This version of the form is not currently in use and is provided for reference only. Download this version of

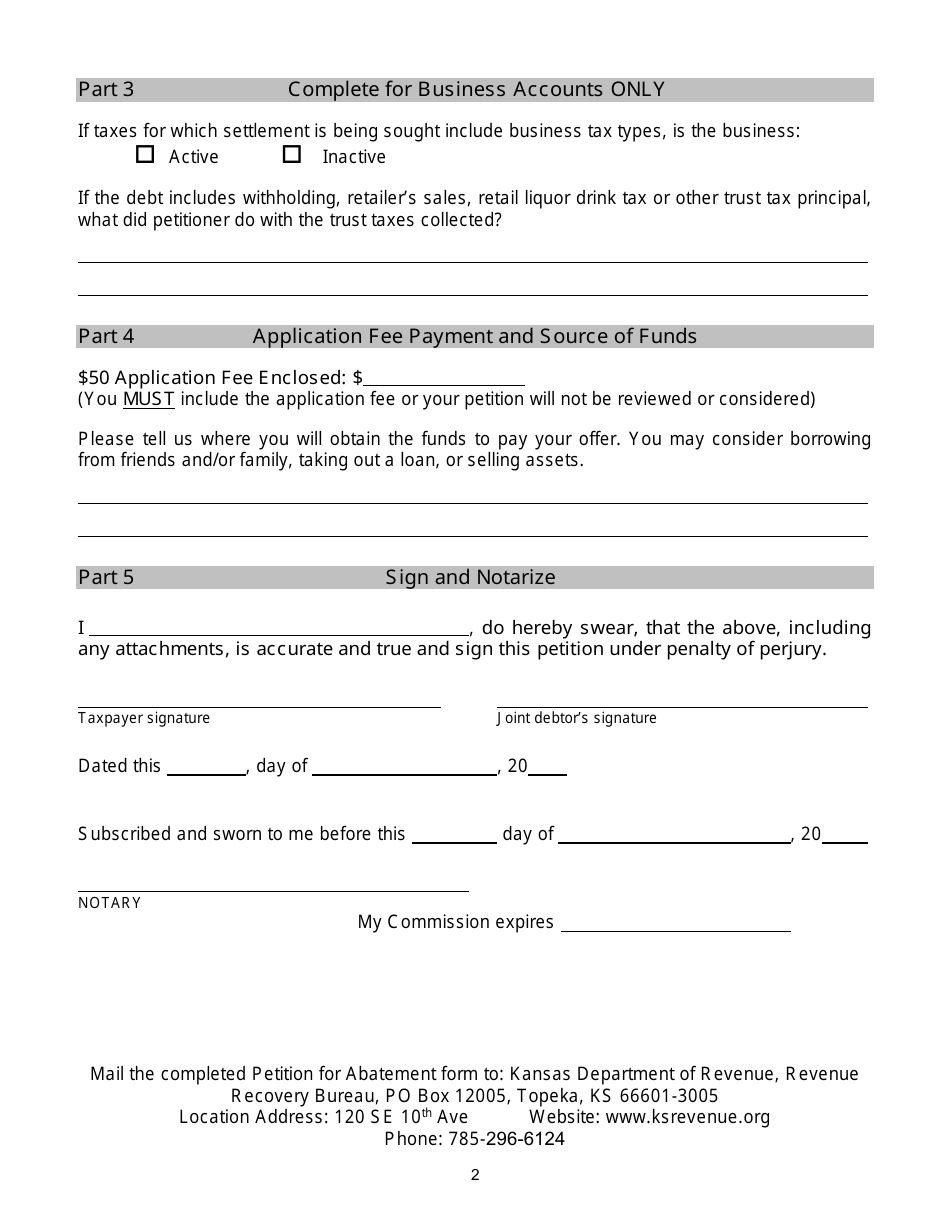

Form CE-5

for the current year.

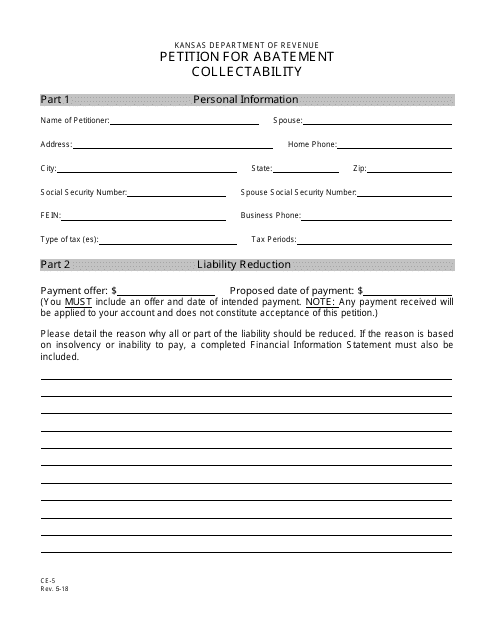

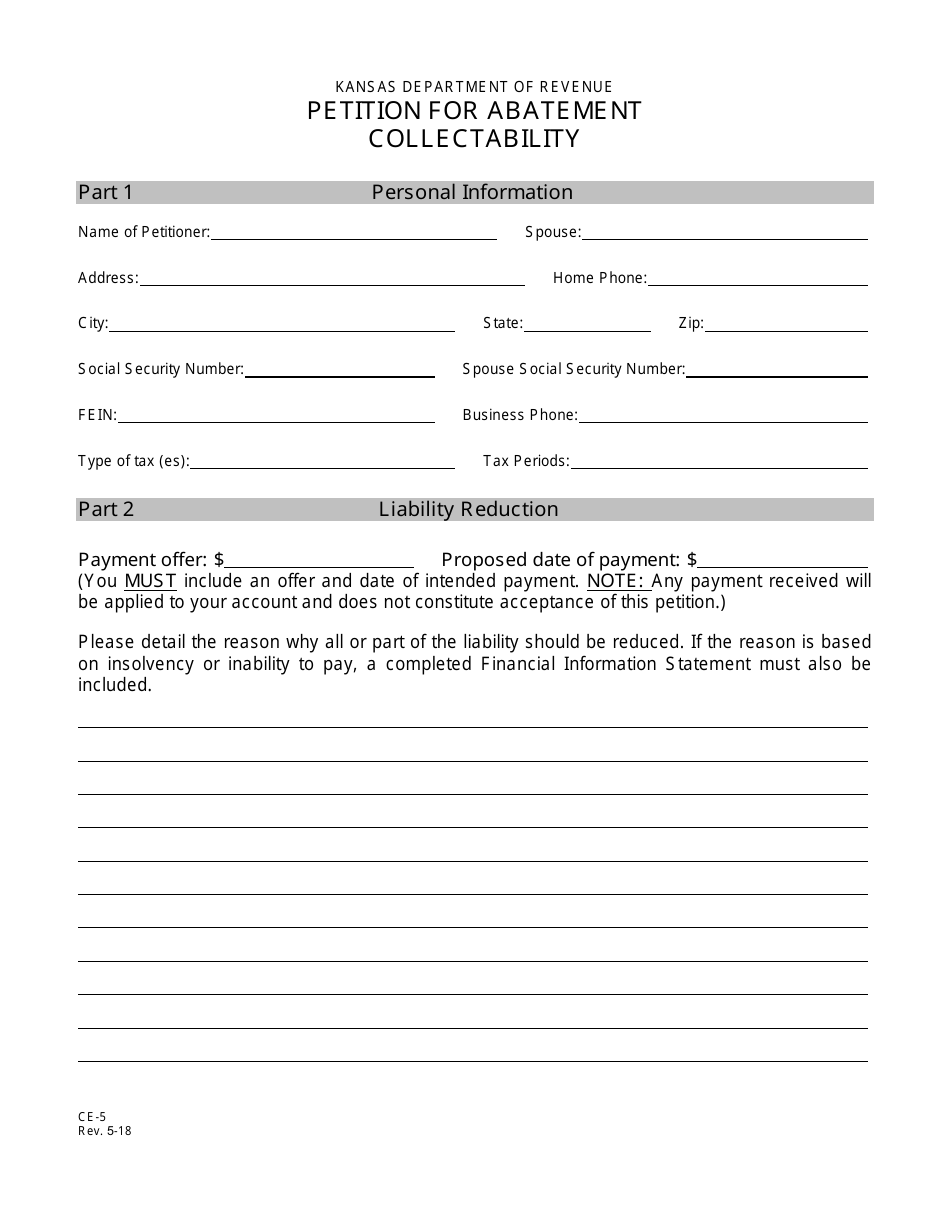

Form CE-5 Petition for Abatement Collectability - Kansas

What Is Form CE-5?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CE-5?

A: Form CE-5 is the petition for abatement collectability form used in the state of Kansas.

Q: What is the purpose of Form CE-5?

A: The purpose of Form CE-5 is to request abatement of taxes or fees that are deemed uncollectible.

Q: Who can use Form CE-5?

A: Form CE-5 can be used by individuals, businesses, or organizations that owe taxes or fees to the state of Kansas.

Q: What is an abatement of collectability?

A: An abatement of collectability is a request to the state to forgive or reduce the amount owed on taxes or fees that cannot be collected.

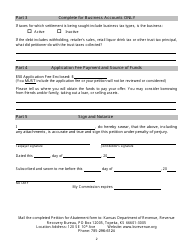

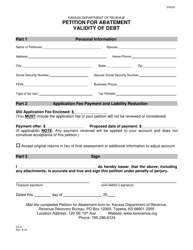

Q: What information is required on Form CE-5?

A: Form CE-5 requires information such as the taxpayer's name, contact information, tax type, and detailed explanation of why the taxes or fees are uncollectible.

Q: Is there a deadline to submit Form CE-5?

A: Yes, Form CE-5 must be submitted within one year from the date the taxes or fees were due or within one year from the date of the final determination of collectability.

Q: Is there a fee to submit Form CE-5?

A: No, there is no fee to submit Form CE-5.

Q: What happens after submitting Form CE-5?

A: After submitting Form CE-5, the Kansas Department of Revenue will review the petition and make a determination on whether to grant the abatement of collectability.

Q: Can I appeal the decision on Form CE-5?

A: Yes, if your petition for abatement of collectability is denied, you have the right to appeal the decision within 30 days.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CE-5 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.