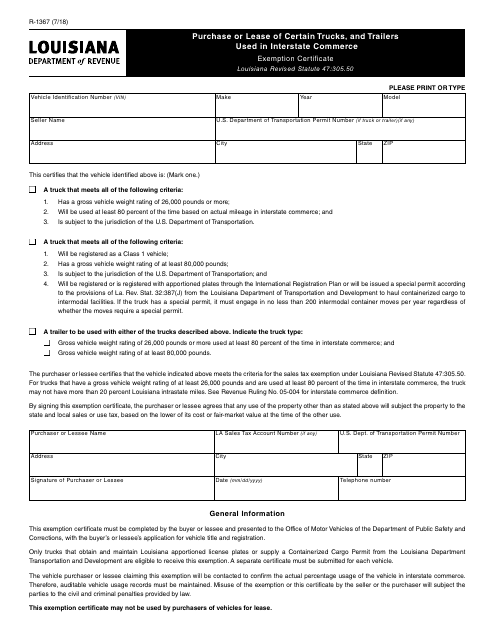

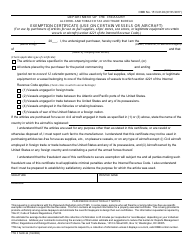

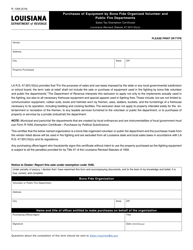

Form R-1367 Exemption Certificate for Purchase or Lease of Certain Trucks, and Trailers Used in Interstate Commerce - Louisiana

What Is Form R-1367?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1367?

A: Form R-1367 is an exemption certificate for the purchase or lease of certain trucks and trailers used in interstate commerce in Louisiana.

Q: Who should use Form R-1367?

A: This form should be used by individuals or businesses that are purchasing or leasing trucks and trailers used in interstate commerce in Louisiana and wish to claim an exemption from certain sales taxes.

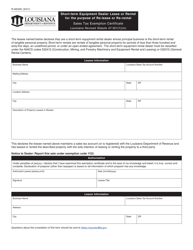

Q: What are the eligibility requirements for claiming the exemption?

A: To claim the exemption, the trucks and trailers must be used exclusively in interstate commerce and meet certain weight requirements.

Q: What taxes are exempted with Form R-1367?

A: By using Form R-1367, you may be exempted from paying state sales taxes and local sales/use taxes on the purchase or lease of qualifying trucks and trailers.

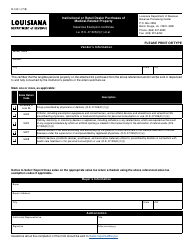

Q: Are there any filing fees associated with Form R-1367?

A: No, there are no filing fees associated with submitting Form R-1367.

Q: Is there an expiration date for Form R-1367?

A: No, there is no expiration date for Form R-1367. However, the exemption is only valid as long as the qualifying trucks and trailers continue to meet the eligibility requirements.

Q: Can I claim a refund for taxes paid before obtaining Form R-1367?

A: Yes, you may be eligible for a refund of taxes paid on qualifying trucks and trailers prior to obtaining Form R-1367. You will need to contact the Louisiana Department of Revenue for more information on the refund process.

Q: What should I do if there are changes in my qualifying trucks and trailers?

A: If there are any changes in the qualifying trucks and trailers, such as sale or disposition, you must notify the Louisiana Department of Revenue within 15 days.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1367 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.