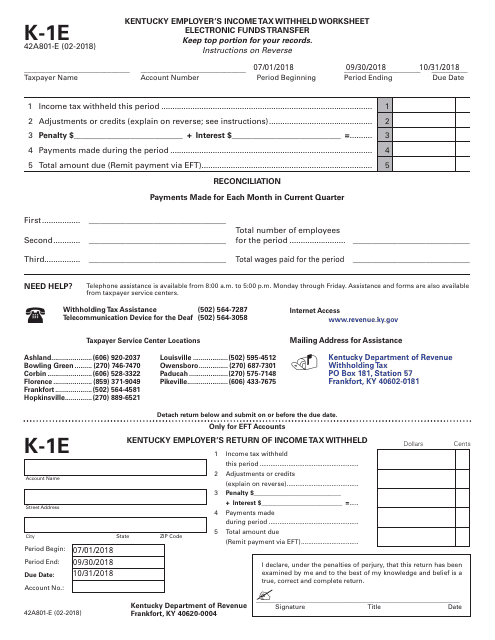

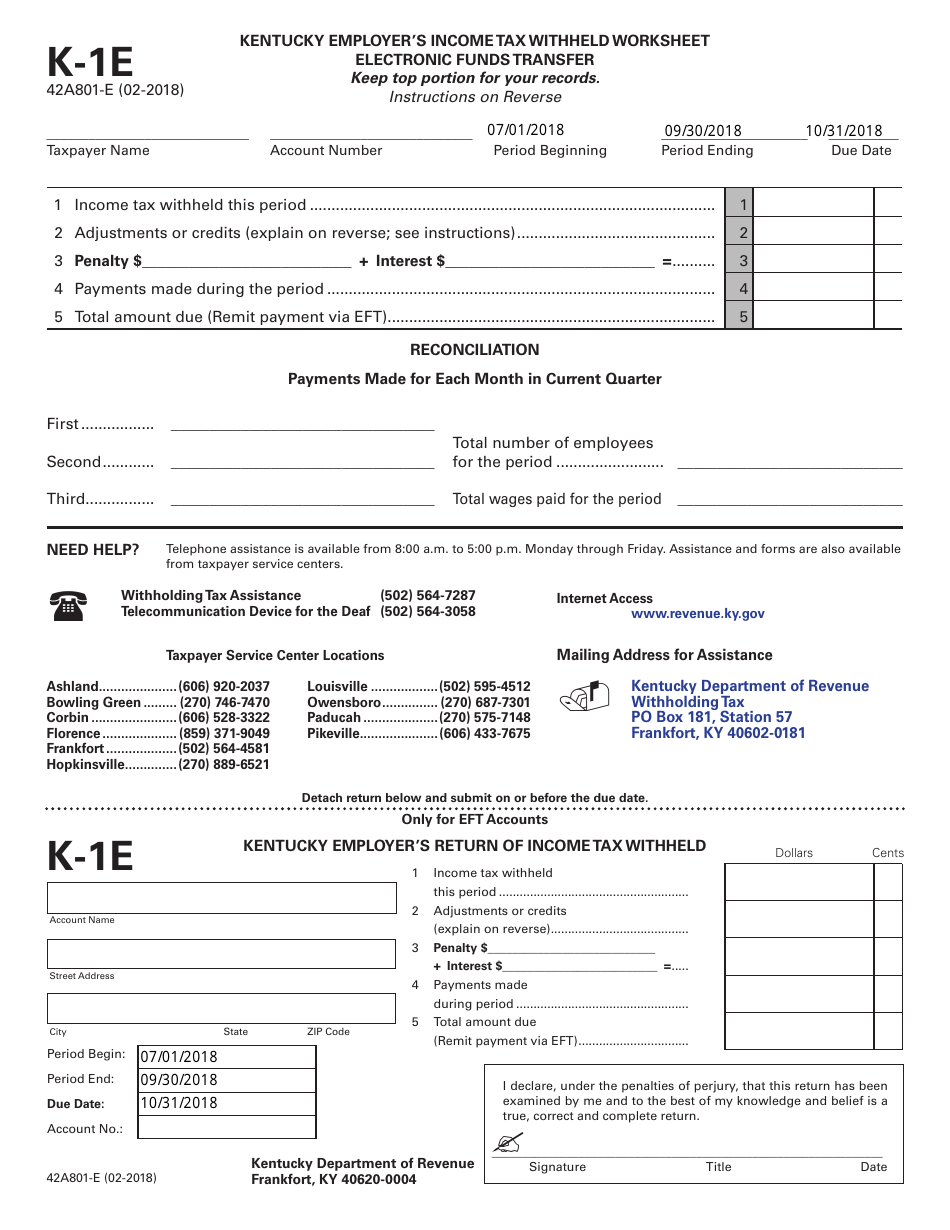

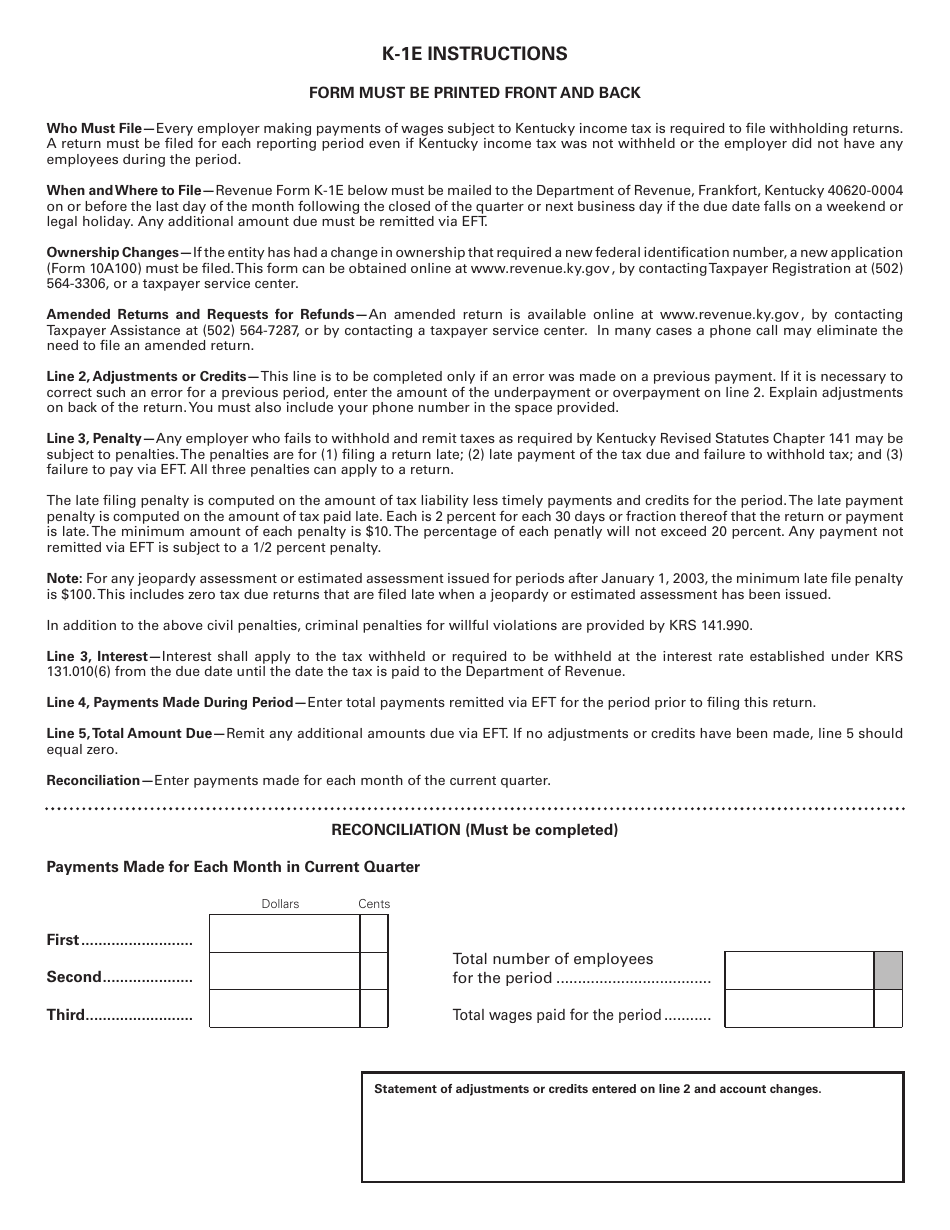

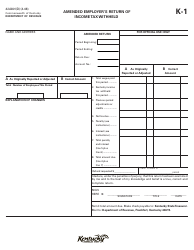

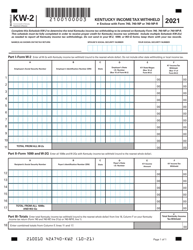

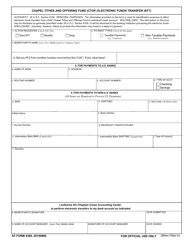

Form 42A801-E (K-1E) Kentucky Employer's Income Tax Withheld Worksheet - Electronic Funds Transfer - Kentucky

What Is Form 42A801-E (K-1E)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 42A801-E?

A: Form 42A801-E is the Kentucky Employer's Income Tax Withheld Worksheet - Electronic Funds Transfer.

Q: What is the purpose of Form 42A801-E?

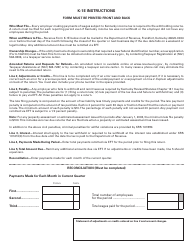

A: The purpose of Form 42A801-E is to calculate the amount of Kentucky employer income tax to be withheld.

Q: Who should use Form 42A801-E?

A: Employers in Kentucky who are required to withhold income tax from their employees' wages should use Form 42A801-E.

Q: What information is needed to complete Form 42A801-E?

A: You will need information about your employees' wages and the Kentucky income tax rates.

Q: Is Form 42A801-E required to be filed electronically?

A: Yes, Form 42A801-E must be filed electronically if you have 10 or more employees.

Q: What if I have less than 10 employees?

A: If you have less than 10 employees, you can choose to file Form 42A801-E electronically or on paper.

Q: Can Form 42A801-E be amended?

A: Yes, if you need to make changes to your initial filing, you can file an amended Form 42A801-E.

Q: What is the deadline for filing Form 42A801-E?

A: Form 42A801-E must be filed by the last day of the month following the end of each calendar quarter.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 42A801-E (K-1E) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.