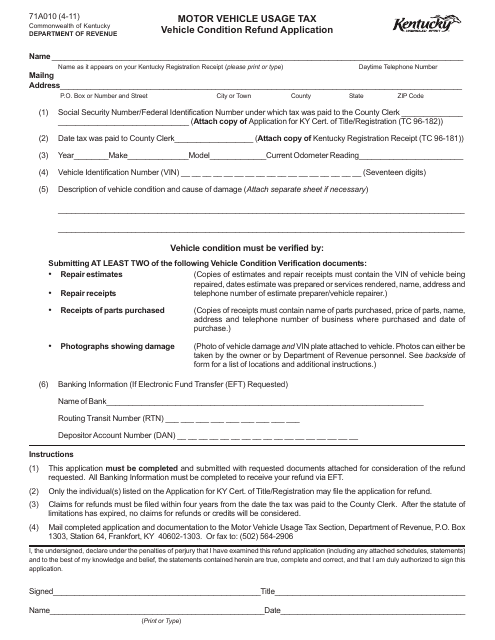

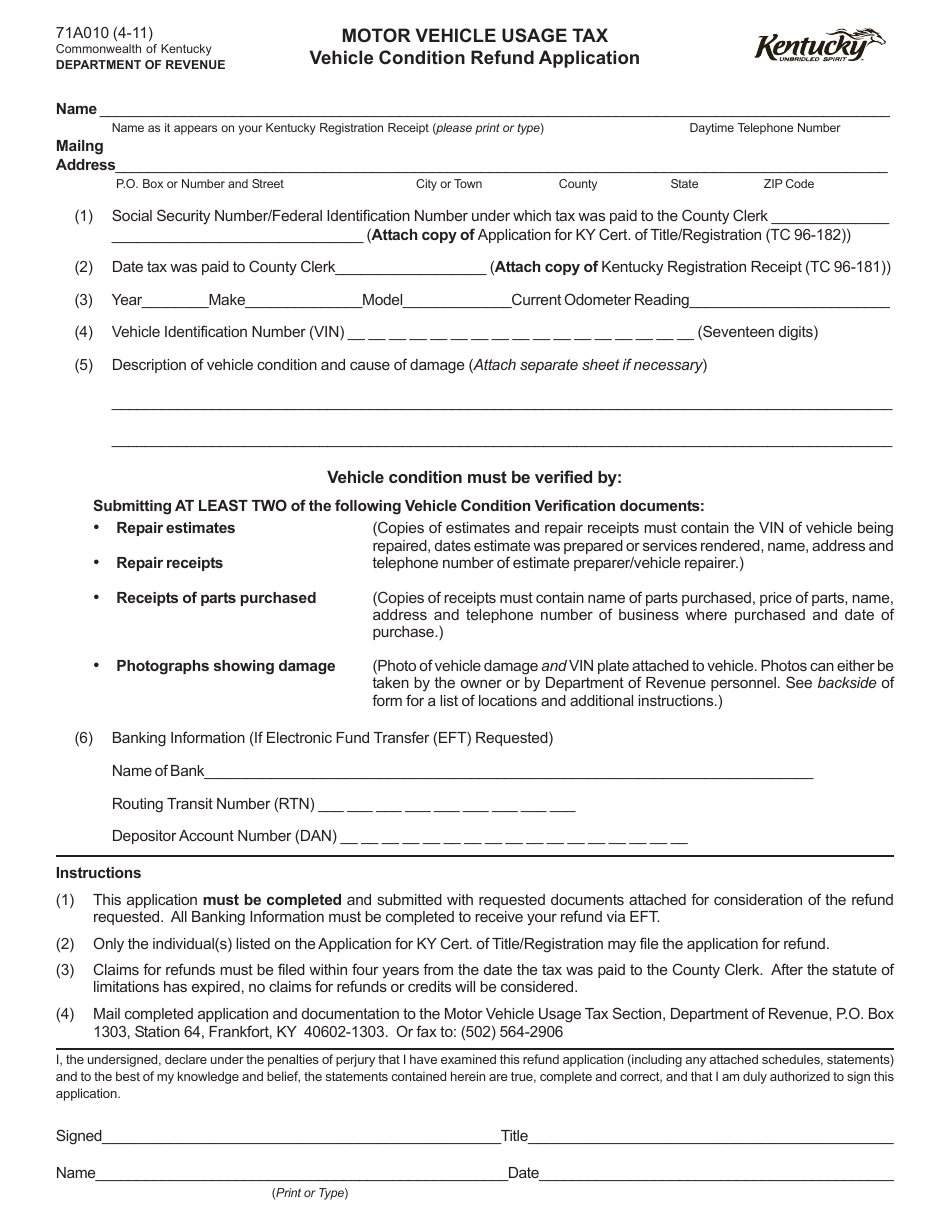

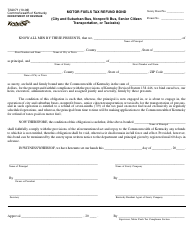

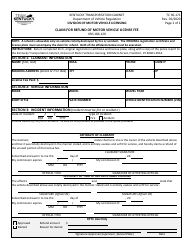

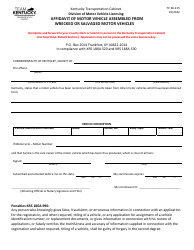

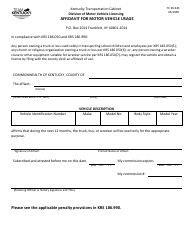

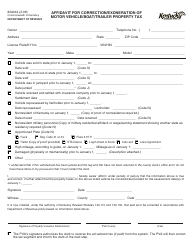

Form 71A010 Vehicle Condition Refund Application - Motor Vehicle Usage Tax - Kentucky

What Is Form 71A010?

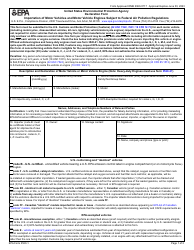

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 71A010?

A: Form 71A010 is the Vehicle Condition Refund Application for Motor Vehicle Usage Tax in Kentucky.

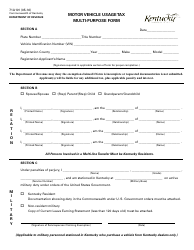

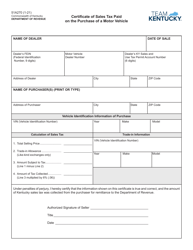

Q: What is Motor Vehicle Usage Tax?

A: Motor Vehicle Usage Tax is a tax levied on the usage of motor vehicles in the state of Kentucky.

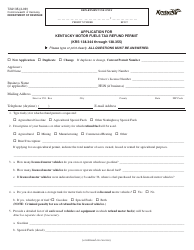

Q: Who can use Form 71A010?

A: Form 71A010 can be used by individuals who have paid Motor Vehicle Usage Tax and are seeking a refund due to a vehicle's condition.

Q: What is the purpose of Form 71A010?

A: The purpose of Form 71A010 is to apply for a refund of Motor Vehicle Usage Tax paid, based on the condition of the vehicle.

Q: What information is required on Form 71A010?

A: Form 71A010 requires information such as vehicle identification number (VIN), model year, make and model of the vehicle, and detailed information about the condition of the vehicle.

Q: Is there a deadline to submit Form 71A010?

A: Yes, Form 71A010 must be submitted within 60 days of the date of purchase of the vehicle or the date the vehicle was registered in Kentucky, whichever is later.

Q: How long does it take to process Form 71A010?

A: The processing time for Form 71A010 varies, but it generally takes around 30 days for the Kentucky Department of Revenue to review and process the application.

Q: What happens after Form 71A010 is approved?

A: If Form 71A010 is approved, the applicant will receive a refund of the Motor Vehicle Usage Tax paid, based on the condition of the vehicle.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the Kentucky Department of Revenue;

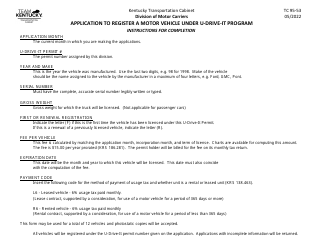

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 71A010 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.