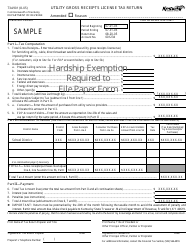

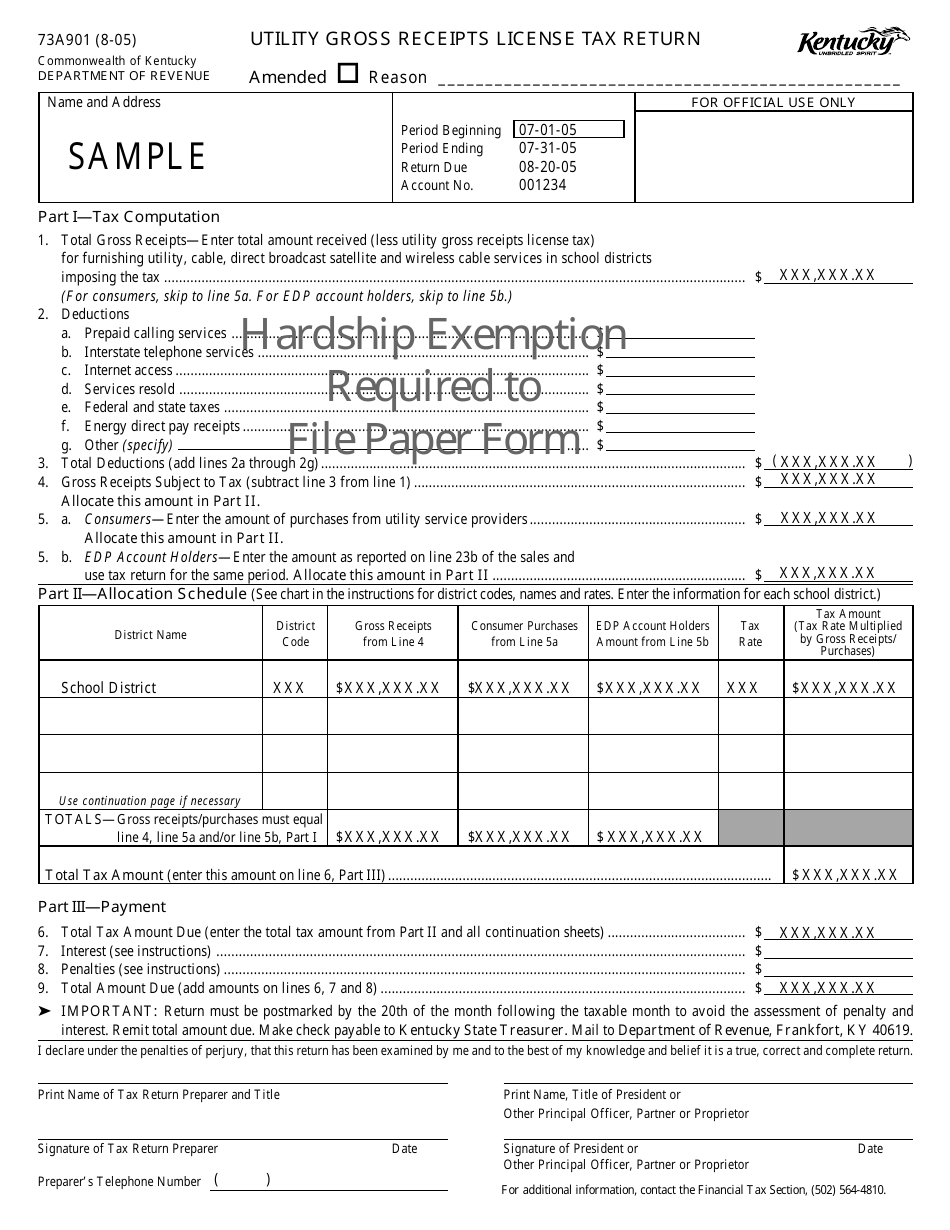

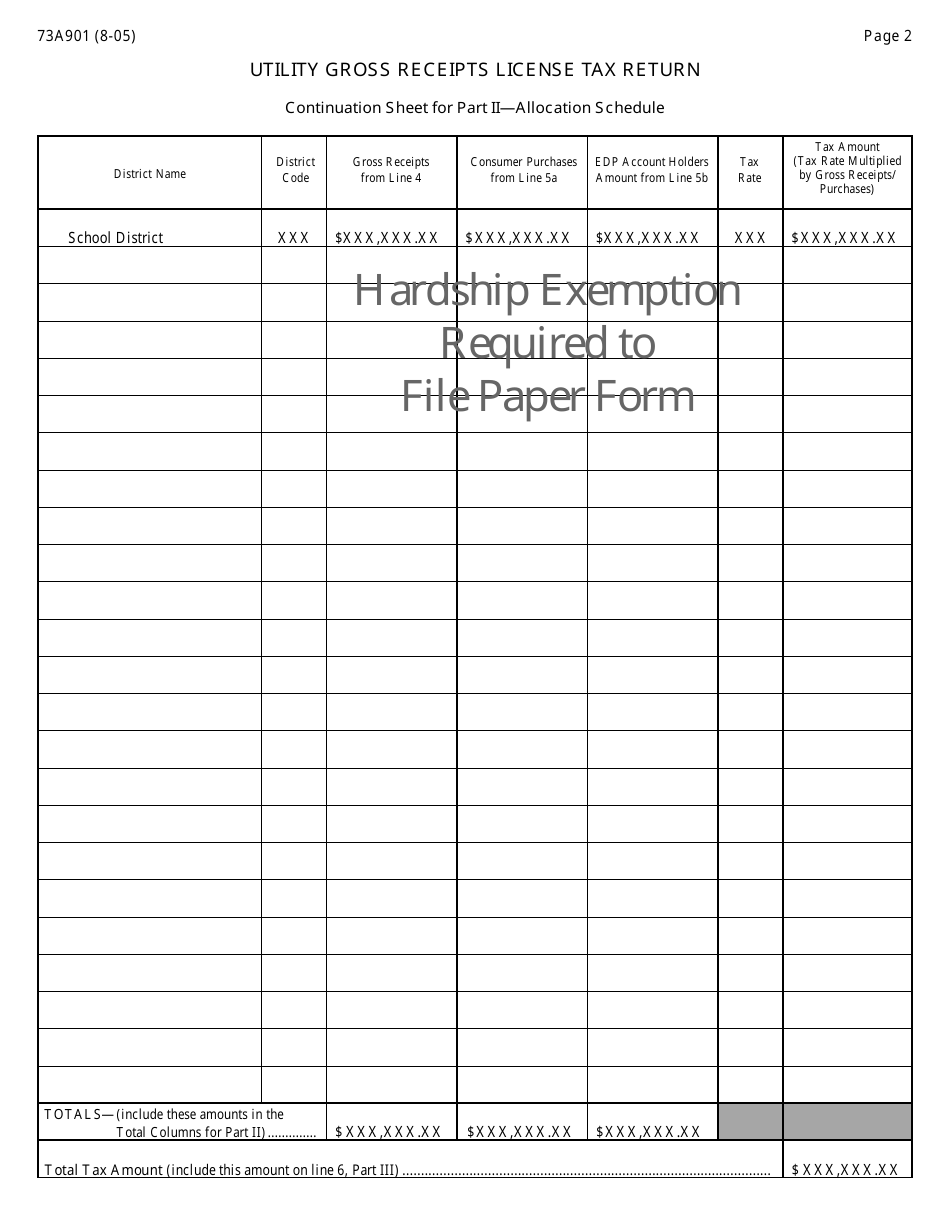

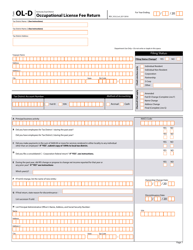

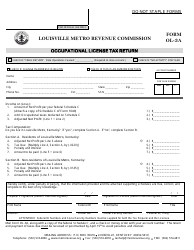

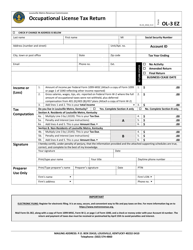

Sample Form 73A901 Utility Gross Receipts License Tax Return - Kentucky

What Is Form 73A901?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A901?

A: Form 73A901 is the Utility Gross ReceiptsLicense Tax Return for the state of Kentucky.

Q: Who needs to file Form 73A901?

A: Utility companies operating in Kentucky need to file Form 73A901.

Q: What is the purpose of Form 73A901?

A: Form 73A901 is used to report and pay the Utility Gross Receipts License Tax.

Q: When is Form 73A901 due?

A: Form 73A901 is due on or before the 20th day of the month following the end of the tax period.

Form Details:

- Released on August 1, 2005;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A901 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.