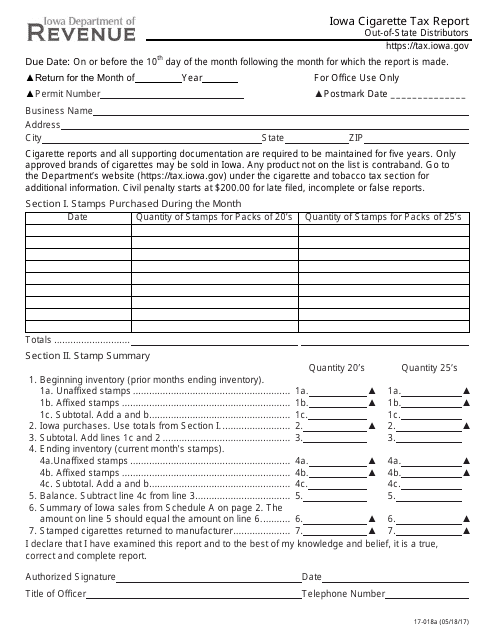

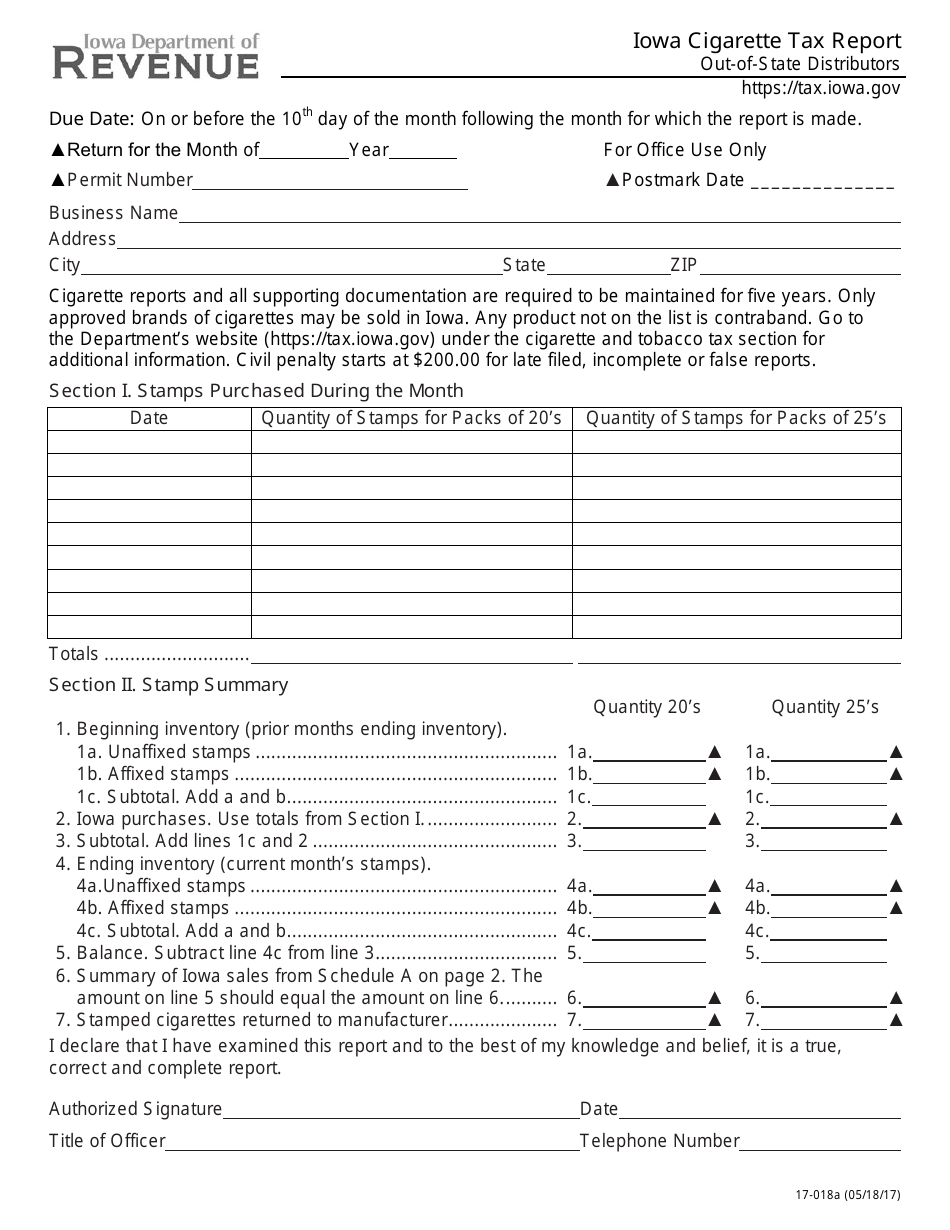

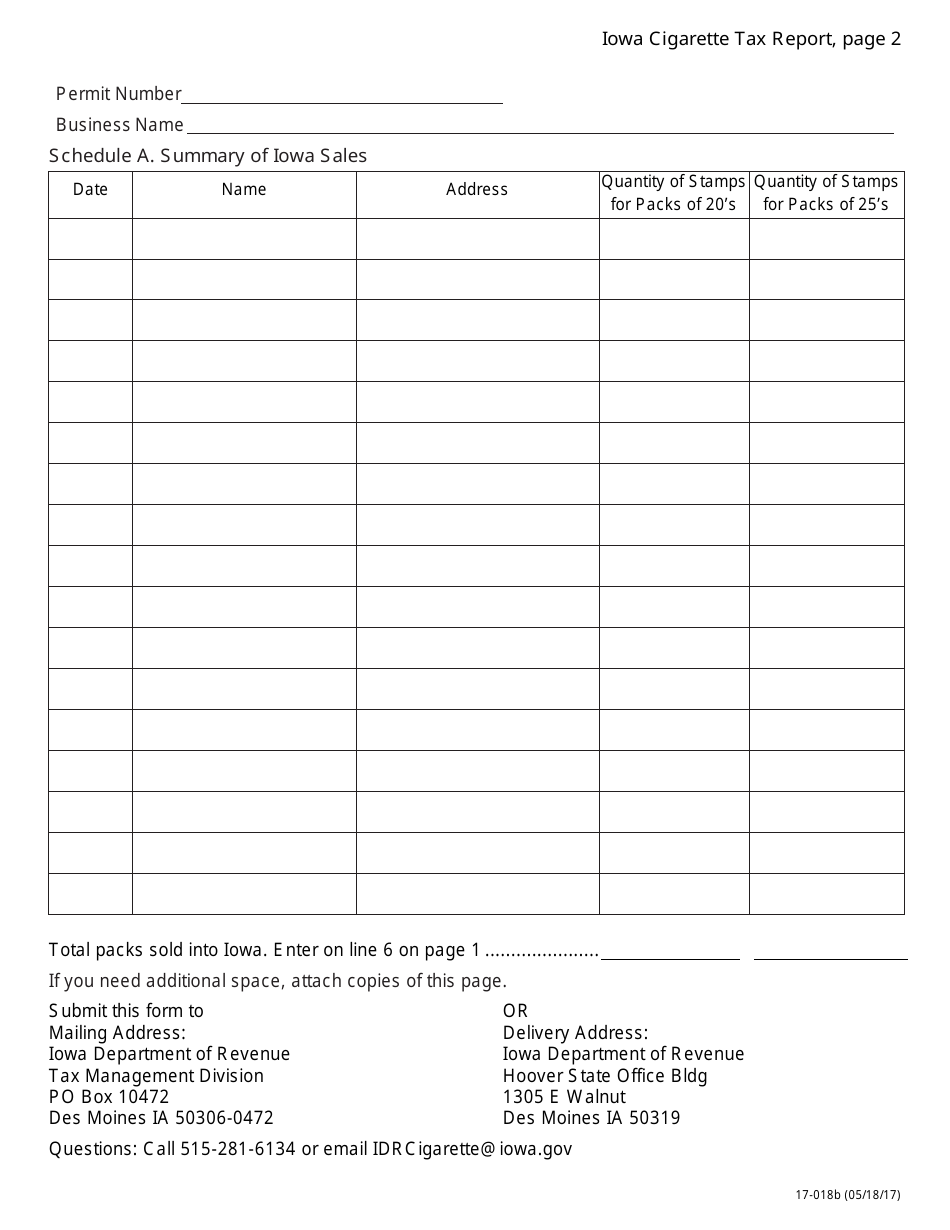

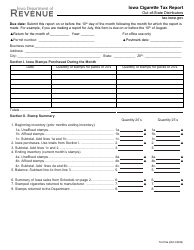

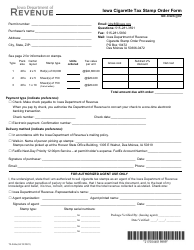

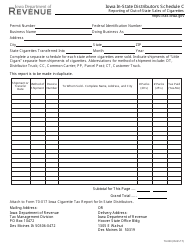

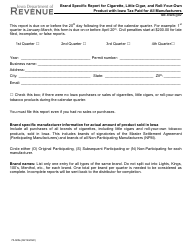

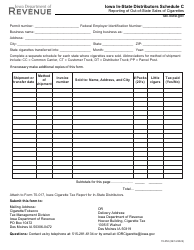

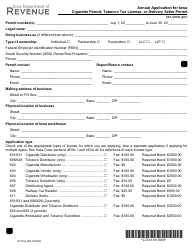

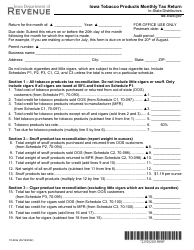

Form 17-018 Iowa Cigarette Tax Report for Out-of-State Distributors - Iowa

What Is Form 17-018?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 17-018?

A: Form 17-018 is the Iowa Cigarette Tax Report for Out-of-State Distributors.

Q: Who needs to file Form 17-018?

A: Out-of-state distributors who sell cigarettes in Iowa must file Form 17-018.

Q: When is Form 17-018 due?

A: Form 17-018 is due on the 20th day of each month.

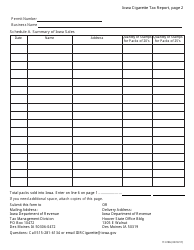

Q: What information is required on Form 17-018?

A: Form 17-018 requires information about the number of cigarettes sold and the amount of tax due.

Q: How can I submit Form 17-018?

A: Form 17-018 can be submitted electronically or by mail.

Q: What happens if I don't file Form 17-018?

A: Failure to file Form 17-018 can result in penalties and interest.

Q: Are there any exemptions for Form 17-018?

A: There may be exemptions for certain types of distributors, but you should consult the Iowa Department of Revenue for more information.

Form Details:

- Released on May 18, 2017;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 17-018 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.