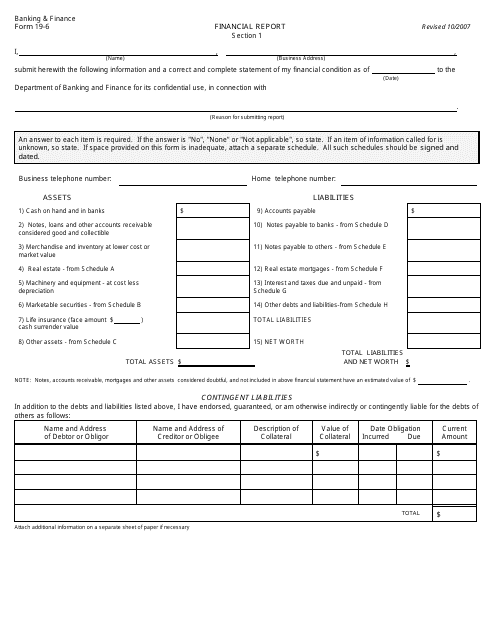

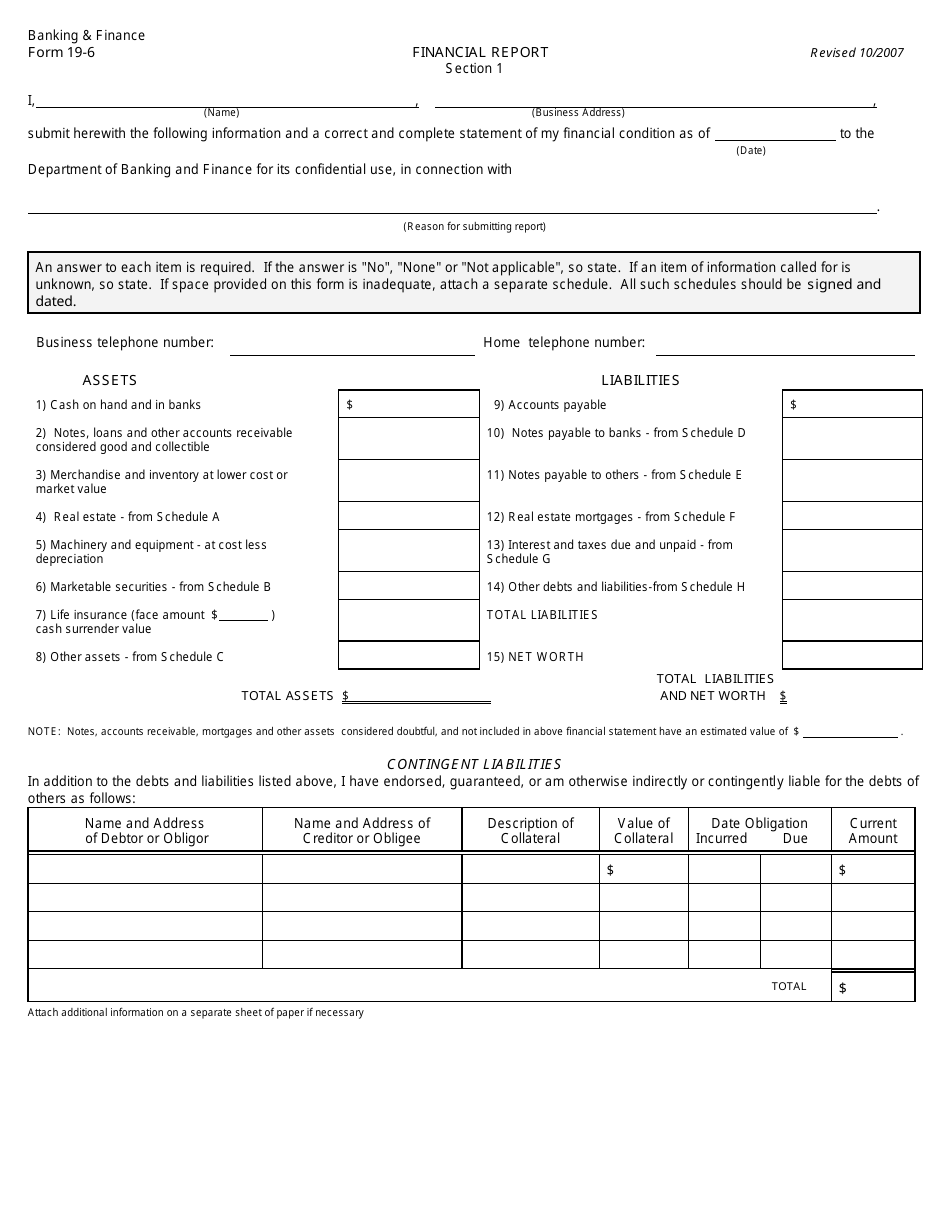

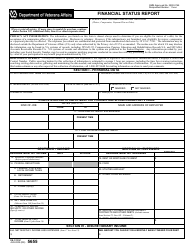

Form 19-6 Financial Report - Georgia (United States)

What Is Form 19-6?

This is a legal form that was released by the Georgia Department of Banking and Finance - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 19-6?

A: Form 19-6 is a financial report used in Georgia (United States).

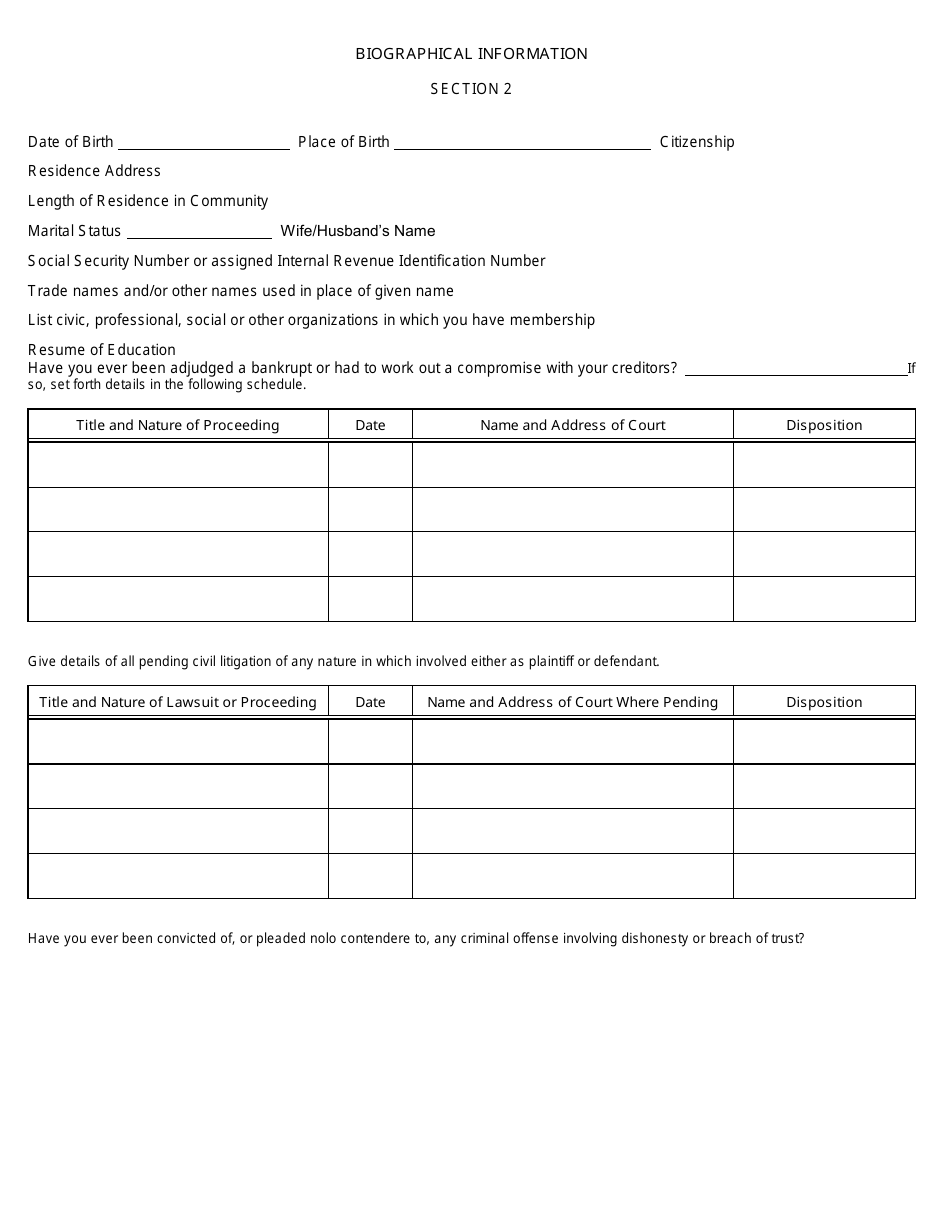

Q: Who needs to complete Form 19-6?

A: Individuals and businesses in Georgia may need to complete Form 19-6.

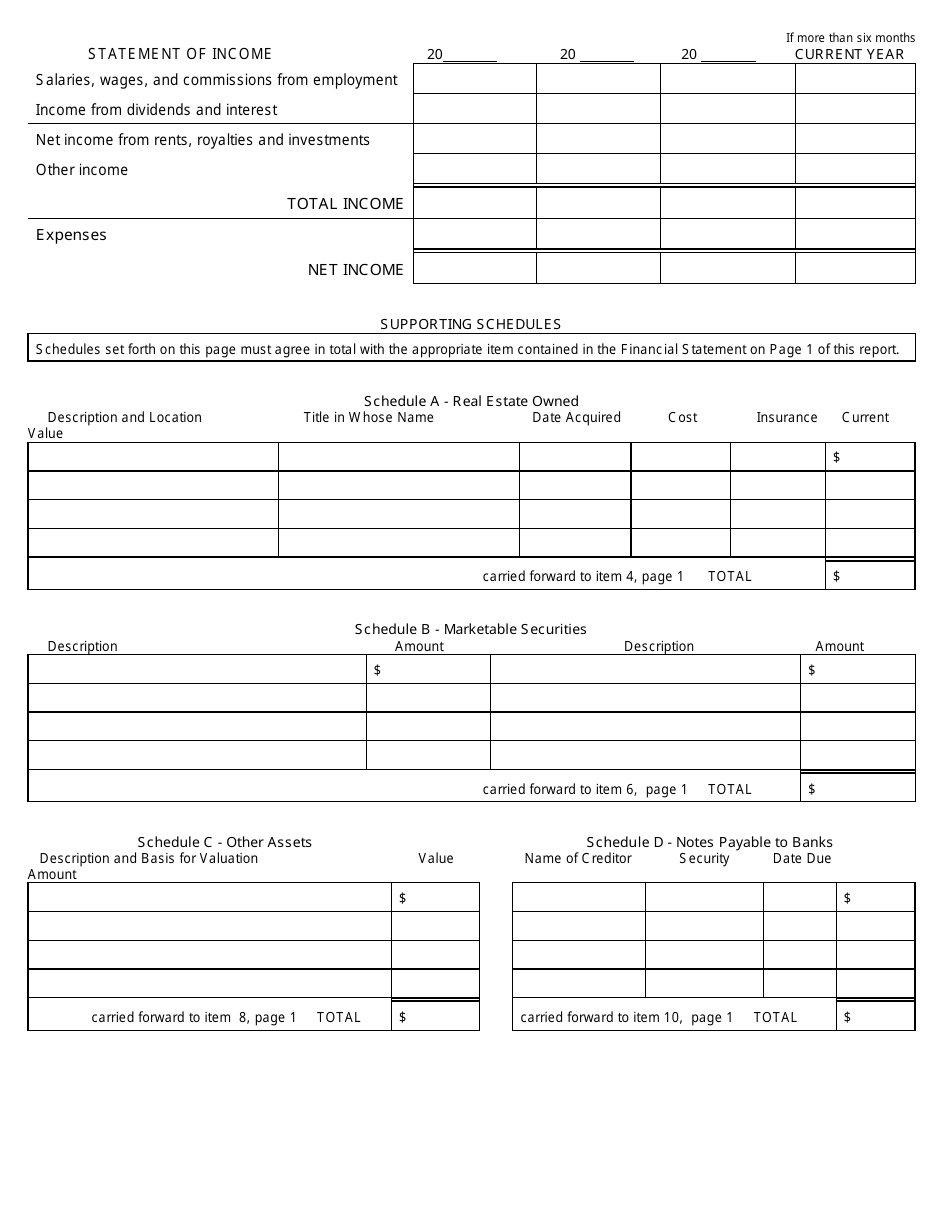

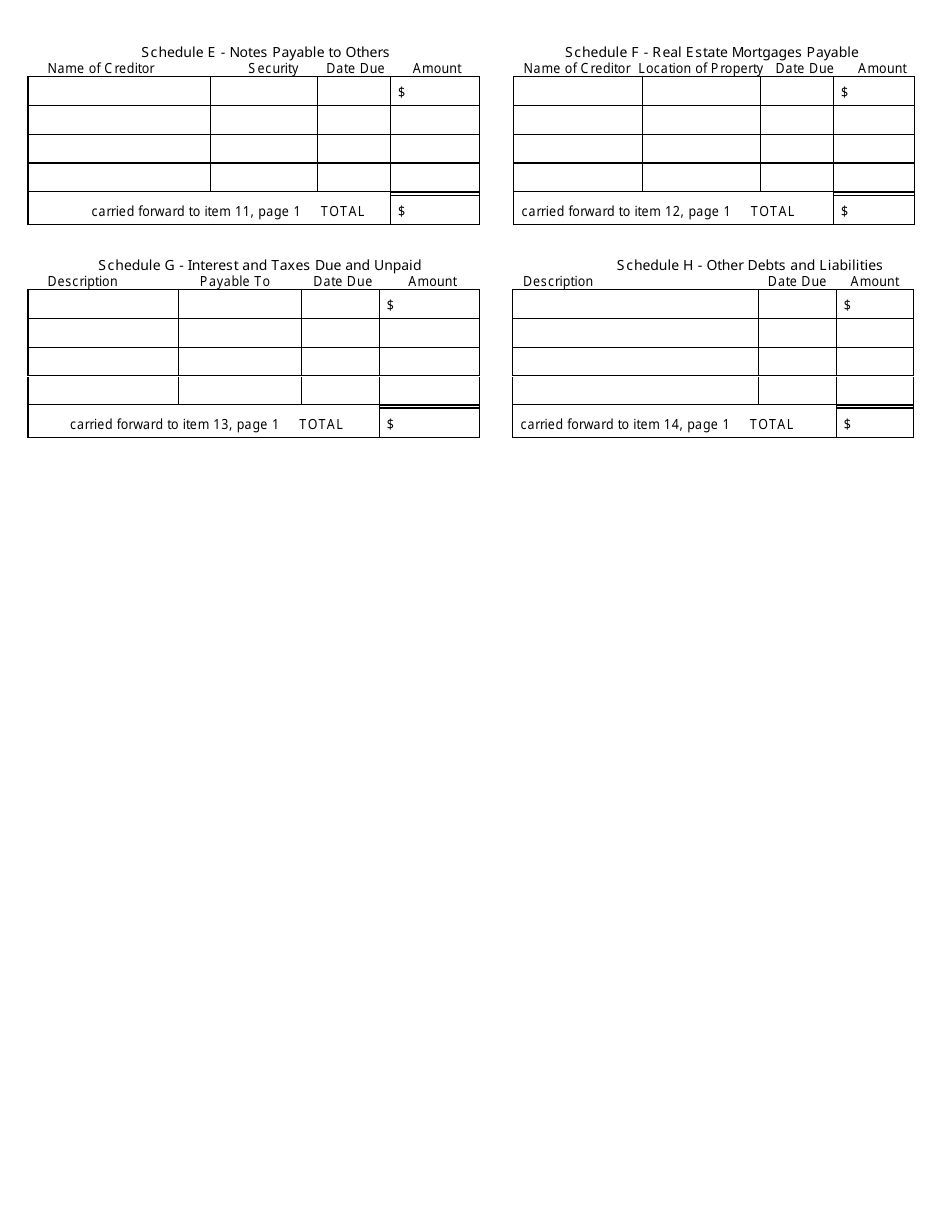

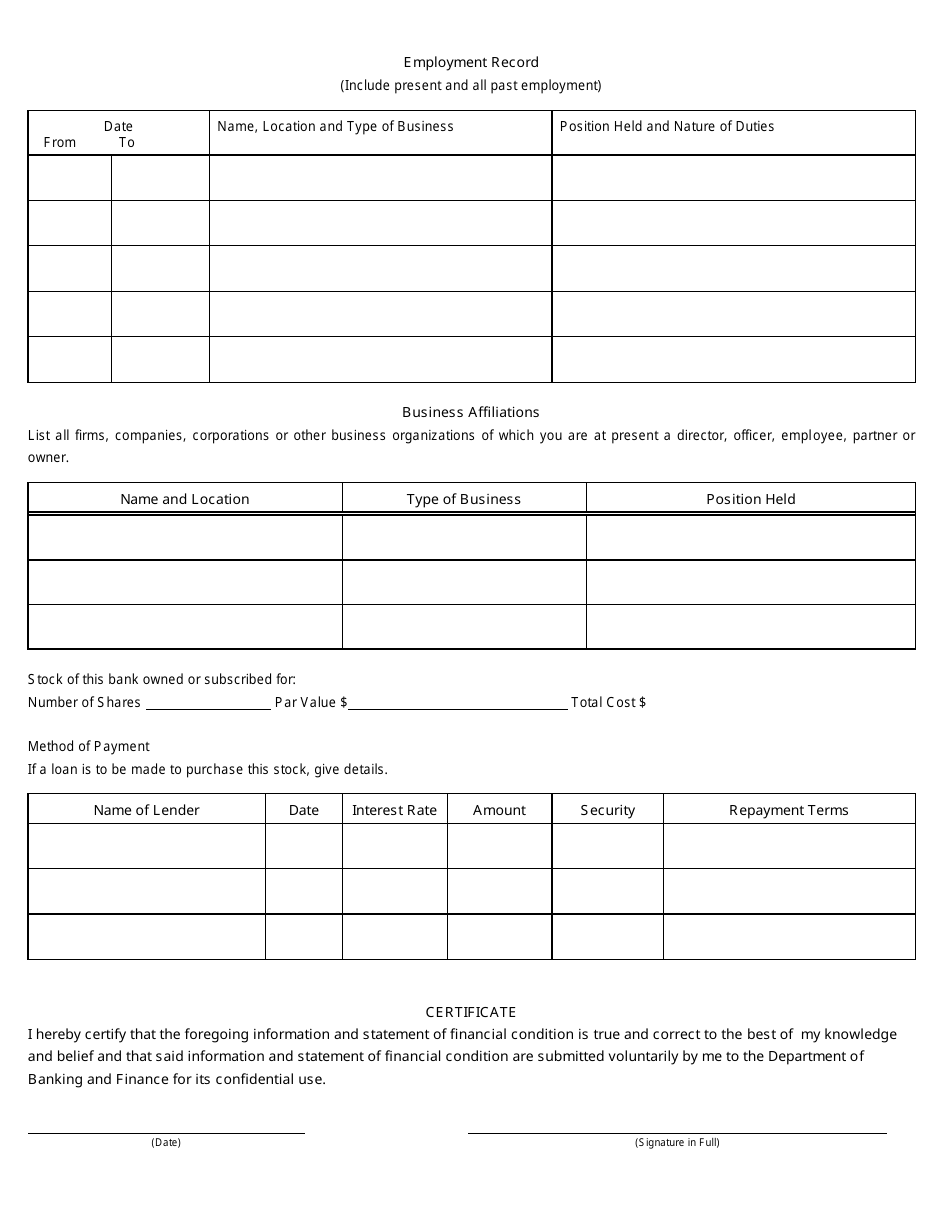

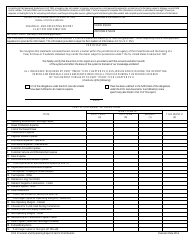

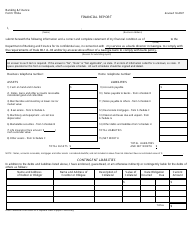

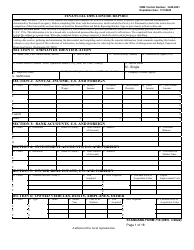

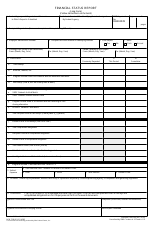

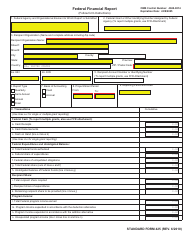

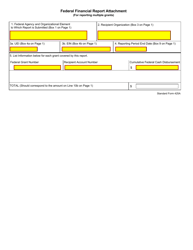

Q: What information is required on Form 19-6?

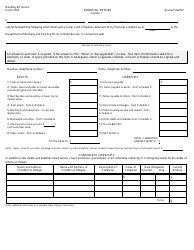

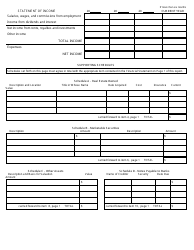

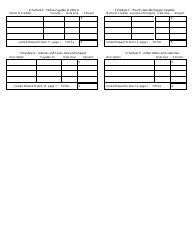

A: Form 19-6 requires information about income, expenses, assets, and liabilities.

Q: When is the deadline to file Form 19-6?

A: The deadline to file Form 19-6 varies and depends on the specific tax year.

Q: Are there any penalties for late filing of Form 19-6?

A: Yes, there may be penalties for late filing of Form 19-6.

Q: Do I need to include supporting documents with Form 19-6?

A: You may need to include supporting documents such as receipts and financial statements with Form 19-6.

Q: What happens after I file Form 19-6?

A: After you file Form 19-6, the Georgia Department of Revenue will review your report and may contact you for further information.

Q: Can I amend my Form 19-6 after filing?

A: Yes, you can amend your Form 19-6 if you discover any errors or need to make changes to the information provided.

Form Details:

- Released on October 1, 2007;

- The latest edition provided by the Georgia Department of Banking and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 19-6 by clicking the link below or browse more documents and templates provided by the Georgia Department of Banking and Finance.