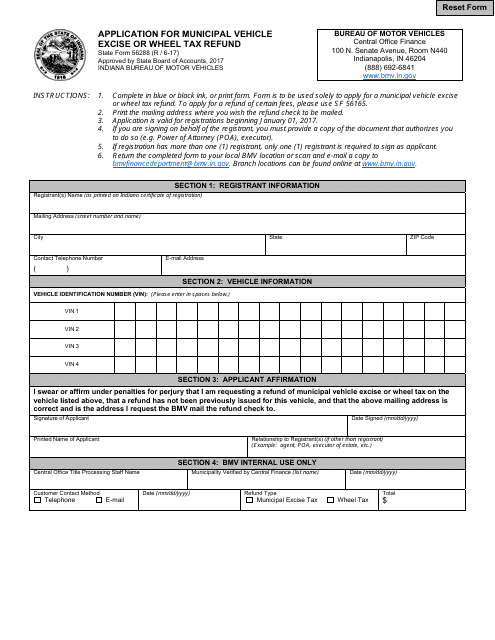

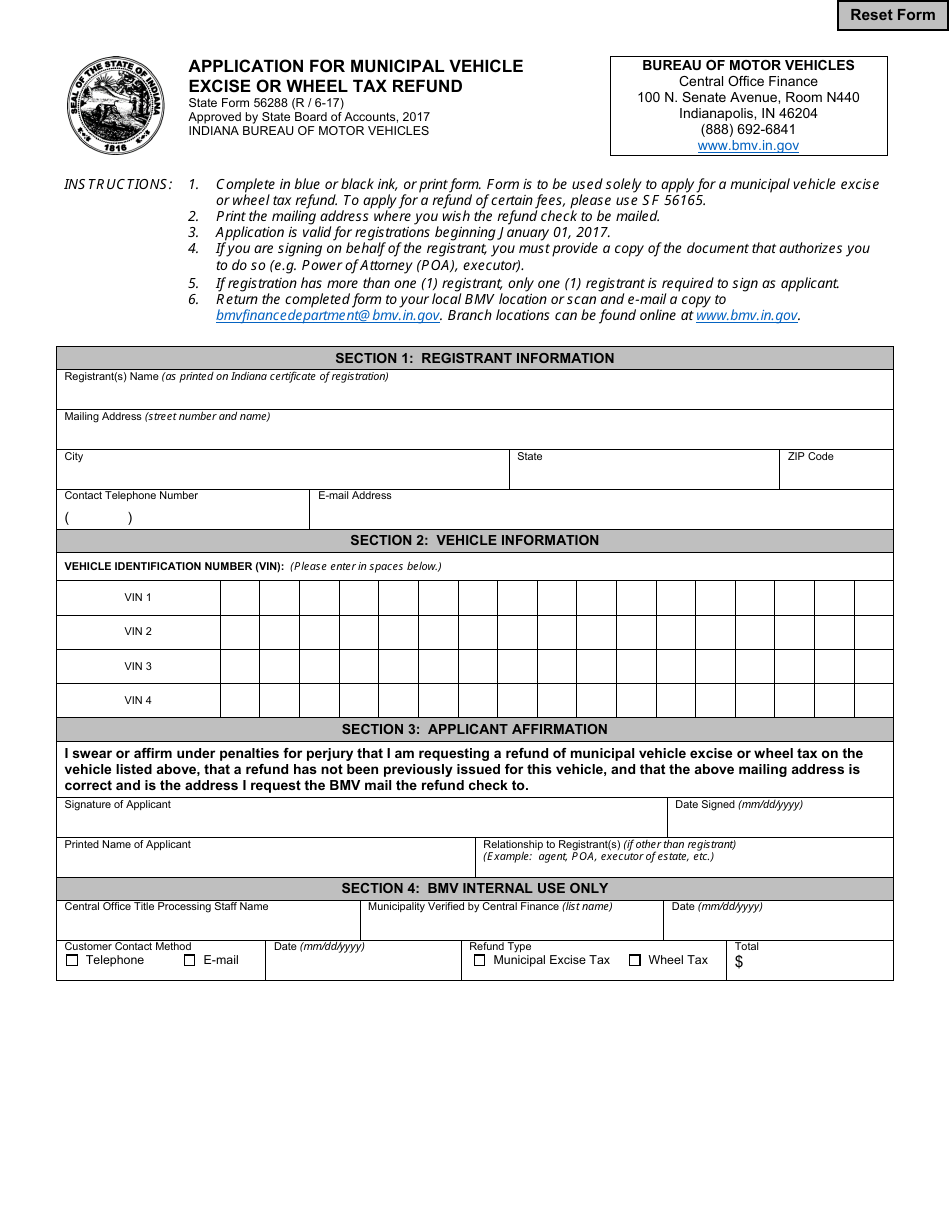

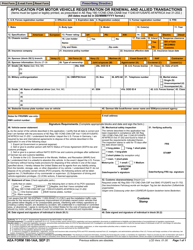

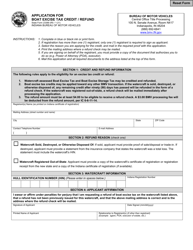

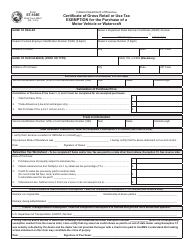

State Form 56288 Application for Municipal Vehicle Excise or Wheel Tax Refund - Indiana

What Is State Form 56288?

This is a legal form that was released by the Indiana Bureau of Motor Vehicles - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56288?

A: Form 56288 is an application for municipal vehicle excise or wheel tax refund in Indiana.

Q: What is the purpose of Form 56288?

A: Form 56288 is used to apply for a refund of municipal vehicle excise or wheel tax paid in Indiana.

Q: Who is eligible to use Form 56288?

A: Individuals who have paid municipal vehicle excise or wheel tax in Indiana and meet certain criteria are eligible to use Form 56288.

Q: What information do I need to provide on Form 56288?

A: You will need to provide your personal information, vehicle details, tax payment information, and any additional required documentation.

Q: Is there a deadline to submit Form 56288?

A: Yes, the deadline to submit Form 56288 varies depending on the municipality. It is recommended to check with your local municipal office for the specific deadline.

Q: Will I receive a refund if my application is approved?

A: If your application is approved, you may be eligible to receive a refund of the municipal vehicle excise or wheel tax paid in Indiana.

Q: What if my application is denied?

A: If your application is denied, you may have the option to appeal the decision or seek further assistance from the Indiana Department of Revenue.

Q: Are there any fees associated with filing Form 56288?

A: There are no fees associated with filing Form 56288. However, you may be required to pay a processing fee if your application is approved.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Indiana Bureau of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56288 by clicking the link below or browse more documents and templates provided by the Indiana Bureau of Motor Vehicles.