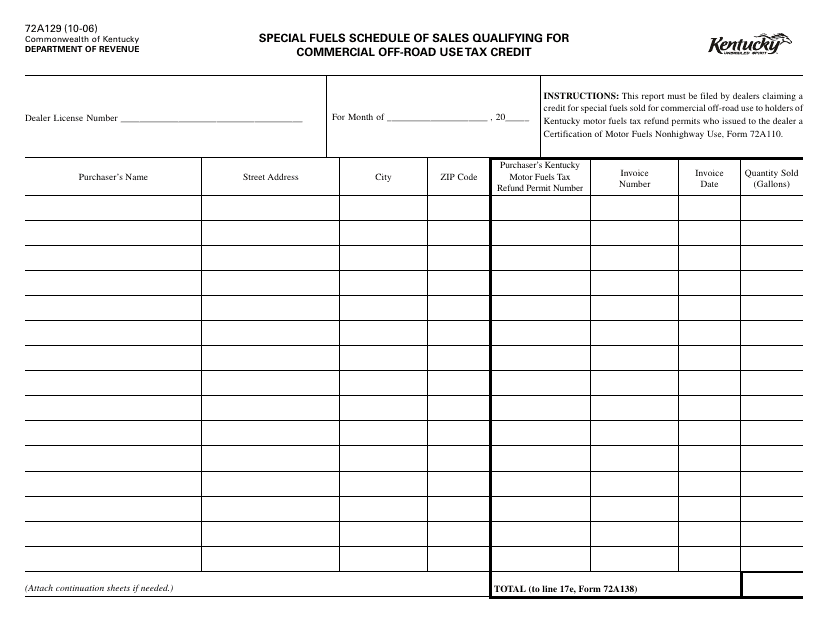

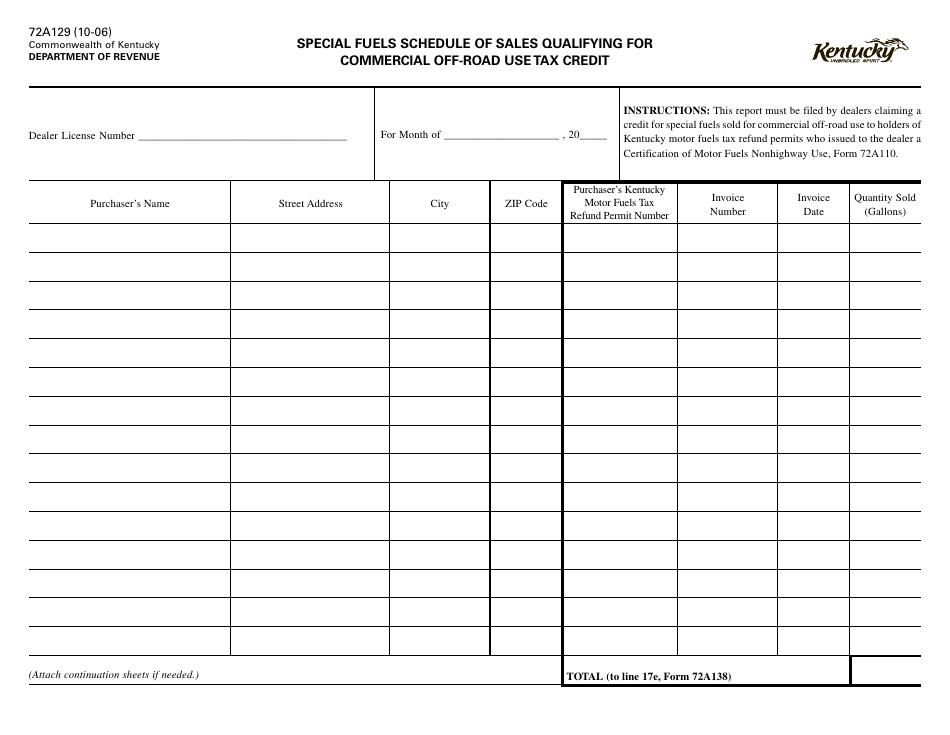

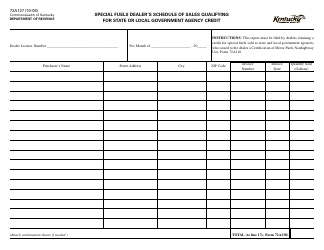

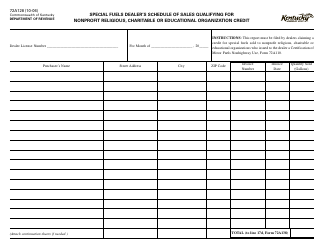

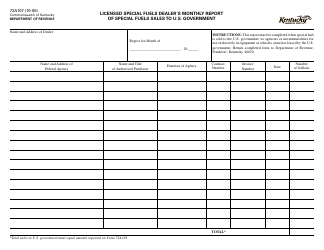

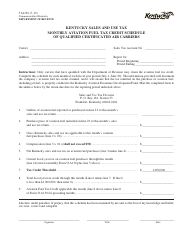

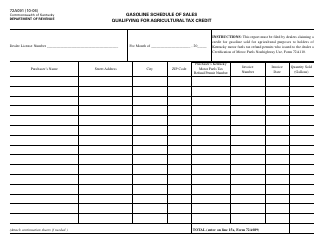

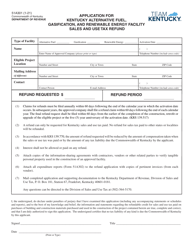

Form 72A129 Special Fuels Schedule of Sales Qualifying for Commercial off-Road Use Tax Credit - Kentucky

What Is Form 72A129?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A129?

A: Form 72A129 is the Special Fuels Schedule of Sales Qualifying for Commercial off-Road Use Tax Credit in Kentucky.

Q: Who needs to fill out Form 72A129?

A: Individuals or businesses selling special fuels that qualify for the commercial off-road use tax credit in Kentucky need to fill out this form.

Q: What is the purpose of Form 72A129?

A: The purpose of Form 72A129 is to report sales of special fuels that qualify for the commercial off-road use tax credit in Kentucky.

Q: What is the commercial off-road use tax credit in Kentucky?

A: The commercial off-road use tax credit in Kentucky is a tax credit given to individuals or businesses that sell special fuels for use in certain off-road vehicles or equipment.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A129 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.