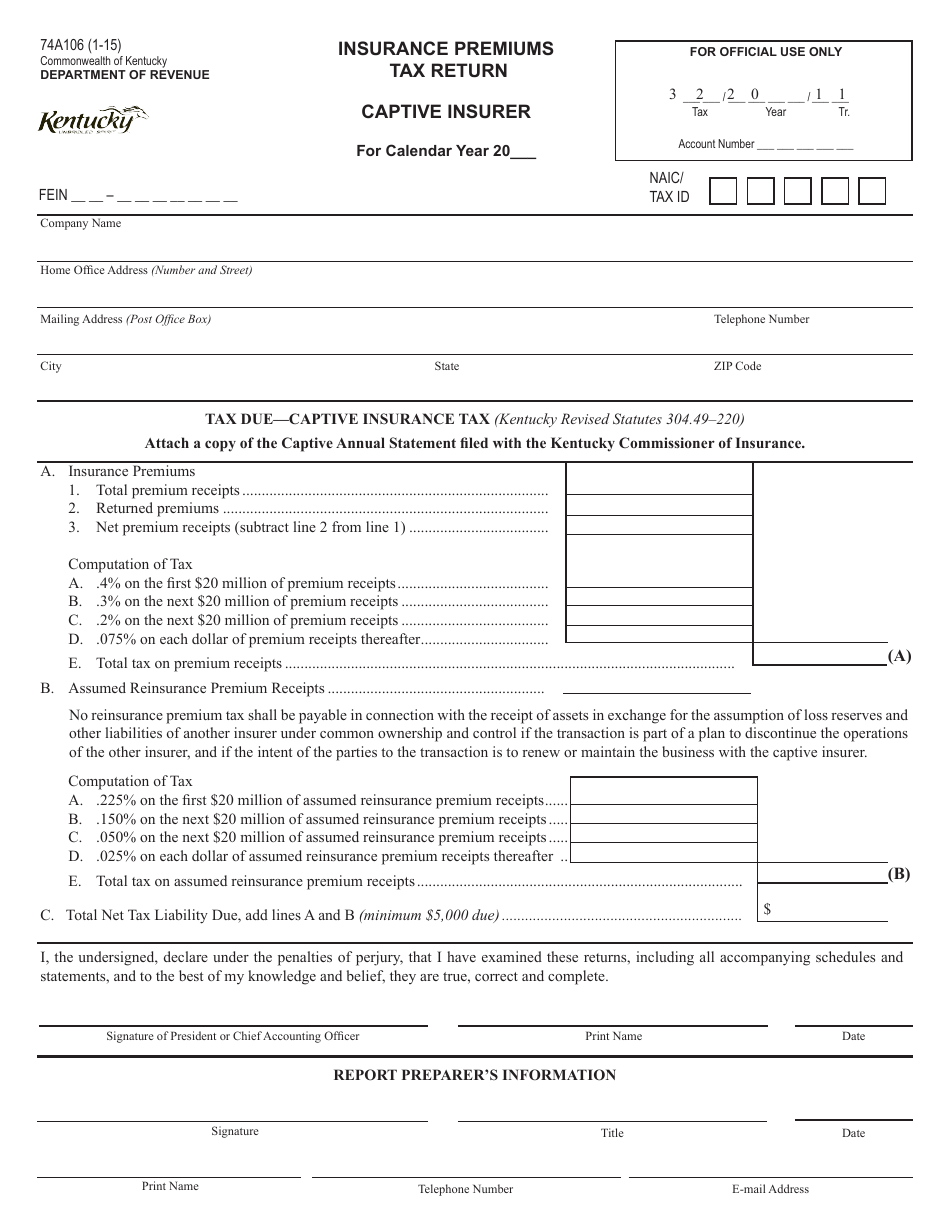

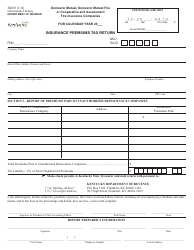

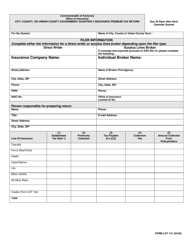

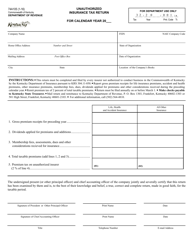

Form 74A106 Insurance Premiums Tax Return - Captive Insurer - Kentucky

What Is Form 74A106?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 74A106?

A: Form 74A106 is the Insurance Premiums Tax Return - Captive Insurer form specifically for the state of Kentucky.

Q: Who needs to file Form 74A106?

A: Captive insurers in Kentucky need to file Form 74A106 to report and pay the insurance premiums tax.

Q: What is a captive insurer?

A: A captive insurer is an insurance company that provides coverage primarily to its affiliated companies.

Q: What is the insurance premiums tax?

A: The insurance premiums tax is a tax imposed on the premiums received by insurance companies.

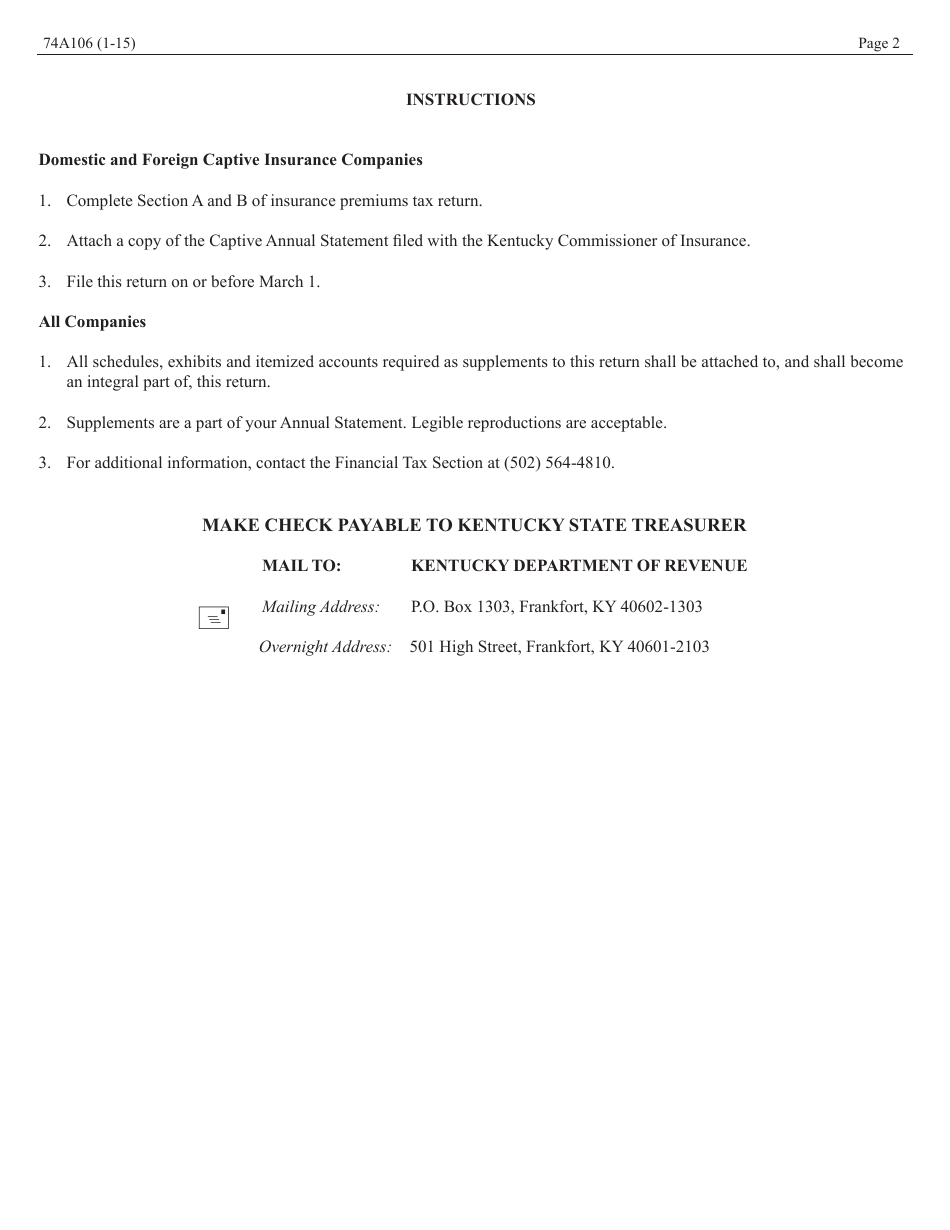

Q: When is the deadline to file Form 74A106?

A: The deadline to file Form 74A106 is typically April 15th of each year.

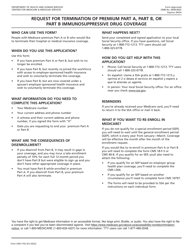

Q: Are there any penalties for late filing of Form 74A106?

A: Yes, there may be penalties for late filing of Form 74A106, so it is important to file on time.

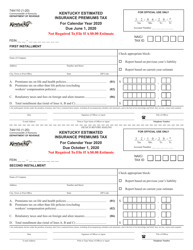

Q: Is there a specific payment method for the insurance premiums tax?

A: Yes, payment for the insurance premiums tax can be made through electronic funds transfer (EFT).

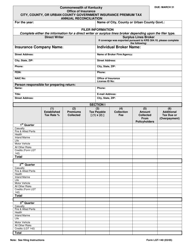

Q: Are there any other forms that may need to be filed along with Form 74A106?

A: Depending on the situation, captive insurers may also need to file other forms such as Form 74A001 and Form 74A003.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 74A106 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.