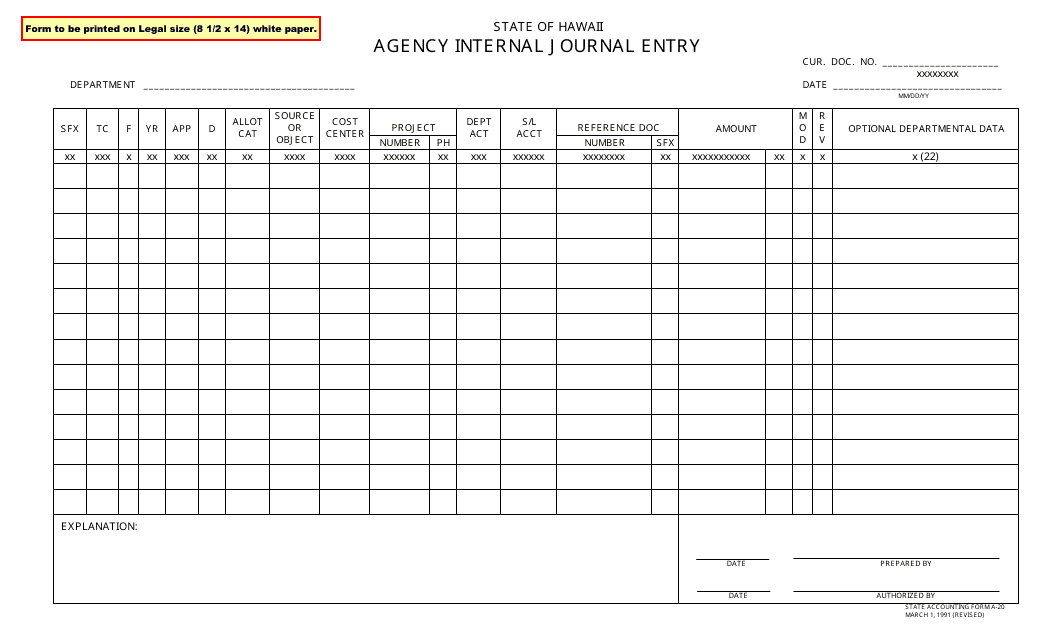

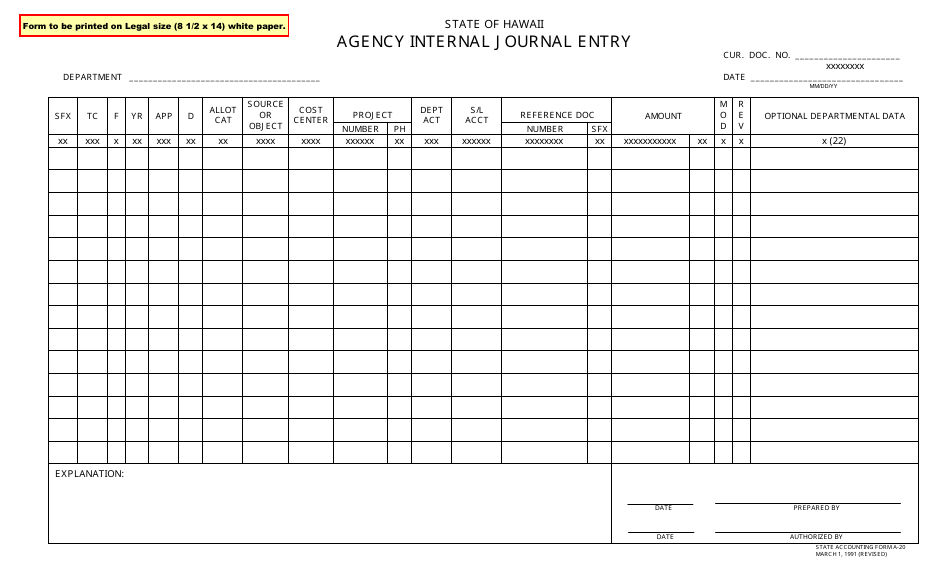

Form A-20 Agency Internal Journal Entry - Hawaii

What Is Form A-20?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-20?

A: Form A-20 is an Agency Internal Journal Entry form.

Q: What is the purpose of Form A-20?

A: The purpose of Form A-20 is to document internal journal entries in an agency.

Q: Who uses Form A-20?

A: Form A-20 is used by agencies to record and track internal journal entries.

Q: What information is required on Form A-20?

A: Form A-20 requires information such as the date, description of the transaction, account numbers, and dollar amounts.

Q: Is Form A-20 specific to the state of Hawaii?

A: Yes, Form A-20 is specific to Hawaii and is used by agencies in the state.

Form Details:

- Released on March 1, 1991;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-20 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.