This version of the form is not currently in use and is provided for reference only. Download this version of

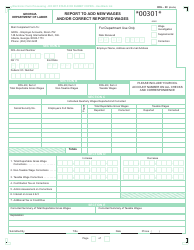

Form DOL-4A

for the current year.

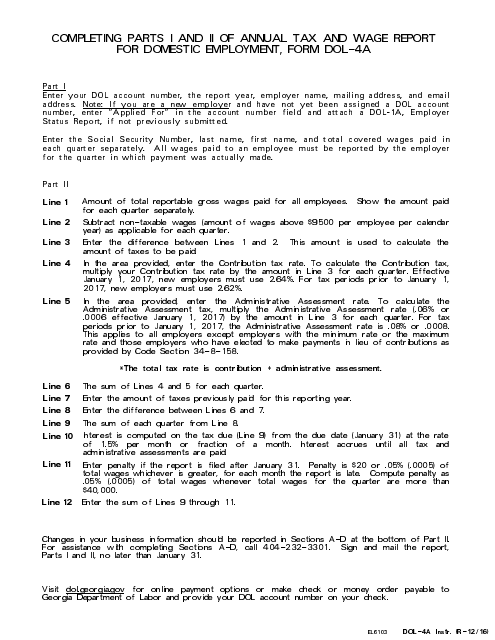

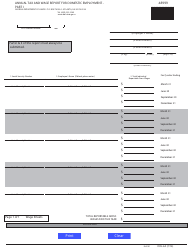

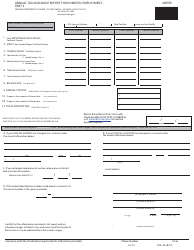

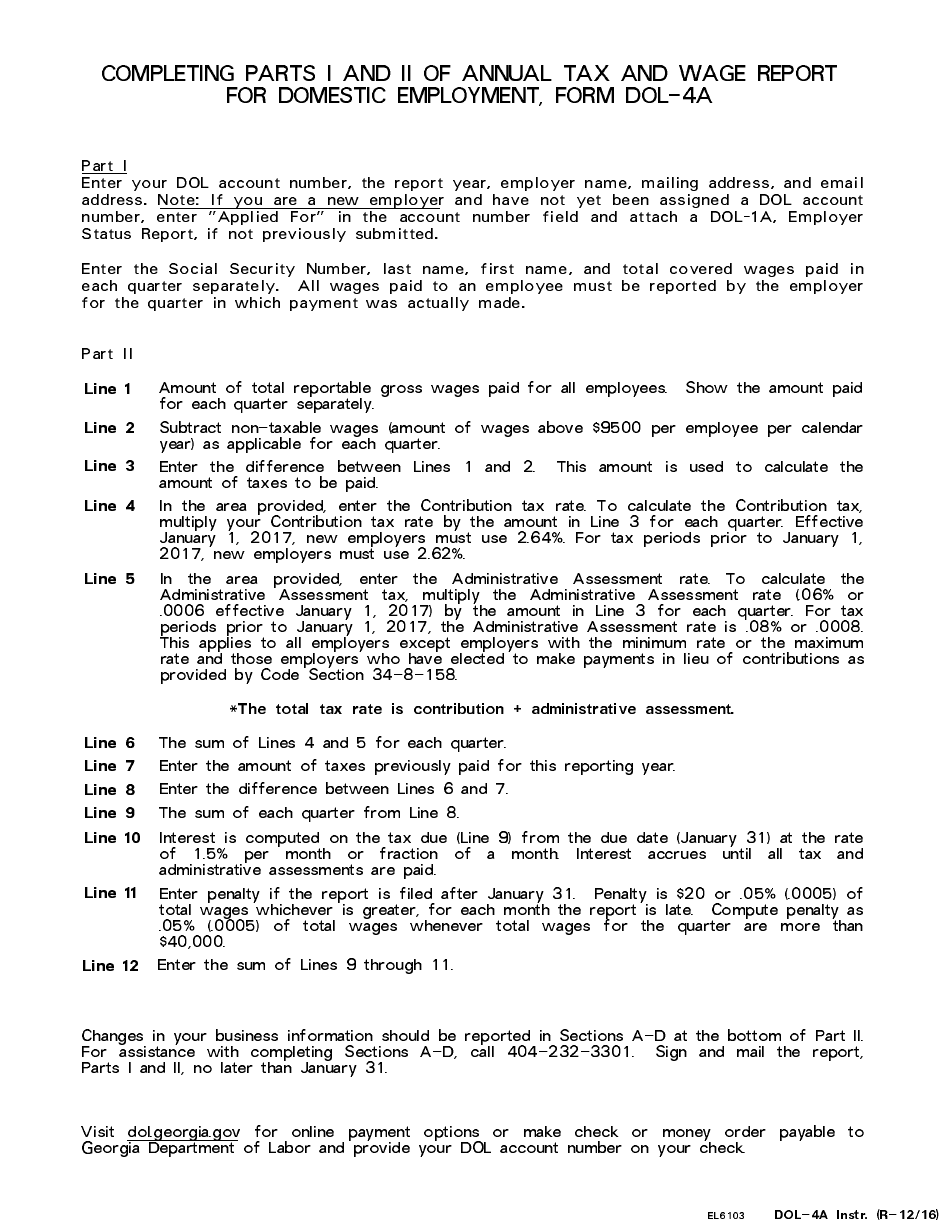

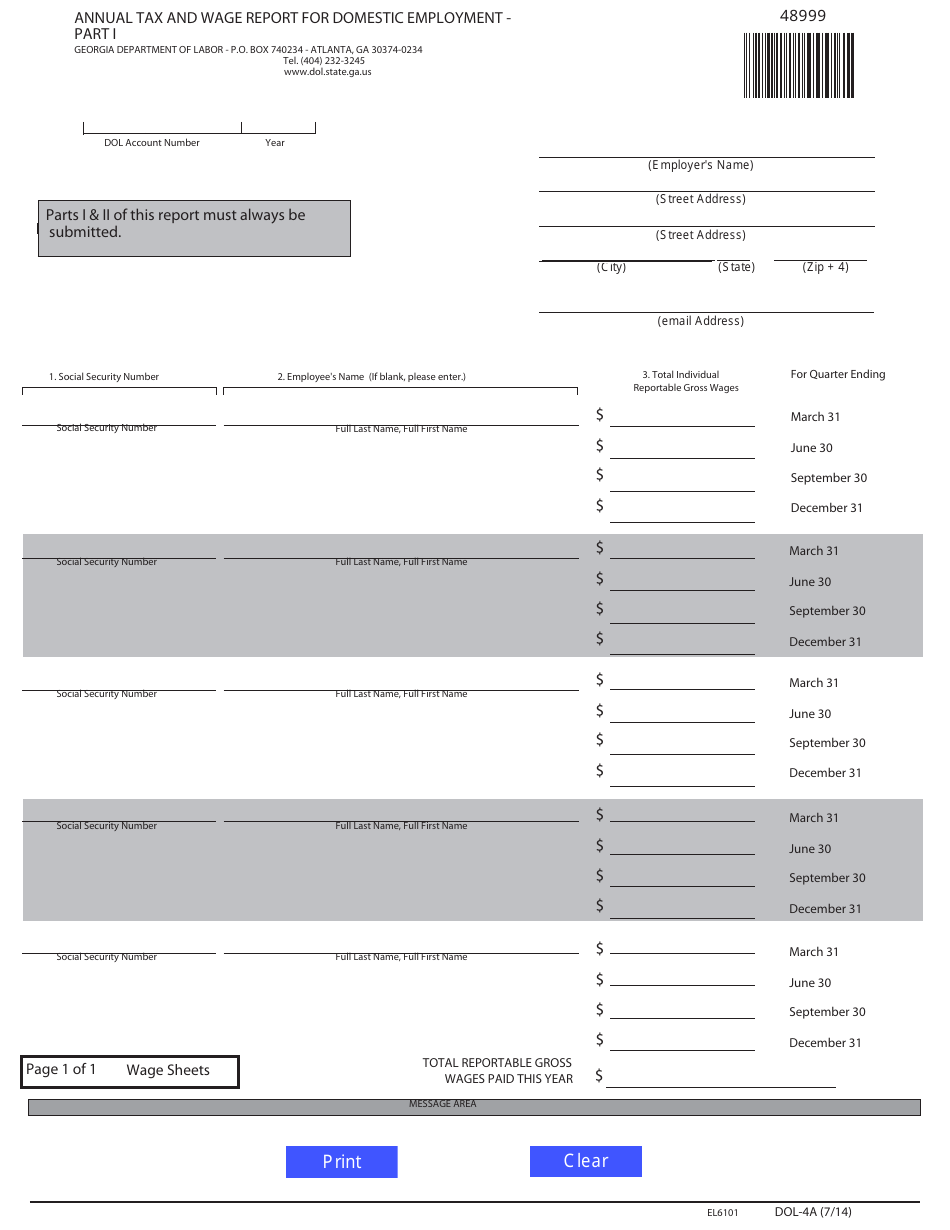

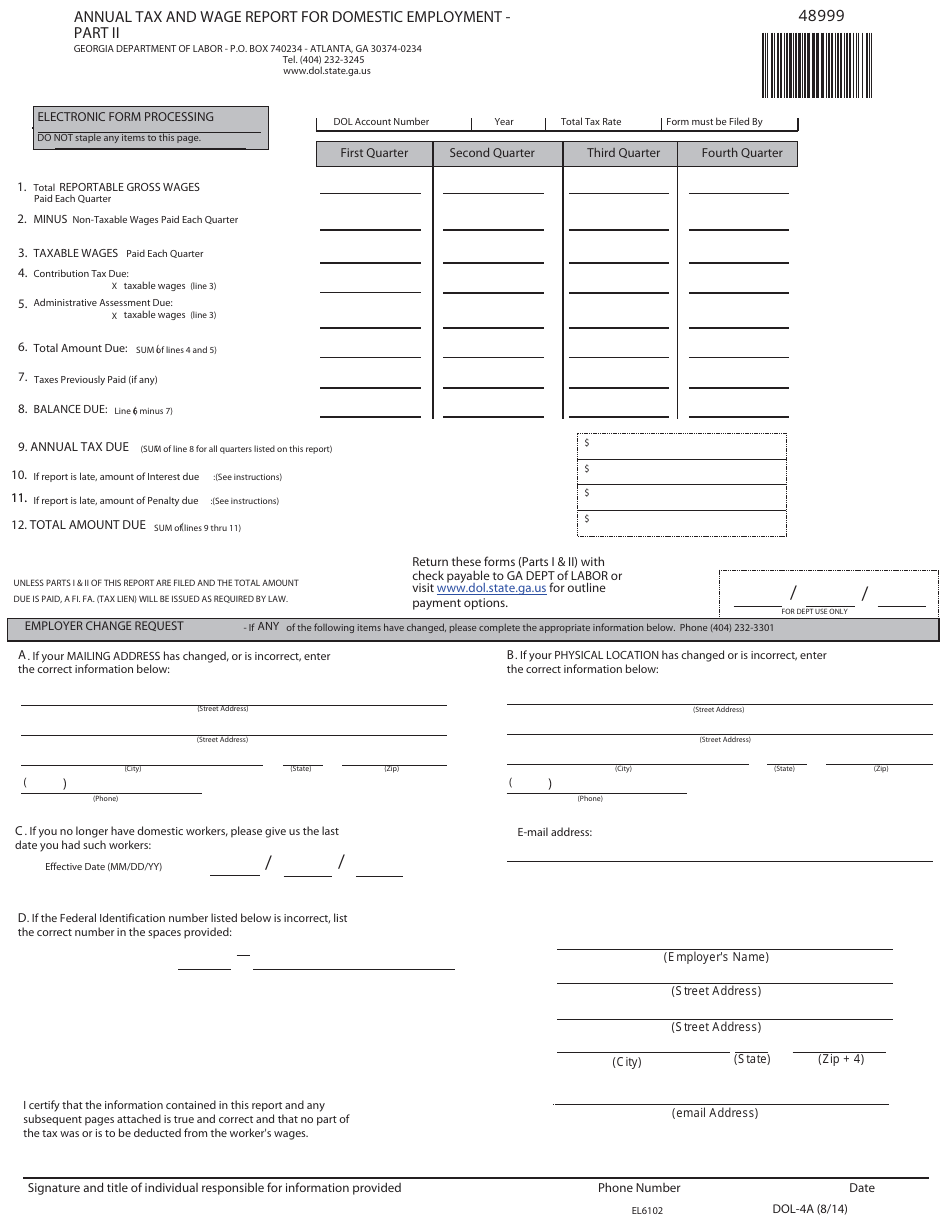

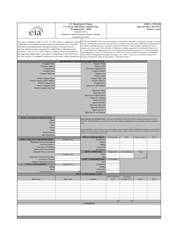

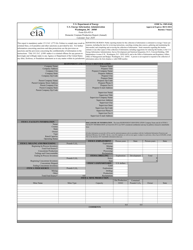

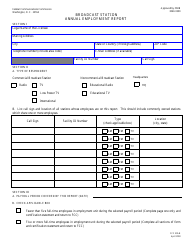

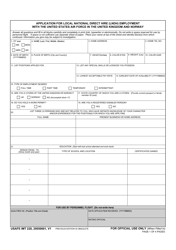

Form DOL-4A Annual Tax and Wage Report for Domestic Employment - Georgia (United States)

What Is Form DOL-4A?

This is a legal form that was released by the Georgia Department of Labor - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DOL-4A?

A: Form DOL-4A is the Annual Tax and Wage Report for Domestic Employment in Georgia.

Q: Who needs to file Form DOL-4A?

A: Employers in Georgia who have domestic employees need to file Form DOL-4A.

Q: What information is required on Form DOL-4A?

A: Form DOL-4A requires information about the employer, domestic employees, wages paid, and taxes withheld.

Q: When is Form DOL-4A due?

A: Form DOL-4A is due on or before January 31st of each year.

Q: How can Form DOL-4A be filed?

A: Form DOL-4A can be filed electronically or by mail.

Q: Is there a fee for filing Form DOL-4A?

A: No, there is no fee for filing Form DOL-4A.

Q: What are the consequences of not filing Form DOL-4A?

A: Failure to file Form DOL-4A or providing false information may result in penalties and interest charges.

Q: Can I make changes to Form DOL-4A after filing?

A: Yes, you can file an amended Form DOL-4A if you need to make changes to your original submission.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Georgia Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOL-4A by clicking the link below or browse more documents and templates provided by the Georgia Department of Labor.