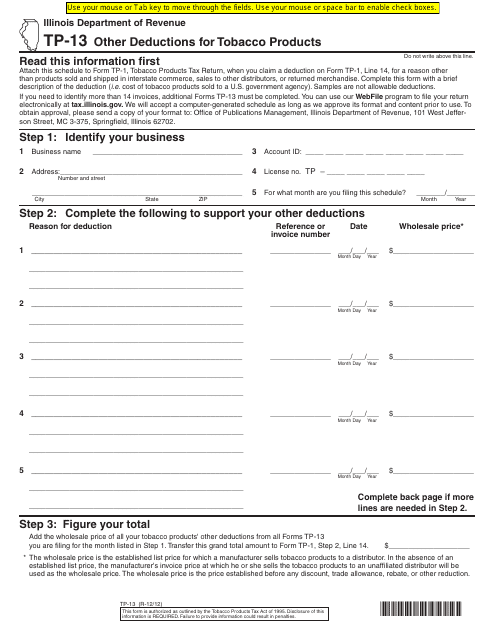

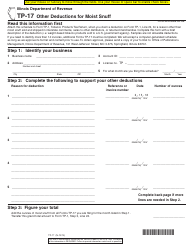

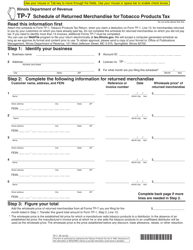

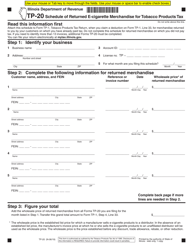

Form TP-13 Other Deductions for Tobacco Products - Illinois

What Is Form TP-13?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-13?

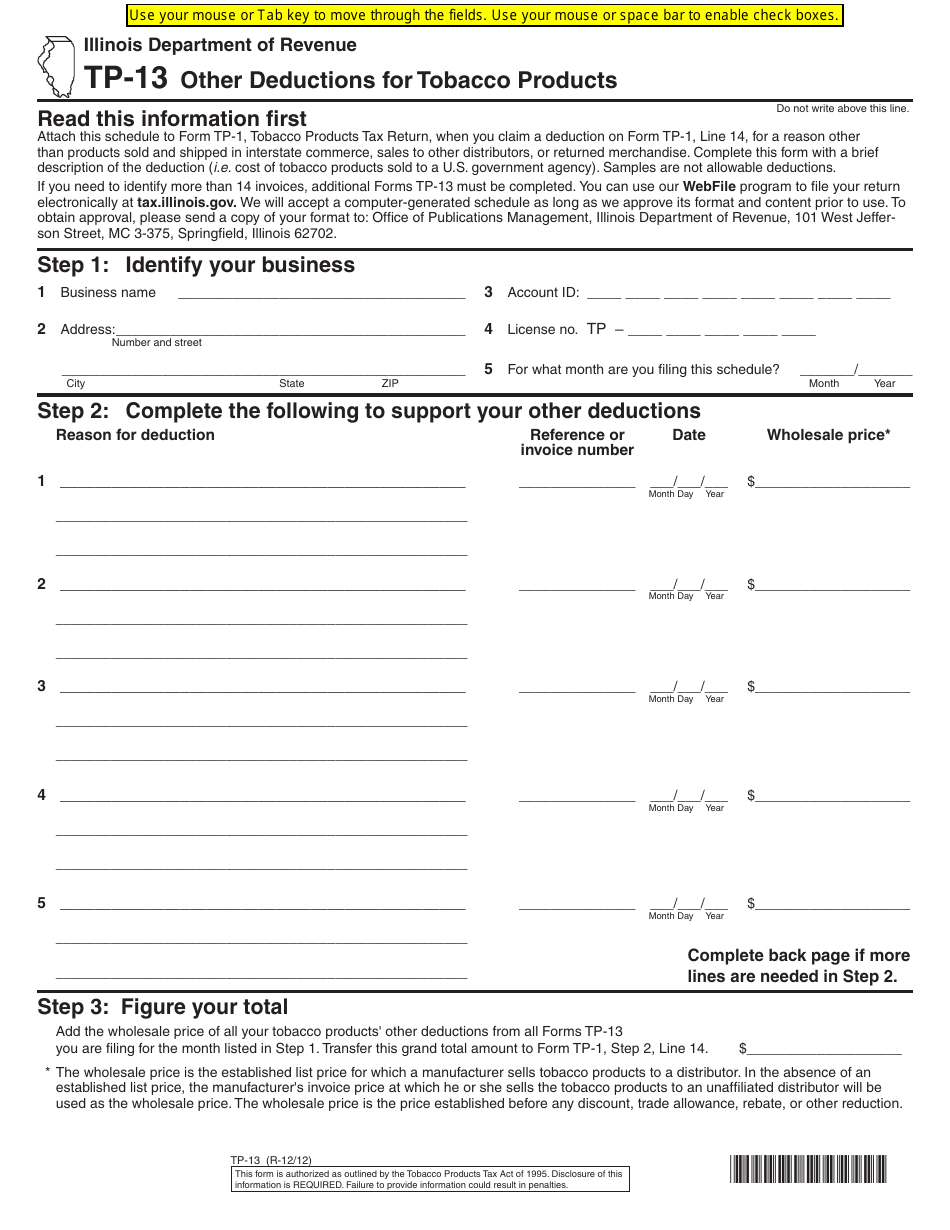

A: Form TP-13 is a tax form used in Illinois to report other deductions for tobacco products.

Q: What are other deductions for tobacco products?

A: Other deductions for tobacco products are expenses that can be subtracted from the taxpayer's tax liability, such as bad debts or discounts.

Q: Who needs to file Form TP-13?

A: Anyone who sells or distributes tobacco products in Illinois and is eligible for other deductions may need to file Form TP-13.

Q: When is the deadline for filing Form TP-13?

A: The deadline for filing Form TP-13 is typically on a quarterly basis. It is important to check with the Illinois Department of Revenue for the specific due dates.

Q: Are there any penalties for not filing Form TP-13?

A: Yes, there may be penalties for not filing or late filing of Form TP-13. It is important to comply with the filing requirements to avoid penalties.

Q: Can I claim deductions for tobacco products on my personal income tax return?

A: No, deductions for tobacco products are specifically reported on Form TP-13 and are not claimed on a personal income tax return.

Q: What supporting documents do I need to attach with Form TP-13?

A: You may be required to attach supporting documents, such as receipts or invoices, to substantiate the deductions claimed on Form TP-13. Check the instructions provided with the form for specific requirements.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TP-13 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.