This version of the form is not currently in use and is provided for reference only. Download this version of

Form SS366

for the current year.

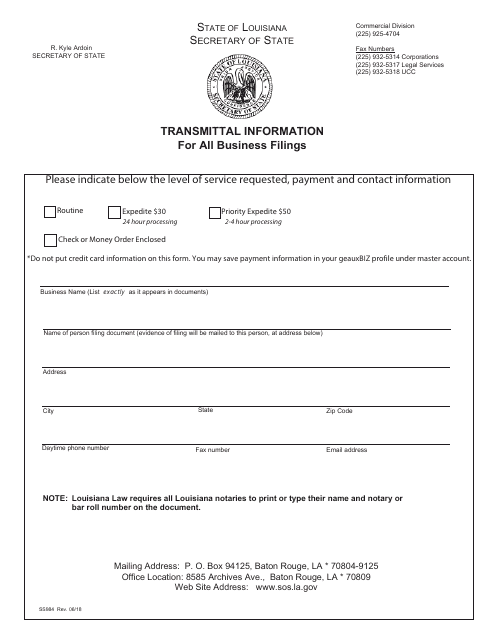

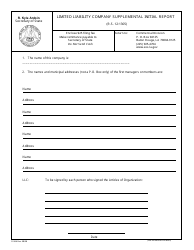

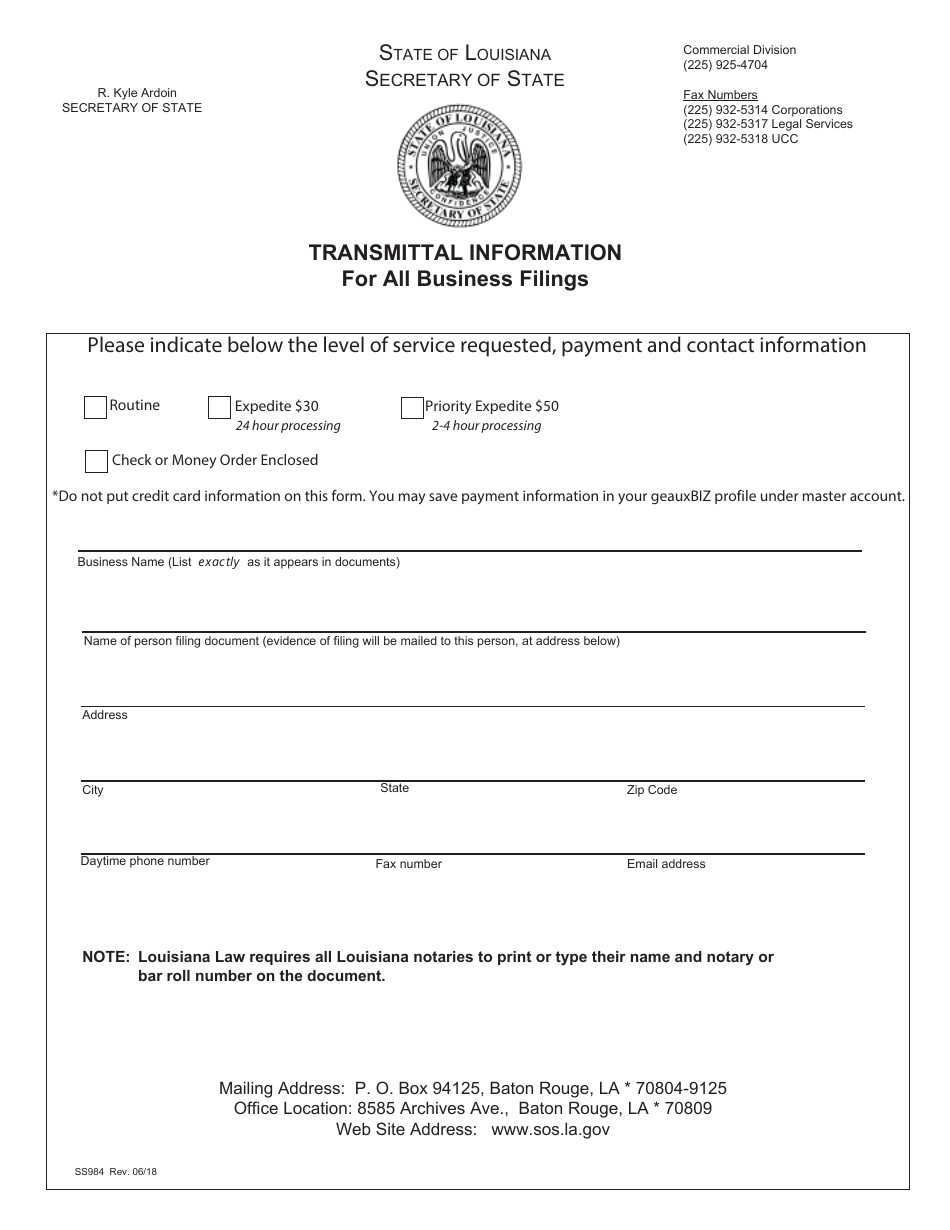

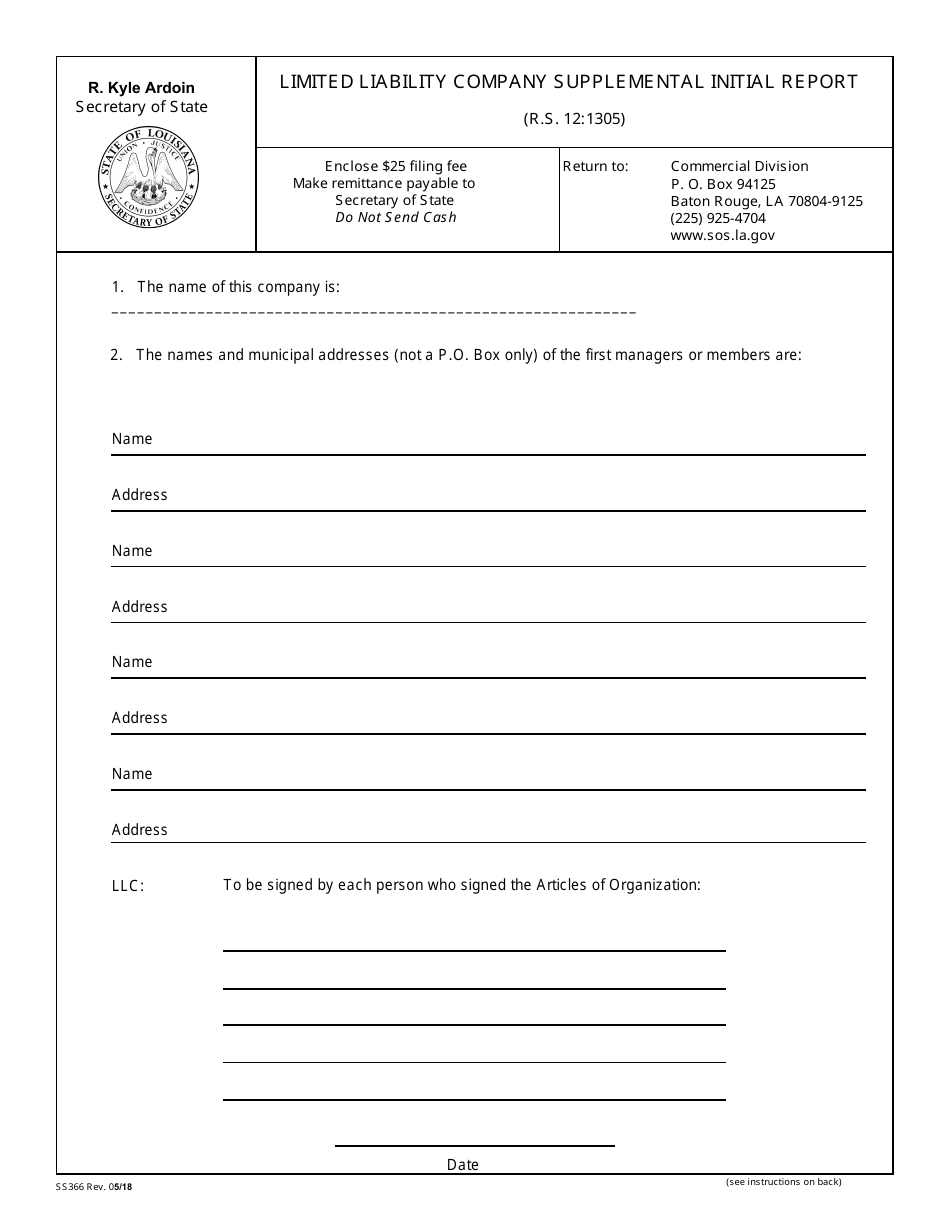

Form SS366 Limited Liability Company Supplemental Initial Report - Louisiana

What Is Form SS366?

This is a legal form that was released by the Louisiana Secretary of State - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS366?

A: Form SS366 is the Limited Liability Company Supplemental Initial Report form used in Louisiana.

Q: What is a Limited Liability Company (LLC)?

A: A Limited Liability Company (LLC) is a business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Q: When is the Limited Liability Company Supplemental Initial Report due?

A: The Limited Liability Company Supplemental Initial Report is due annually by the anniversary month of the LLC's formation.

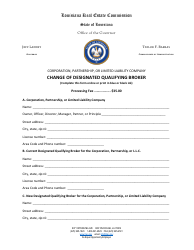

Q: What information is required on the Form SS366?

A: The Form SS366 requires information such as the LLC's name, mailing address, registered agent information, and principal office address.

Q: What is the filing fee for the Limited Liability Company Supplemental Initial Report?

A: The filing fee for the Form SS366 is $25.

Q: What happens if the Limited Liability Company Supplemental Initial Report is not filed on time?

A: If the Form SS366 is not filed on time, the LLC may be subject to penalties and potential administrative dissolution.

Q: Can changes be made to the Limited Liability Company Supplemental Initial Report after submission?

A: Yes, changes can be made to the Form SS366 after submission by filing an Amended Supplemental Initial Report.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Louisiana Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SS366 by clicking the link below or browse more documents and templates provided by the Louisiana Secretary of State.