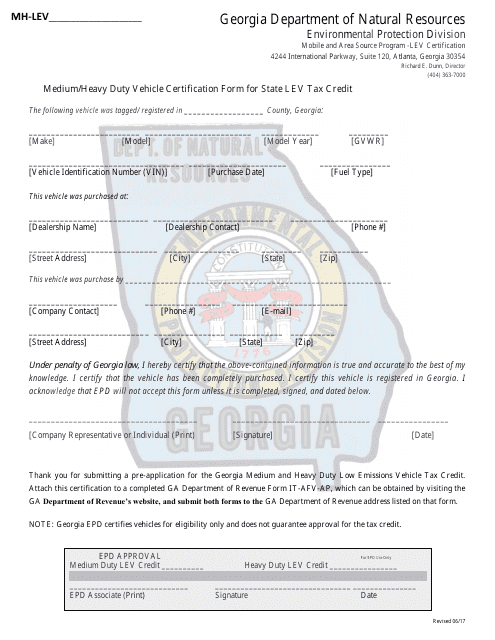

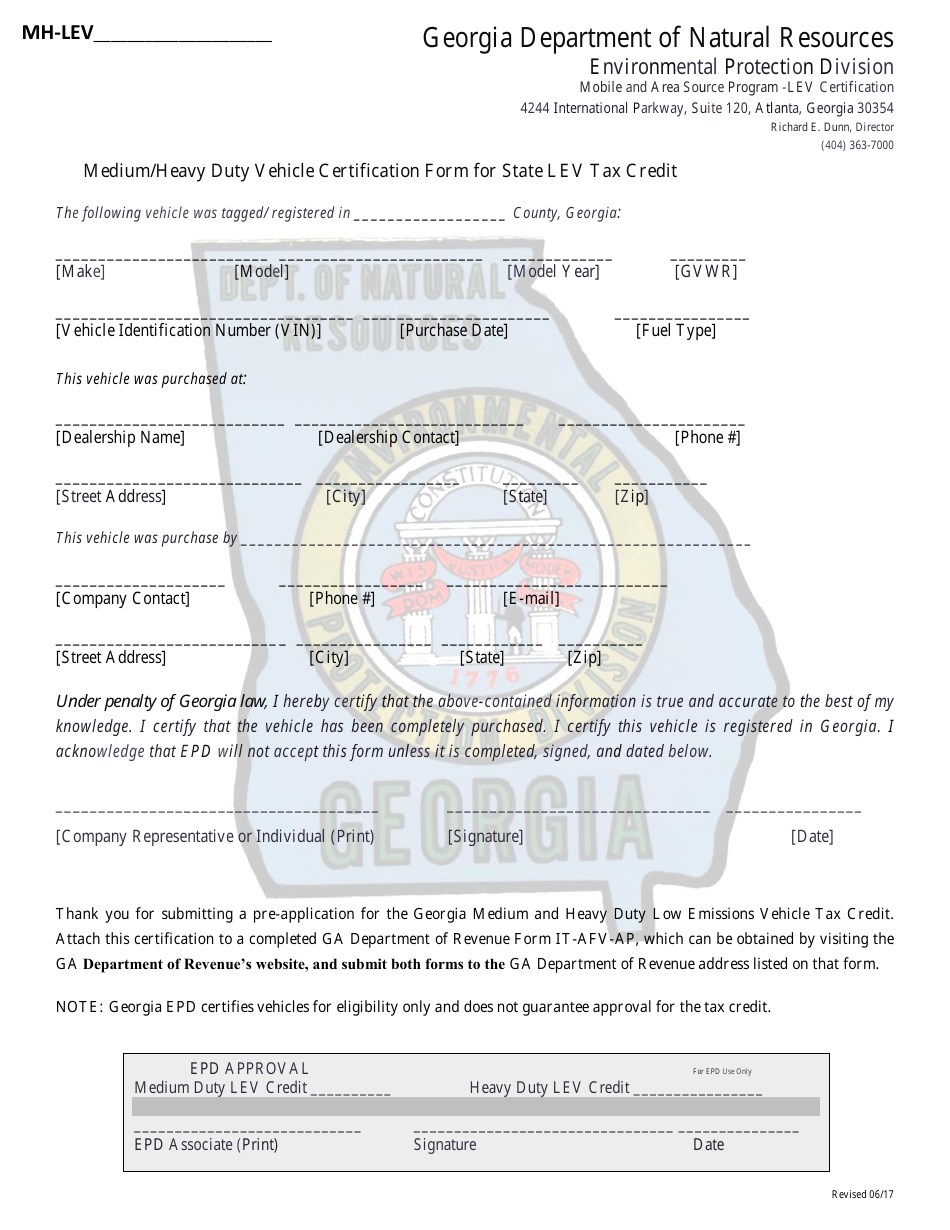

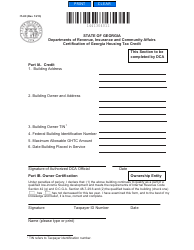

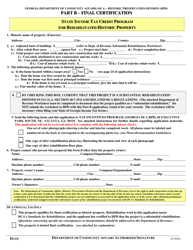

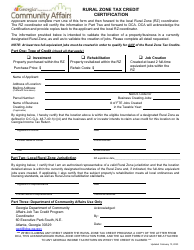

Medium / Heavy Duty Vehicle Certification Form for State Lev Tax Credit - Georgia (United States)

Medium/Heavy Duty Vehicle Certification Form for State Lev Tax Credit is a legal document that was released by the Georgia Department of Natural Resources - a government authority operating within Georgia (United States).

FAQ

Q: What is the Medium/Heavy Duty Vehicle Certification Form for State Level Tax Credit in Georgia?

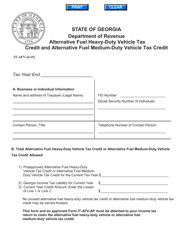

A: The Medium/Heavy Duty Vehicle Certification Form is a document used in Georgia for the purpose of claiming a tax credit for purchasing a medium or heavy-duty vehicle.

Q: Who is eligible to claim the State Level Tax Credit for medium/heavy duty vehicles in Georgia?

A: Individuals, fleet owners, and businesses that have purchased or leased qualified medium or heavy-duty vehicles in Georgia are eligible to claim the State Level Tax Credit.

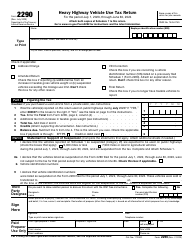

Q: What vehicles qualify for the tax credit in Georgia?

A: Vehicles that meet the specifications outlined by the Georgia Department of Revenue and are certified through the Medium/Heavy Duty Vehicle Certification Form may qualify for the tax credit.

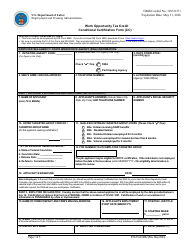

Q: What information is required on the Certification Form?

A: The Certification Form requires information about the make, model, and year of the vehicle, as well as documentation of the purchase or lease transaction.

Q: What is the deadline for submitting the Certification Form?

A: The Certification Form must be submitted to the Georgia Department of Revenue within 30 days of purchasing or leasing the qualified vehicle.

Q: What is the amount of the tax credit for qualifying vehicles in Georgia?

A: The amount of the tax credit varies depending on the weight and type of the vehicle, as well as other factors. It is best to consult the Georgia Department of Revenue or a tax professional for specific details.

Q: Can the tax credit be carried forward or transferred to another person or entity?

A: No, the tax credit cannot be carried forward to future years or transferred to another person or entity.

Q: Are there any restrictions or limitations on claiming the tax credit?

A: Yes, there are certain restrictions and limitations on claiming the tax credit, including but not limited to the type and weight of the vehicle, its intended use, and the availability of funds for the tax credit program.

Form Details:

- Released on June 1, 2017;

- The latest edition currently provided by the Georgia Department of Natural Resources;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Georgia Department of Natural Resources.