This version of the form is not currently in use and is provided for reference only. Download this version of

Form SSA-521

for the current year.

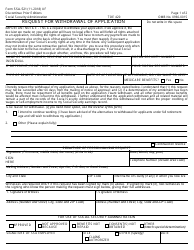

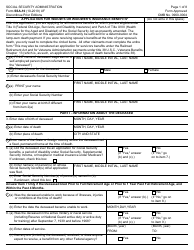

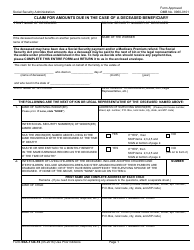

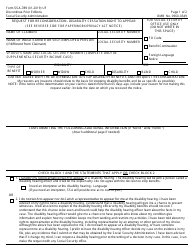

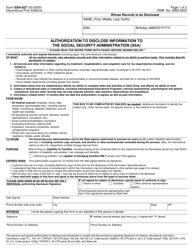

Form SSA-521 Request for Withdrawal of Application

What Is Form SSA-521?

Form SSA-521, Request for Withdrawal of Application , is a form used to cancel the application for Social Security benefits you submitted. Form SSA-521-SP is a Spanish version of the same document.

Alternate Name:

- SSA Form 521.

The document was issued by the U.S. Social Security Administration (SSA) with the latest version released on November 1, 2018 , with previous editions obsolete. A fillable SSA-521 Form can be downloaded through the link below.

What Is Form SSA-521 Used For?

If after applying for Social Security retirement benefits you have changed your mind about when to start them, you can withdraw your claim by submitting Form SSA-521. The withdrawal can be requested even if you have been receiving your benefits for some time. The information you provide via the form is used by the SSA officials to determine whether you are eligible for cancellation of benefits. If you provide incomplete information, it may result in the rejection of your application.

Form SSA-521 Instructions

You may withdraw your benefits application within twelve months from the date you were entitled to receive your Social Security benefits. You are allowed to submit the withdrawal only once in your life and can cancel your withdrawal within 60 days after its approval. You may withdraw your Medicare with your Social Security benefits, or you may keep your Medicare coverage.

If you have reached full retirement age, you are not allowed to withdraw your retirement application. However, if you are not yet age 70, you can ask the SSA to suspend your benefit payments. If your withdrawal is approved, you must repay all of the money you and your family received due to the retirement application. If anyone receives benefits based on your application, this individual must also provide written consent to the withdrawal.

How to Fill Out Form SSA-521?

The document is easy to complete. It takes about five minutes to look through the instructions, gather information, and find the answers. Follow the steps below in order to fill out Form SSA-521 correctly:

- Enter the name of the individual entitled to receive Social Security benefits.

- Indicate the Social Security Number (SSN) of the eligible individual.

- If you are not the person entitled to Social Security benefits, provide your full name (including the middle initial).

- Indicate your SSN.

- Specify the type of benefits you wish to withdraw.

- Enter the exact date of application for these benefits.

- Check the applicable box to specify if you want to keep your Medicare coverage.

- Explain the withdrawal reason. If you want to continue working, choose Box 1. Otherwise, check Box 2 and provide a detailed explanation of your decision. If the space provided is not enough, continue on the reverse side. Do not forget to check the "Continued on Reverse" Box.

- Sign the document. Write your first name, middle initial, and last name in ink.

- Enter the date in MMDDYYY format.

- Provide the phone number you can be reached at (including area code).

- Indicate your full mailing address, including city, state, and ZIP code.

- Enter the name of the county you currently reside in.

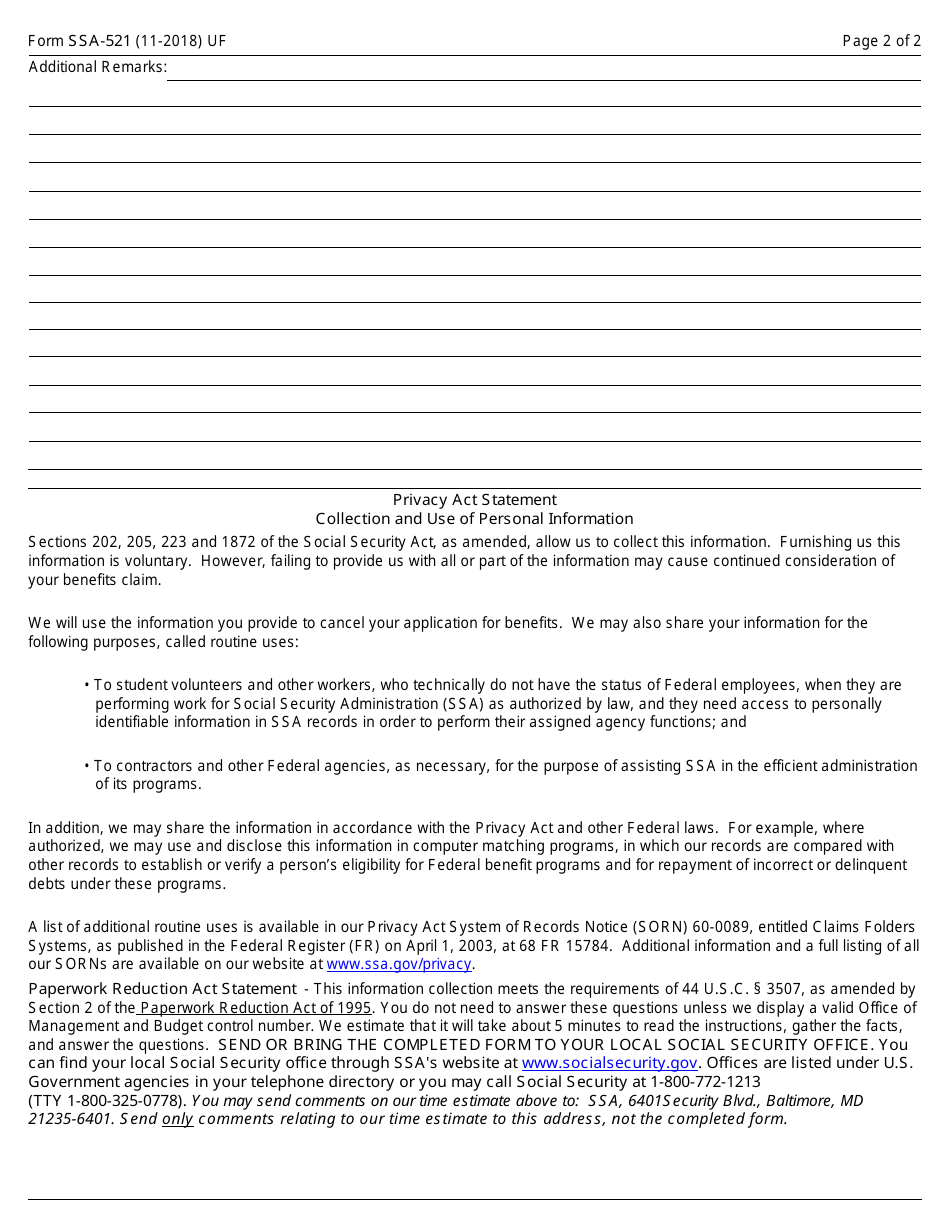

It may take from a few weeks to a few months to process the completed form. After approving the withdrawal, the SSA will inform you about the exact amount you need to repay and the schedule of repayments.

Where Do I Send Form SSA-521?

Send or bring the filled-out SSA Form 521 in person to the nearest Social Security office. Find a list of all offices on the SSA official website. Besides, you can check them up in your telephone directory in the U.S. Government agencies section.