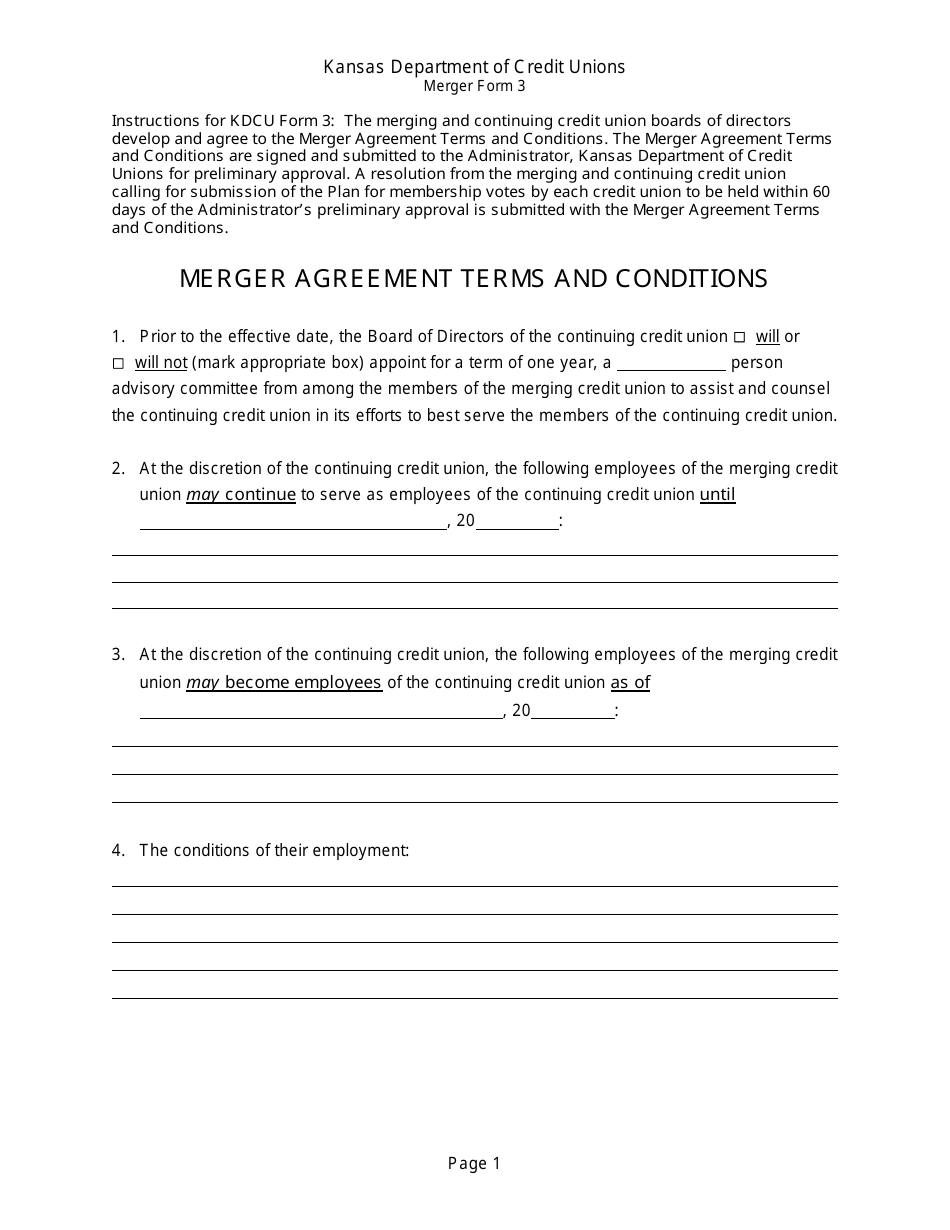

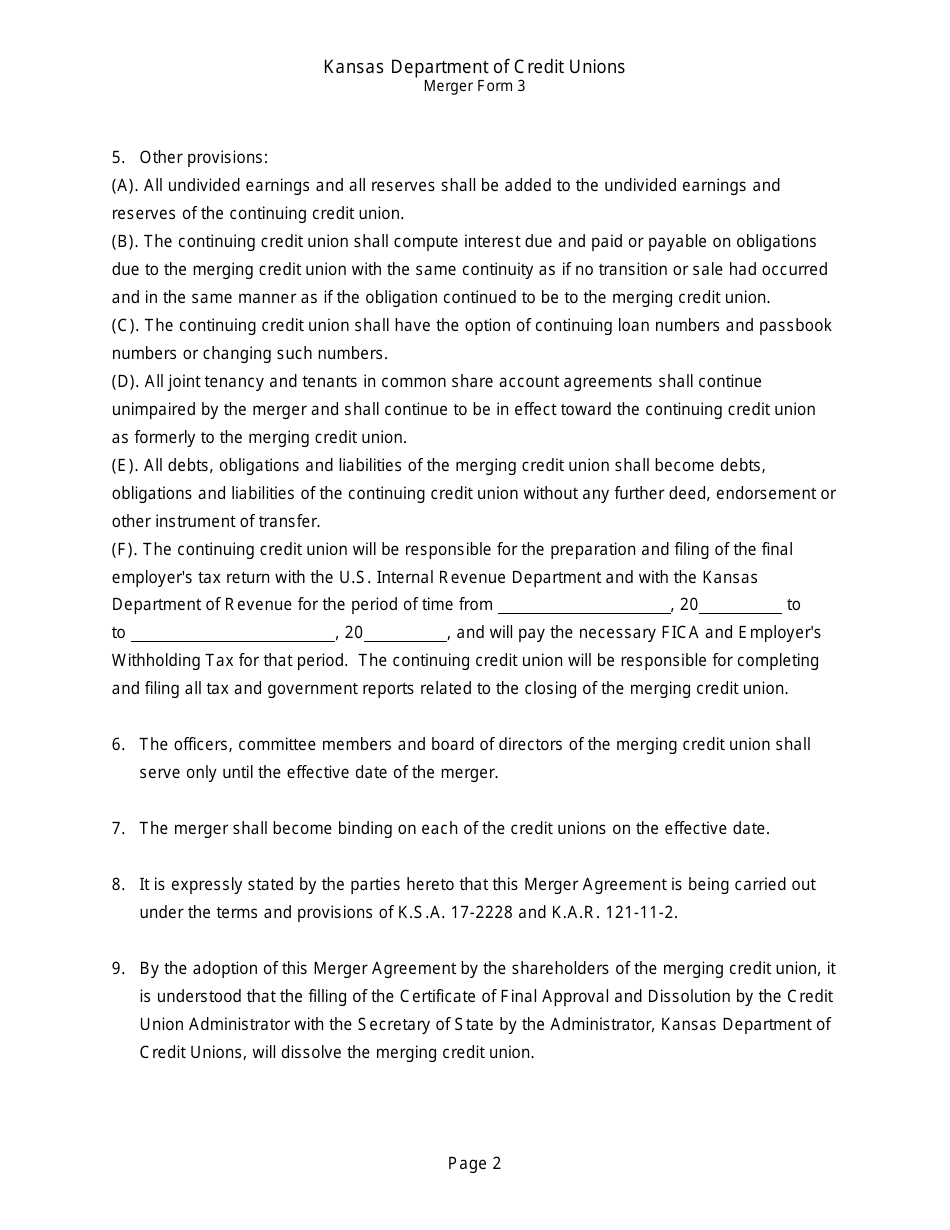

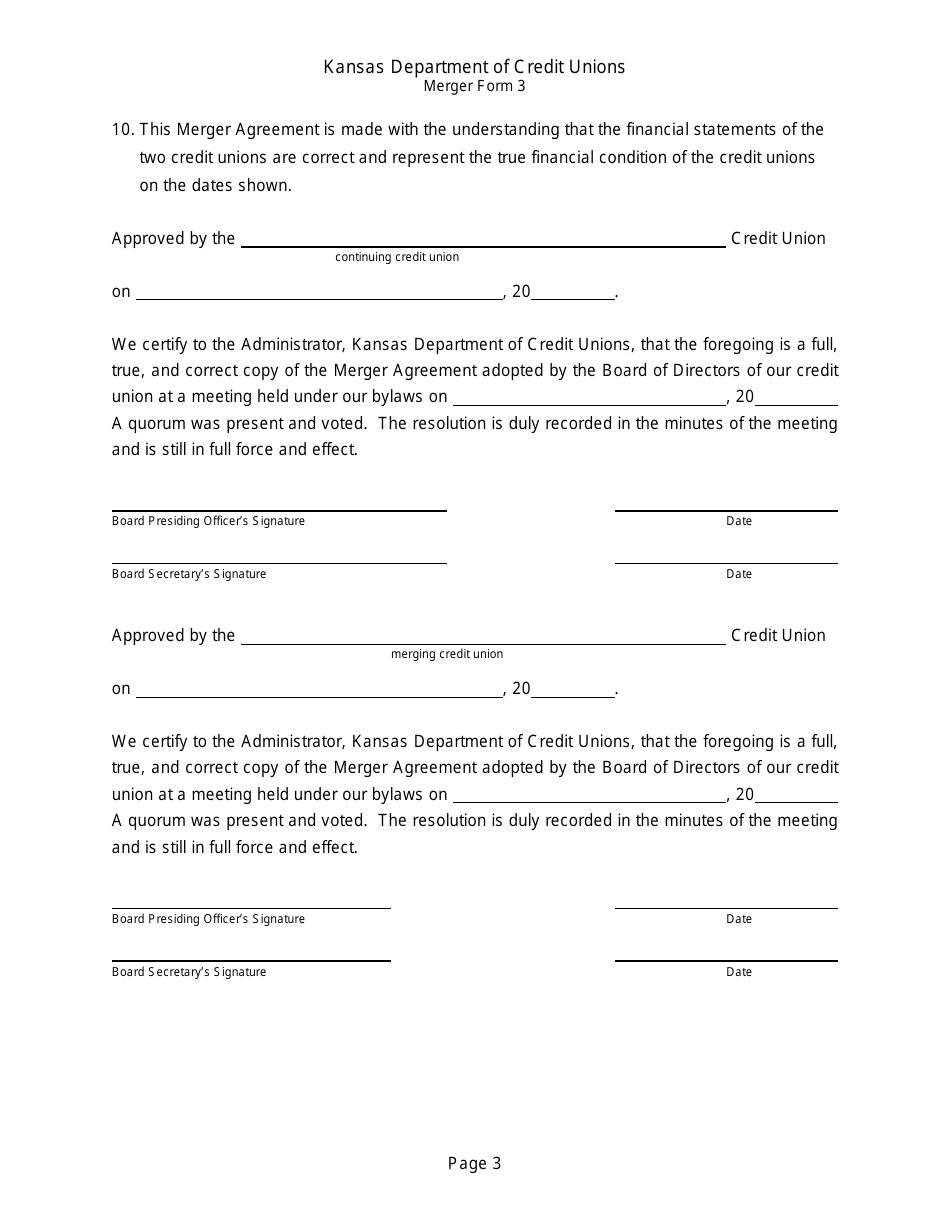

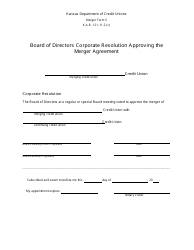

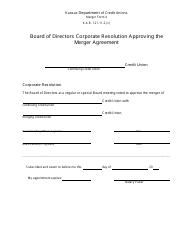

Form 3 Merger Agreement Terms and Conditions - Kansas

What Is Form 3?

This is a legal form that was released by the Kansas Department of Credit Unions - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

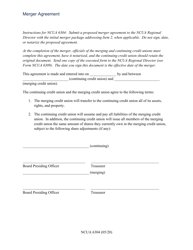

Q: What is a merger agreement?

A: A merger agreement is a legal document that outlines the terms and conditions of a merger between two or more companies.

Q: What are the key terms and conditions in a merger agreement?

A: The key terms and conditions in a merger agreement include the purchase price, payment terms, allocation of assets and liabilities, governing law, and conditions for closing the merger.

Q: Why is a merger agreement important?

A: A merger agreement is important as it provides a framework for the merger and ensures that all parties involved are aware of their rights, obligations, and responsibilities.

Q: What is the purchase price in a merger agreement?

A: The purchase price is the amount of money or consideration to be paid by the acquiring company to the target company's shareholders in exchange for their shares.

Q: What are payment terms in a merger agreement?

A: Payment terms in a merger agreement specify the schedule and method of payment for the purchase price, such as cash, stock, or a combination of both.

Q: What is the allocation of assets and liabilities in a merger agreement?

A: The allocation of assets and liabilities in a merger agreement determines how the combined company's assets and liabilities will be divided between the merging entities.

Q: What is the governing law in a merger agreement?

A: The governing law in a merger agreement specifies which jurisdiction's laws will govern the interpretation and enforcement of the agreement.

Q: What are the conditions for closing the merger in a merger agreement?

A: The conditions for closing the merger in a merger agreement outline the specific requirements or events that must occur before the merger can be completed, such as regulatory approvals or shareholder votes.

Form Details:

- The latest edition provided by the Kansas Department of Credit Unions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 3 by clicking the link below or browse more documents and templates provided by the Kansas Department of Credit Unions.