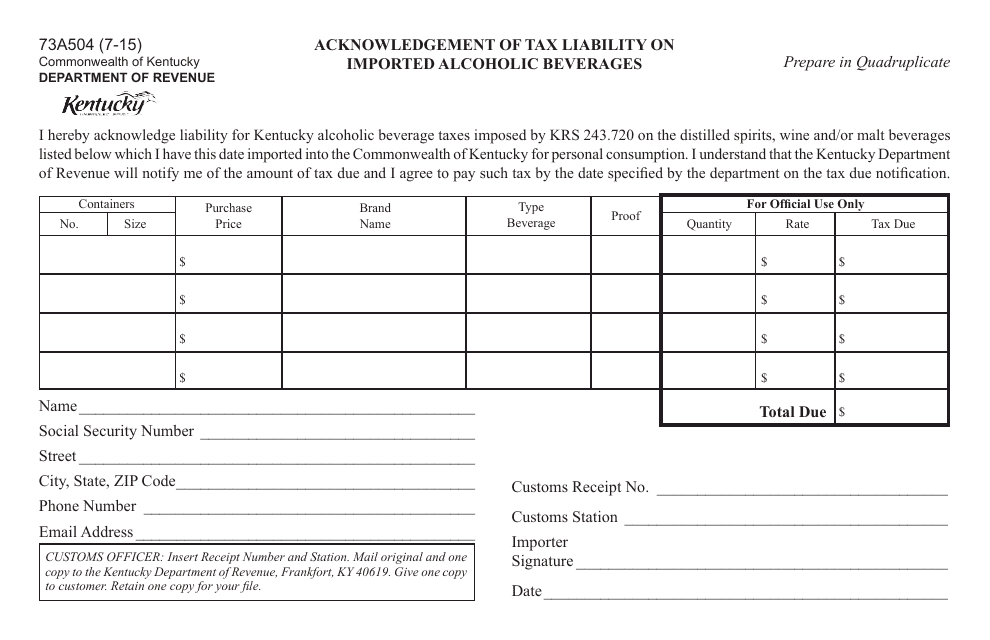

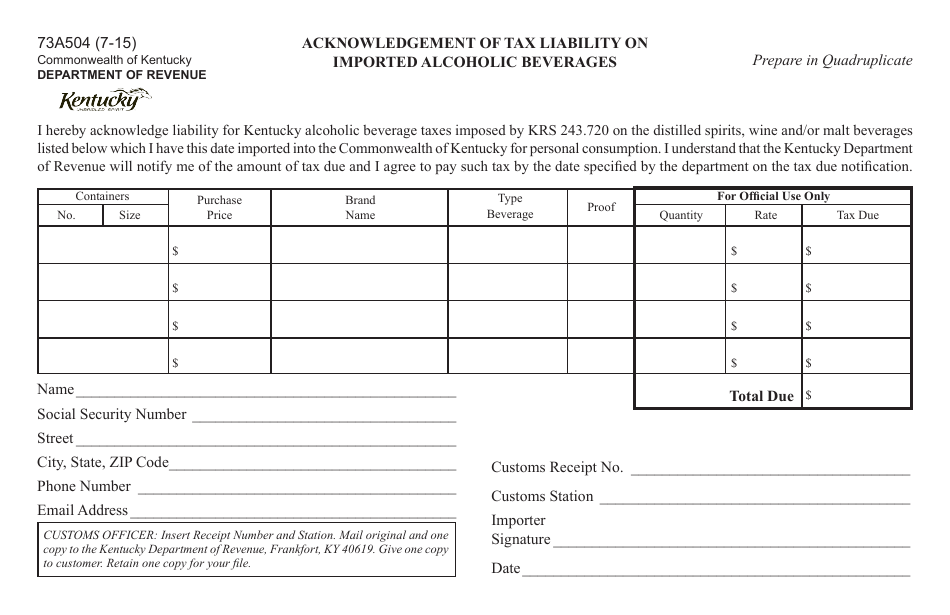

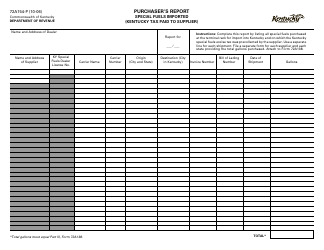

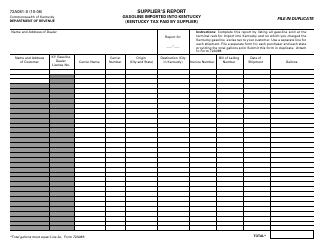

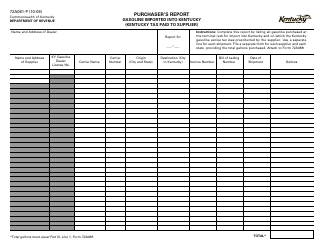

Form 73A504 Acknowledgement of Tax Liability on Imported Alcoholic Beverages - Kentucky

What Is Form 73A504?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A504?

A: Form 73A504 is the Acknowledgement of Tax Liability on Imported Alcoholic Beverages in Kentucky.

Q: What is the purpose of Form 73A504?

A: The purpose of Form 73A504 is to acknowledge and report the tax liability on imported alcoholic beverages in Kentucky.

Q: Who needs to use Form 73A504?

A: Anyone who imports alcoholic beverages into Kentucky and has a tax liability for those imports needs to use Form 73A504.

Q: How do I fill out Form 73A504?

A: You need to provide information about the importer, the alcoholic beverages imported, and the tax liability associated with the imports.

Q: When is the deadline to submit Form 73A504?

A: The deadline to submit Form 73A504 is determined by the Kentucky Department of Revenue and can vary.

Q: Are there any penalties for not filing Form 73A504?

A: Yes, failure to file or late filing of Form 73A504 may result in penalties and interest.

Q: Is Form 73A504 specific to Kentucky?

A: Yes, Form 73A504 is specific to the state of Kentucky and its tax laws regarding imported alcoholic beverages.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A504 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.