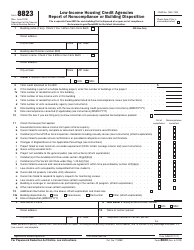

This version of the form is not currently in use and is provided for reference only. Download this version of

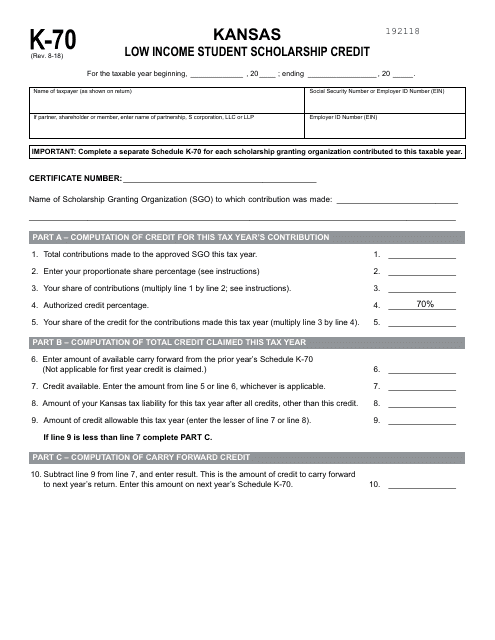

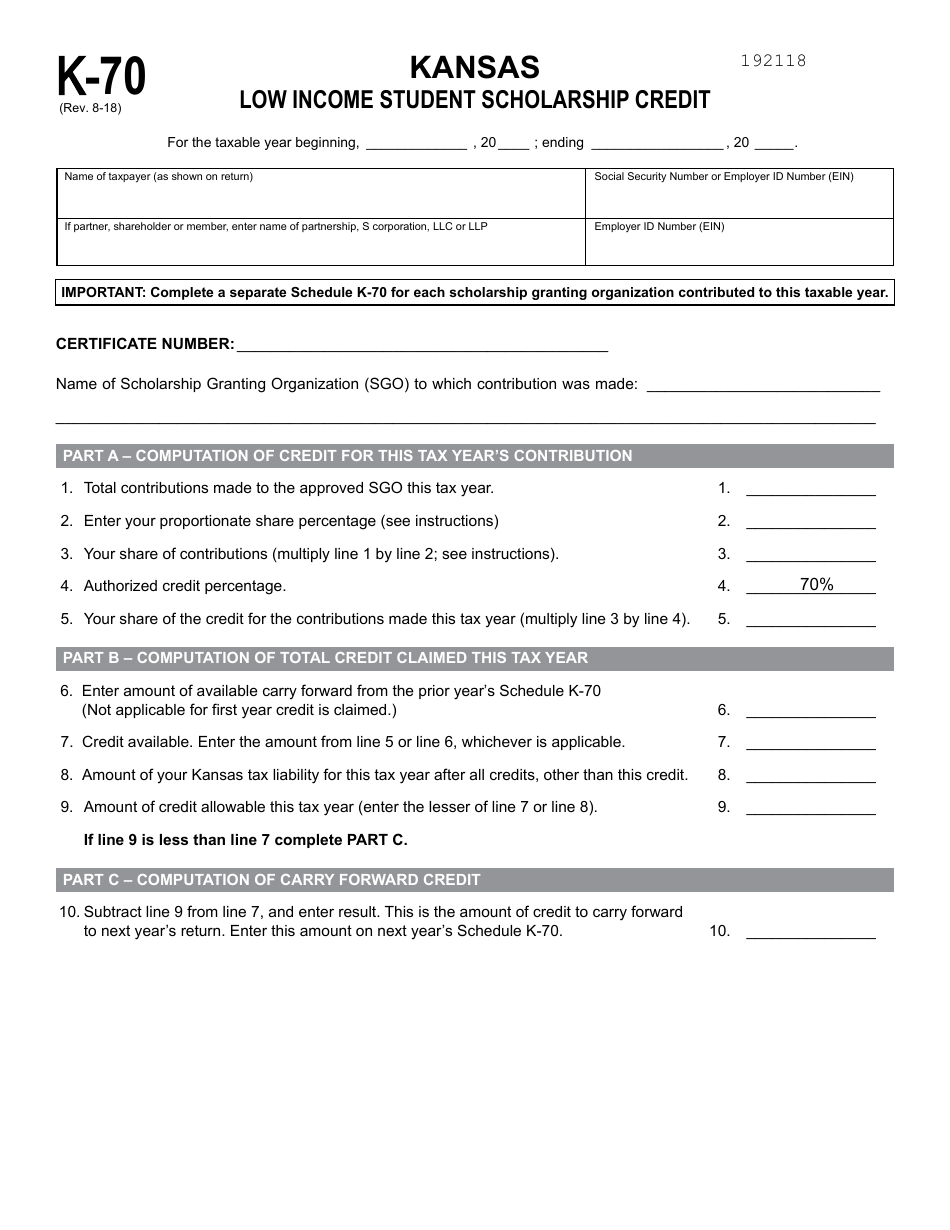

Schedule K-70

for the current year.

Schedule K-70 Low Income Student Scholarship Credit - Kansas

What Is Schedule K-70?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-70?

A: Schedule K-70 is a tax form used in Kansas to claim the Low Income Student Scholarship Credit.

Q: What is the Low Income Student Scholarship Credit?

A: The Low Income Student Scholarship Credit is a tax credit available to Kansas taxpayers who contribute to eligible scholarship granting organizations.

Q: Who is eligible for the Low Income Student Scholarship Credit?

A: Kansas taxpayers who make qualifying contributions to eligible scholarship granting organizations are eligible for the credit.

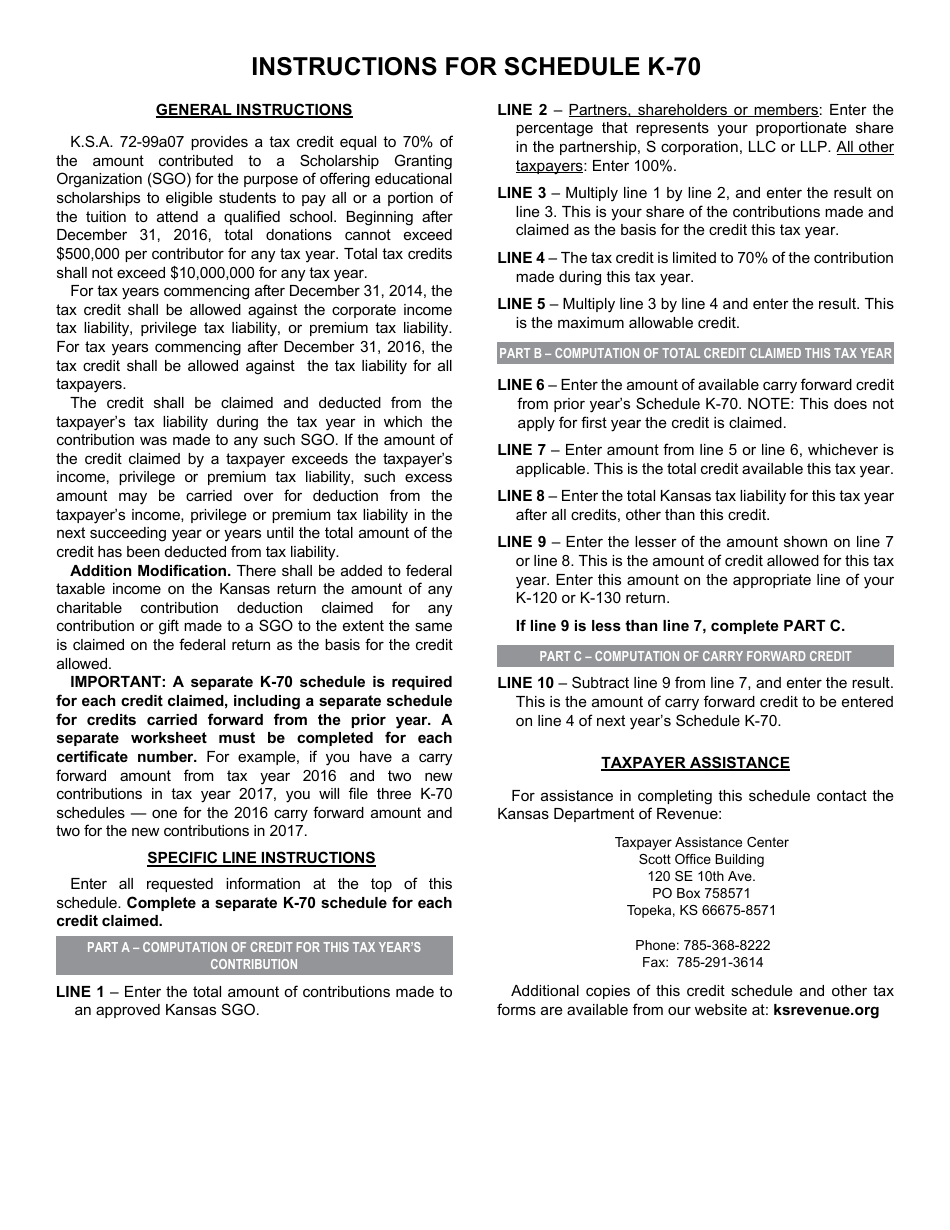

Q: How much is the Low Income Student Scholarship Credit?

A: The credit is equal to 70% of the taxpayer's qualifying contributions.

Q: What are qualifying contributions?

A: Qualifying contributions are cash contributions made by the taxpayer to an eligible scholarship granting organization.

Q: What is an eligible scholarship granting organization?

A: An eligible scholarship granting organization is a non-profit organization that provides scholarships to low-income students in Kansas.

Q: How do I claim the Low Income Student Scholarship Credit?

A: To claim the credit, you must complete and attach Schedule K-70 to your Kansas income tax return.

Q: Is the credit refundable?

A: No, the credit is non-refundable.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain income limitations and other restrictions that apply to the credit. It is recommended to consult the instructions for Schedule K-70 or a tax professional for more details.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-70 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.