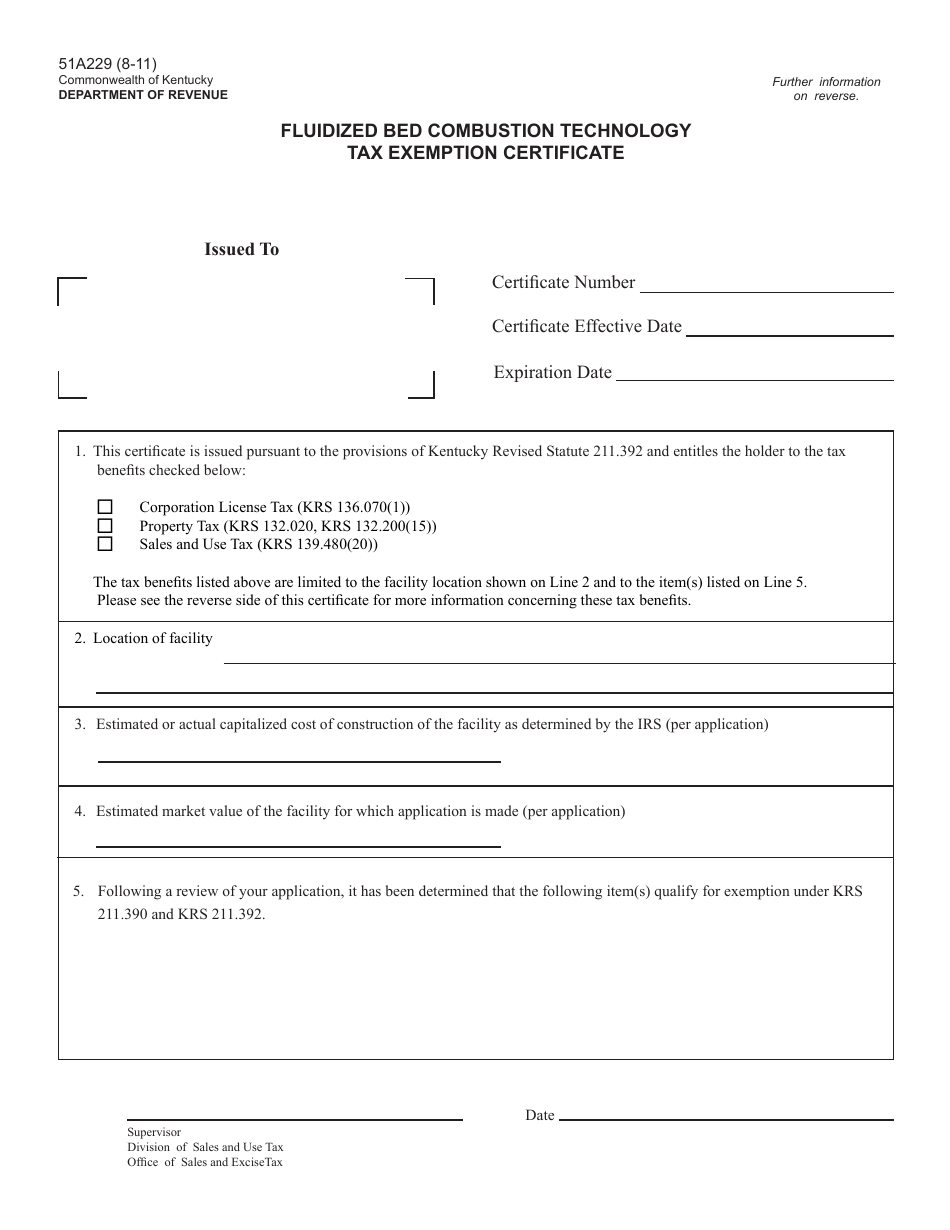

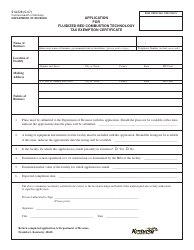

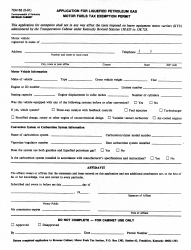

Form 51A229 Fluidized Bed Combustion Technology Tax Exemption Certificate - Kentucky

What Is Form 51A229?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A229?

A: Form 51A229 is the Fluidized Bed Combustion Technology Tax Exemption Certificate for Kentucky.

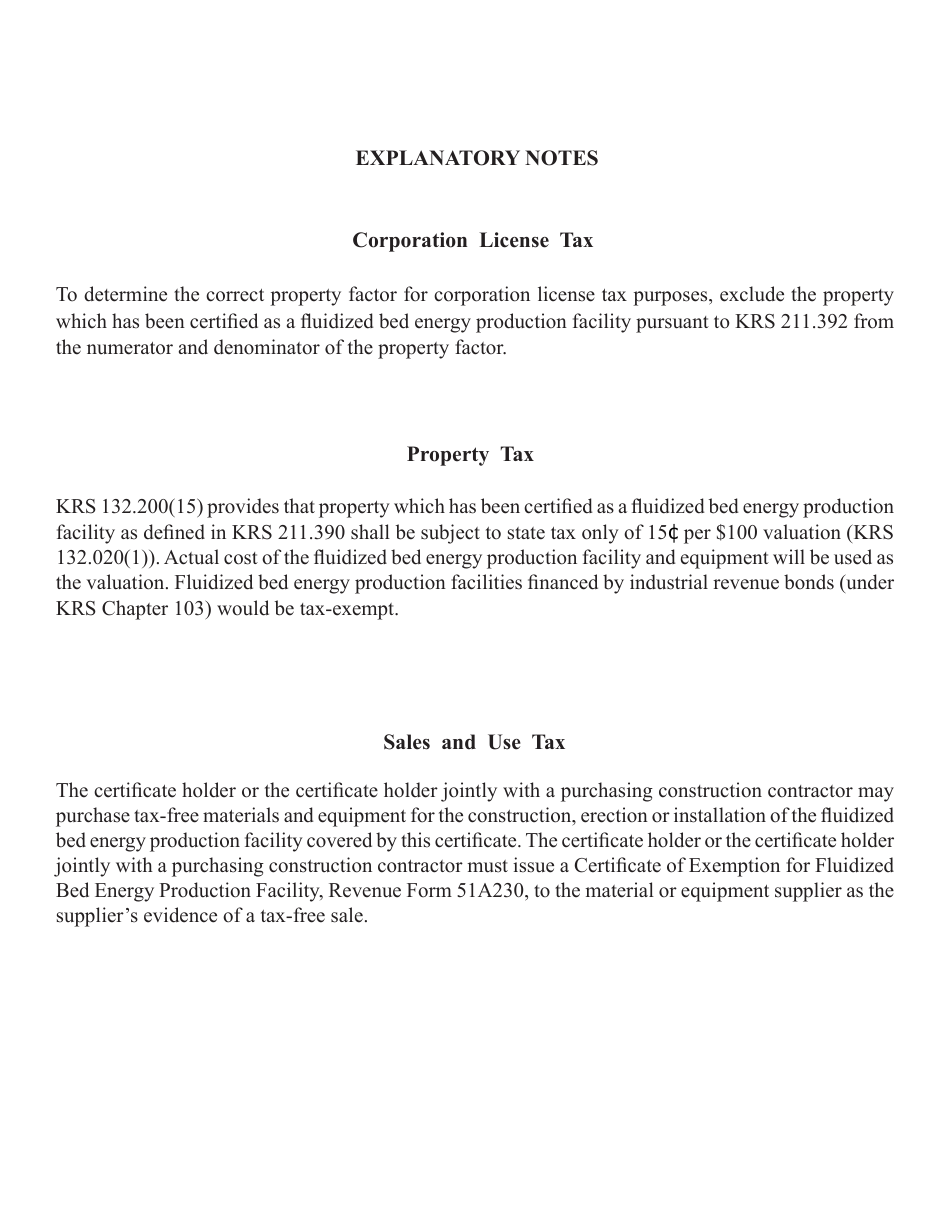

Q: What is the purpose of Form 51A229?

A: The purpose of Form 51A229 is to provide a tax exemption for companies utilizing fluidized bed combustion technology in Kentucky.

Q: Who is eligible for the tax exemption?

A: Companies that use fluidized bed combustion technology in Kentucky are eligible for the tax exemption.

Q: Are there any requirements to qualify for the tax exemption?

A: Yes, companies must meet certain criteria and provide supporting documentation to qualify for the tax exemption.

Q: What should I do with the completed form?

A: Once completed, the form should be submitted to the Kentucky Department of Revenue.

Q: Is the tax exemption permanent?

A: No, the tax exemption is subject to annual certification by the Kentucky Department of Revenue.

Q: Can I claim the tax exemption for previous years?

A: No, the tax exemption can only be claimed for the current year and future years.

Q: Who can I contact for more information about Form 51A229?

A: For more information, you can contact the Kentucky Department of Revenue directly.

Form Details:

- Released on August 1, 2011;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A229 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.