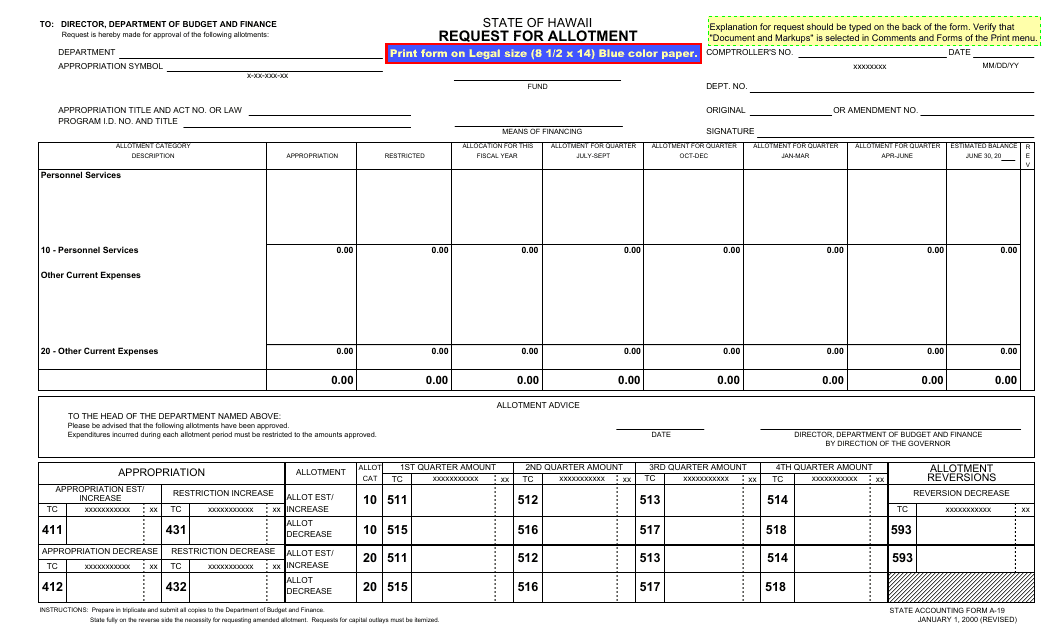

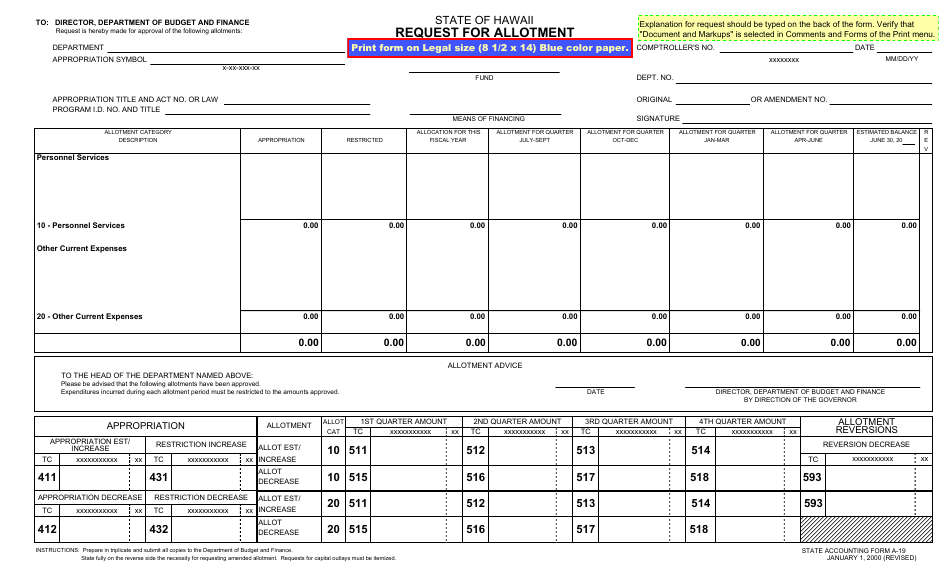

Form A-19 Request for Allotment - Hawaii

What Is Form A-19?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-19?

A: Form A-19 is a request for allotment form.

Q: What is the purpose of Form A-19?

A: The purpose of Form A-19 is to request an allotment.

Q: Who can use Form A-19?

A: Form A-19 can be used by individuals in Hawaii.

Q: Is there a fee to submit Form A-19?

A: No, there is no fee to submit Form A-19.

Q: How long does it take to process Form A-19?

A: Processing time for Form A-19 varies, but it usually takes a few weeks.

Q: Can I submit Form A-19 electronically?

A: Yes, Form A-19 can be submitted electronically.

Q: What should I do if I made a mistake on Form A-19?

A: If you made a mistake on Form A-19, you should contact the Hawaii Department of Taxation.

Q: What happens after I submit Form A-19?

A: After you submit Form A-19, it will be reviewed by the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-19 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.