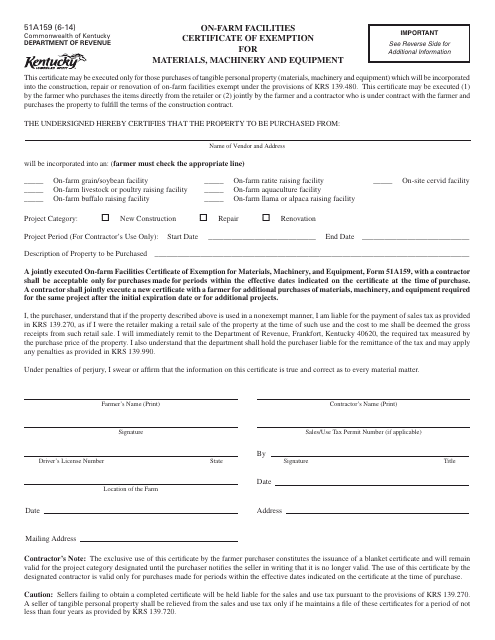

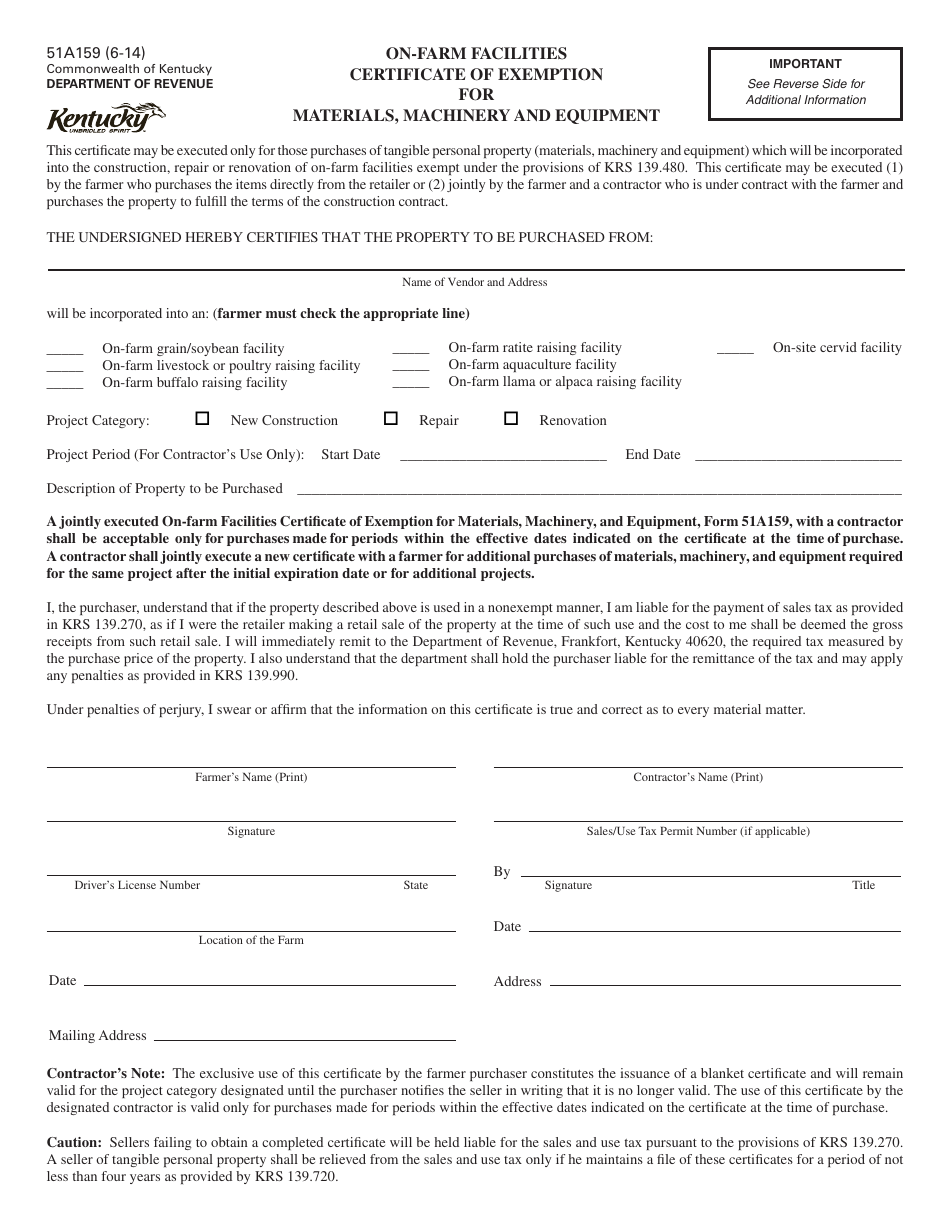

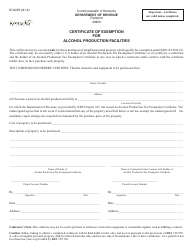

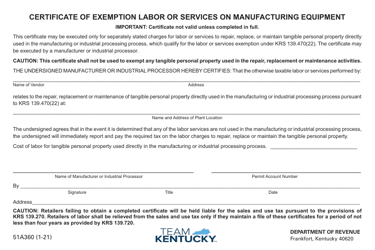

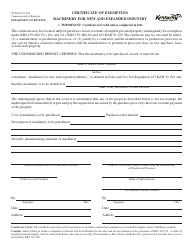

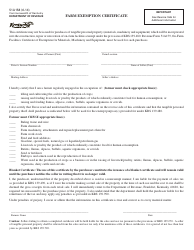

Form 51A159 On-Farm Facilities Certificate of Exemption for Materials, Machinery and Equipment - Kentucky

What Is Form 51A159?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A159?

A: Form 51A159 is a Certificate of Exemption for Materials, Machinery and Equipment used in on-farm facilities.

Q: What is the purpose of Form 51A159?

A: The purpose of Form 51A159 is to claim an exemption from Kentucky sales and use tax on materials, machinery and equipment used in on-farm facilities.

Q: Who needs to fill out Form 51A159?

A: Farmers or agricultural producers who purchase materials, machinery, and equipment for use in on-farm facilities in Kentucky need to fill out Form 51A159.

Q: What is the benefit of filling out Form 51A159?

A: By filling out Form 51A159, farmers can claim an exemption from Kentucky sales and use tax on qualified purchases for on-farm facilities.

Q: What information is required on Form 51A159?

A: Form 51A159 requires information such as the farmer's name, address, farm location, description of property being purchased, and the reason for claiming the exemption.

Q: Are there any restrictions on the use of materials, machinery, and equipment claimed on Form 51A159?

A: Yes, the materials, machinery, and equipment claimed on Form 51A159 must be used exclusively for on-farm purposes.

Q: Is there a deadline for submitting Form 51A159?

A: Form 51A159 should be completed and submitted to the Kentucky Department of Revenue within 30 days of the qualified purchase.

Q: Can I claim the exemption on previous purchases?

A: No, Form 51A159 can only be used to claim the exemption on qualified purchases made after the form is submitted.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A159 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.