This version of the form is not currently in use and is provided for reference only. Download this version of

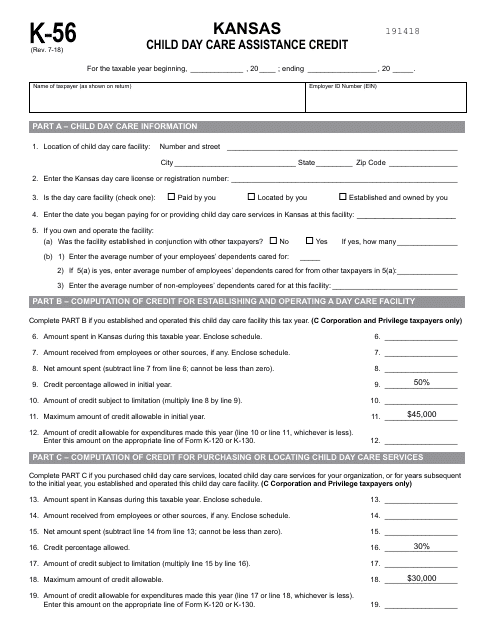

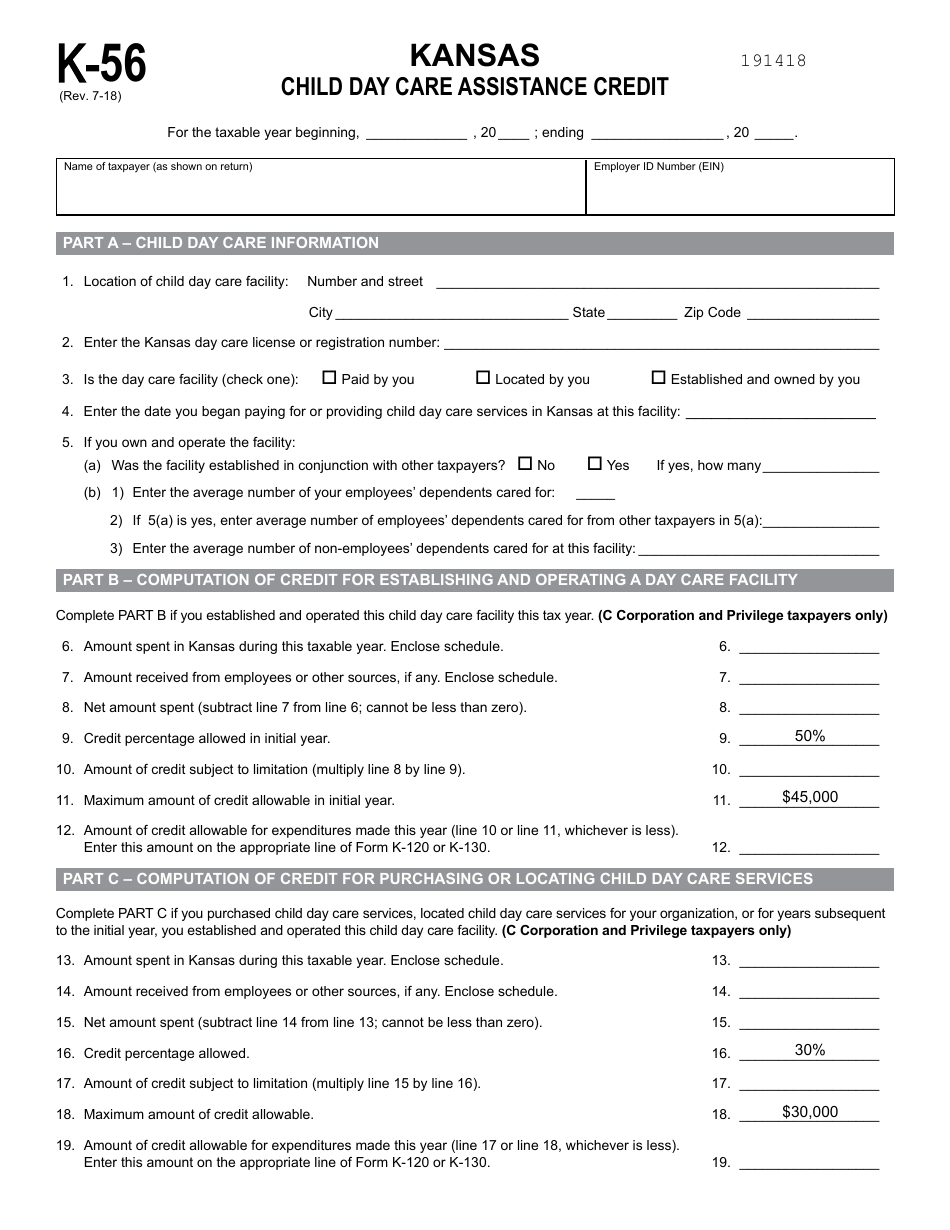

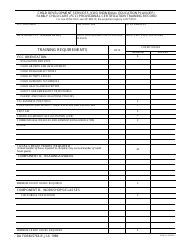

Schedule K-56

for the current year.

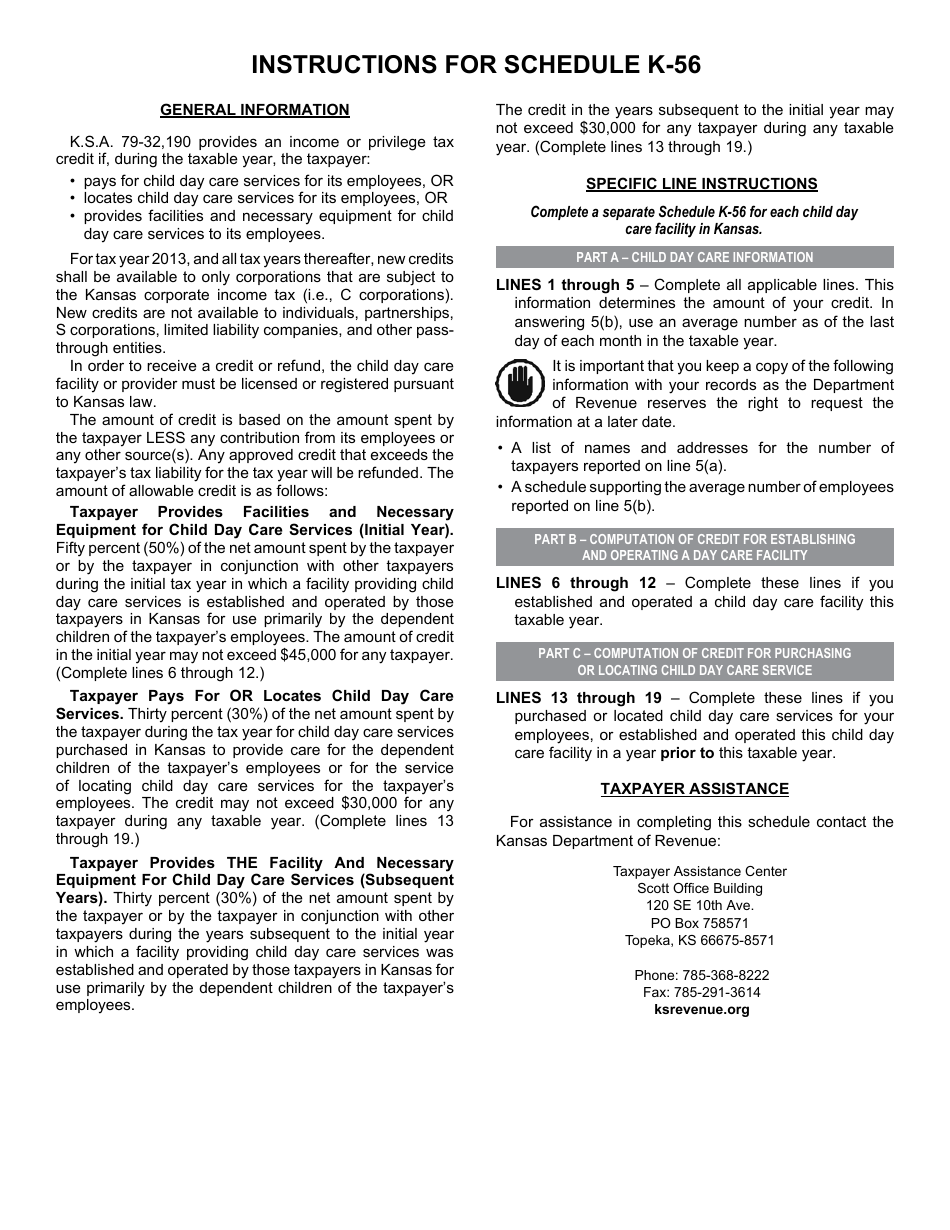

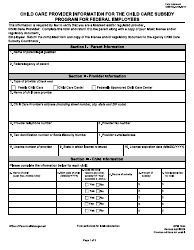

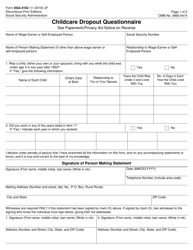

Schedule K-56 Child Day Care Assistance Credit - Kansas

What Is Schedule K-56?

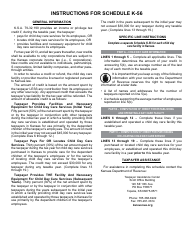

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-56?

A: Schedule K-56 is a tax form used to claim the Child Day Care Assistance Credit in Kansas.

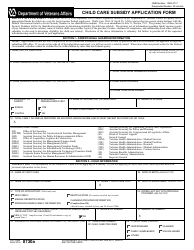

Q: What is the purpose of the Child Day Care Assistance Credit?

A: The purpose of the Child Day Care Assistance Credit is to provide financial relief to taxpayers who incur expenses for child day care services in Kansas.

Q: Who is eligible for the Child Day Care Assistance Credit?

A: Taxpayers who have incurred child day care expenses for qualifying dependents in Kansas may be eligible for the credit.

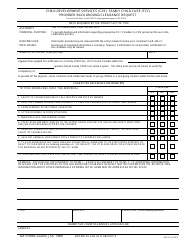

Q: What are qualifying child day care expenses?

A: Qualifying child day care expenses include the costs of care provided by a licensed child care facility or an individual who meets certain requirements.

Q: How much is the Child Day Care Assistance Credit?

A: The credit amount is determined based on a percentage of the qualifying child day care expenses, subject to certain limitations.

Q: How can I claim the Child Day Care Assistance Credit?

A: To claim the credit, you need to complete and attach Schedule K-56 to your Kansas income tax return, provide the required information, and meet all eligibility requirements.

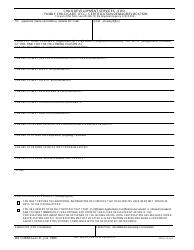

Q: What is the deadline for claiming the Child Day Care Assistance Credit?

A: The deadline for claiming the credit is the same as the deadline for filing your Kansas income tax return.

Q: Can I claim the Child Day Care Assistance Credit if I receive other child care benefits?

A: You may still be eligible for the credit even if you receive other child care benefits, but the credit amount may be reduced.

Q: Are there any income limitations for claiming the Child Day Care Assistance Credit?

A: Yes, there are income limitations for claiming the credit. The credit amount gradually phases out as your income exceeds certain thresholds.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule K-56 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.