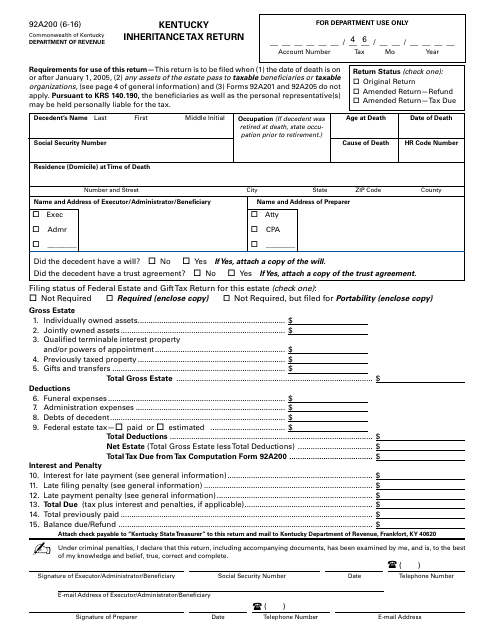

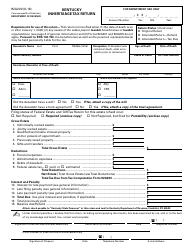

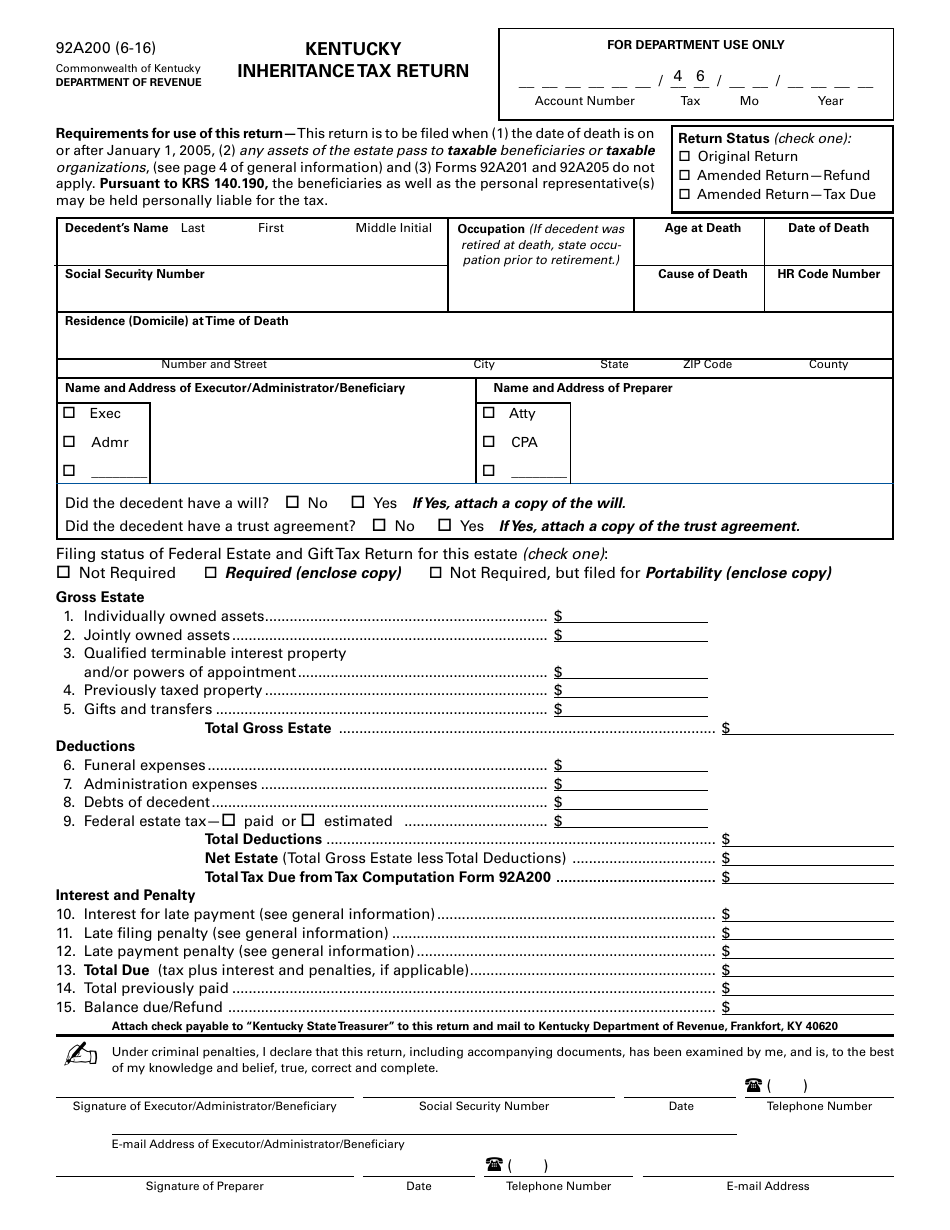

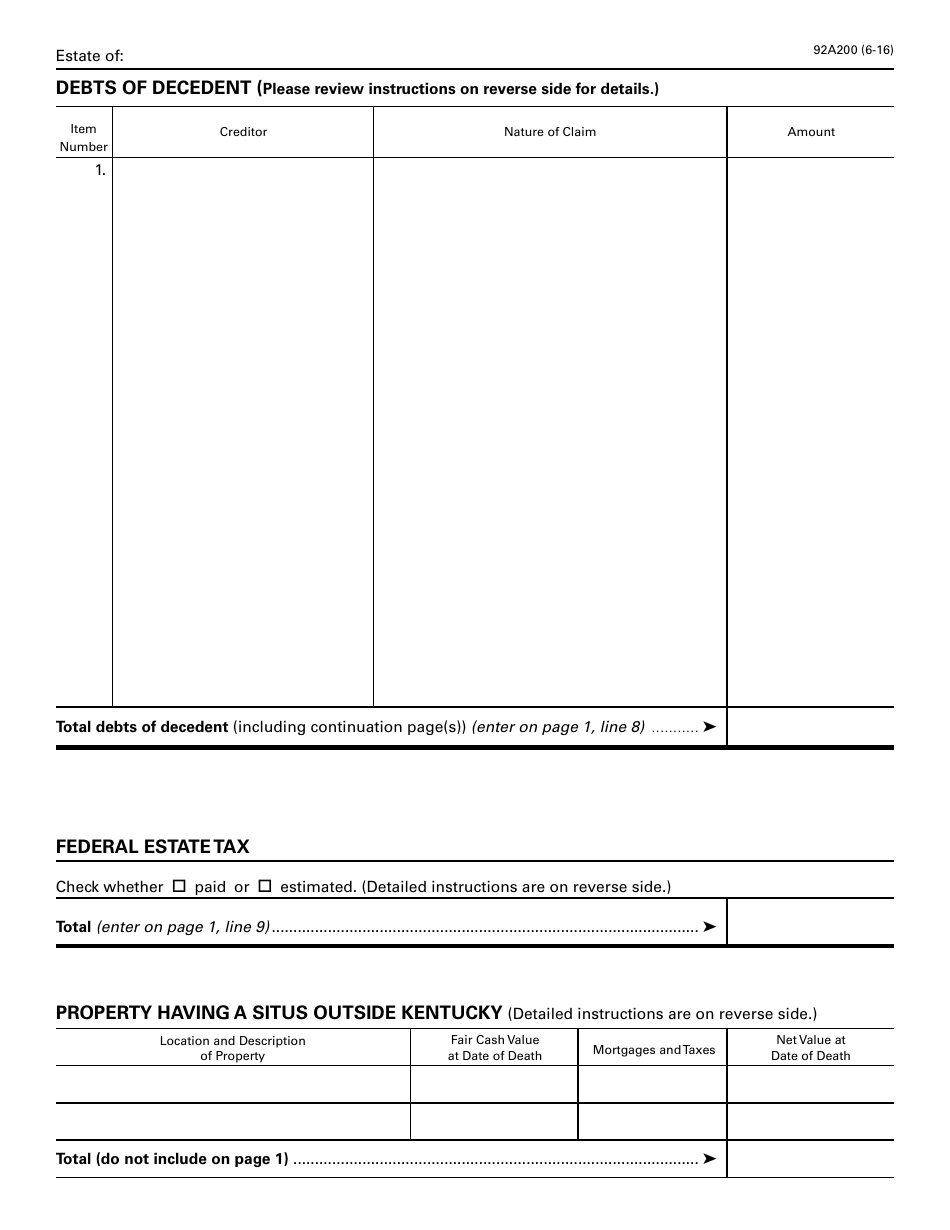

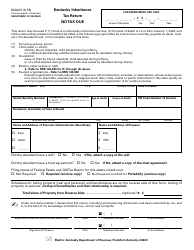

Form 92A200 Kentucky Inheritance Tax Return - Kentucky

What Is Form 92A200?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 92A200?

A: Form 92A200 is the Kentucky Inheritance Tax Return.

Q: What is the purpose of Form 92A200?

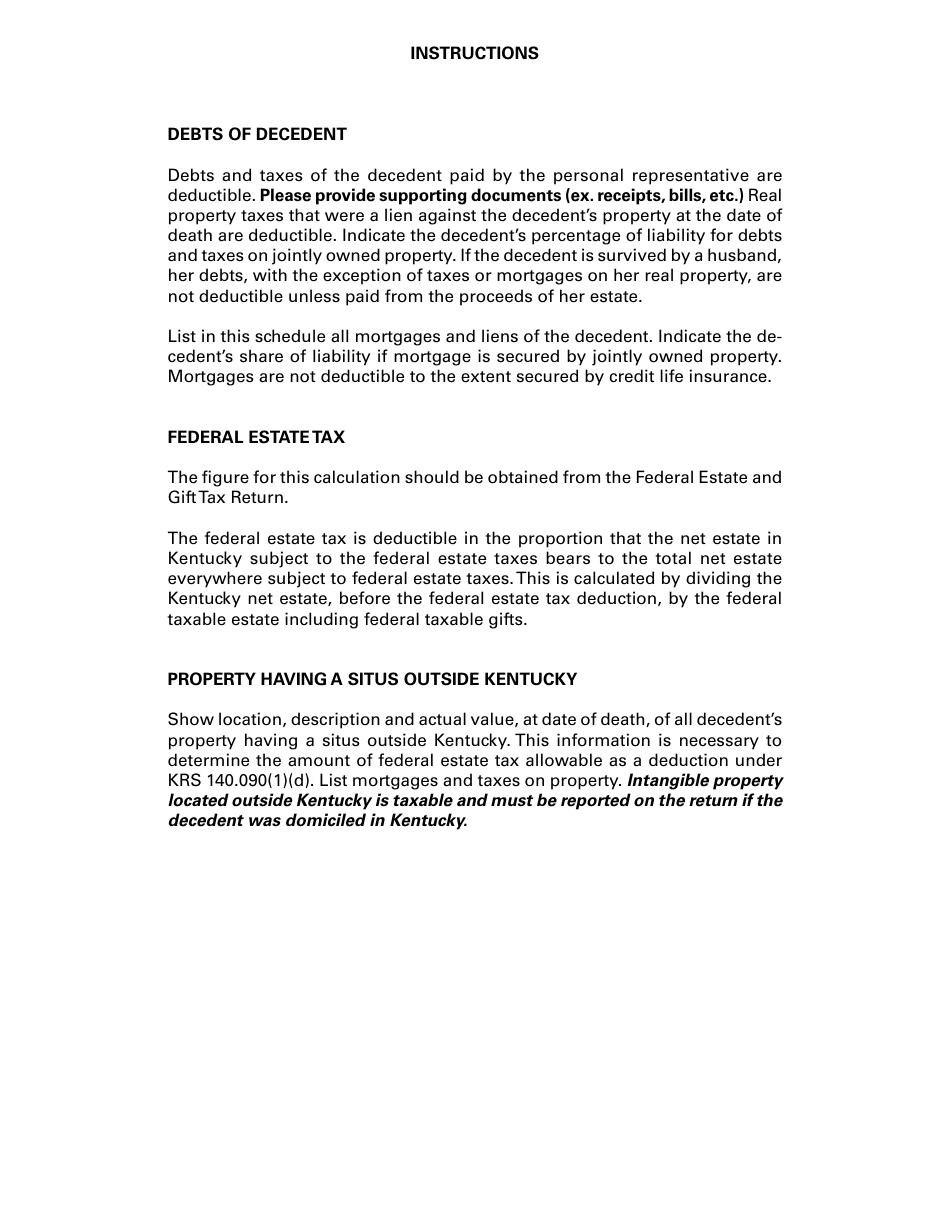

A: The purpose of Form 92A200 is to report and pay inheritance tax in the state of Kentucky.

Q: Who needs to file Form 92A200?

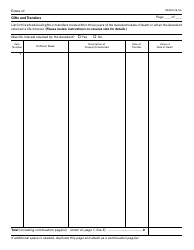

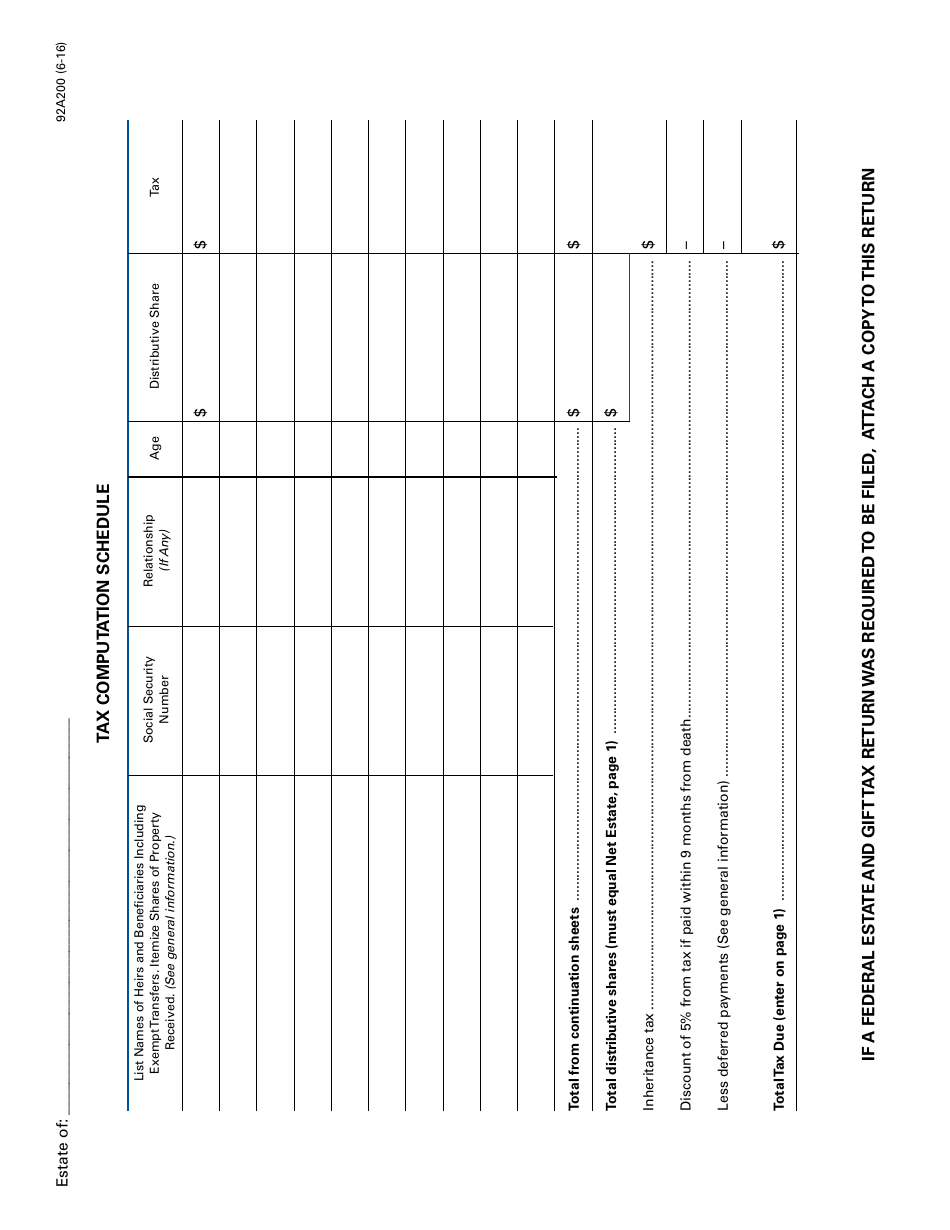

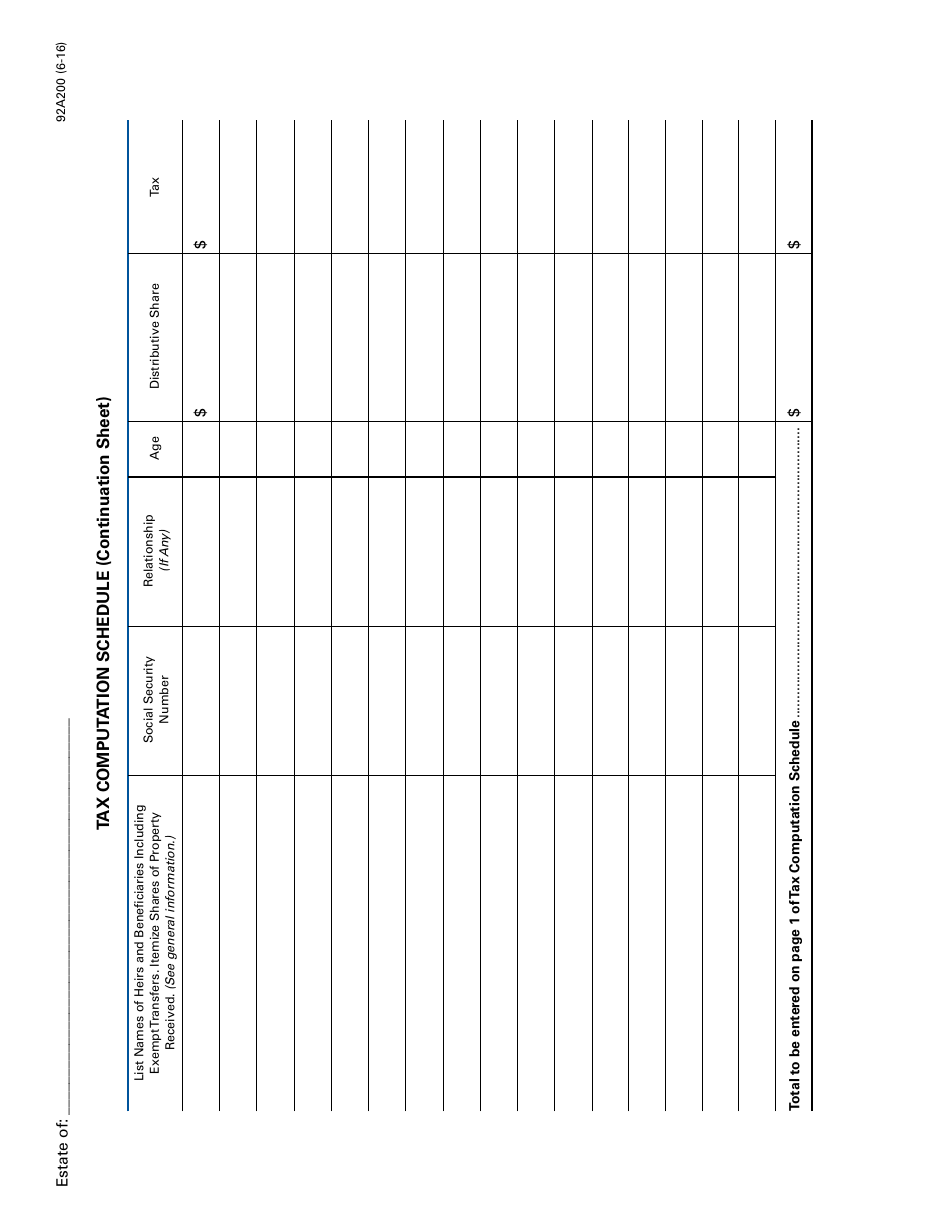

A: Form 92A200 needs to be filed by the executor or administrator of an estate if the estate is subject to inheritance tax in Kentucky.

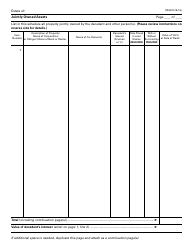

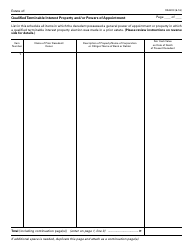

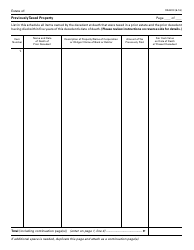

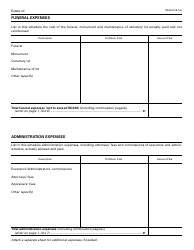

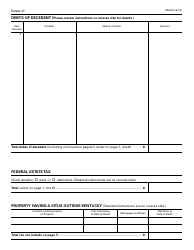

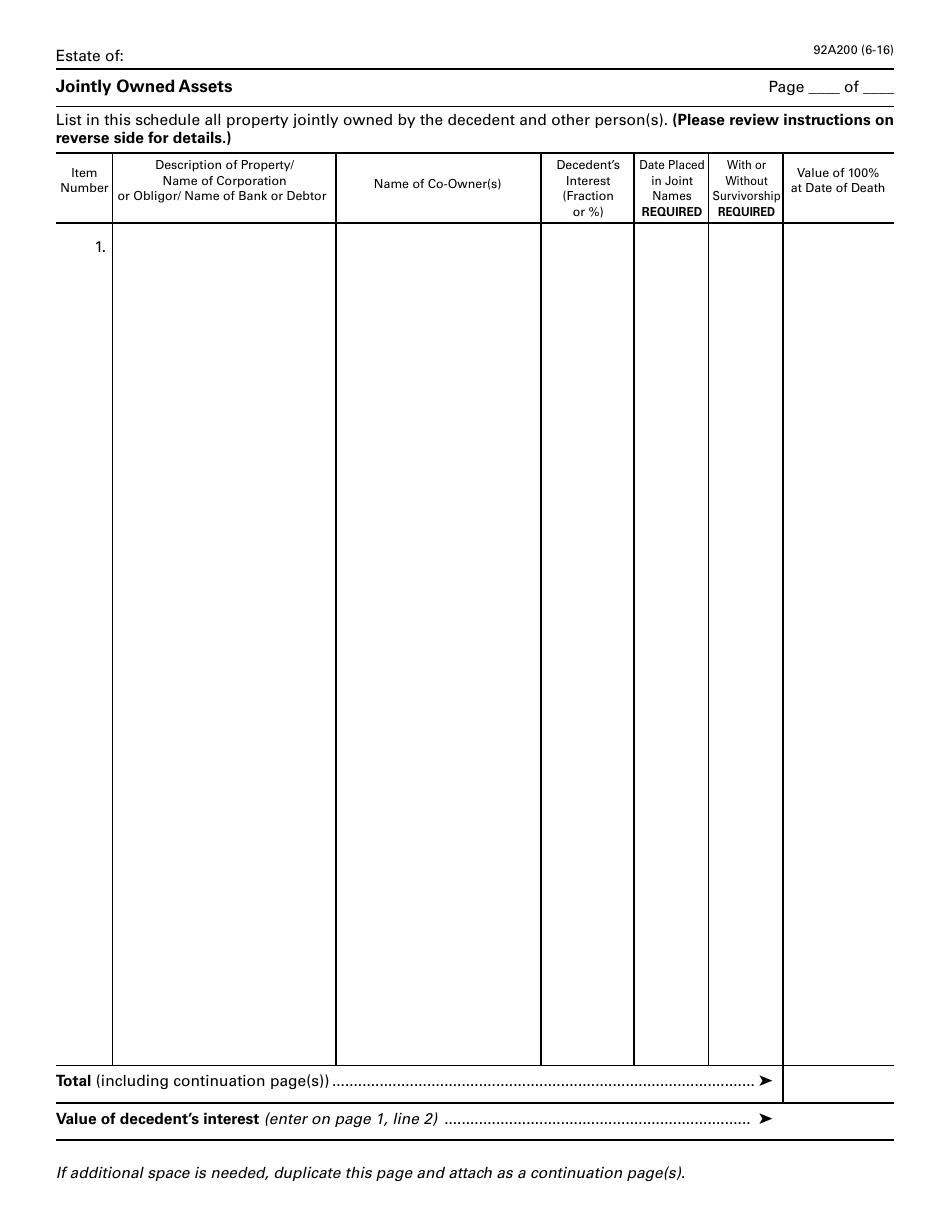

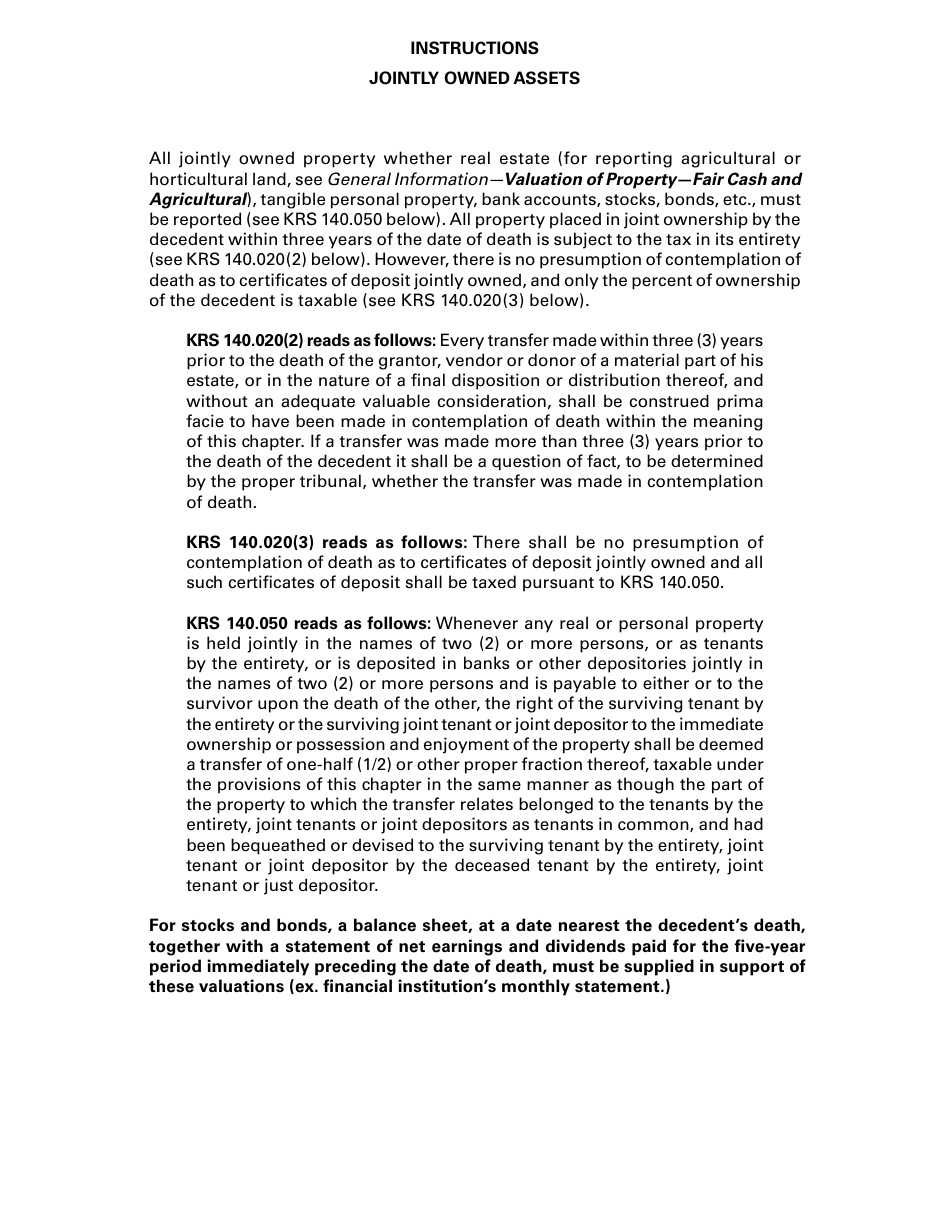

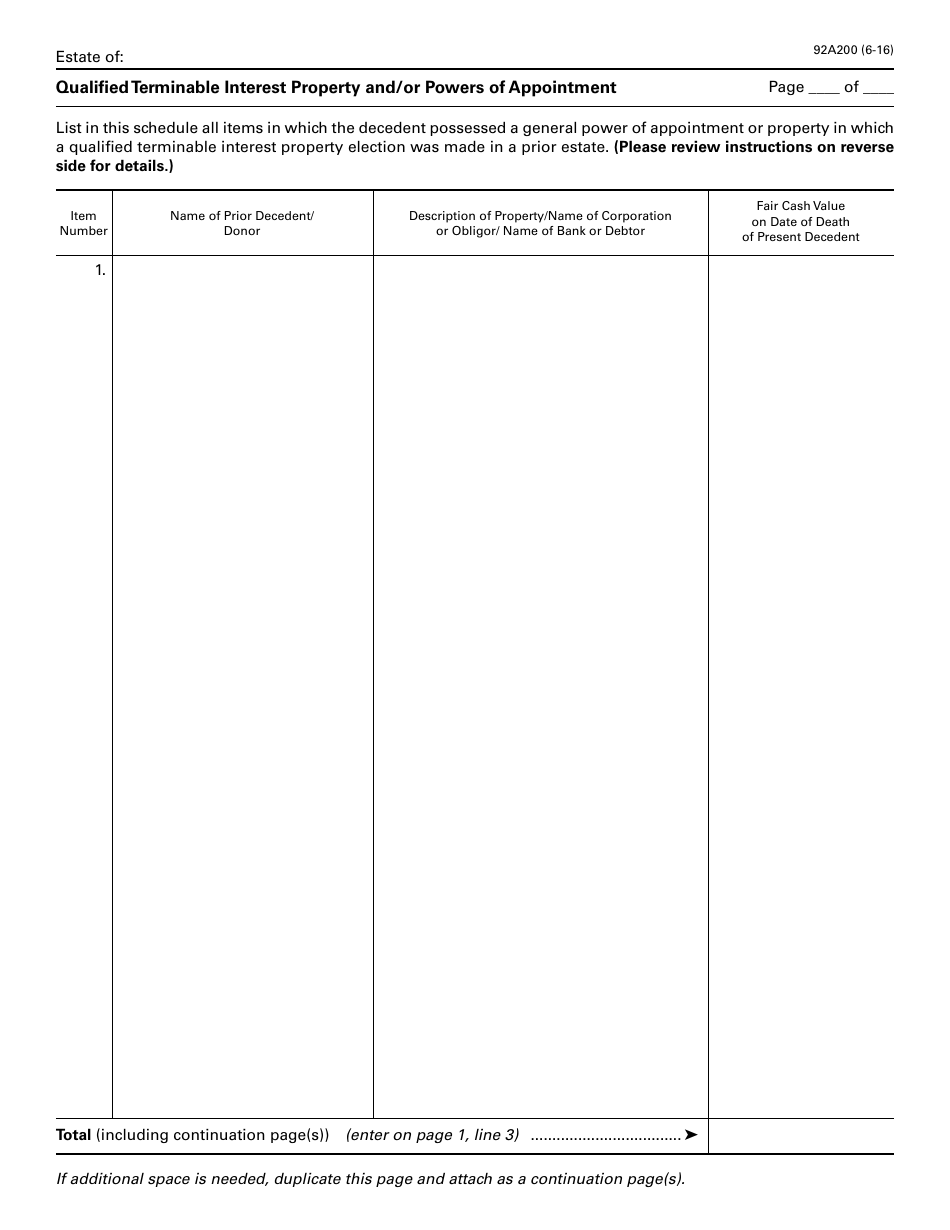

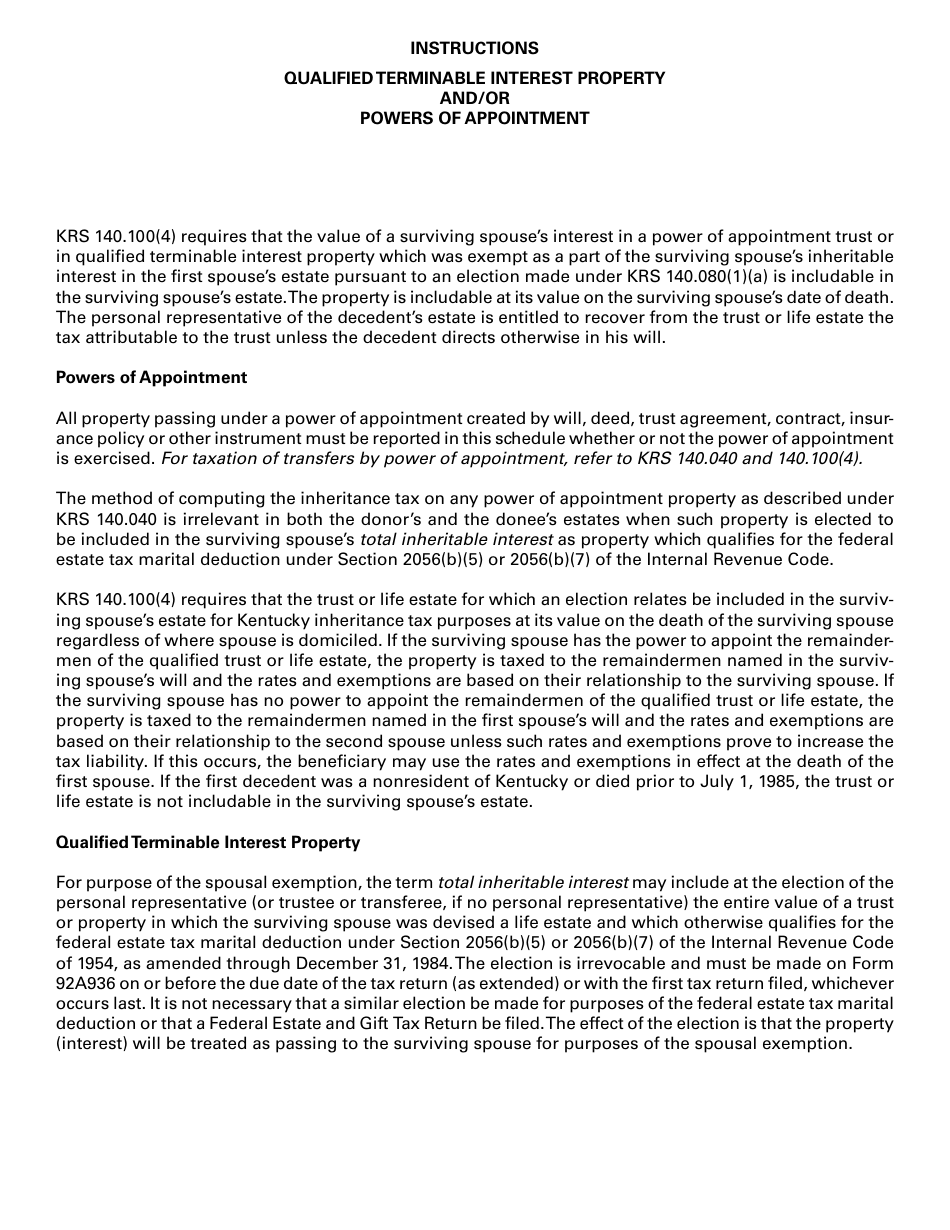

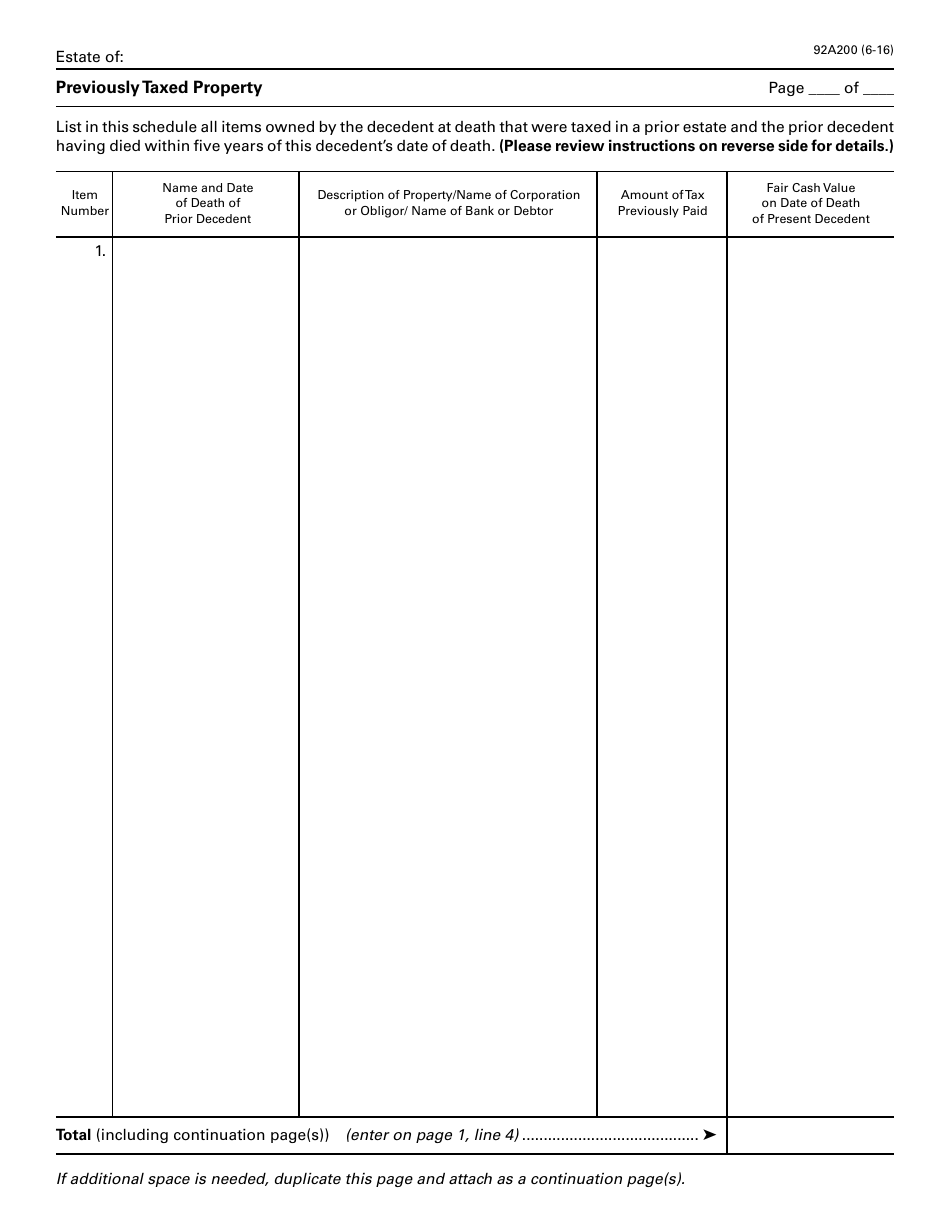

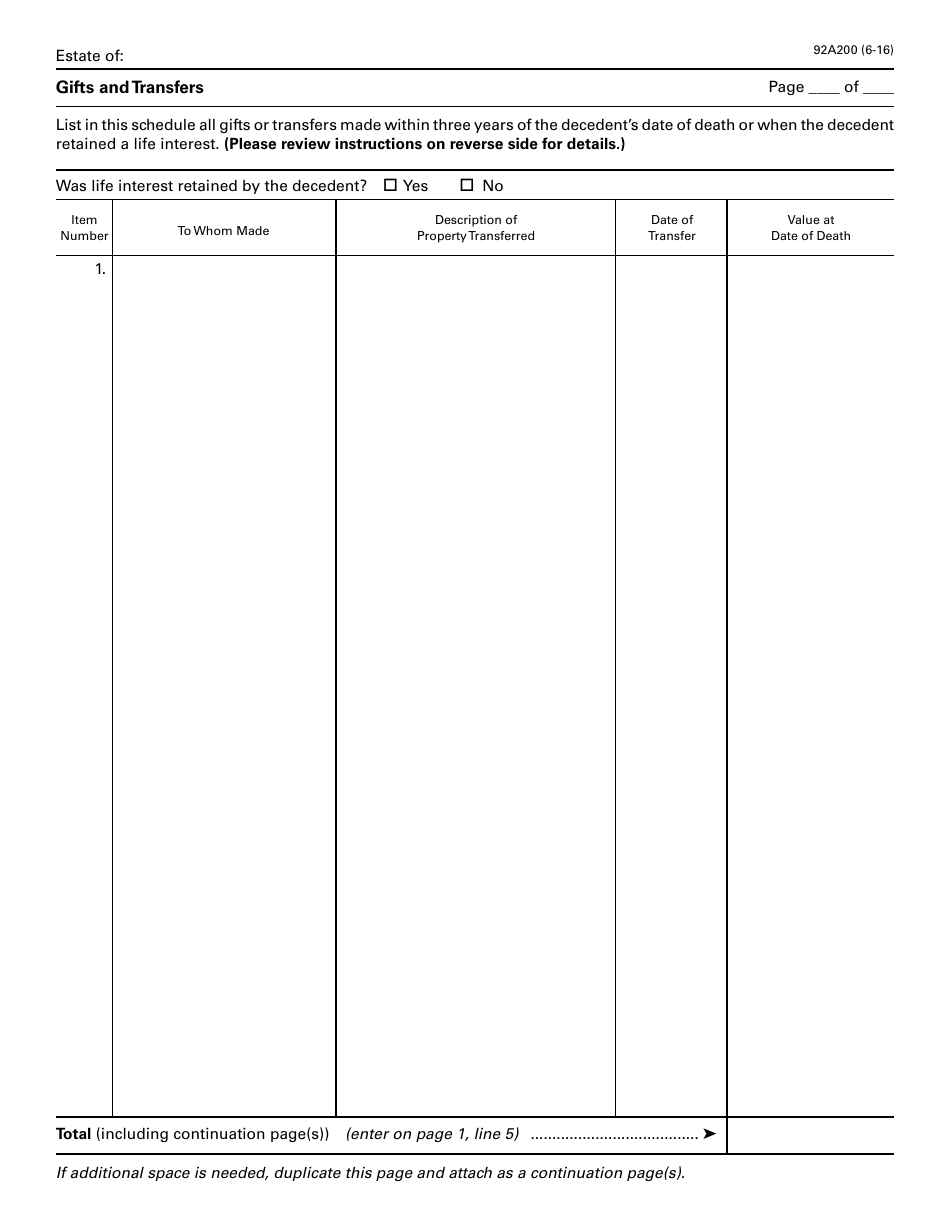

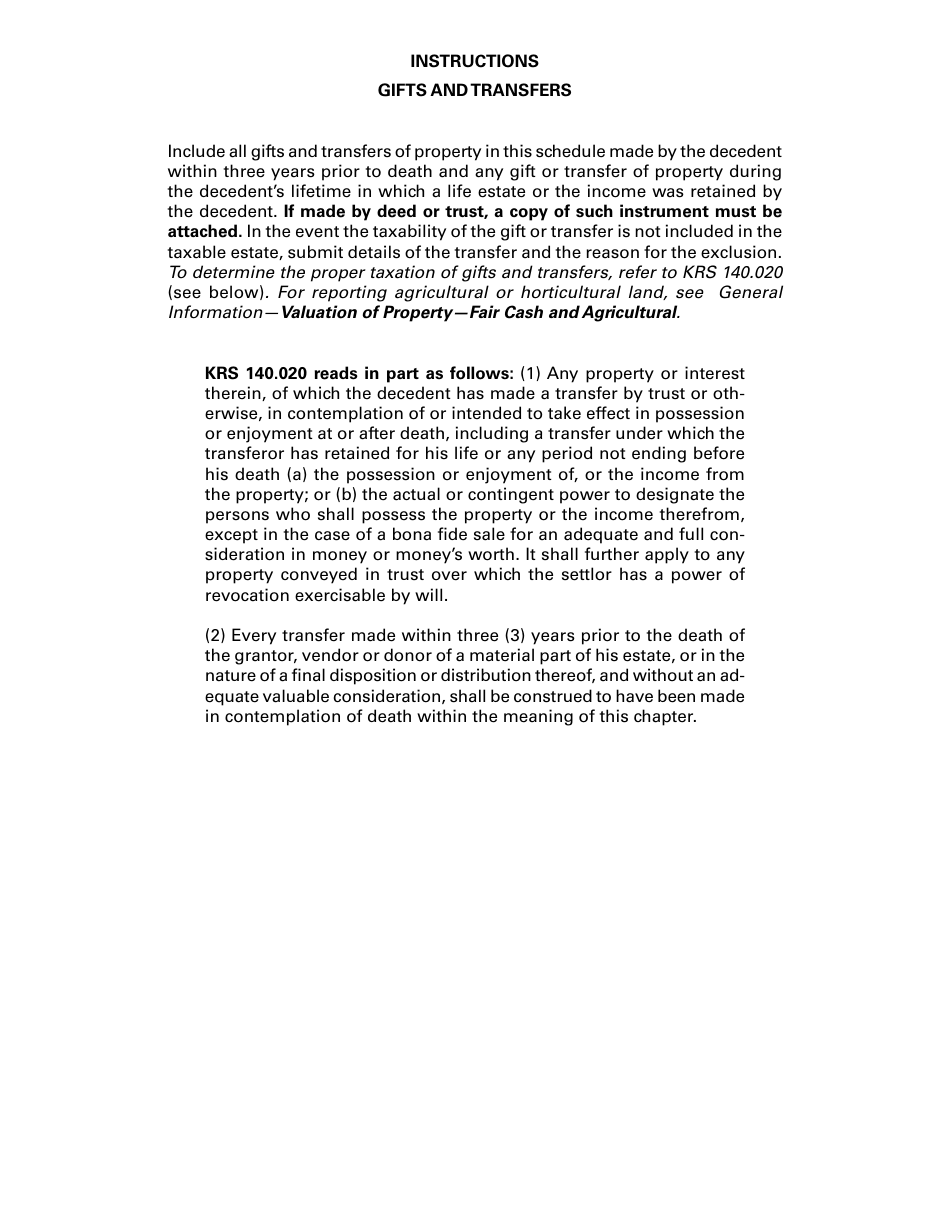

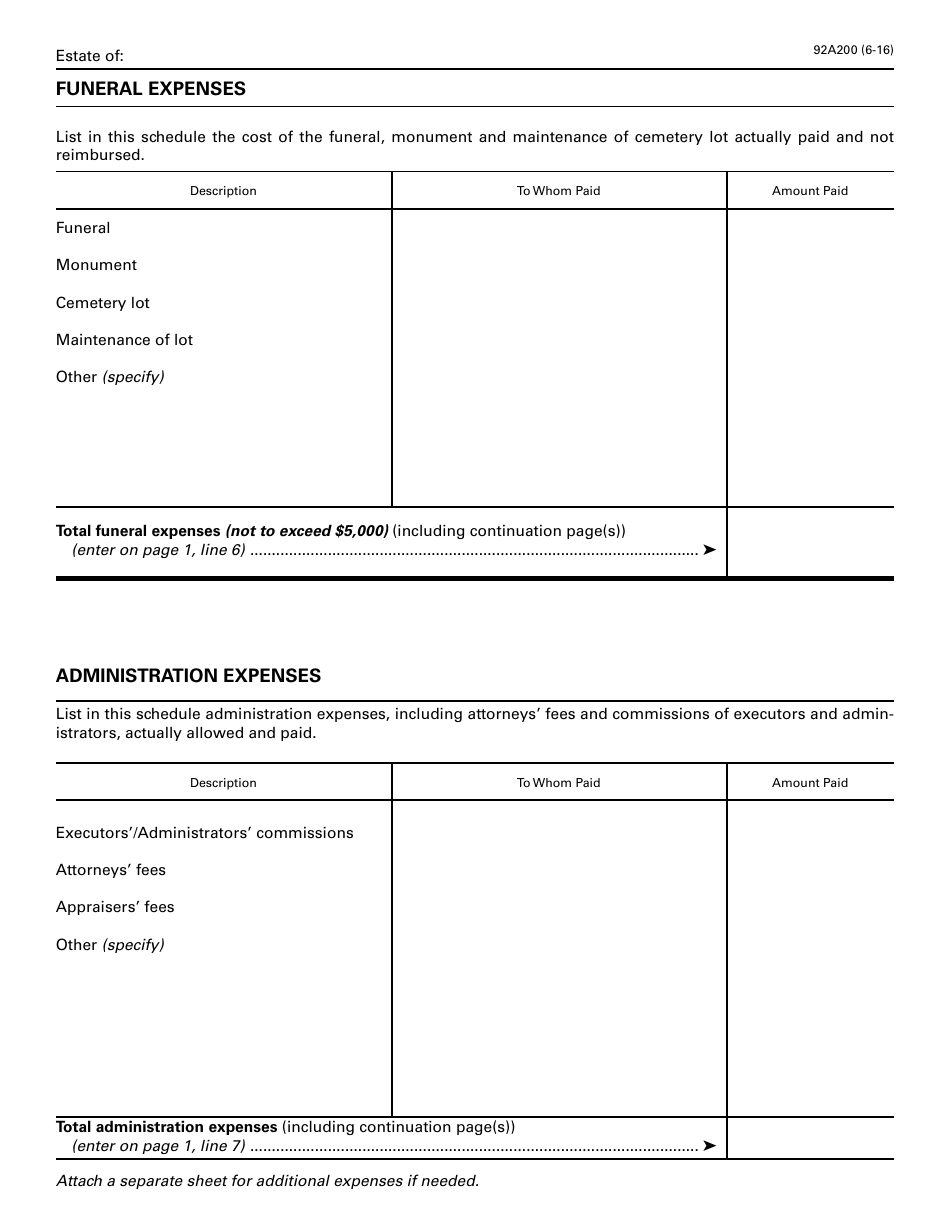

Q: What information do I need to complete Form 92A200?

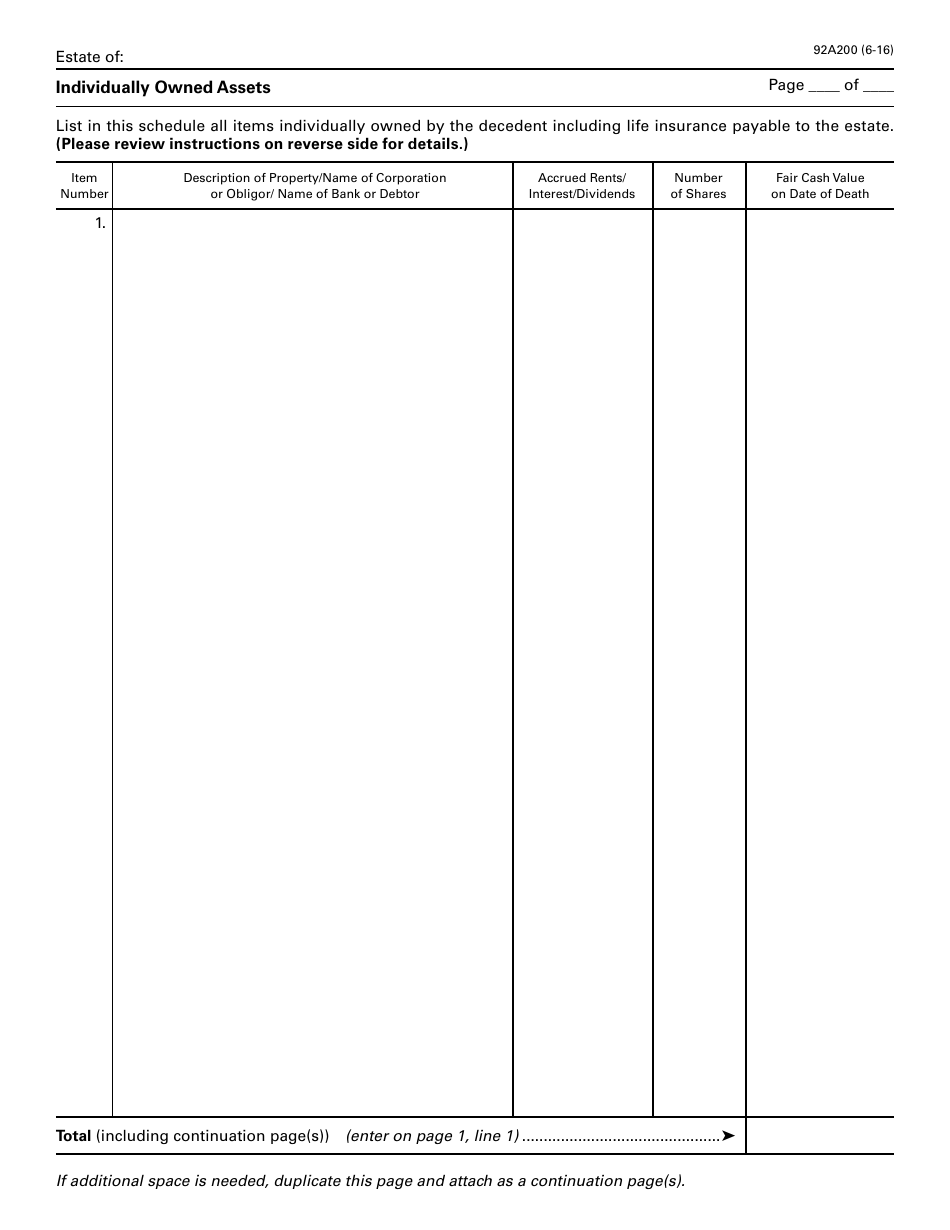

A: To complete Form 92A200, you will need information about the deceased person's assets, beneficiaries, and any applicable exemptions.

Q: When is Form 92A200 due?

A: Form 92A200 is due within nine months from the date of the decedent's death.

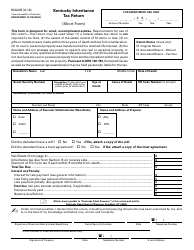

Q: Are there any penalties for late filing of Form 92A200?

A: Yes, there are penalties for late filing of Form 92A200. It is important to file the return and pay the tax on time to avoid penalties and interest.

Q: How do I pay the inheritance tax owed on Form 92A200?

A: You can pay the inheritance tax owed on Form 92A200 by check or money order payable to the Kentucky State Treasurer.

Q: Is inheritance tax the same as estate tax?

A: No, inheritance tax and estate tax are different. Inheritance tax is based on the relationship between the deceased person and the beneficiary, while estate tax is based on the total value of the deceased person's assets.

Q: Can I get a refund if I overpay the inheritance tax?

A: Yes, if you overpay the inheritance tax, you can request a refund from the Kentucky Department of Revenue.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 92A200 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.