This version of the form is not currently in use and is provided for reference only. Download this version of

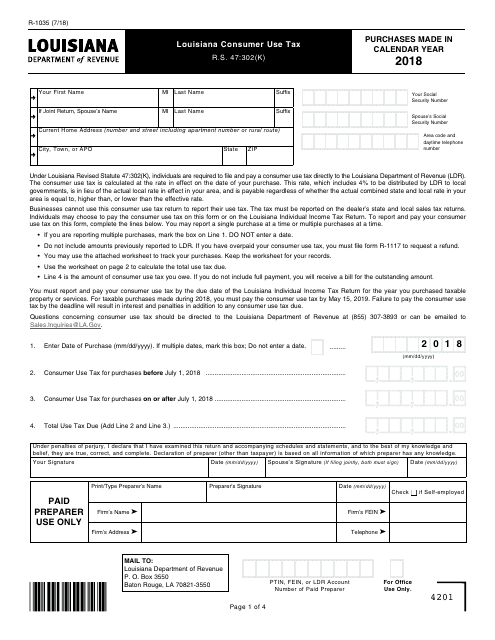

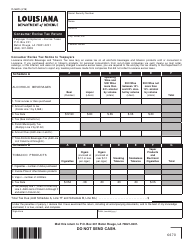

Form R-1035

for the current year.

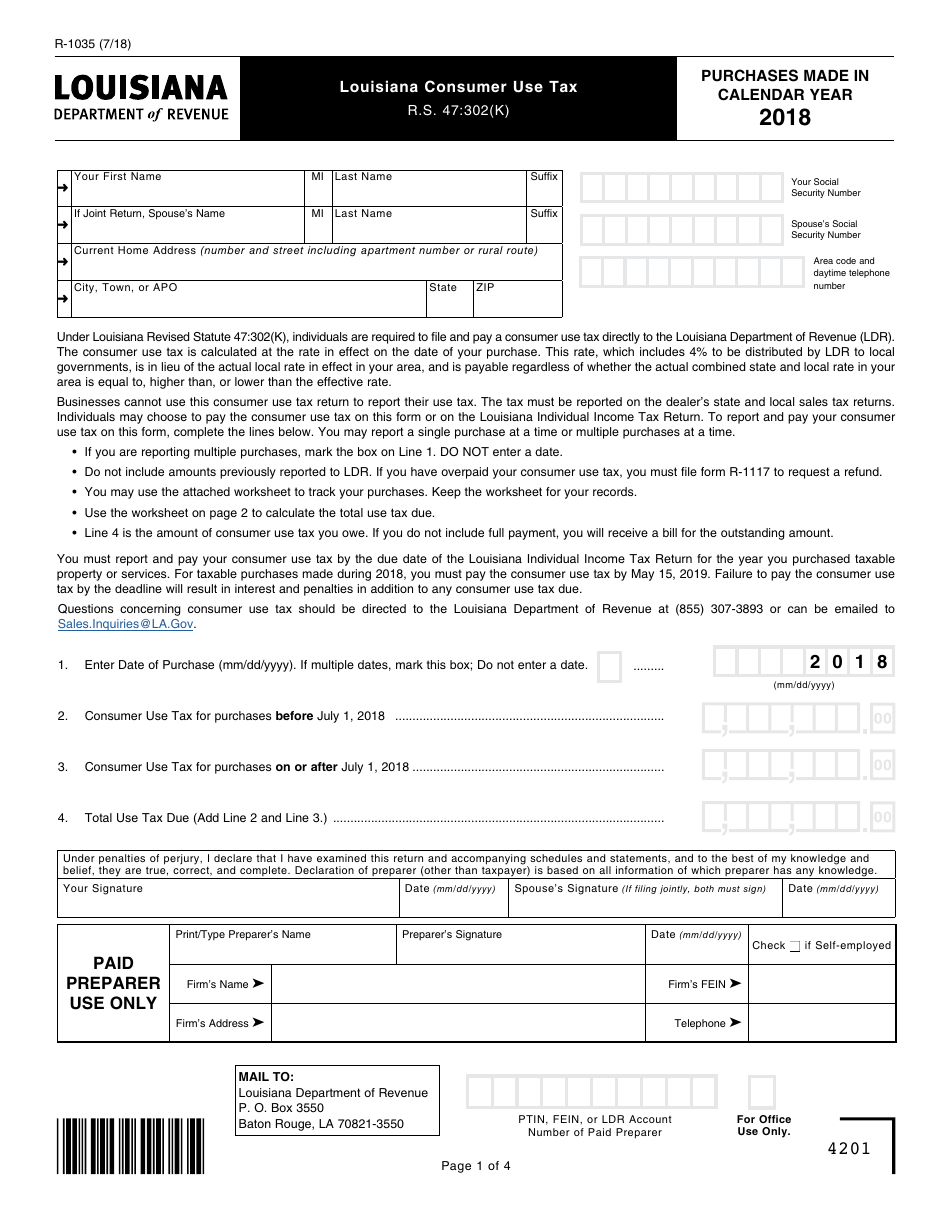

Form R-1035 Louisiana Consumer Use Tax - Louisiana

What Is Form R-1035?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1035?

A: Form R-1035 is the Louisiana Consumer Use Tax form.

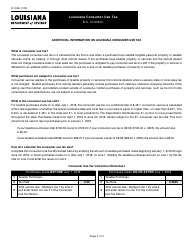

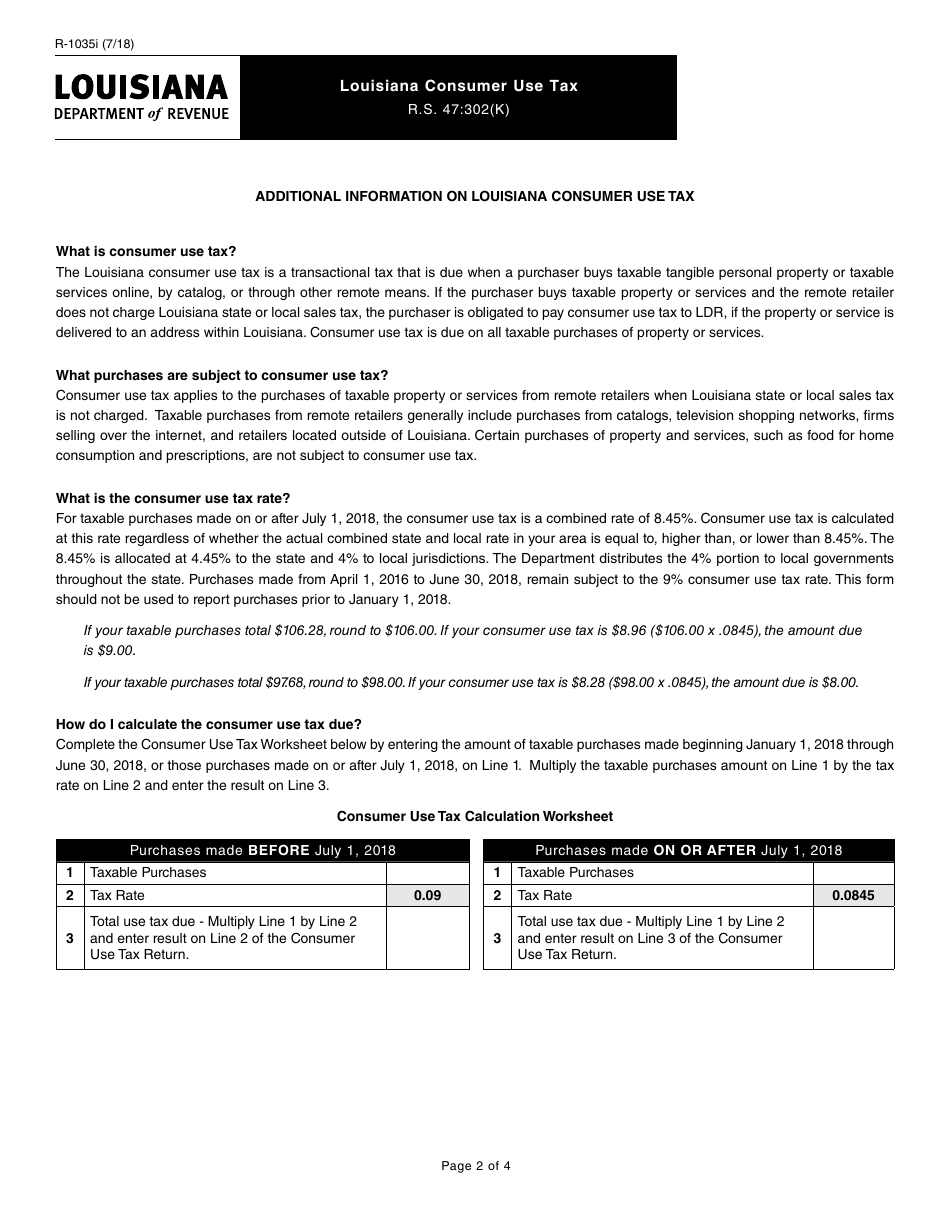

Q: What is the Louisiana Consumer Use Tax?

A: The Louisiana Consumer Use Tax is a tax on goods purchased out of state for use in Louisiana.

Q: Who needs to file Form R-1035?

A: Anyone who purchases goods out of state for use in Louisiana needs to file Form R-1035.

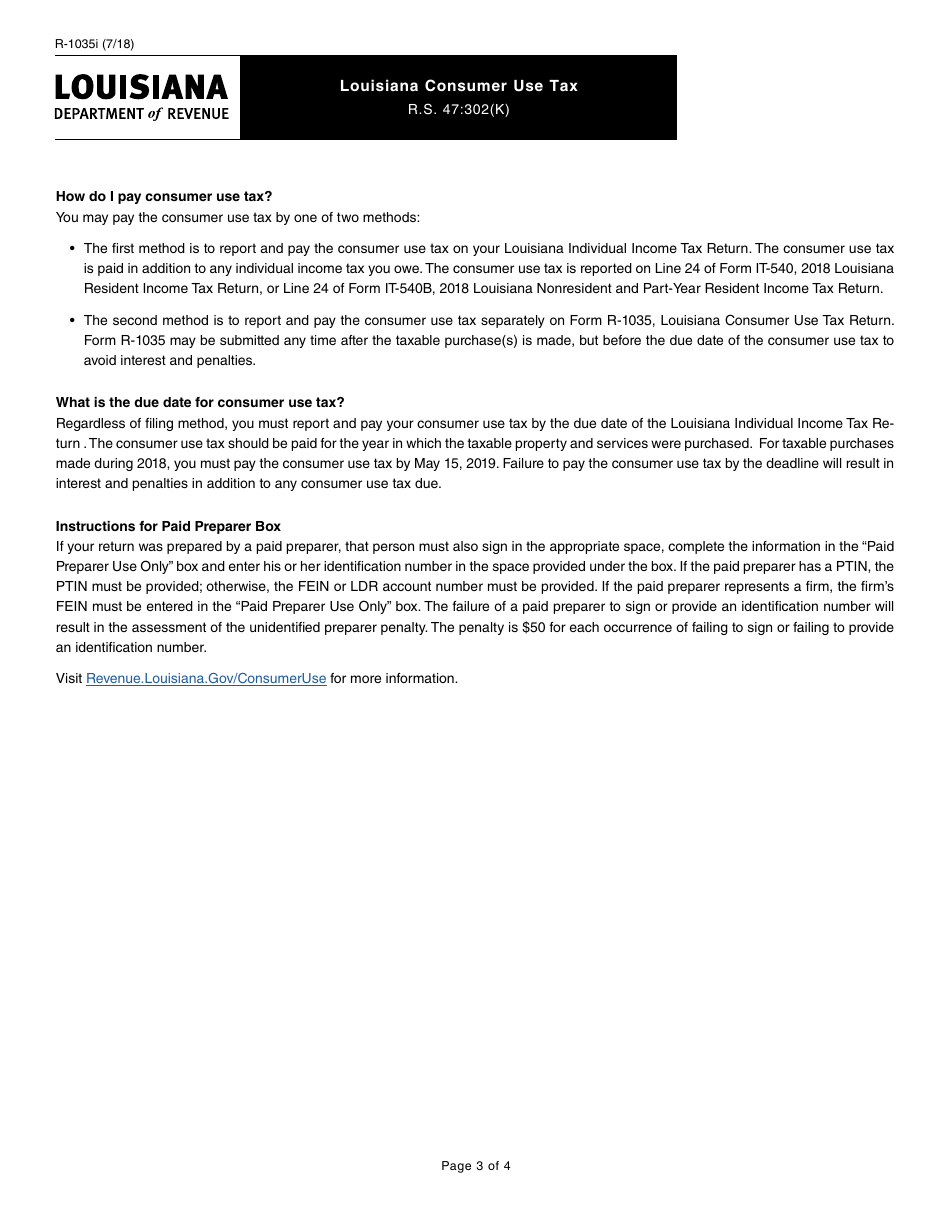

Q: When is Form R-1035 due?

A: Form R-1035 is due on the 20th day of the month following the purchase of the goods.

Q: Are there any exemptions to the Louisiana Consumer Use Tax?

A: Yes, there are certain exemptions for items such as prescription drugs and certain agricultural equipment.

Q: What happens if I don't file Form R-1035?

A: Failure to file Form R-1035 may result in penalties and interest charges.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1035 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.