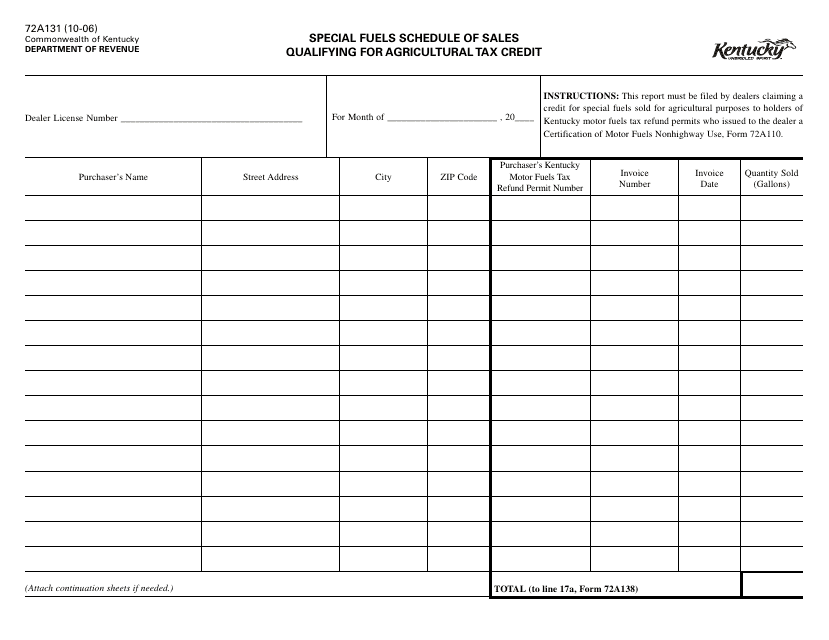

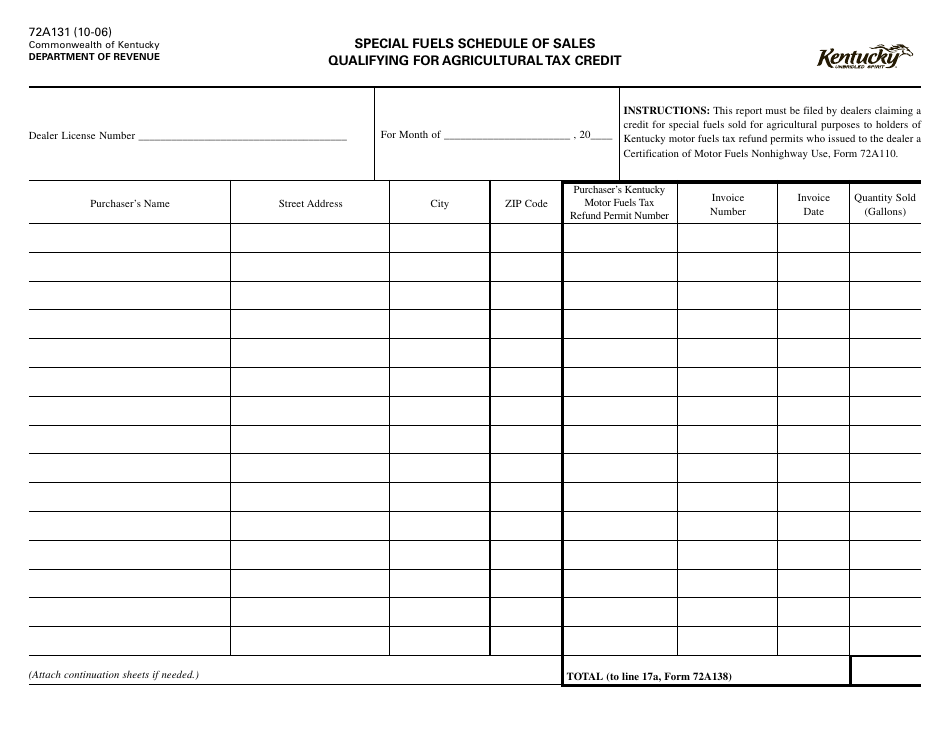

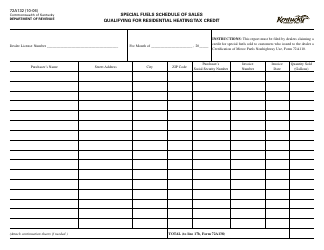

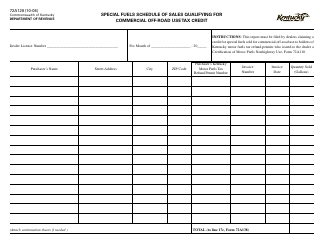

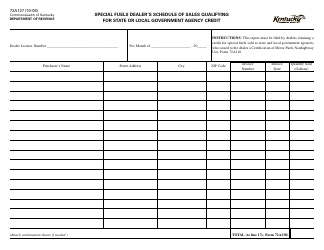

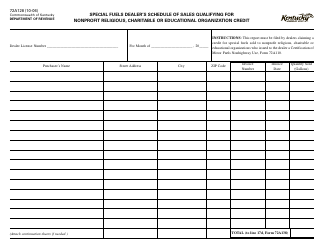

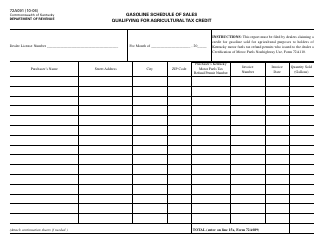

Form 72A131 Special Fuels Schedule of Sales Qualifying for Agricultural Tax Credit - Kentucky

What Is Form 72A131?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A131?

A: Form 72A131 is the Special Fuels Schedule of Sales Qualifying for Agricultural Tax Credit in Kentucky.

Q: What is the purpose of Form 72A131?

A: The purpose of Form 72A131 is to report sales of special fuels that qualify for the agricultural tax credit in Kentucky.

Q: Who needs to fill out Form 72A131?

A: Anyone who sells special fuels that qualify for the agricultural tax credit in Kentucky needs to fill out Form 72A131.

Q: What are special fuels?

A: Special fuels refer to gasoline, diesel fuel, kerosene, propane, and other fuels used in engines, motor vehicles, and farm machinery.

Q: What is the agricultural tax credit?

A: The agricultural tax credit is a tax credit that allows certain agricultural entities to receive a refund for the taxes paid on special fuels used in farming activities.

Q: When is the deadline to file Form 72A131?

A: The deadline to file Form 72A131 is typically on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form 72A131?

A: Yes, there may be penalties for not timely filing or failing to provide accurate information on Form 72A131.

Q: What supporting documents are required for Form 72A131?

A: Typically, you will need to keep records of the fuel sales, invoices, and supporting documentation to substantiate the claim for the agricultural tax credit.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A131 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.