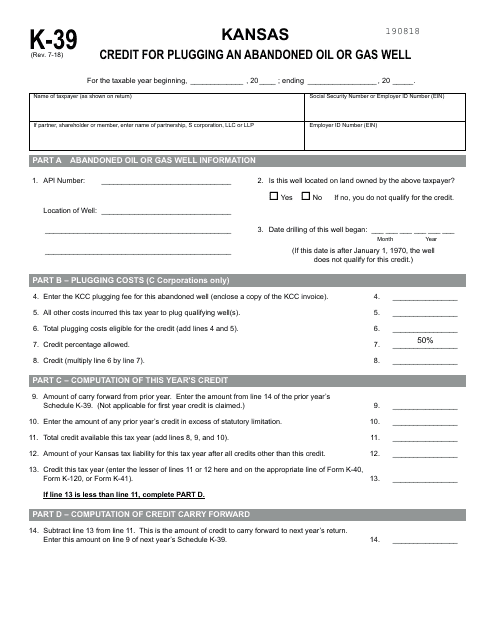

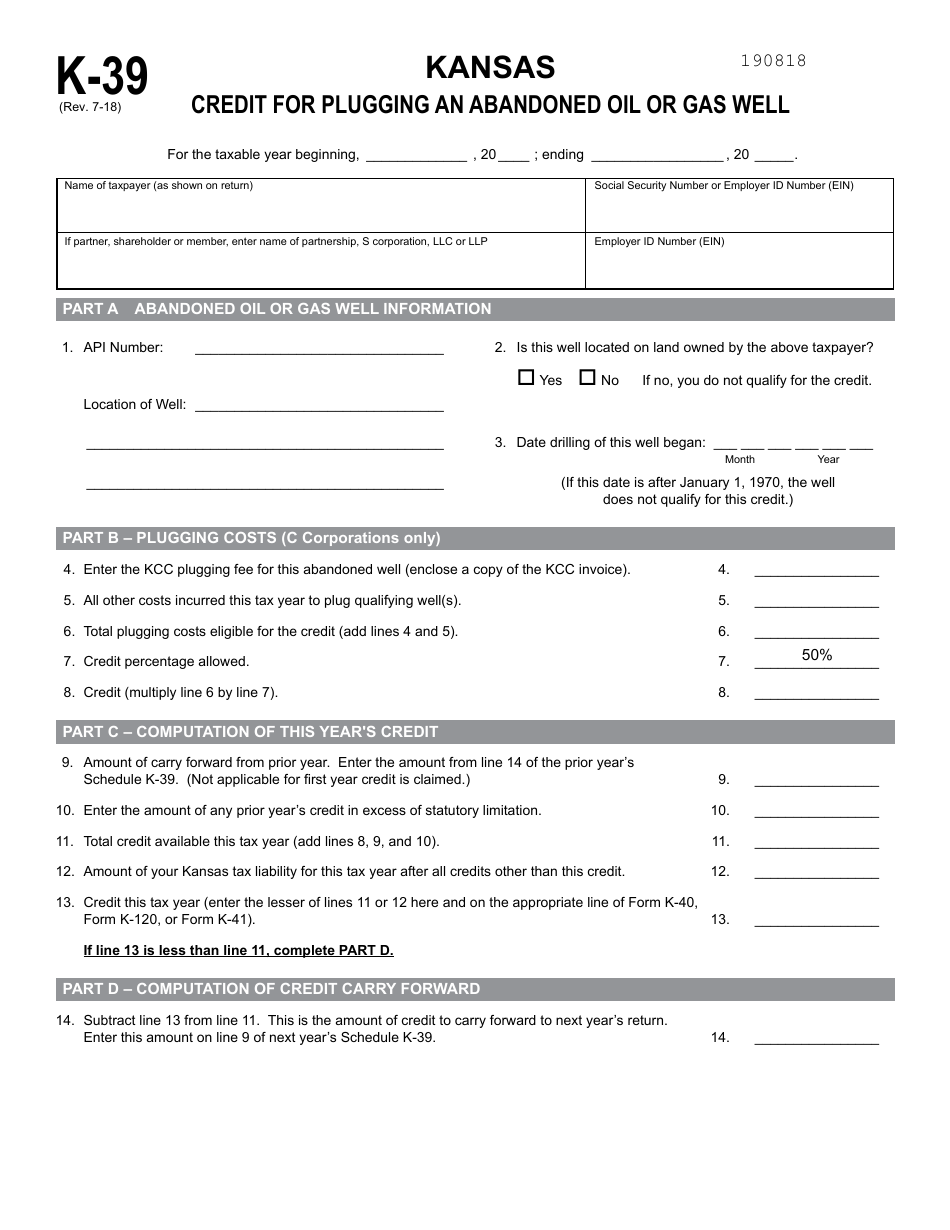

This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule K-39

for the current year.

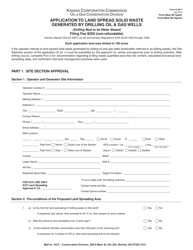

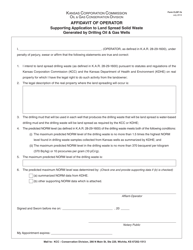

Schedule K-39 Plugging an Abandoned Oil or Gas Well Credit - Kansas

What Is Schedule K-39?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-39?

A: Schedule K-39 is a tax form used in Kansas to claim the Plugging an Abandoned Oil or Gas Well Credit.

Q: What is the Plugging an Abandoned Oil or Gas Well Credit?

A: The Plugging an Abandoned Oil or Gas Well Credit is a tax credit available in Kansas for costs incurred in plugging an abandoned oil or gas well.

Q: Who can claim the Plugging an Abandoned Oil or Gas Well Credit?

A: Individuals and businesses that have incurred costs for plugging an abandoned oil or gas well in Kansas can claim this credit.

Q: What are the eligibility requirements for the credit?

A: To be eligible for the Plugging an Abandoned Oil or Gas Well Credit, the well must be abandoned and the costs must be directly related to the plugging process.

Q: How much is the Plugging an Abandoned Oil or Gas Well Credit?

A: The amount of the credit is equal to 50% of the eligible costs incurred in plugging the well.

Q: How do I claim the Plugging an Abandoned Oil or Gas Well Credit?

A: To claim the credit, you need to file Schedule K-39 with your Kansas income tax return.

Q: Is there a limit on the amount of the credit?

A: Yes, the credit is limited to $50,000 per abandoned well.

Q: Can the credit be carried forward or backward?

A: No, the credit cannot be carried forward or backward. It can only be used in the tax year in which the costs were incurred.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-39 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.