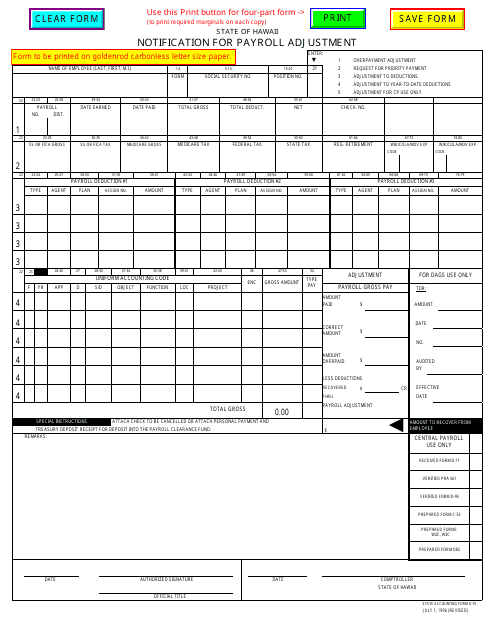

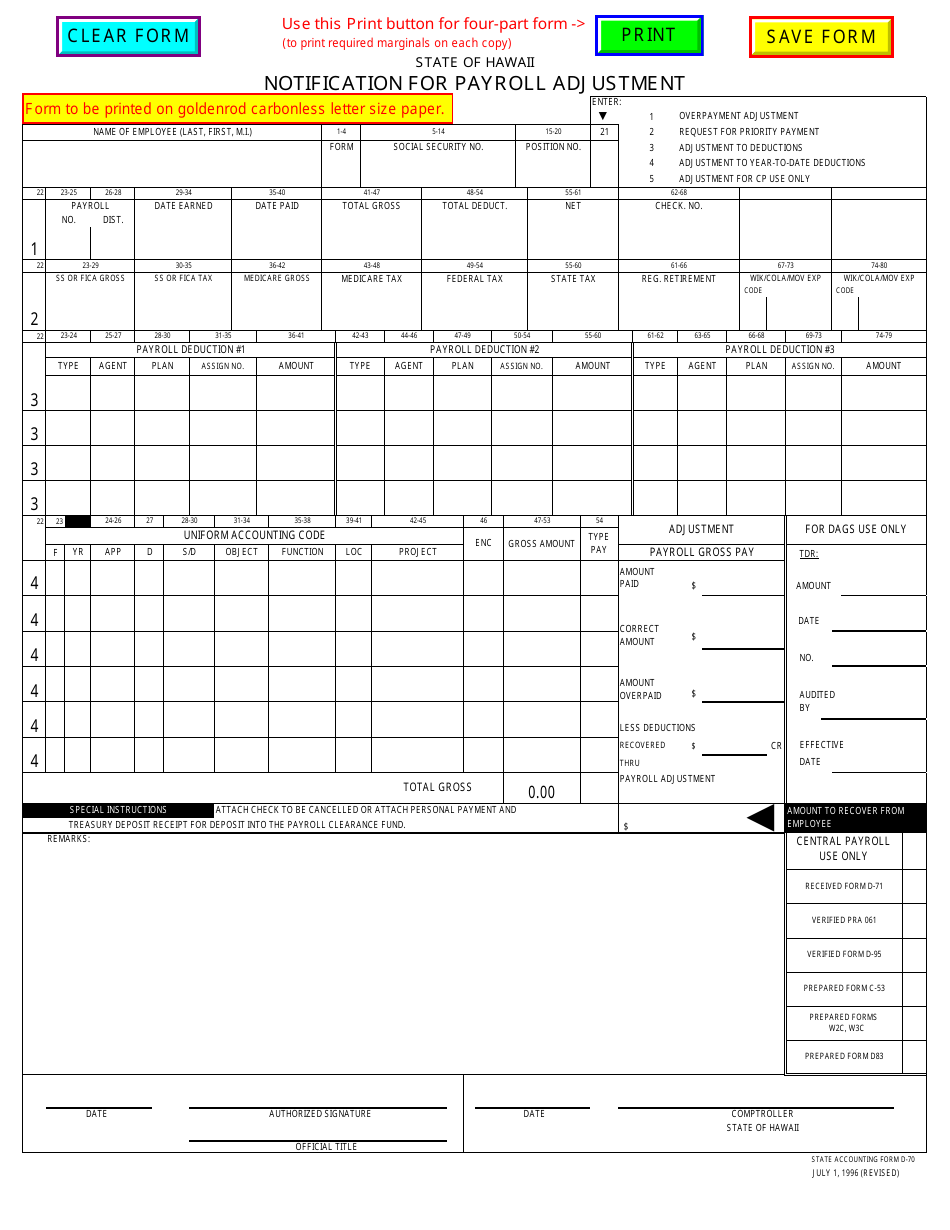

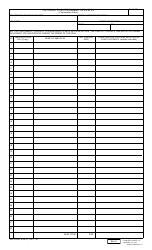

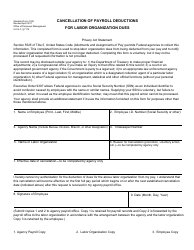

Form D-70 Notification for Payroll Adjustment - Hawaii

What Is Form D-70?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

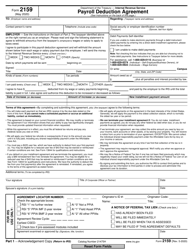

Q: What is Form D-70?

A: Form D-70 is a form used in Hawaii for notifying the Department of Labor and Industrial Relations about payroll adjustments.

Q: When should Form D-70 be filed?

A: Form D-70 should be filed within 10 calendar days after the adjustment is made.

Q: Who needs to file Form D-70?

A: Employers in Hawaii need to file Form D-70 if they make a payroll adjustment that affects wages, hours, or working conditions of employees.

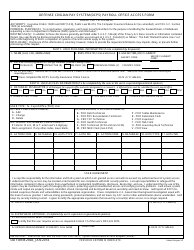

Form Details:

- Released on July 1, 1996;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-70 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.