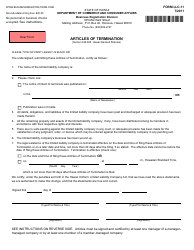

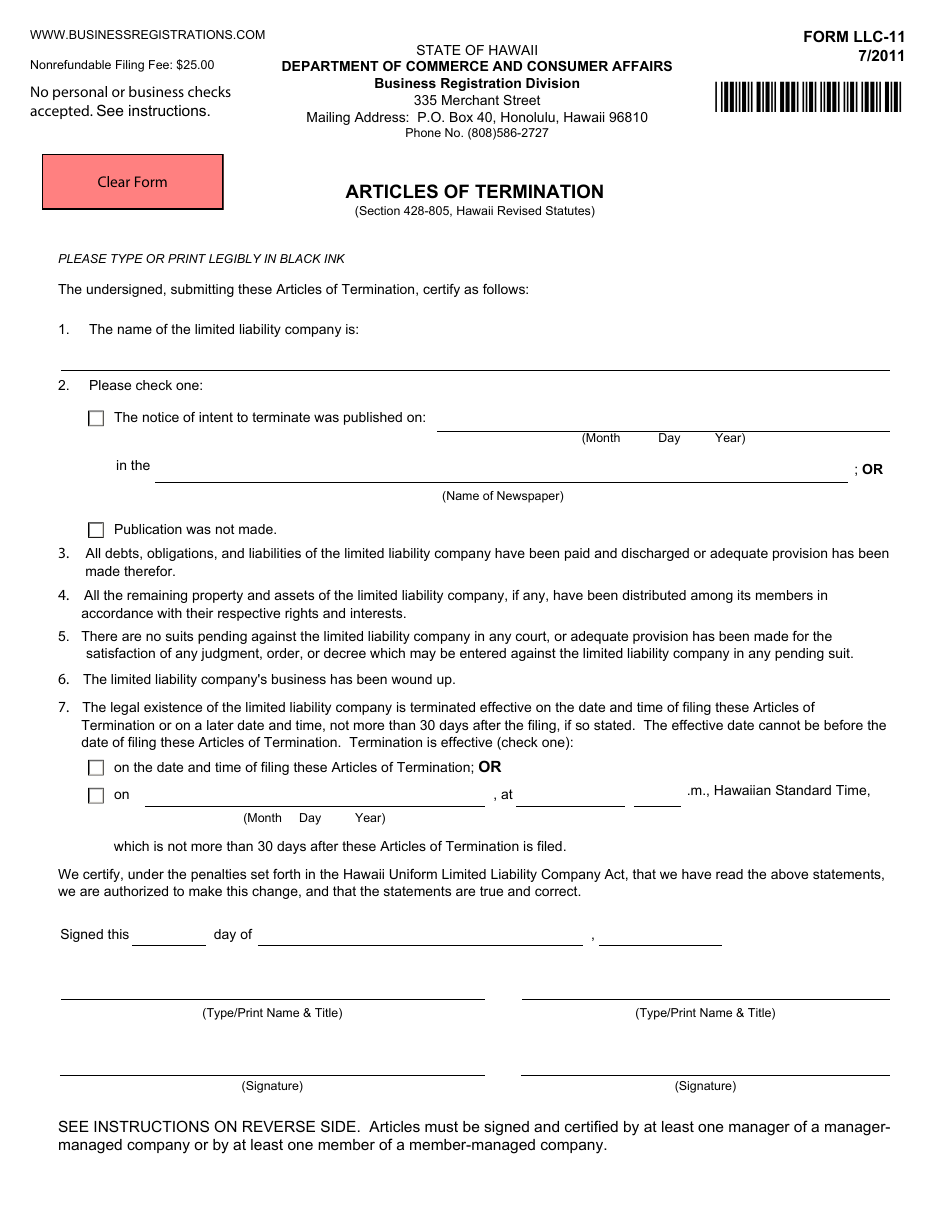

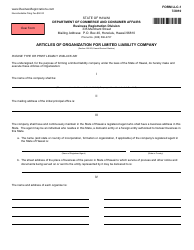

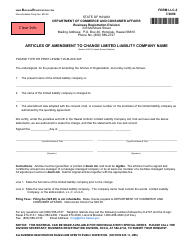

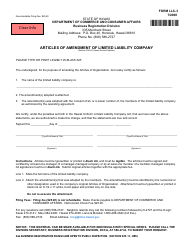

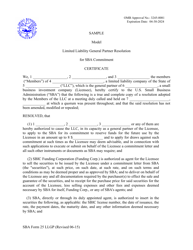

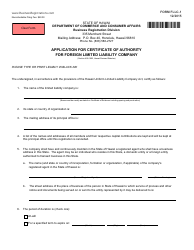

Form LLC-11 Articles of Termination - Hawaii

What Is Form LLC-11?

This is a legal form that was released by the Hawaii Department of Commerce & Consumer Affairs - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LLC-11 Articles of Termination?

A: LLC-11 Articles of Termination is a legal document used in the state of Hawaii to dissolve a limited liability company (LLC).

Q: How do I complete LLC-11 Articles of Termination?

A: To complete LLC-11 Articles of Termination, you need to provide information about the LLC, its members, and the reason for termination.

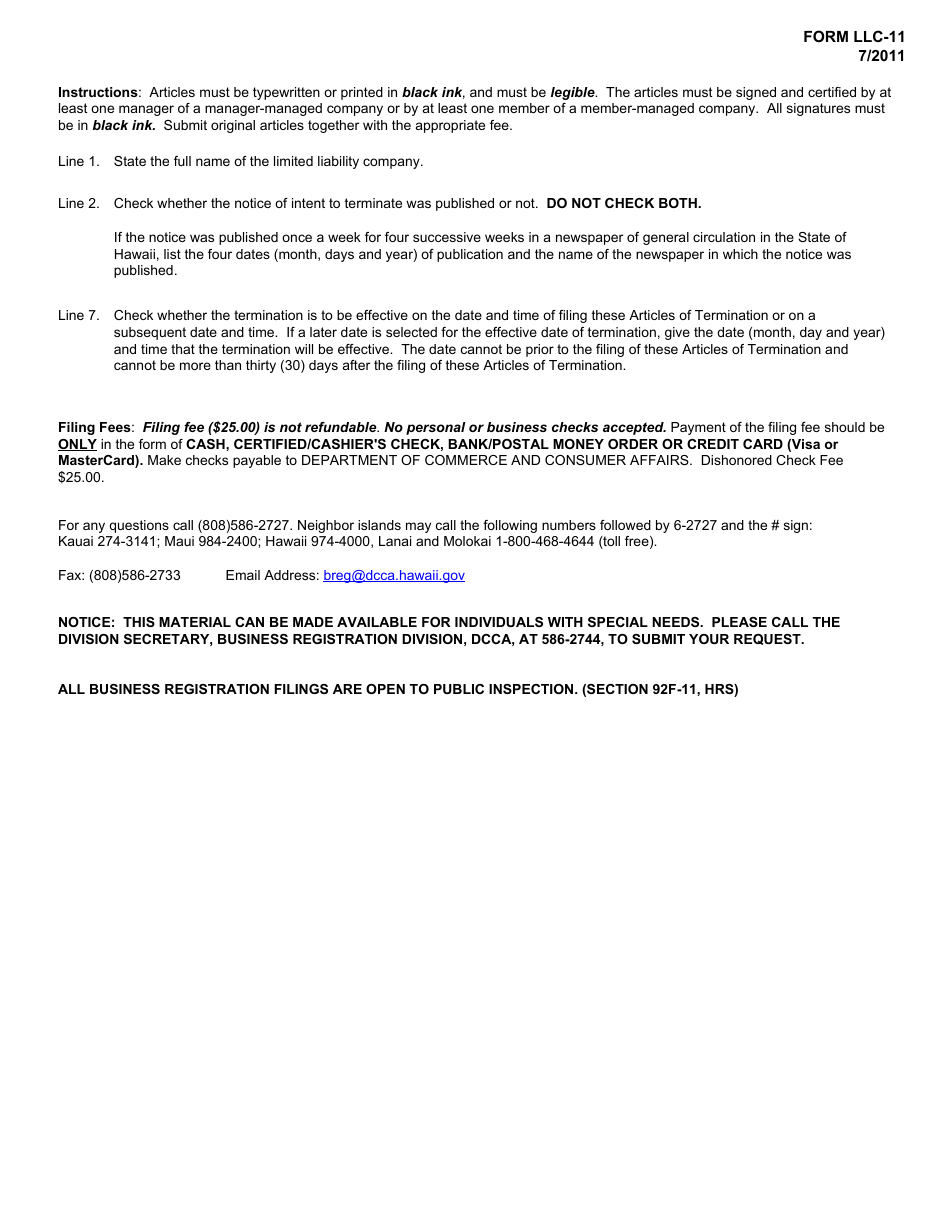

Q: What is the fee for filing LLC-11 Articles of Termination in Hawaii?

A: The fee for filing LLC-11 Articles of Termination in Hawaii is $25.

Q: Do I need to notify any other agencies or entities when filing LLC-11 Articles of Termination?

A: Yes, you may need to notify other agencies or entities, such as the Internal Revenue Service (IRS) and the Hawaii Department of Taxation.

Q: Can I dissolve my LLC without filing LLC-11 Articles of Termination?

A: No, LLC-11 Articles of Termination is required to officially dissolve an LLC in Hawaii.

Q: Is there a specific timeframe for filing LLC-11 Articles of Termination in Hawaii?

A: There is no specific timeframe, but it is recommended to file LLC-11 Articles of Termination as soon as you decide to dissolve your LLC.

Q: What happens after filing LLC-11 Articles of Termination?

A: After filing LLC-11 Articles of Termination, your LLC will be officially dissolved, and you will no longer have any legal obligations or liabilities as an LLC.

Q: Can I revive a dissolved LLC in Hawaii?

A: Yes, you can revive a dissolved LLC in Hawaii by filing a Certificate of Revival with the Hawaii Department of Commerce and Consumer Affairs.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Hawaii Department of Commerce & Consumer Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-11 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Commerce & Consumer Affairs.