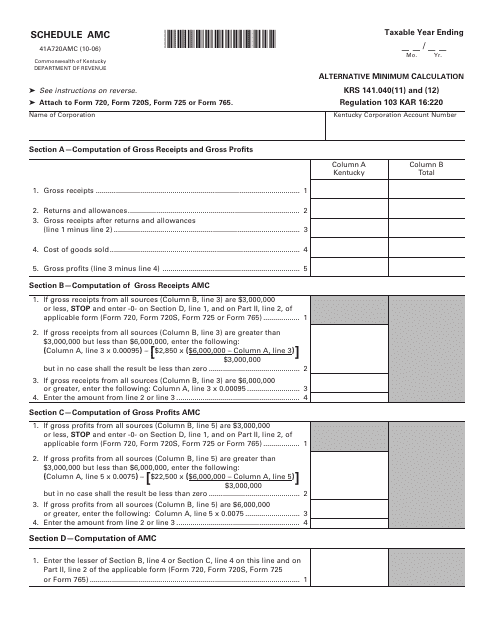

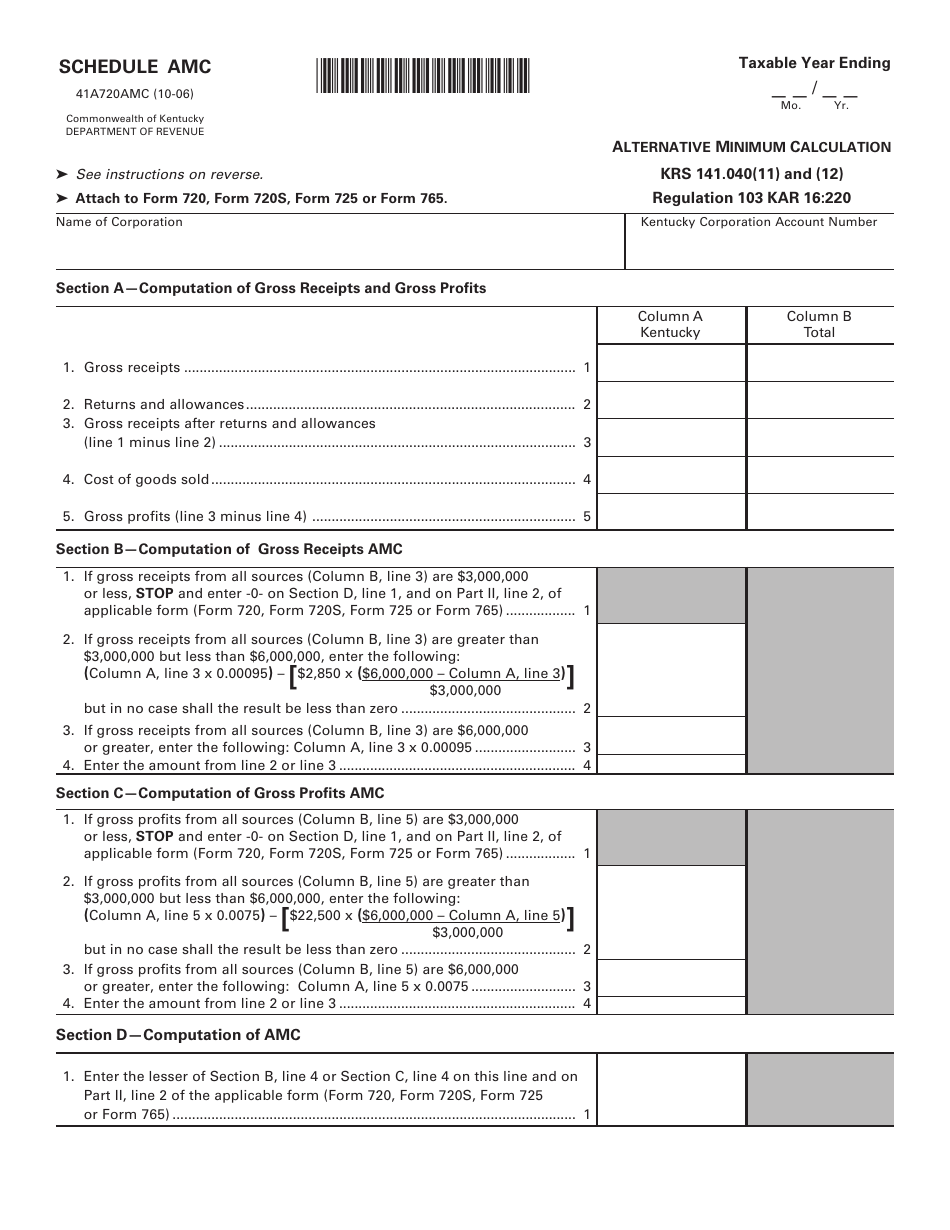

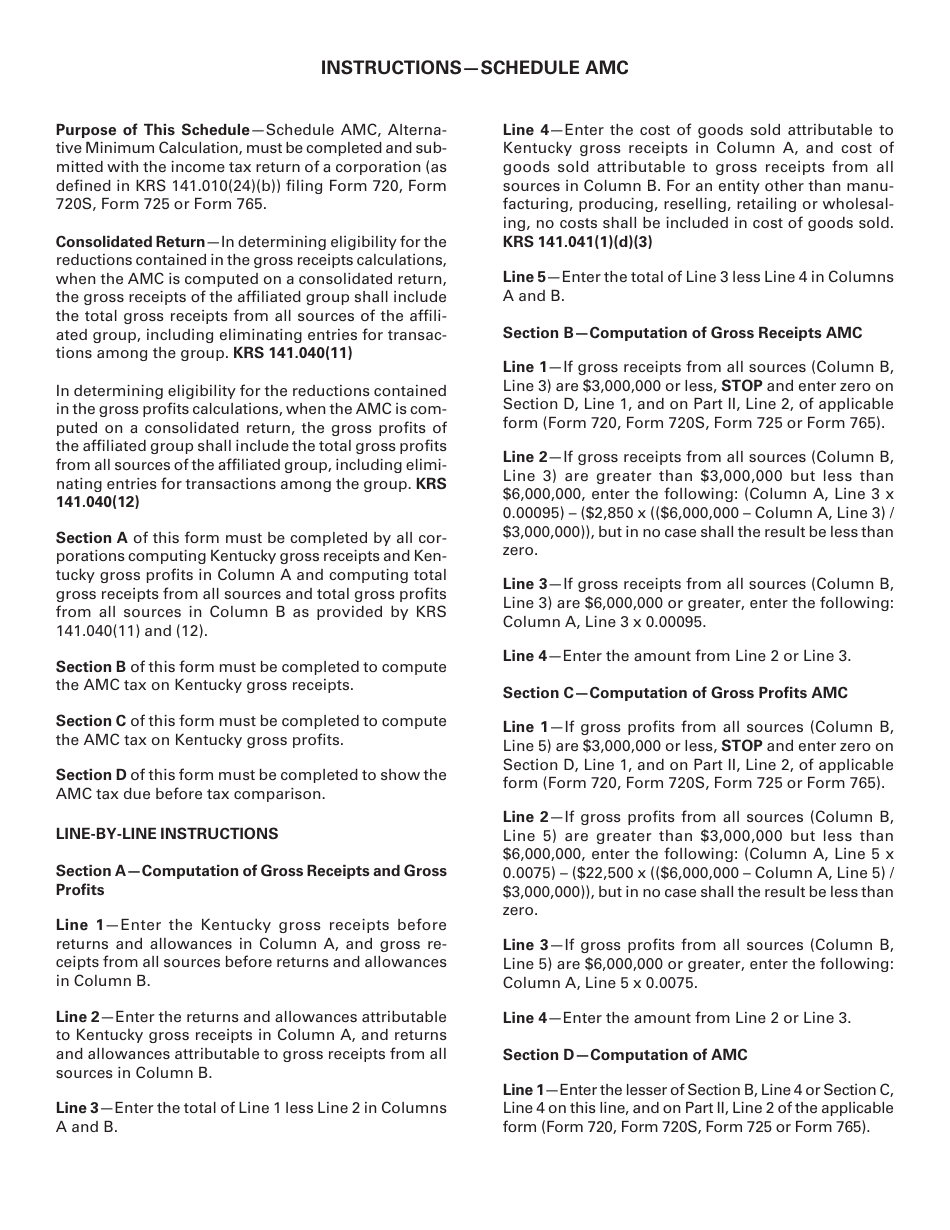

Form 41A720AMC Schedule AMC Alternative Minimum Calculation - Kentucky

What Is Form 41A720AMC Schedule AMC?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720AMC Schedule AMC?

A: Form 41A720AMC Schedule AMC is a tax form used in Kentucky for calculating Alternative Minimum Calculation (AMC).

Q: What is the purpose of Schedule AMC?

A: The purpose of Schedule AMC is to determine if a taxpayer owes any alternative minimum tax in Kentucky.

Q: Who needs to file Schedule AMC?

A: Taxpayers in Kentucky who are subject to the alternative minimum tax need to file Schedule AMC.

Q: How is the alternative minimum tax calculated?

A: The alternative minimum tax is calculated using specific rules and calculations outlined in Schedule AMC.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 41A720AMC Schedule AMC by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.