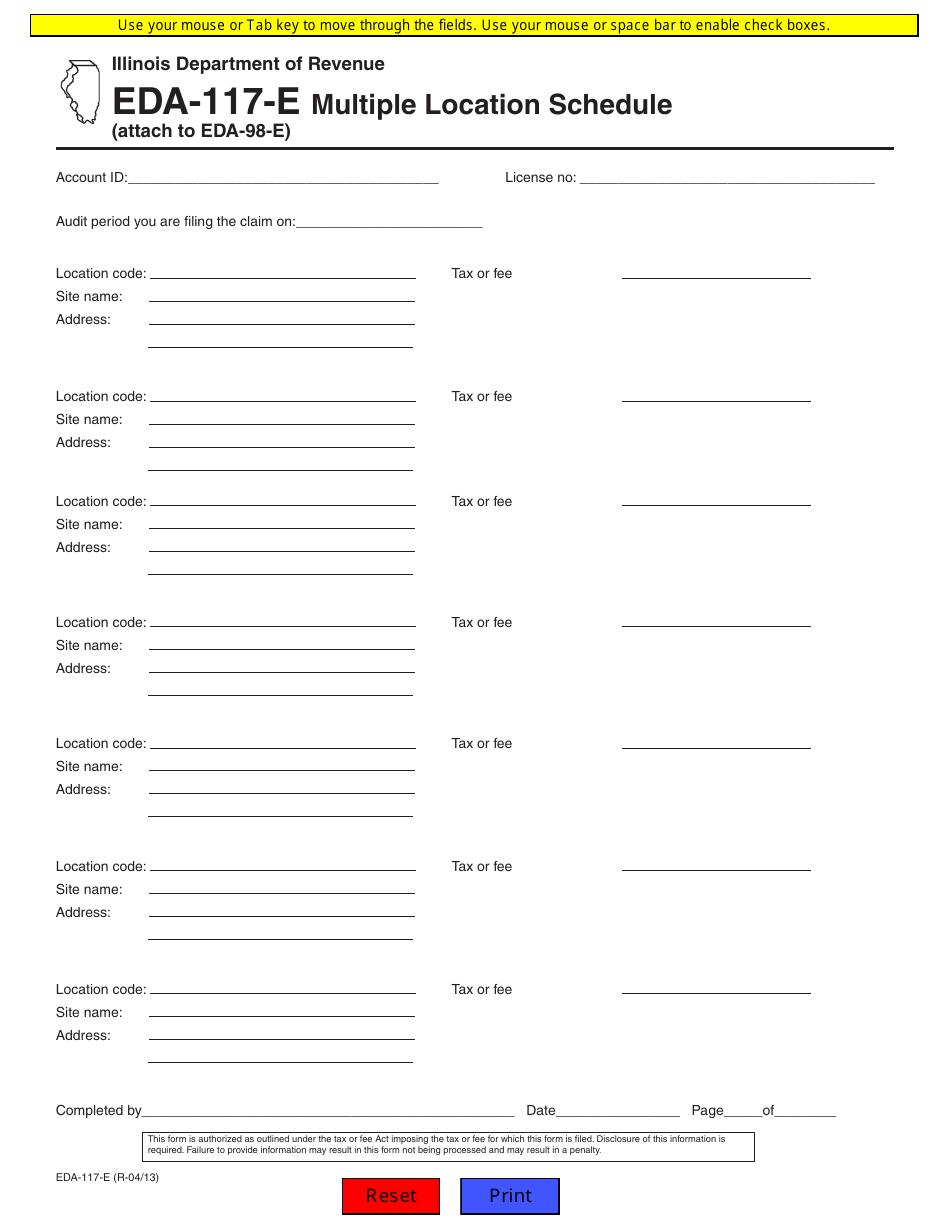

Form EDA-117-E Multiple Location Schedule - Illinois

What Is Form EDA-117-E?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EDA-117-E?

A: Form EDA-117-E is the Multiple Location Schedule for the state of Illinois.

Q: What is the purpose of Form EDA-117-E?

A: The purpose of Form EDA-117-E is to report multiple locations for businesses operating in Illinois.

Q: Who needs to fill out Form EDA-117-E?

A: Businesses operating in Illinois with multiple locations need to fill out Form EDA-117-E.

Q: Is Form EDA-117-E mandatory?

A: Yes, businesses with multiple locations in Illinois are required to fill out Form EDA-117-E.

Q: What information do I need to provide in Form EDA-117-E?

A: You need to provide the details of each location, including the address and sales tax collected for each location.

Q: When is the deadline to submit Form EDA-117-E?

A: The deadline to submit Form EDA-117-E is usually on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of Form EDA-117-E?

A: Yes, there may be penalties for late or incorrect filing of Form EDA-117-E, including fines and interest charges.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EDA-117-E by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.