This version of the form is not currently in use and is provided for reference only. Download this version of

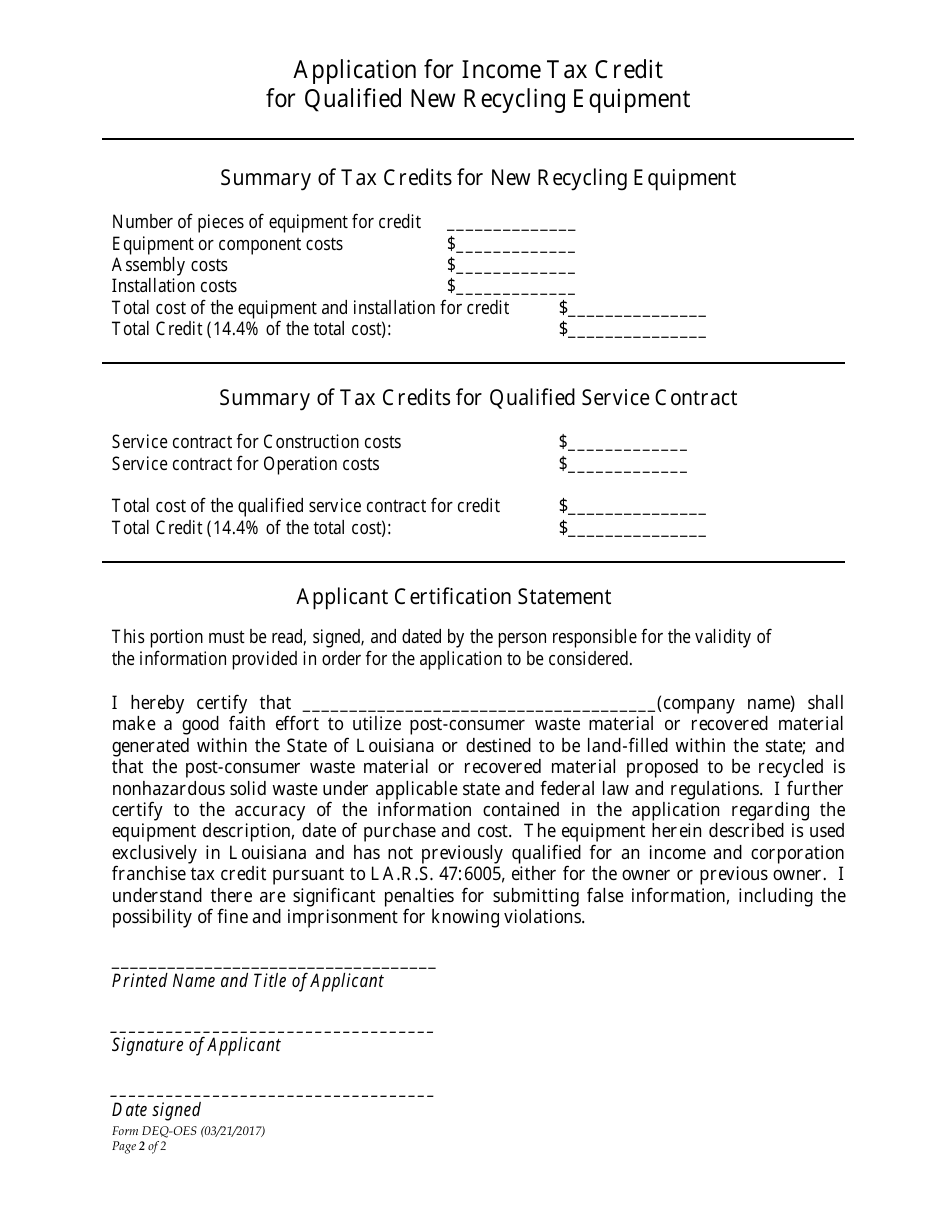

Form DEQ-OES

for the current year.

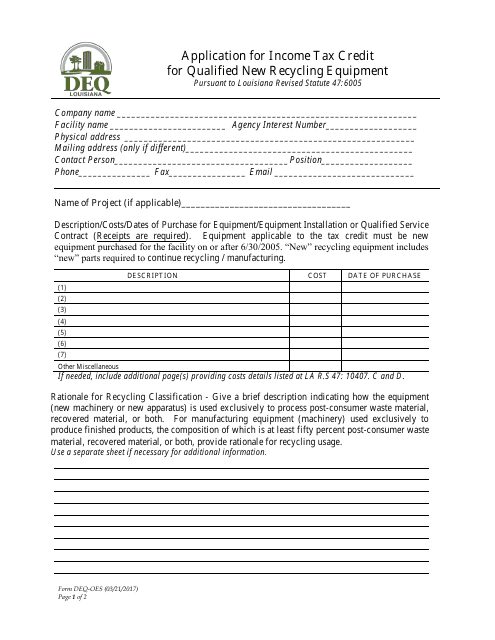

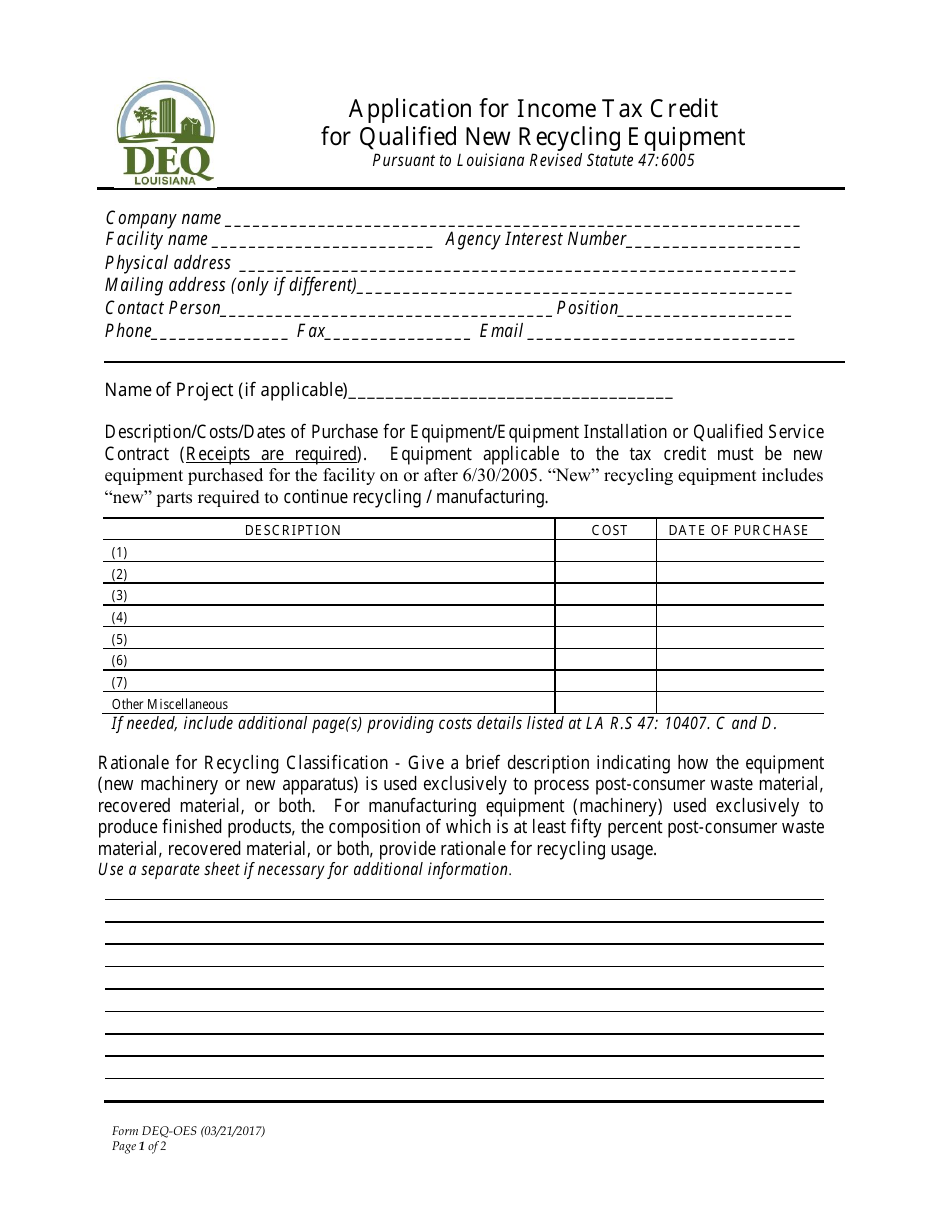

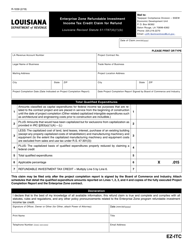

Form DEQ-OES Application for Income Tax Credit for Qualified New Recycling Equipment - Louisiana

What Is Form DEQ-OES?

This is a legal form that was released by the Louisiana Department of Environmental Quality - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DEQ-OES Application for Income Tax Credit for Qualified New Recycling Equipment?

A: The DEQ-OES Application for Income Tax Credit for Qualified New Recycling Equipment is a form used to apply for an income tax credit in Louisiana for the purchase of qualified new recycling equipment.

Q: What is the purpose of this tax credit?

A: The purpose of this tax credit is to incentivize businesses in Louisiana to invest in new recycling equipment, thereby promoting recycling and waste reduction efforts.

Q: Who is eligible to apply for this tax credit?

A: Any business or individual that has purchased qualified new recycling equipment in Louisiana is eligible to apply for this tax credit.

Q: What is considered qualified new recycling equipment?

A: Qualified new recycling equipment includes machinery, equipment, and containers used for the collection, separation, processing, or storage of recyclable materials.

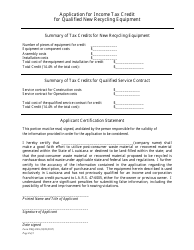

Q: How much is the income tax credit?

A: The income tax credit is for 10% of the cost of the qualified new recycling equipment, up to a maximum credit of $100,000 per individual or legal entity.

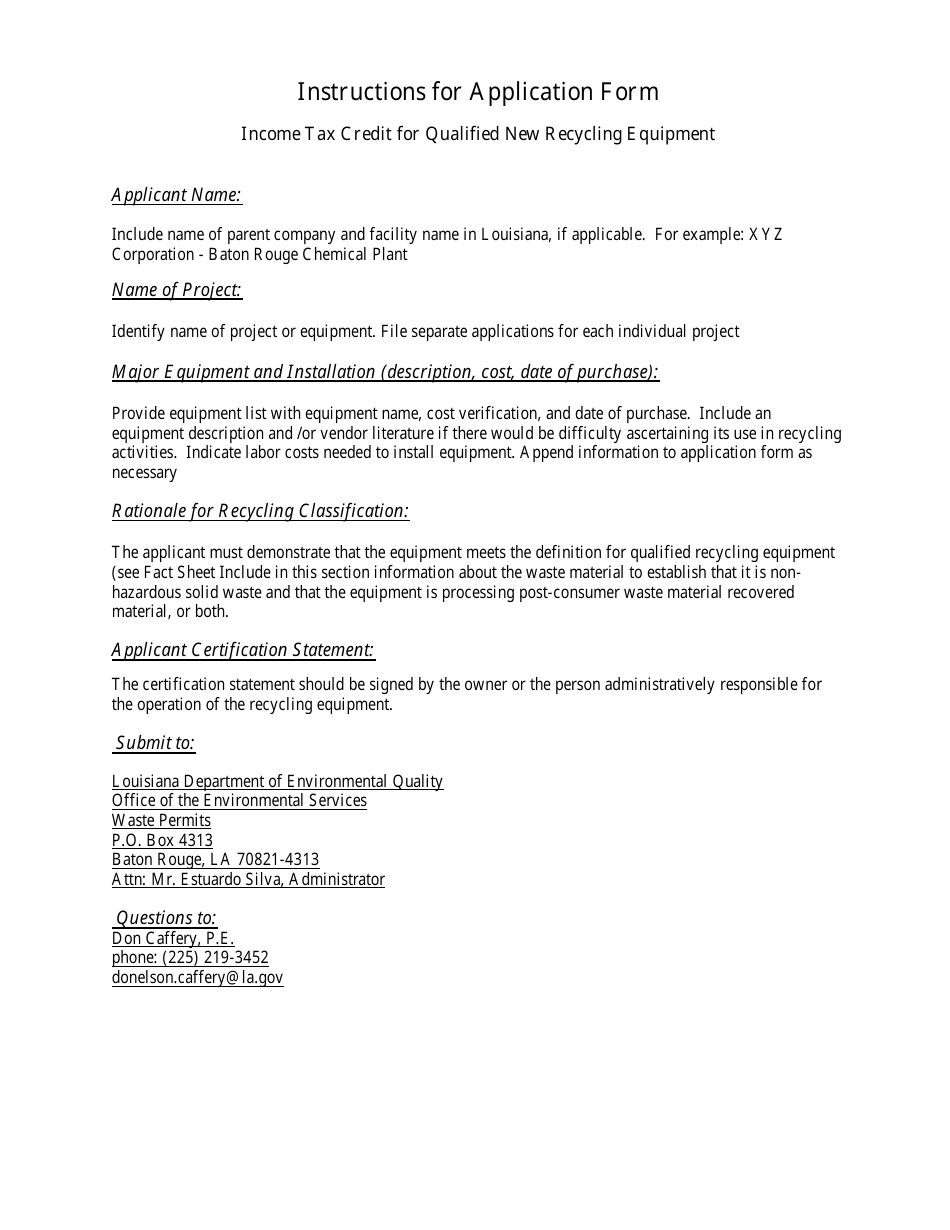

Q: What are the required documents to include with the application?

A: The application must include an invoice or receipt for the purchase of the qualified new recycling equipment, and the equipment must have been placed into service in Louisiana during the tax year for which the credit is claimed.

Q: When is the deadline to submit the application?

A: The application must be submitted to the Louisiana Department of Environmental Quality (LDEQ) by the end of the tax year for which the credit is claimed.

Q: Is there a limit on the total amount of tax credits available?

A: Yes, the total amount of tax credits available for this program is limited to $500,000 per fiscal year.

Q: How long does it take to process the application?

A: The processing time for the application may vary, but it typically takes several weeks to several months for the LDEQ to review and approve the application.

Form Details:

- Released on March 21, 2017;

- The latest edition provided by the Louisiana Department of Environmental Quality;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DEQ-OES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Environmental Quality.