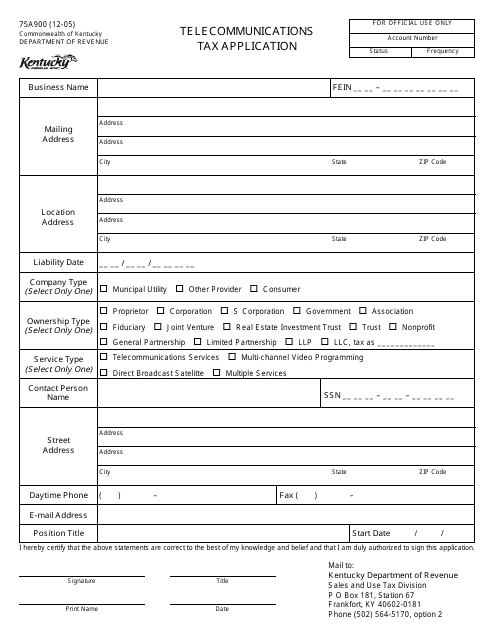

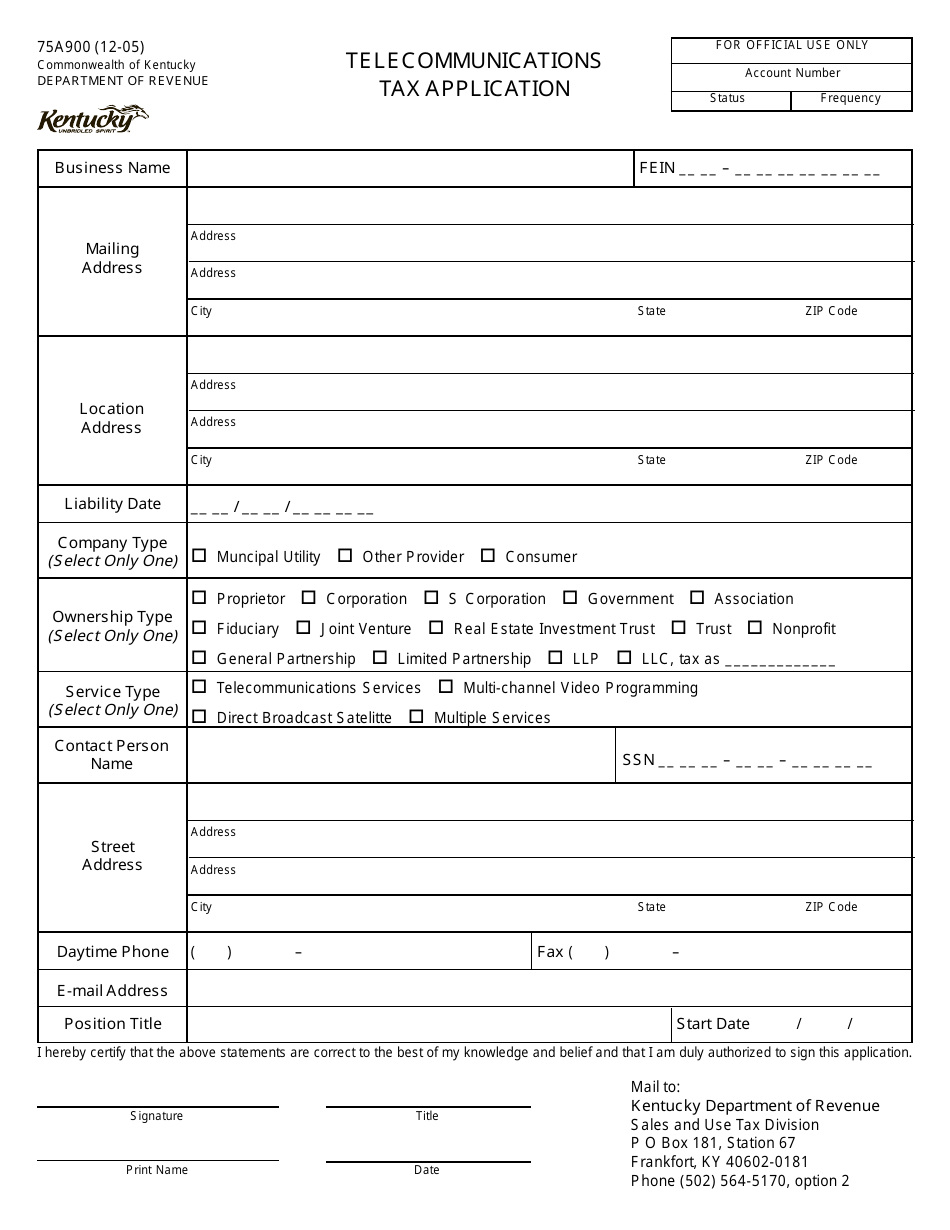

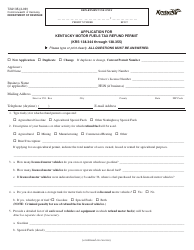

Form 75A900 Telecommunications Tax Application - Kentucky

What Is Form 75A900?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 75A900?

A: Form 75A900 is the Telecommunications Tax Application for the state of Kentucky.

Q: Who needs to file Form 75A900?

A: Telecommunications providers operating in Kentucky need to file Form 75A900.

Q: What is the purpose of Form 75A900?

A: The purpose of Form 75A900 is to report and pay telecommunications taxes to the state of Kentucky.

Q: How often do I need to file Form 75A900?

A: Form 75A900 is filed monthly.

Q: What information do I need to complete Form 75A900?

A: You will need information about your telecommunications operations in Kentucky, including revenue and tax liability.

Q: Are there any penalties for not filing Form 75A900?

A: Yes, there are penalties for noncompliance, including fines and interest on overdue taxes.

Q: Is there a deadline for filing Form 75A900?

A: Yes, Form 75A900 must be filed by the 20th of each month following the reporting period.

Q: Do I need to attach any additional documents with Form 75A900?

A: No, you do not need to attach any additional documents with Form 75A900, unless specifically requested by the Kentucky Department of Revenue.

Form Details:

- Released on December 1, 2005;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 75A900 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.