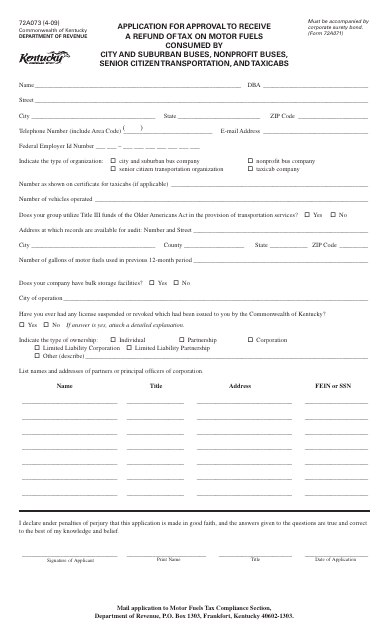

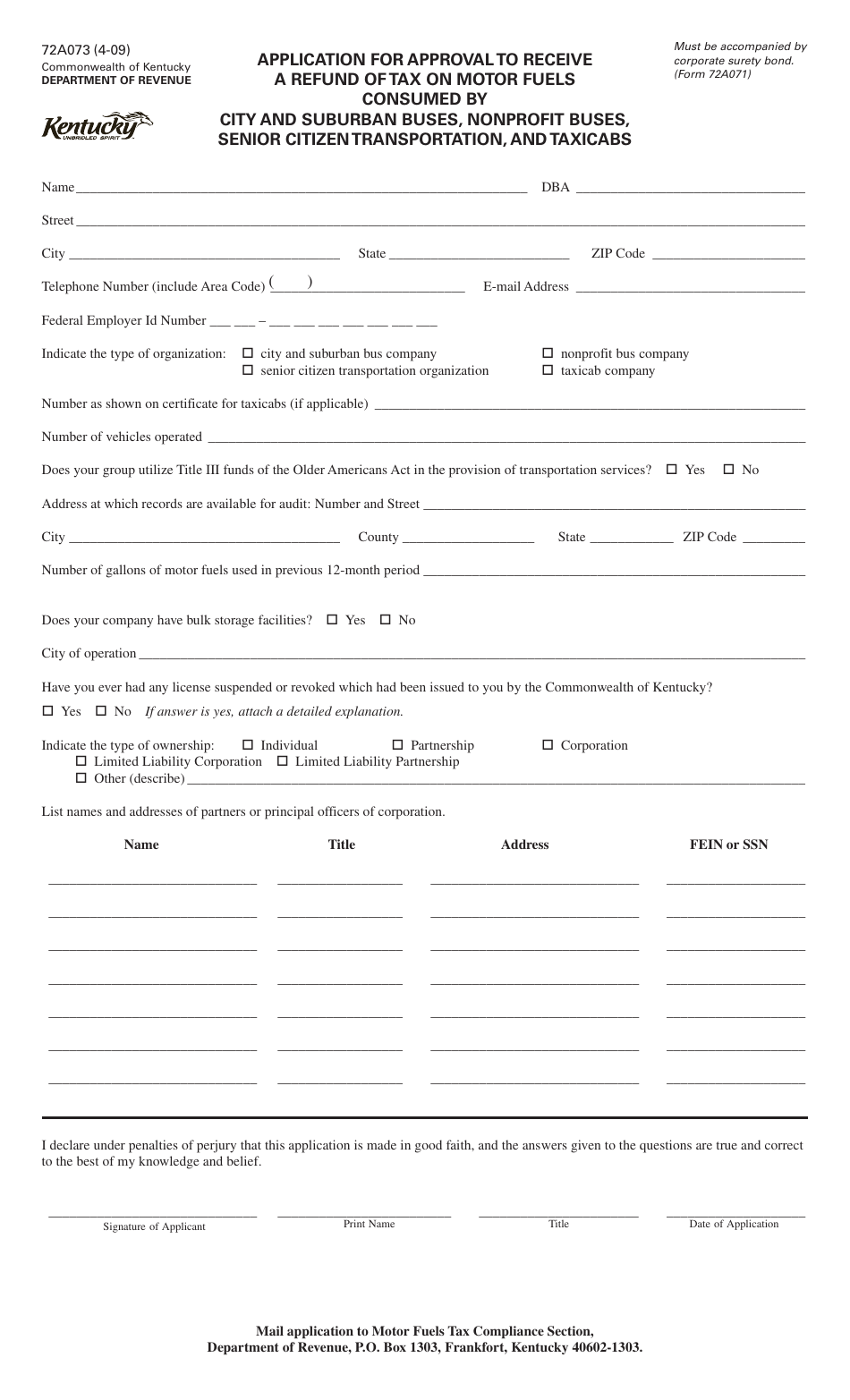

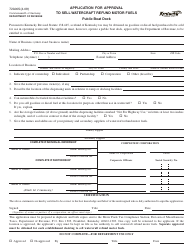

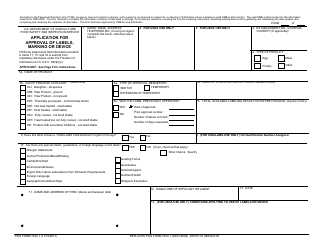

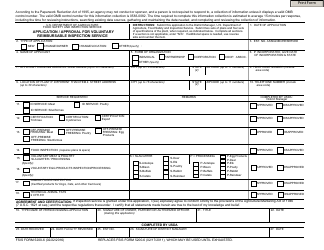

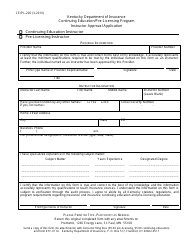

Form 72A073 Application for Approval to Receive a Refund of Tax on Motor Fuels Consumed by City and Suburban Buses, Nonprofit Buses, Senior Citizen Transportation, and Taxicabs - Kentucky

What Is Form 72A073?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A073?

A: Form 72A073 is an application for approval to receive a refund of tax on motor fuels consumed by various types of buses and taxicabs in Kentucky.

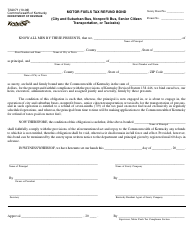

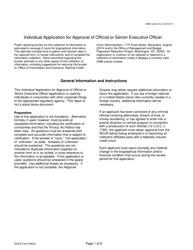

Q: Who can use Form 72A073?

A: This form can be used by city and suburban buses, nonprofit buses, senior citizen transportation, and taxicabs in Kentucky.

Q: What is the purpose of Form 72A073?

A: The purpose of this form is to apply for a refund of tax on motor fuels consumed by eligible vehicles in Kentucky.

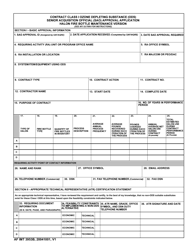

Q: How do I complete Form 72A073?

A: You should carefully fill in the required information on the form, providing details about your eligible vehicles and the fuel consumed.

Q: Is there a deadline to file Form 72A073?

A: Yes, you must submit this form within three years from the end of the calendar year in which the motor fuel was purchased.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A073 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.