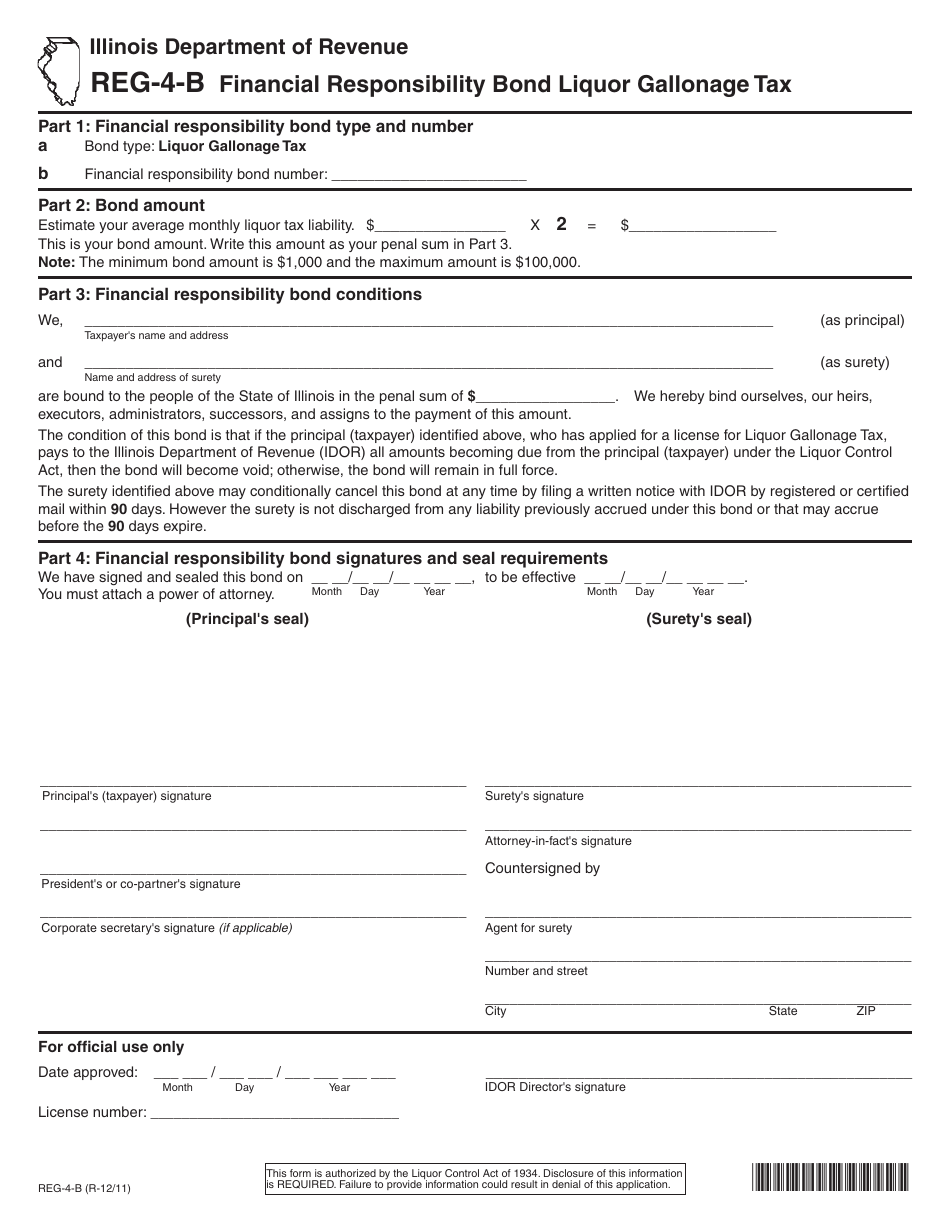

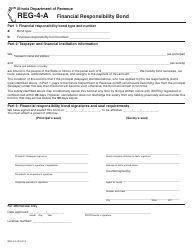

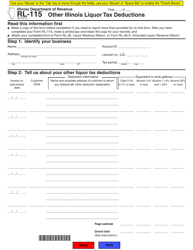

Form REG-4-B Financial Responsibility Bond Liquor Gallonage Tax - Illinois

What Is Form REG-4-B?

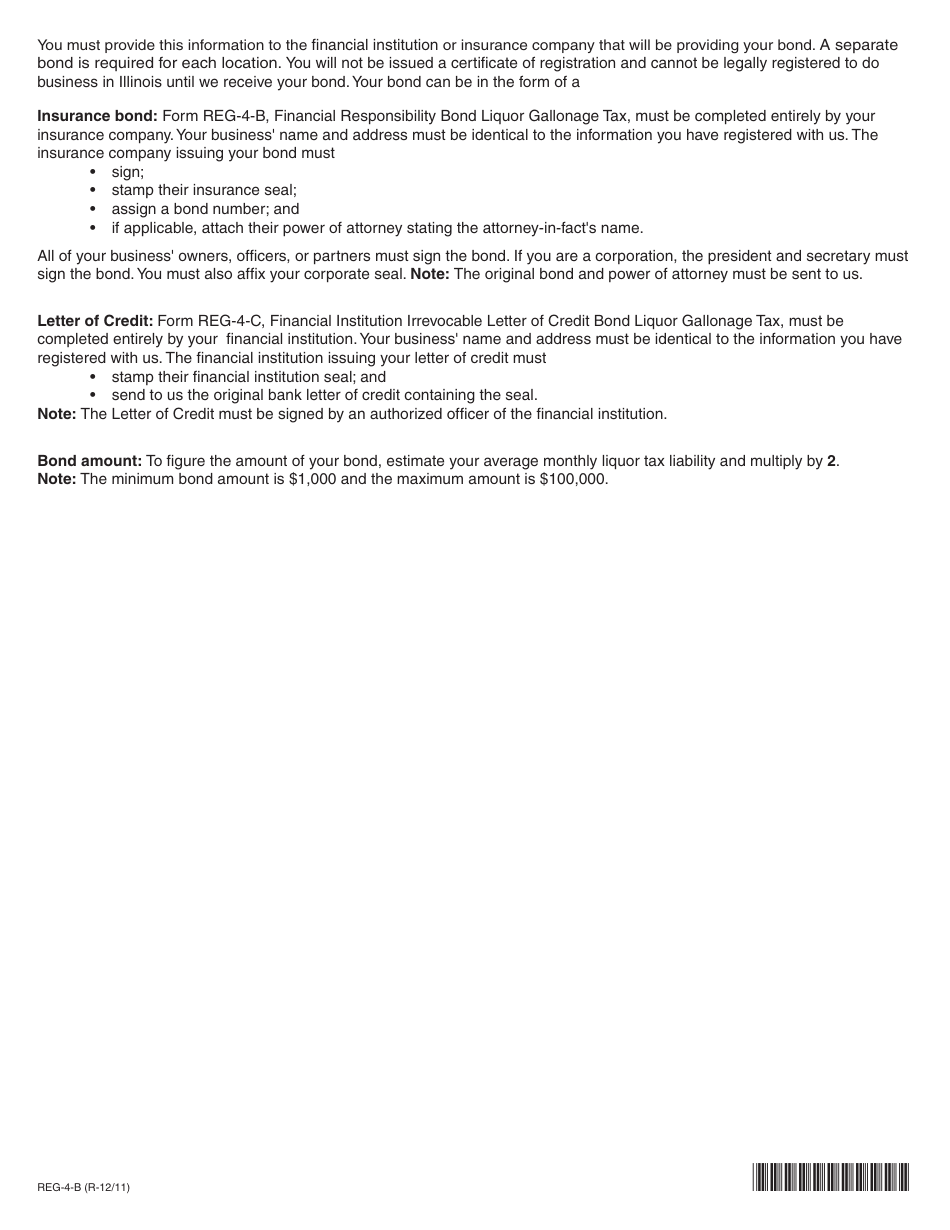

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REG-4-B form?

A: The REG-4-B form is the Financial Responsibility Bond Liquor Gallonage Tax form in Illinois.

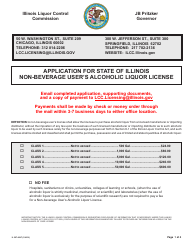

Q: What is the purpose of the REG-4-B form?

A: The REG-4-B form is used to establish financial responsibility for businesses engaged in the sale of alcoholic beverages in Illinois.

Q: Who needs to file the REG-4-B form?

A: Any business that sells alcoholic beverages in Illinois is required to file the REG-4-B form.

Q: What is the Liquor Gallonage Tax?

A: The Liquor Gallonage Tax is a tax imposed on the sale of alcoholic beverages based on the number of gallons sold.

Q: What is a Financial Responsibility Bond?

A: A Financial Responsibility Bond is a type of surety bond that ensures payment of taxes and compliance with the law by businesses engaged in the sale of alcoholic beverages.

Q: Are there any exemptions to filing the REG-4-B form?

A: Certain types of businesses, such as non-profit organizations and governmental entities, may be exempt from filing the REG-4-B form. It is best to check with the Illinois Department of Revenue for specific exemption criteria.

Q: When is the REG-4-B form due?

A: The REG-4-B form is typically due on a quarterly basis, with specific due dates provided by the Illinois Department of Revenue.

Q: What happens if I don't file the REG-4-B form?

A: Failure to file the REG-4-B form or pay the Liquor Gallonage Tax can result in penalties and fines imposed by the Illinois Department of Revenue.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-4-B by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.