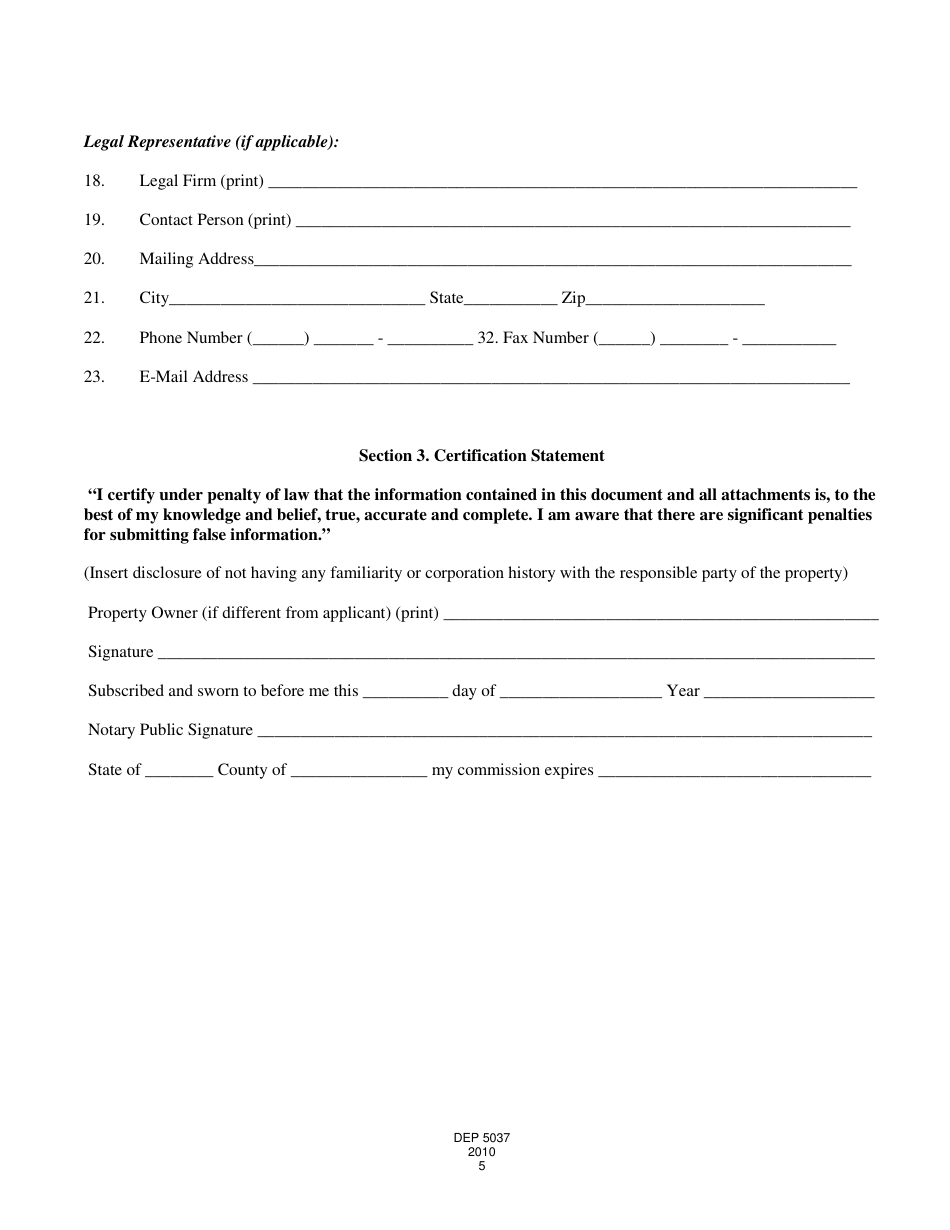

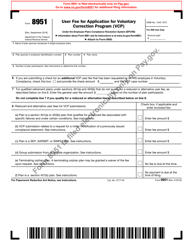

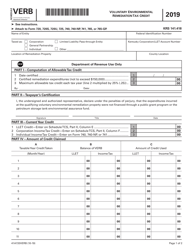

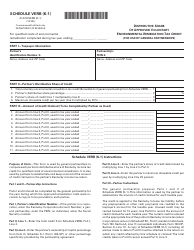

Form DEP5037 Application for Voluntary Environmental Remediation Tax Incentive - Kentucky

What Is Form DEP5037?

This is a legal form that was released by the Kentucky Department for Environmental Protection - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

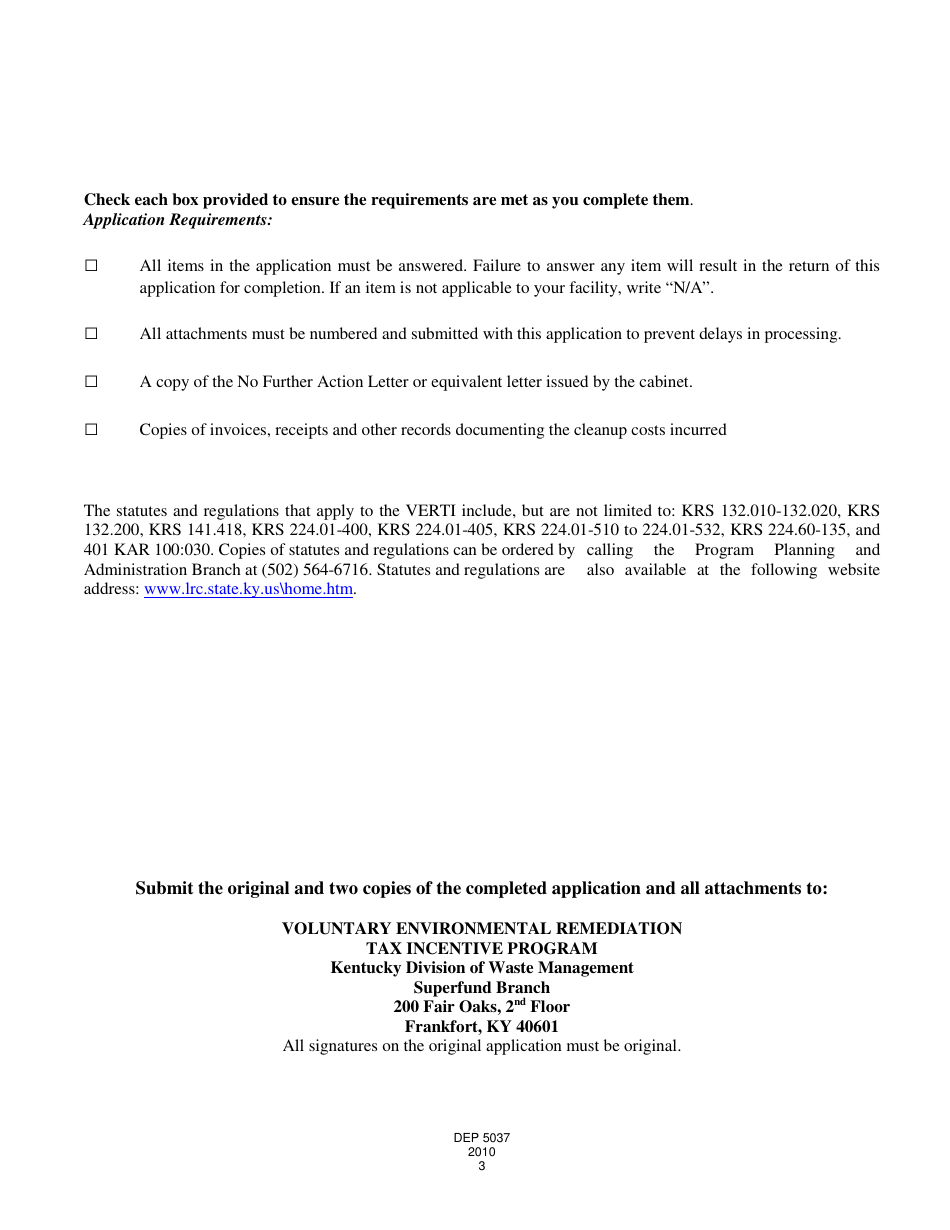

Q: What is DEP5037?

A: DEP5037 is the application form for the Voluntary Environmental RemediationTax Incentive program in Kentucky.

Q: What is the Voluntary Environmental Remediation Tax Incentive?

A: The Voluntary Environmental Remediation Tax Incentive is a program in Kentucky that provides tax incentives for property owners who voluntarily clean upcontaminated sites.

Q: Who can use the DEP5037 form?

A: Property owners in Kentucky who wish to apply for the Voluntary Environmental Remediation Tax Incentive can use the DEP5037 form.

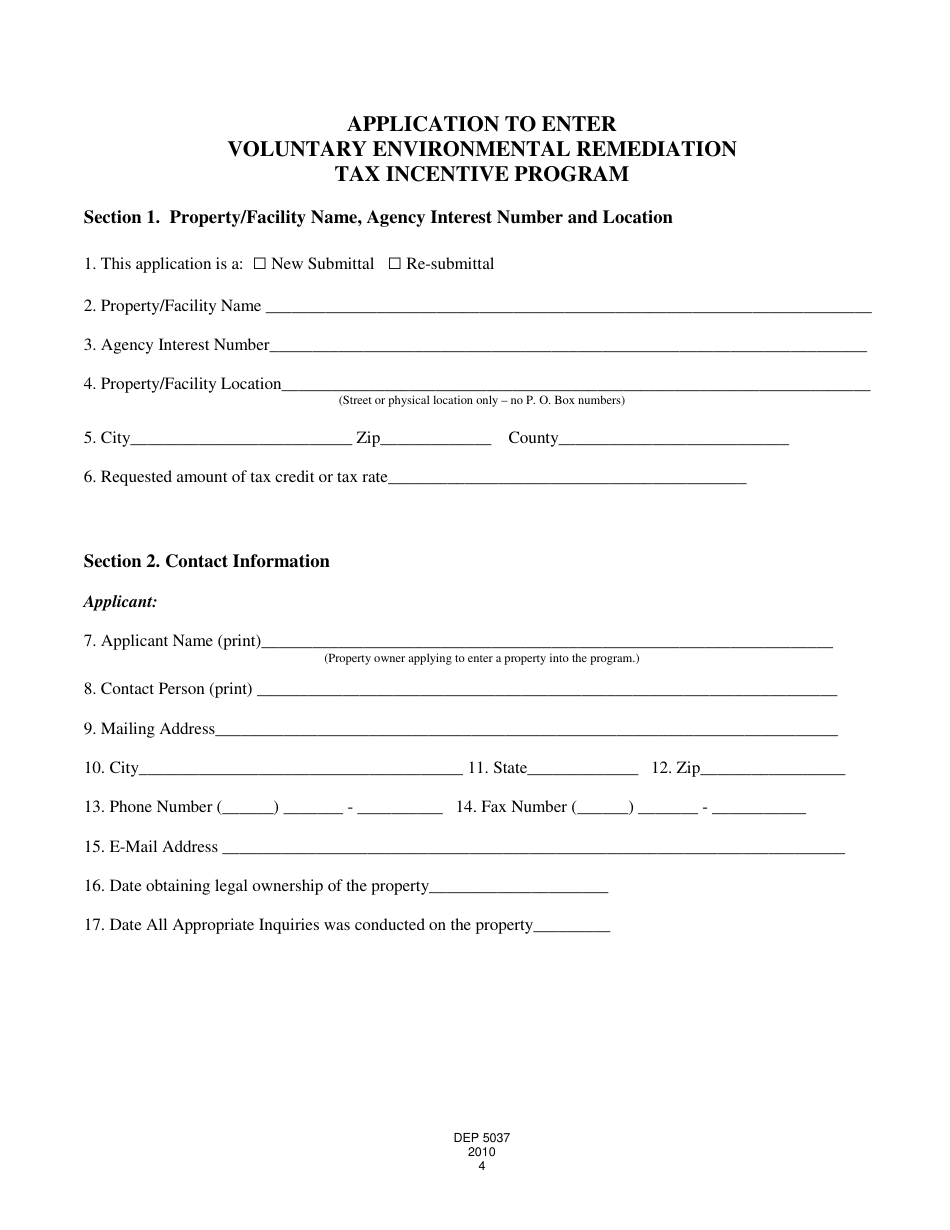

Q: What information is required on the DEP5037 form?

A: The DEP5037 form requires information such as the property owner's contact information, site location details, and a description of the proposed remediation activities.

Q: Are there any fees associated with the DEP5037 application?

A: Yes, there is a non-refundable application fee of $250 for submitting the DEP5037 form.

Q: What are the benefits of the Voluntary Environmental Remediation Tax Incentive?

A: The benefits of the Voluntary Environmental Remediation Tax Incentive include eligibility for tax credits, deductions, and exemptions related to the costs of environmental remediation.

Q: Is participation in the Voluntary Environmental Remediation Tax Incentive program mandatory?

A: No, participation in the program is voluntary. Property owners can choose whether or not to participate.

Q: How long does it take to process the DEP5037 application?

A: The processing time for the DEP5037 application can vary, but it generally takes several weeks to several months for a decision to be made.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the Kentucky Department for Environmental Protection;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DEP5037 by clicking the link below or browse more documents and templates provided by the Kentucky Department for Environmental Protection.