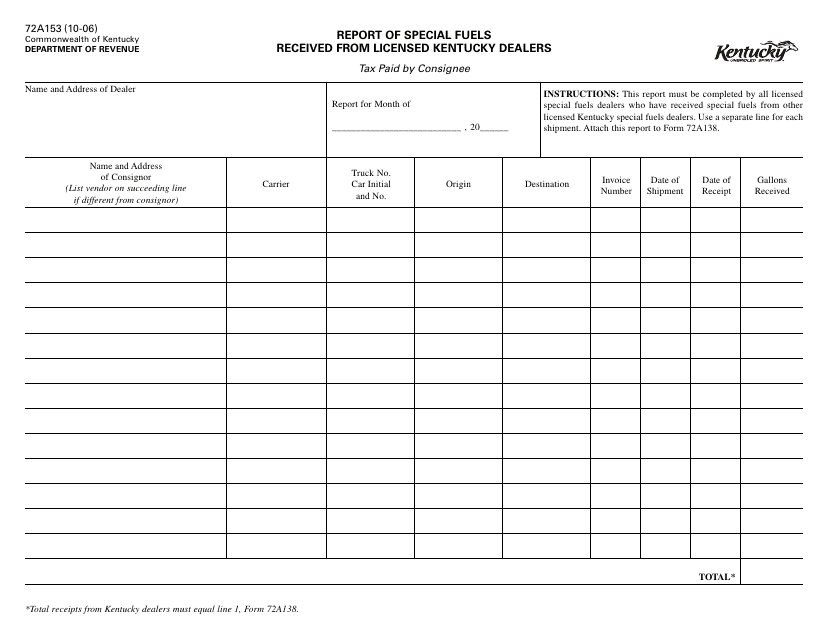

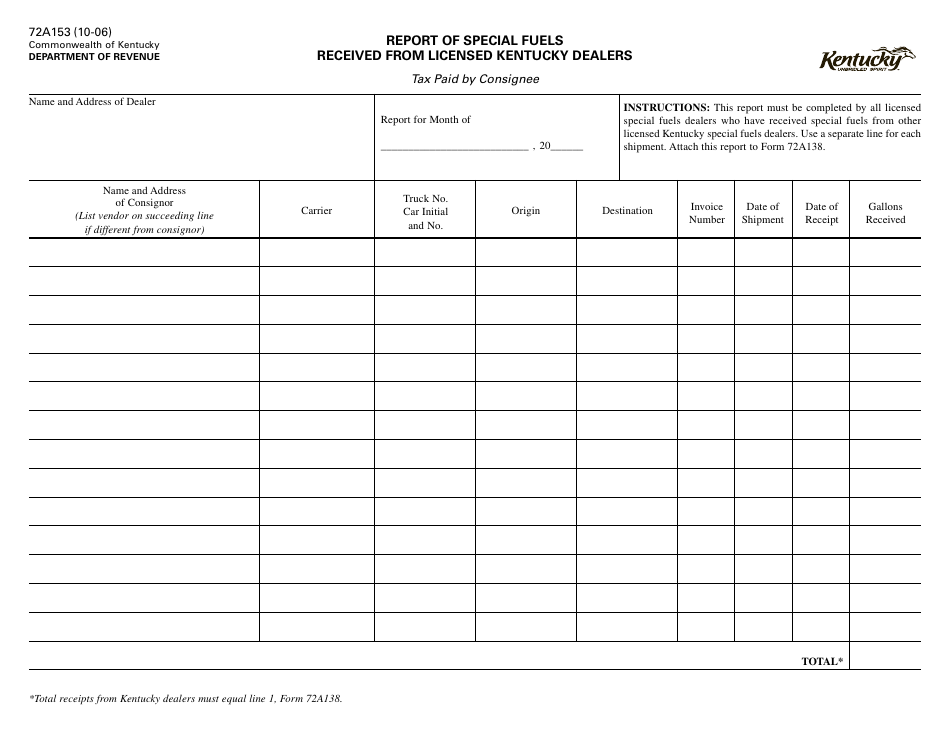

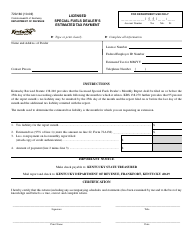

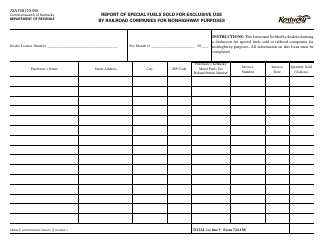

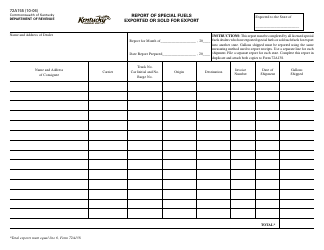

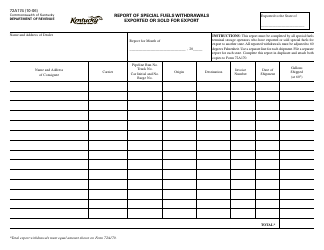

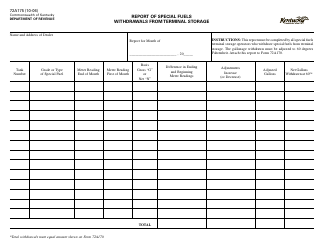

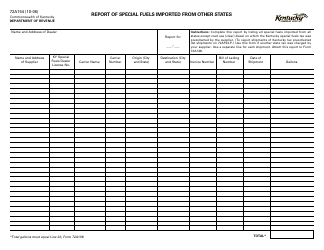

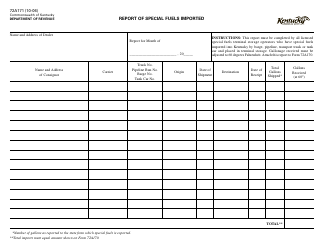

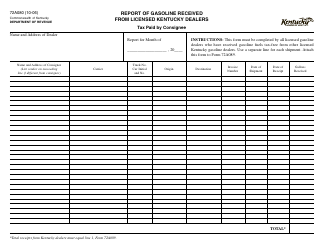

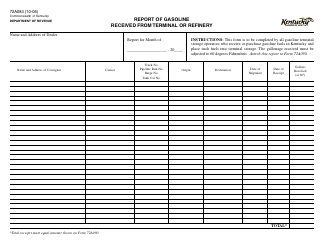

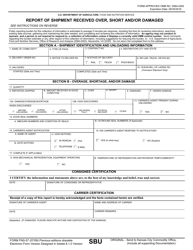

Form 72A153 Report of Special Fuels Received From Licensed Kentucky Dealers - Kentucky

What Is Form 72A153?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 72A153?

A: Form 72A153 is the Report of Special Fuels Received From Licensed Kentucky Dealers in Kentucky.

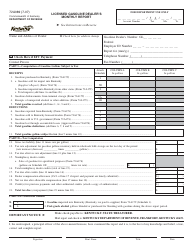

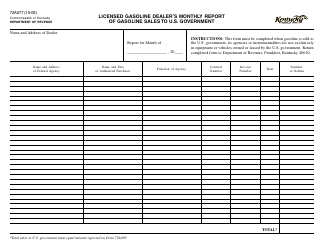

Q: Who needs to fill out form 72A153?

A: Licensed Kentucky dealers who receive special fuels need to fill out form 72A153.

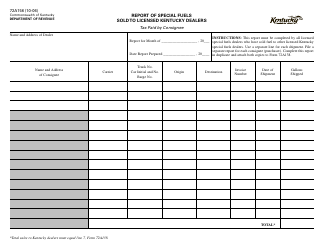

Q: What information is required on form 72A153?

A: Form 72A153 requires information about the special fuels received from licensed Kentucky dealers including the quantity, type, and the supplier.

Q: When is form 72A153 due?

A: Form 72A153 is due by the last day of the month following the calendar quarter in which the special fuels were received.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A153 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.