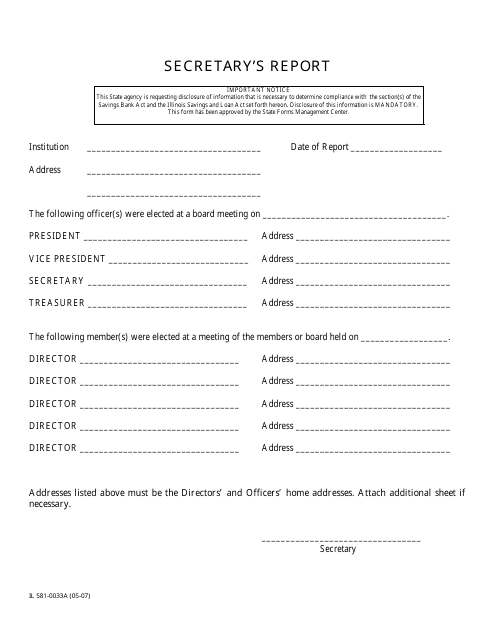

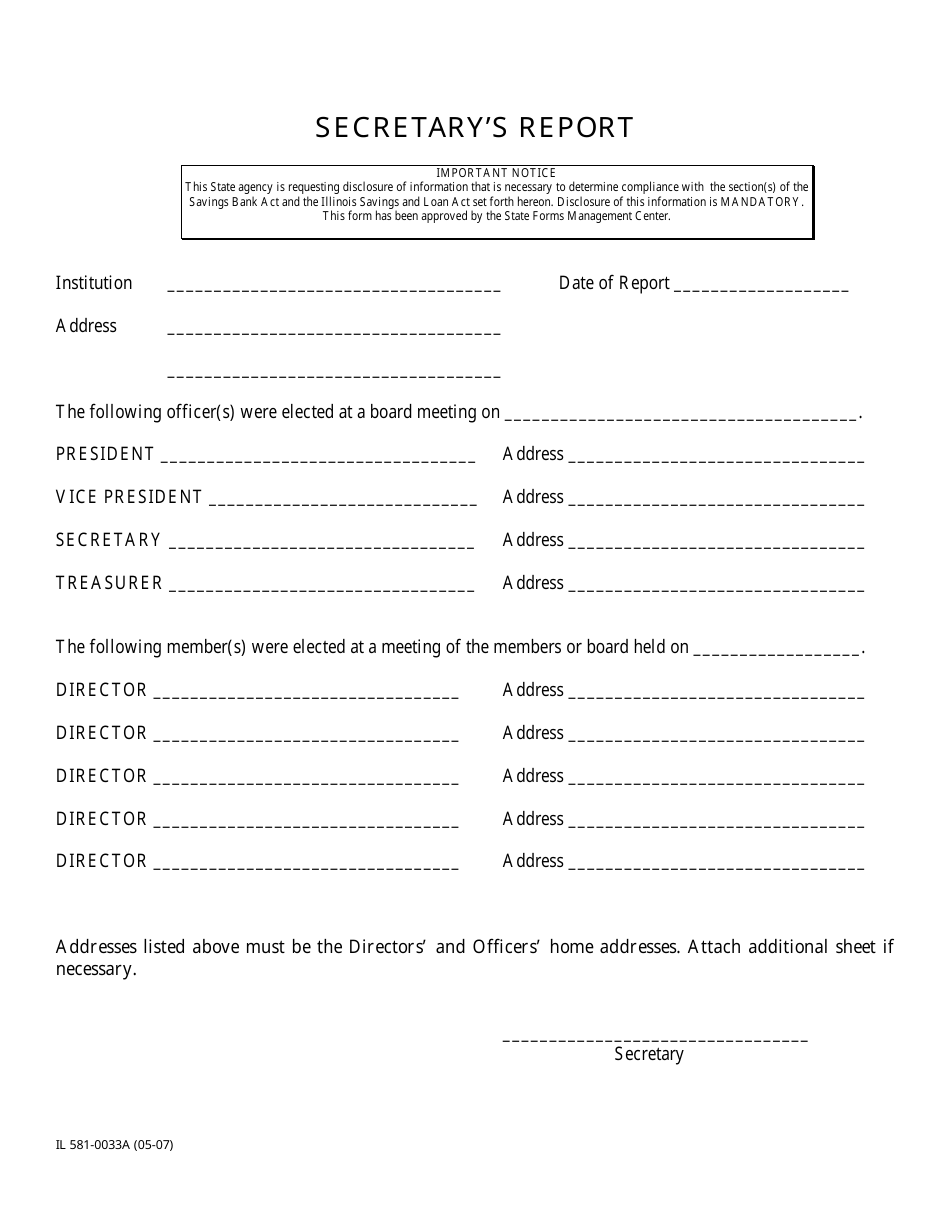

Form IL581-0033A Secretary's Report - Illinois

What Is Form IL581-0033A?

This is a legal form that was released by the Illinois Department of Financial and Professional Regulation - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL581-0033A?

A: Form IL581-0033A is the Secretary's Report in Illinois.

Q: Who needs to file Form IL581-0033A?

A: Organizations that are registered as charitable or nonprofit in Illinois need to file Form IL581-0033A.

Q: What is the purpose of Form IL581-0033A?

A: The purpose of Form IL581-0033A is to provide an annual report on the activities of the organization to the Illinois Secretary of State.

Q: What information is required on Form IL581-0033A?

A: Form IL581-0033A requires information about the organization's officers, directors, and registered agent, as well as a financial statement.

Q: When is Form IL581-0033A due?

A: Form IL581-0033A is due on the anniversary month of the organization's initial registration.

Q: Is there a fee for filing Form IL581-0033A?

A: Yes, there is a fee for filing Form IL581-0033A. The fee amount depends on the organization's annual gross receipts.

Q: What happens if I don't file Form IL581-0033A?

A: Failure to file Form IL581-0033A can result in penalties and potential loss of the organization's good standing.

Q: Can I request an extension to file Form IL581-0033A?

A: Yes, organizations can request an extension to file Form IL581-0033A. The extension request must be made before the original due date.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the Illinois Department of Financial and Professional Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IL581-0033A by clicking the link below or browse more documents and templates provided by the Illinois Department of Financial and Professional Regulation.