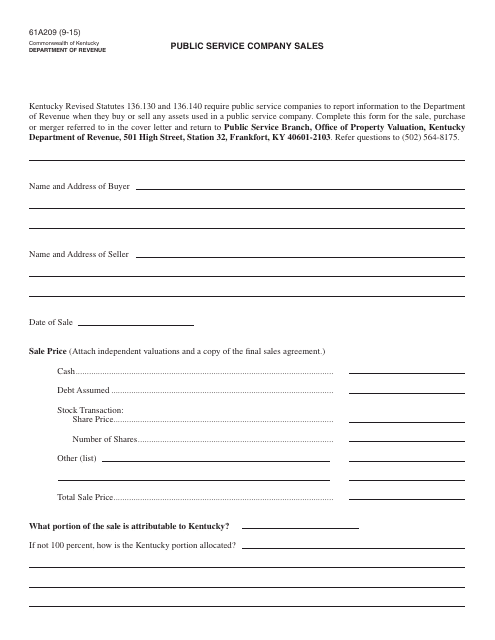

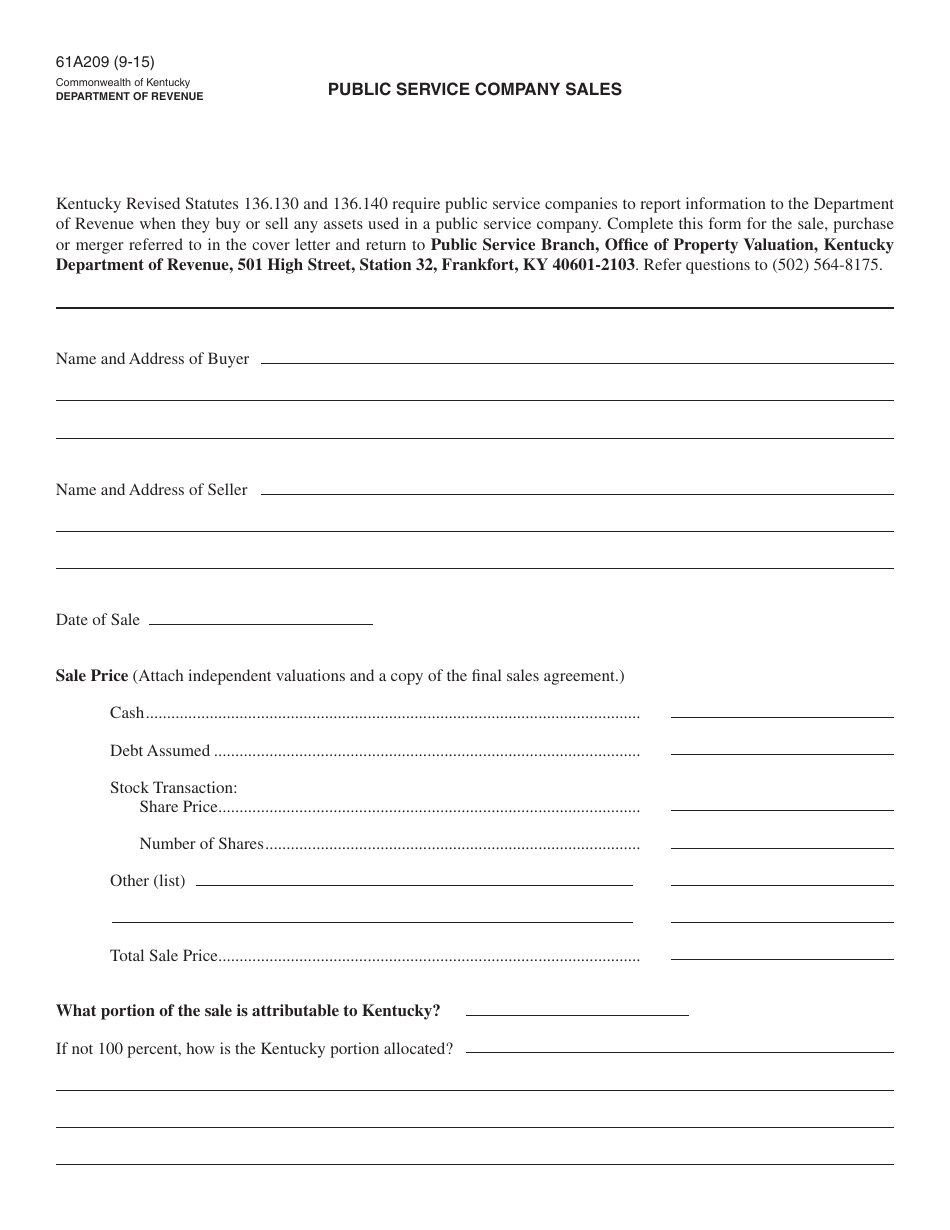

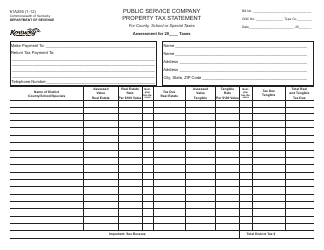

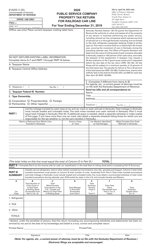

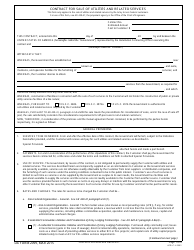

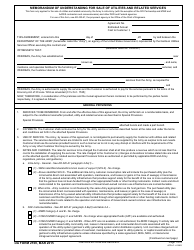

Form 61A209 Public Service Company Sales - Kentucky

What Is Form 61A209?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 61A209?

A: Form 61A209 is a tax form used by public service companies in Kentucky to report sales.

Q: Who is required to file Form 61A209?

A: Public service companies in Kentucky are required to file Form 61A209.

Q: What is considered a public service company?

A: Public service companies in Kentucky include utilities such as electric, gas, water, and telecommunications companies.

Q: What sales are reported on Form 61A209?

A: Form 61A209 is used to report sales of tangible personal property or taxable services.

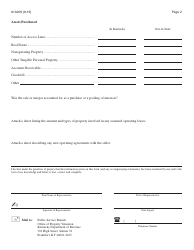

Q: Are there any exemptions or deductions available on Form 61A209?

A: Yes, certain exemptions and deductions may apply. It is advisable to consult the instructions for Form 61A209 or seek professional tax advice.

Q: When is Form 61A209 due?

A: Form 61A209 is due by the last day of the month following the end of the reporting period.

Q: What happens if I fail to file Form 61A209 or file it late?

A: Failure to file or late filing of Form 61A209 may result in penalties or interest charges. It is important to comply with the filing deadlines.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 61A209 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.