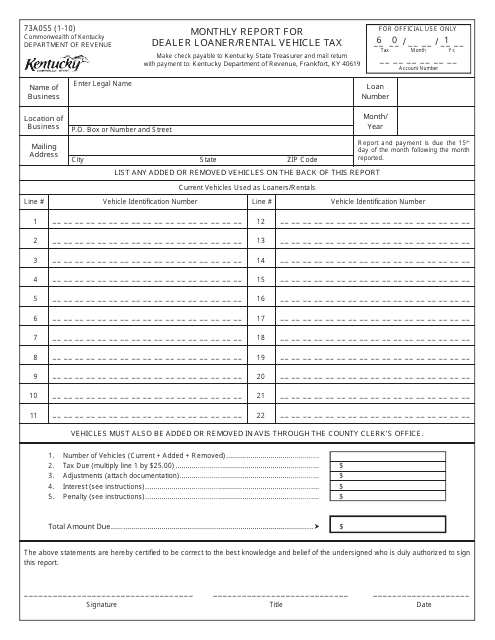

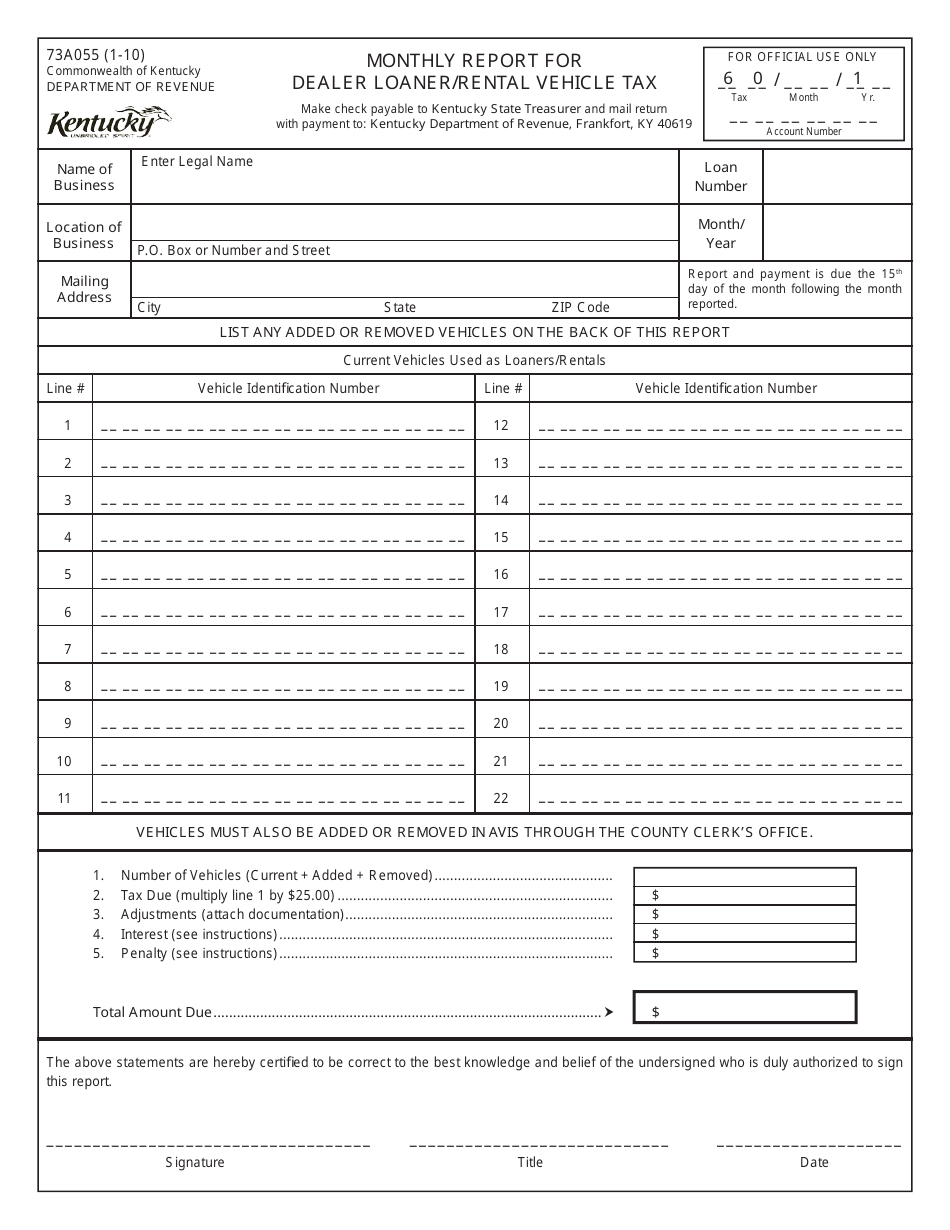

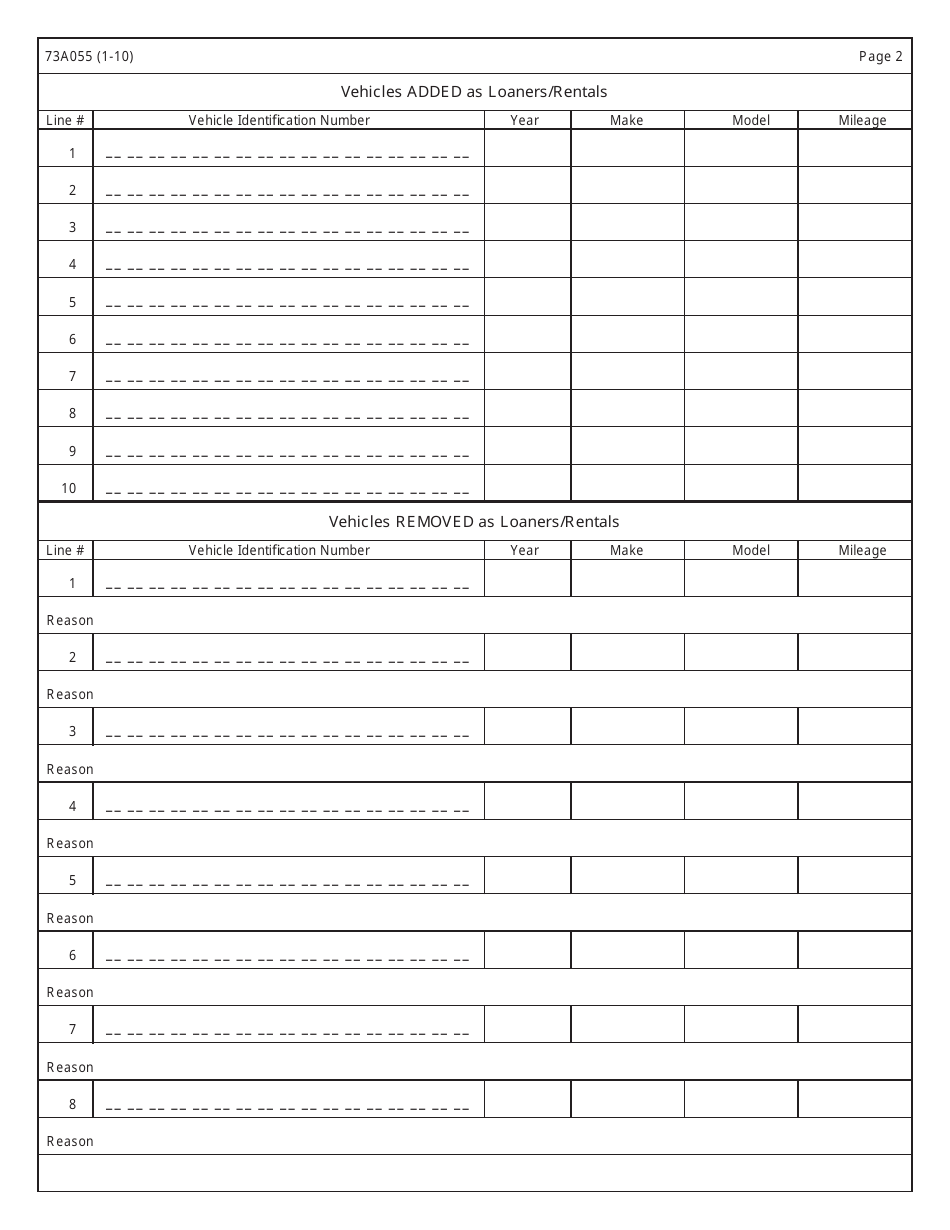

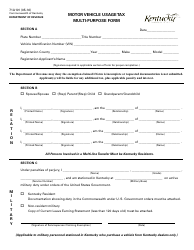

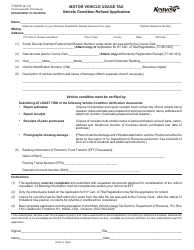

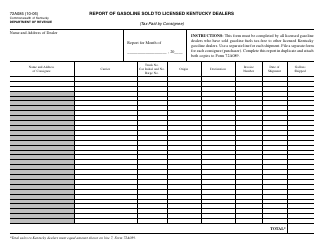

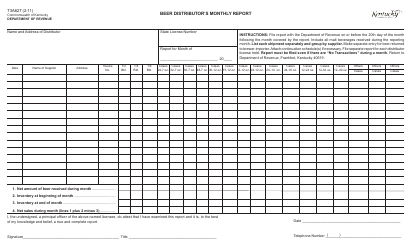

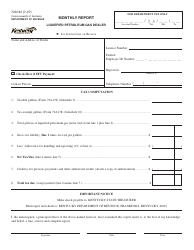

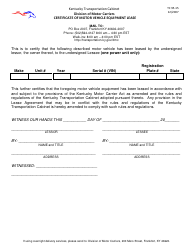

Form 73A055 Monthly Report for Dealer Loaner / Rental Vehicle Tax - Kentucky

What Is Form 73A055?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A055?

A: Form 73A055 is the Monthly Report for Dealer Loaner/Rental Vehicle Tax in Kentucky.

Q: Who needs to file Form 73A055?

A: Dealers who own or operate loaner or rental vehicles in Kentucky need to file Form 73A055.

Q: What is the purpose of Form 73A055?

A: The purpose of Form 73A055 is to report and remit the dealer loaner/rental vehicle tax in Kentucky.

Q: What information is required on Form 73A055?

A: Form 73A055 requires information such as the dealer's name, address, sales taxaccount number, and the number of loaner/rental vehicles owned or operated in Kentucky.

Q: How often should Form 73A055 be filed?

A: Form 73A055 should be filed monthly.

Q: Is there a deadline for filing Form 73A055?

A: Yes, Form 73A055 must be filed and the tax remitted by the 20th day of the month following the month being reported.

Q: Are there any penalties for late filing or non-filing of Form 73A055?

A: Yes, there are penalties for late filing or non-filing of Form 73A055. It is important to file the form and remit the tax on time to avoid penalties.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 73A055 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.