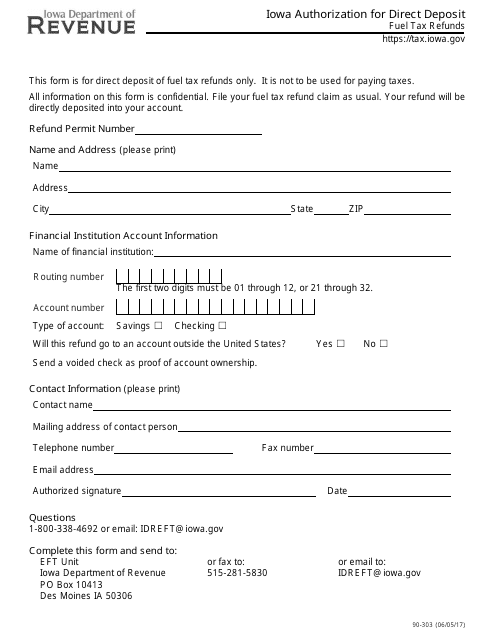

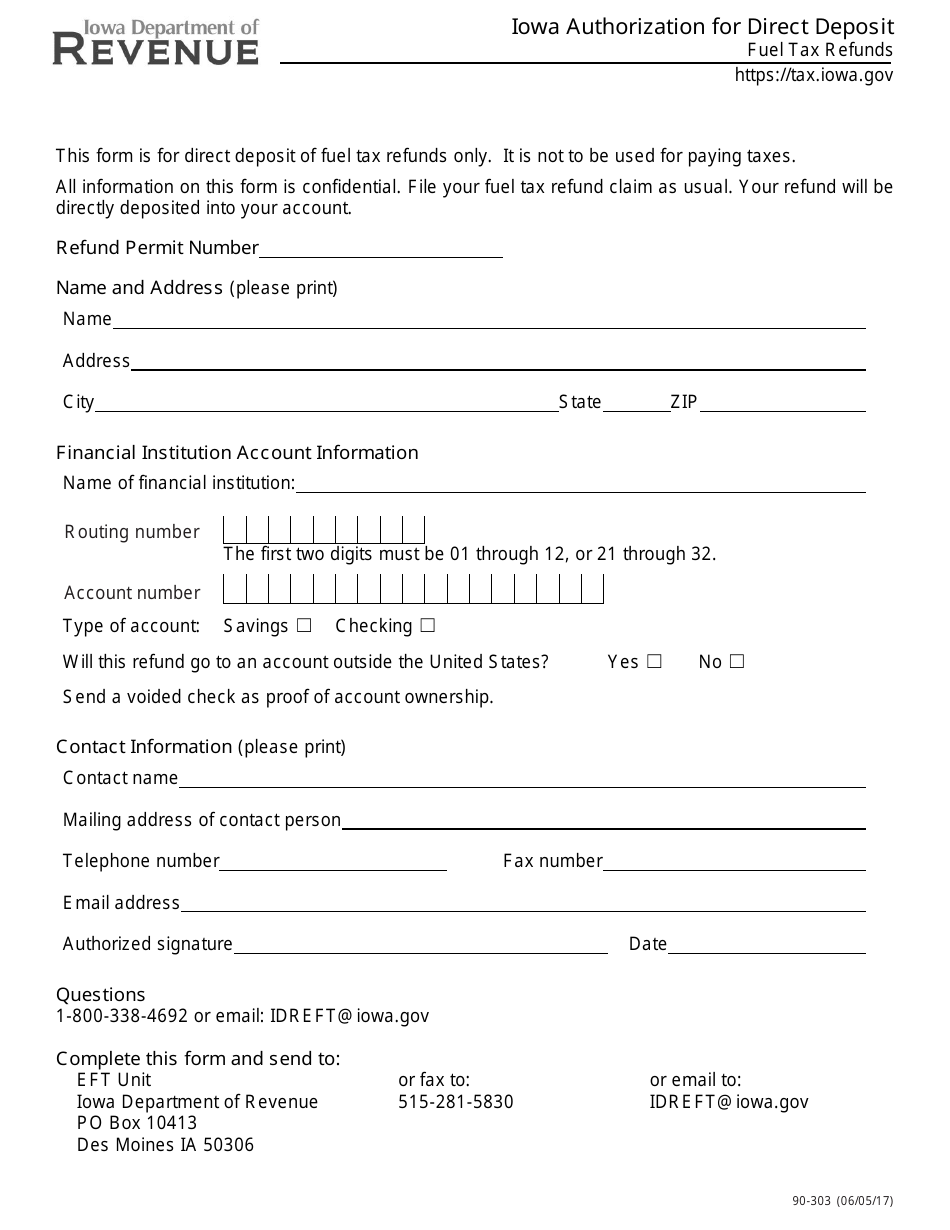

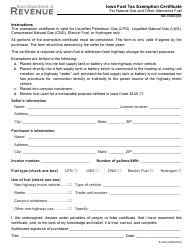

Form 90-303 Application for Direct Deposit of Fuel Tax Refunds - Iowa

What Is Form 90-303?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

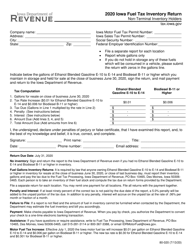

Q: What is Form 90-303?

A: Form 90-303 is the Application for Direct Deposit of Fuel Tax Refunds in Iowa.

Q: Who can use Form 90-303?

A: Anyone in Iowa who is eligible for fuel tax refunds can use Form 90-303.

Q: What is the purpose of Form 90-303?

A: The purpose of Form 90-303 is to apply for direct deposit of fuel tax refunds in Iowa.

Q: What information do I need to provide on Form 90-303?

A: You need to provide your name, business information, account information, and the amount of refund you are requesting.

Q: Is there a fee to file Form 90-303?

A: No, there is no fee to file Form 90-303.

Q: When should I file Form 90-303?

A: You should file Form 90-303 as soon as possible after the end of the reporting period for which you are seeking a refund.

Q: How long does it take to process Form 90-303?

A: Processing times may vary, but it generally takes 4-6 weeks to process Form 90-303.

Form Details:

- Released on June 5, 2017;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 90-303 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.