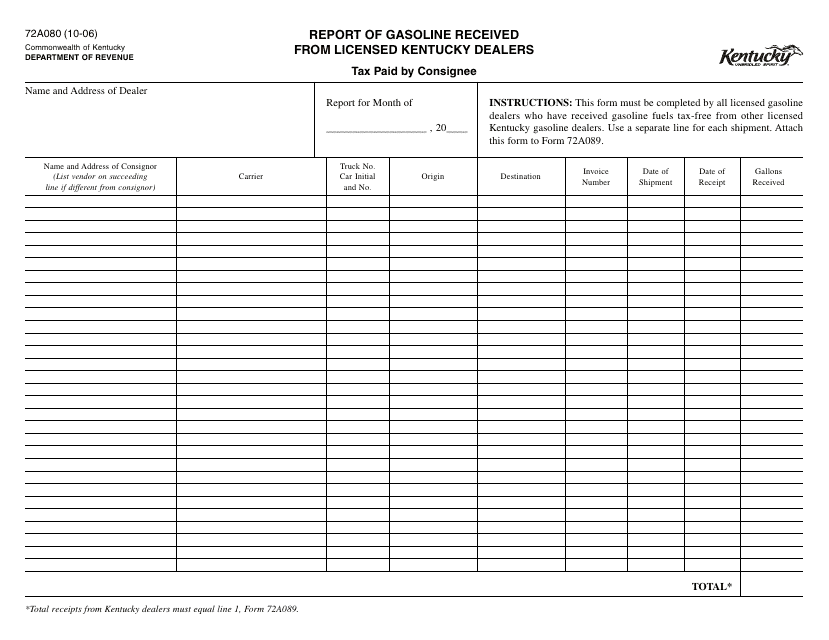

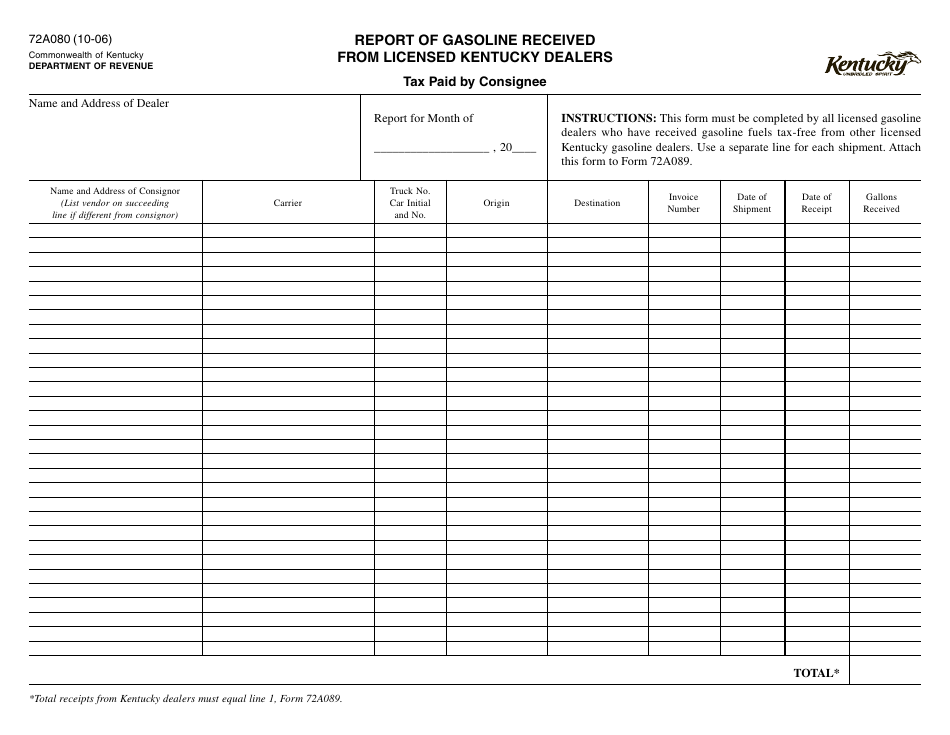

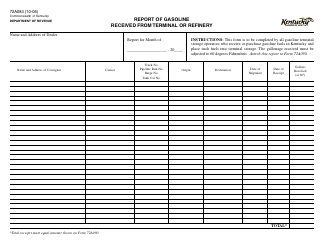

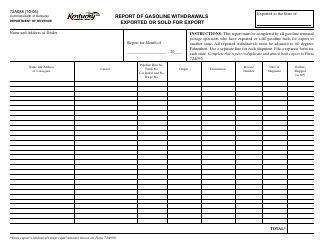

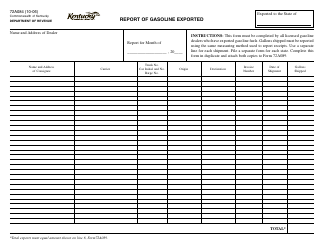

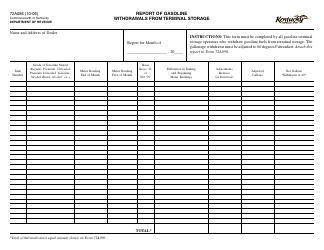

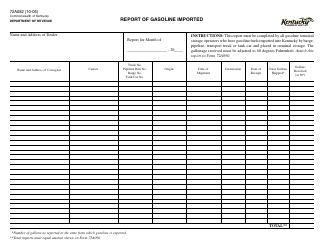

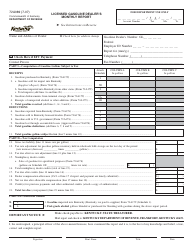

Form 72A080 Report of Gasoline Received From Licensed Kentucky Dealers - Tax Paid by Consignee - Kentucky

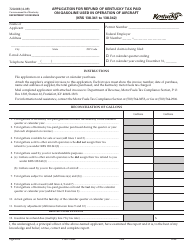

What Is Form 72A080?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A080?

A: Form 72A080 is the Report of Gasoline Received From Licensed Kentucky Dealers - Tax Paid by Consignee.

Q: Who needs to file Form 72A080?

A: Anyone who receives gasoline from licensed Kentucky dealers and pays the tax on it needs to file Form 72A080.

Q: What is the purpose of filing Form 72A080?

A: The purpose of filing Form 72A080 is to report the gasoline received from licensed Kentucky dealers and the tax paid by the consignee.

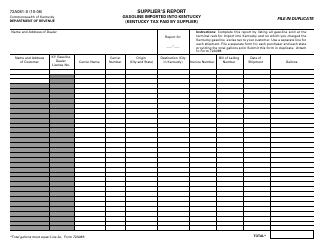

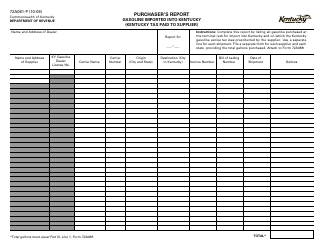

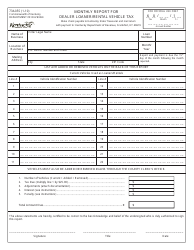

Q: What information is required on Form 72A080?

A: Form 72A080 requires information such as the consignee's name and address, the dealer's name and address, the total number of gallons received, and the amount of tax paid.

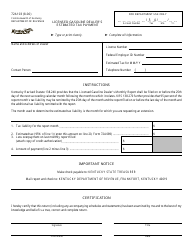

Q: When is the deadline for filing Form 72A080?

A: The deadline for filing Form 72A080 is typically the 20th day of the month following the month of receipt of the gasoline.

Q: Are there any penalties for late filing of Form 72A080?

A: Yes, there are penalties for late filing of Form 72A080, including potential interest charges on any unpaid tax amount.

Q: Do I need to include any supporting documents with Form 72A080?

A: No, you do not need to include any supporting documents with Form 72A080. However, you should keep all records and documents related to the gasoline received and tax paid for future reference.

Q: Who can I contact for more information about Form 72A080?

A: For more information about Form 72A080, you can contact the Kentucky Department of Revenue's Excise Tax Section.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A080 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.