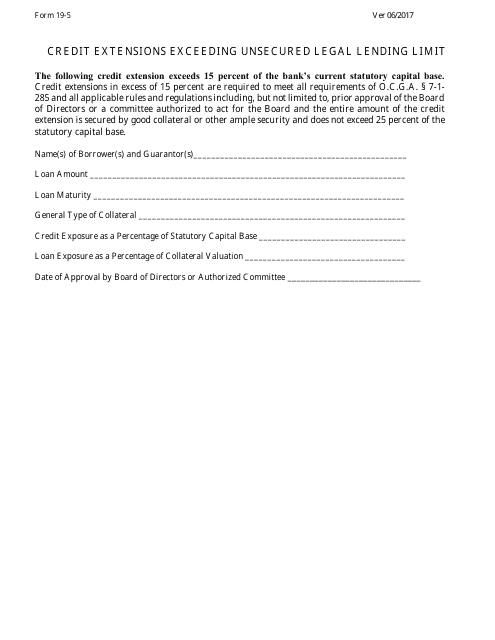

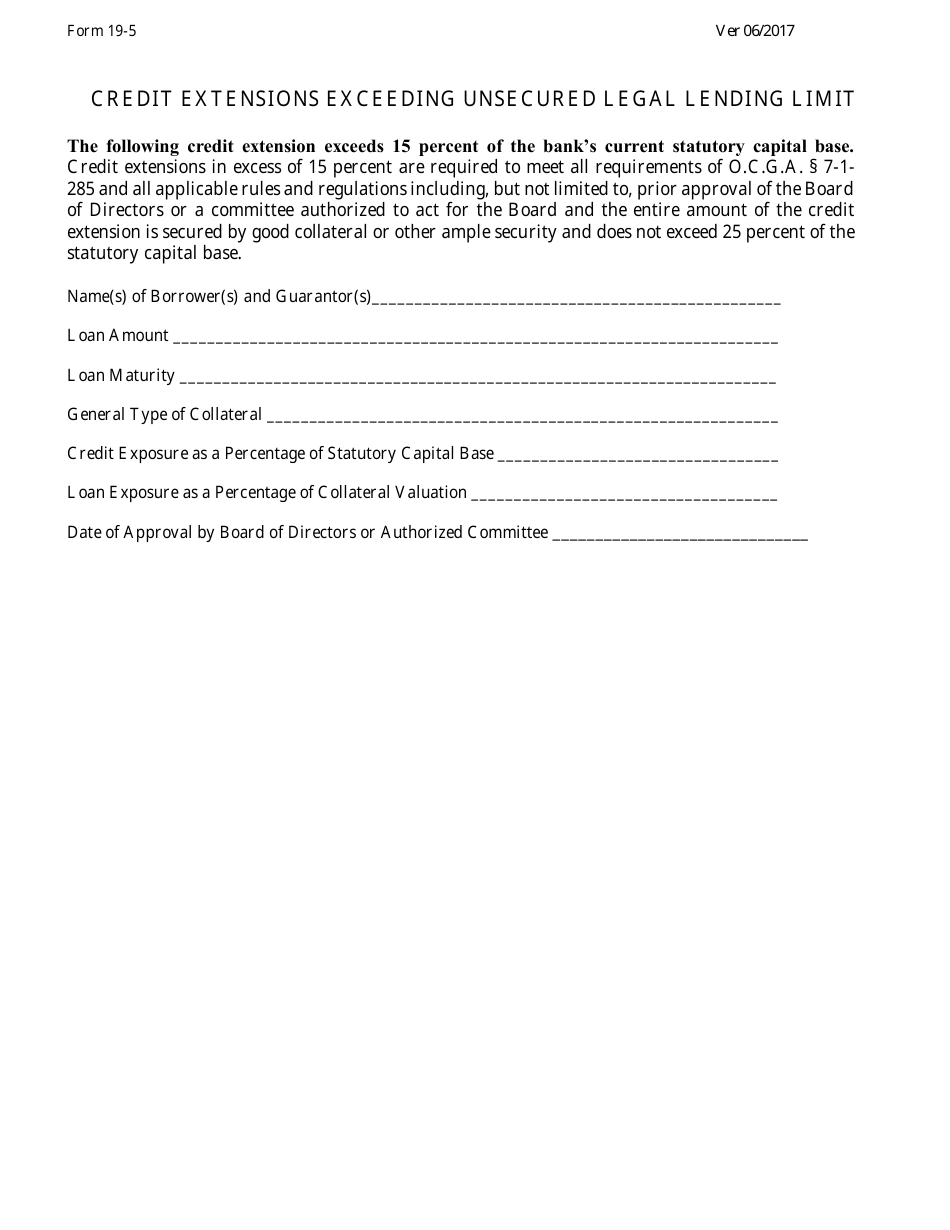

Form 19-5 Credit Extensions Exceeding Unsecured Legal Lending Limit - Georgia (United States)

What Is Form 19-5?

This is a legal form that was released by the Georgia Department of Banking and Finance - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 19-5 Credit Extensions Exceeding Unsecured Legal Lending Limit?

A: Form 19-5 is a document used in Georgia to report credit extensions that exceed the unsecured legal lending limit.

Q: What is the unsecured legal lending limit in Georgia?

A: The unsecured legal lending limit in Georgia refers to the maximum amount of credit that a lender can extend without requiring collateral.

Q: Why is Form 19-5 necessary?

A: Form 19-5 is necessary to ensure compliance with the legal lending limits and to monitor credit extensions that go beyond those limits.

Q: Who is required to use Form 19-5?

A: Lenders in Georgia who extend credit beyond the unsecured legal lending limit are required to use Form 19-5 to report such credit extensions.

Q: What information is included in Form 19-5?

A: Form 19-5 includes details about the credit extension, such as the borrower's information, loan amount, collateral, and any exemptions that apply.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Georgia Department of Banking and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 19-5 by clicking the link below or browse more documents and templates provided by the Georgia Department of Banking and Finance.