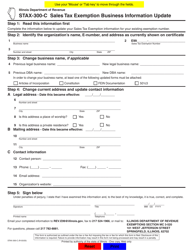

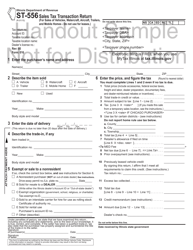

This version of the form is not currently in use and is provided for reference only. Download this version of

Form STAX-1

for the current year.

Form STAX-1 Application for Sales Tax Exemption - Illinois

What Is Form STAX-1?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STAX-1?

A: Form STAX-1 is an application for sales tax exemption in Illinois.

Q: Who can use Form STAX-1?

A: Any person or entity that qualifies for a sales tax exemption in Illinois can use Form STAX-1.

Q: What is a sales tax exemption?

A: A sales tax exemption is a permission from the state to not pay sales tax on certain purchases.

Q: How do I qualify for a sales tax exemption in Illinois?

A: To qualify for a sales tax exemption in Illinois, you generally need to be a nonprofit organization or meet specific criteria as outlined by the state.

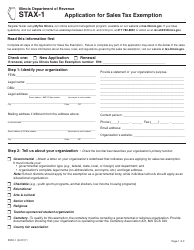

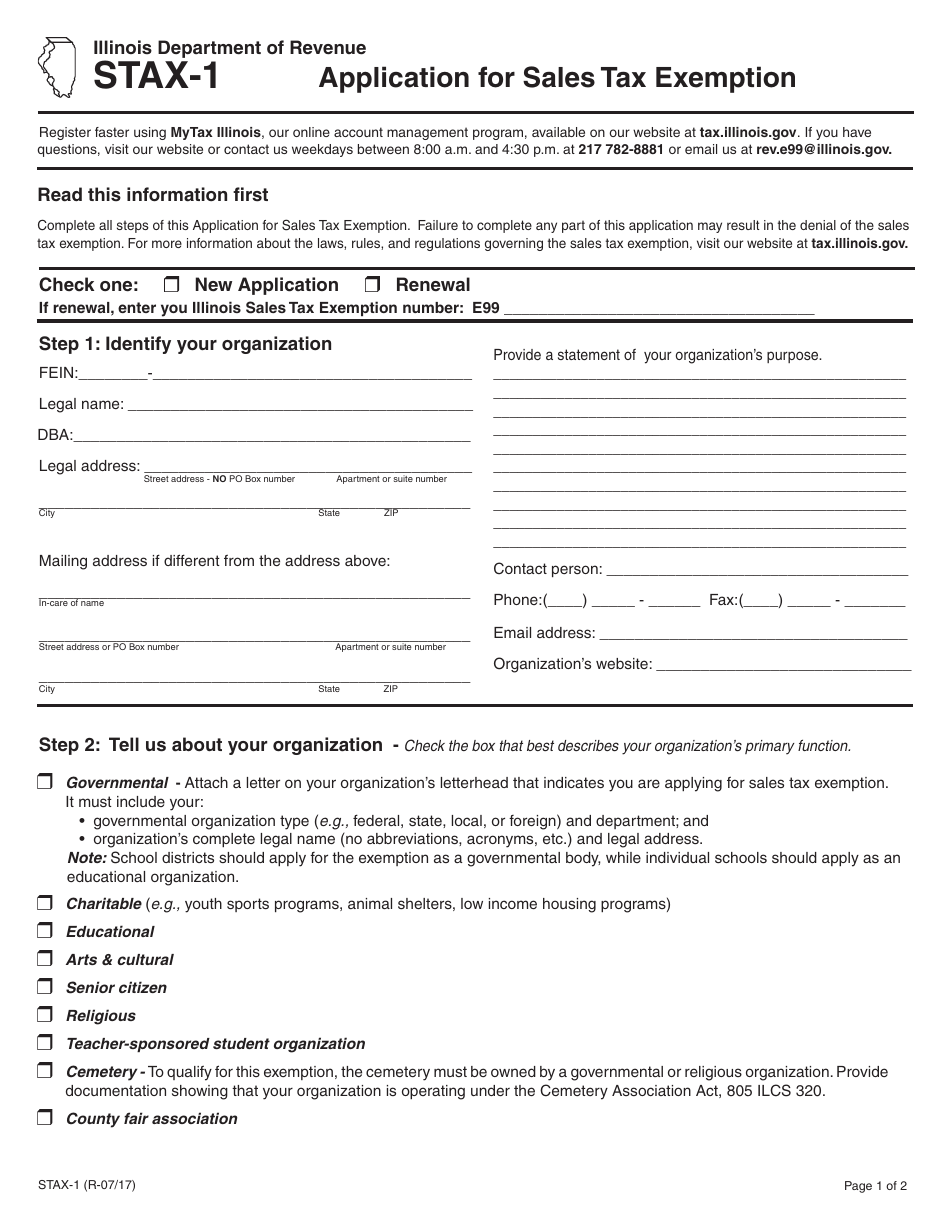

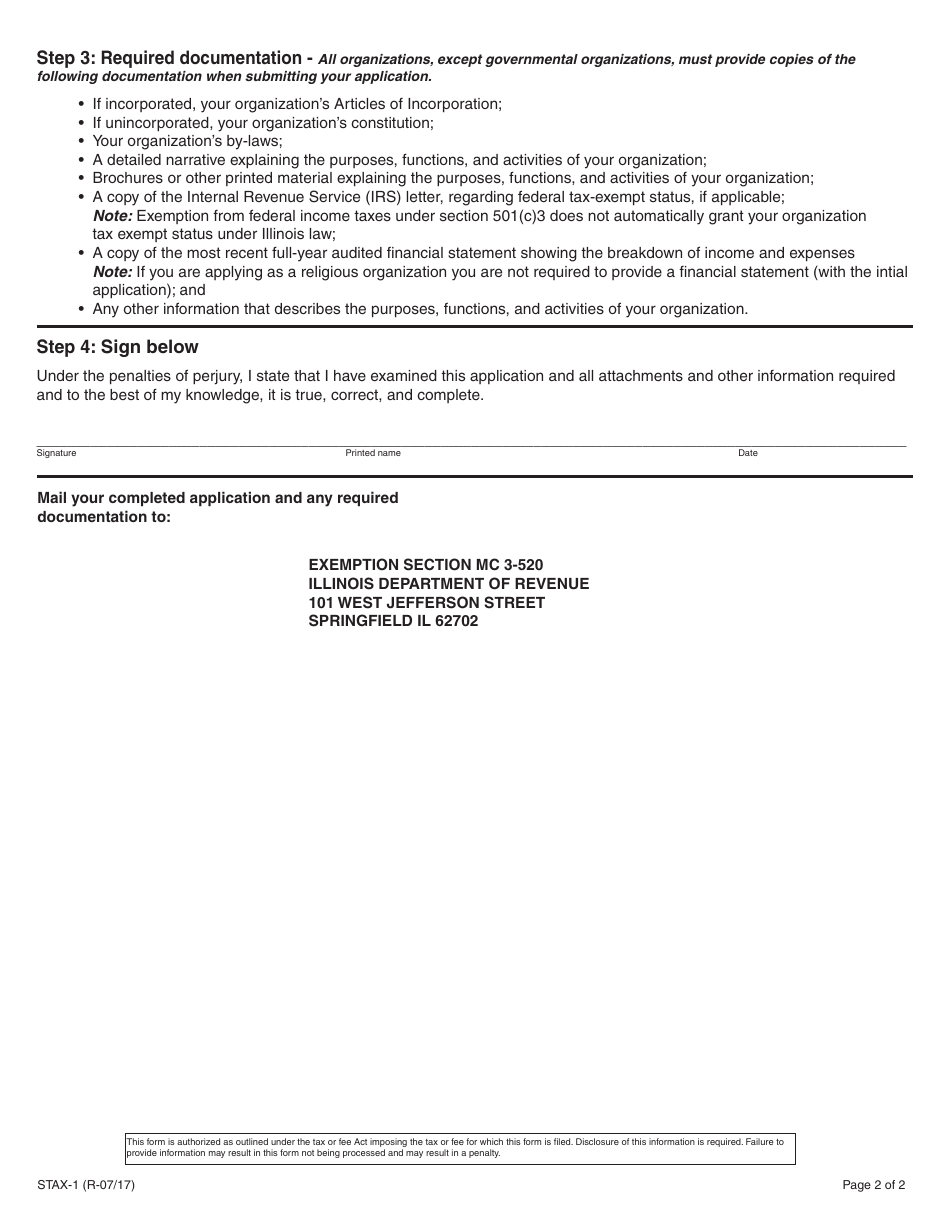

Q: What information do I need to provide on Form STAX-1?

A: You will need to provide your contact information, a description of your organization or business, and details about why you qualify for a sales tax exemption.

Q: Is there a fee to file Form STAX-1?

A: No, there is no fee to file Form STAX-1.

Q: How long does it take to process Form STAX-1?

A: Processing times may vary, but you can generally expect a response within a few weeks of submitting your application.

Q: What do I do if my Form STAX-1 is approved?

A: If your Form STAX-1 is approved, you will receive a sales tax exemption certificate that you can present to vendors when making qualifying purchases.

Q: What if my Form STAX-1 is denied?

A: If your Form STAX-1 is denied, you may have the opportunity to appeal the decision or provide additional information to support your application.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form STAX-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.