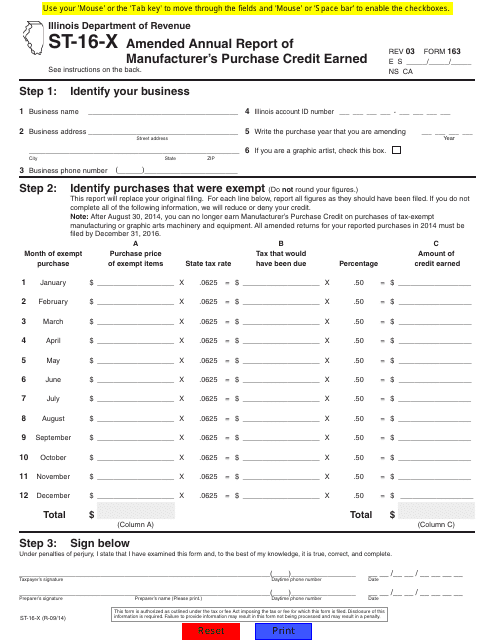

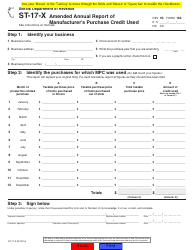

Form ST-16-X Amended Annual Report of Manufacturer's Purchase Credit Earned - Illinois

What Is Form ST-16-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-16-X?

A: Form ST-16-X is the Amended Annual Report of Manufacturer's Purchase Credit Earned for Illinois.

Q: Who needs to file Form ST-16-X?

A: Manufacturers who have earned purchase credits in Illinois and need to amend their annual report.

Q: What is the purpose of Form ST-16-X?

A: The purpose of Form ST-16-X is to report any changes or corrections to the original annual report of manufacturer's purchase credit earned.

Q: When should Form ST-16-X be filed?

A: Form ST-16-X should be filed when there are changes or corrections to the original annual report, and it should be filed as soon as possible.

Q: Is there a deadline for filing Form ST-16-X?

A: There is no specific deadline for filing Form ST-16-X, but it should be filed as soon as possible to avoid any penalties or interest.

Q: What information is required on Form ST-16-X?

A: Form ST-16-X requires information such as the taxpayer's name, account number, reason for filing, and the changes or corrections being made to the original annual report.

Q: Is there a fee for filing Form ST-16-X?

A: No, there is no fee for filing Form ST-16-X.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-16-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.